Second-hand shops and labeling

In the current realities, second-hand stores have no obligation to work in the “Honest Sign” system. They are not mentioned in any regulation regulating the labeling process, as well as the goods they sell. These are the products under the codes:

- TN VED EAES 6309 - Clothing and other used products;

- OKPD2 47.79 - Services for retail trade of used goods in stores.

Thus, if you sell used goods in a second-hand store, then you do not need to connect to the Honest Sign system.

How to arrange a return of goods from a commission agent?

How to prepare documents for the return of goods from the commission agent? To understand how to prepare documents for return from the commission agent, the committent must take into account all the deadlines.

In the case when the shipment of defective items and their return by the consumer occurred one month before the moment when the commission agent approves the report, then the commission agent enters certain sales records into the report. And if the item was returned after the reporting documents were approved, then the principal must compensate for the funds that were returned to the buyer.

In addition, when the commission agent receives an application for the return of the product by the buyer, the organization creates an accounting of the actual income received from the sale of the product. The invoice must also contain the cost of the item and all relevant calculations.

Thrift stores and labeling

If you are a commission agent, then the key role is played by who you take the goods from:

- for individuals

- from legal entities or individual entrepreneurs

Labeling rules will vary depending on this. But in both cases, the commission agent works with a labeling system, that is, he must register in the “Honest Mark” system if he takes on a new product for sale.

In addition to new goods, the consignment shop can also take used goods for sale. Such goods are not subject to labeling, since they belong to a product group with the EAEU HS code 6309.

The commission agent accepts new goods from individuals

In addition to registration in the “Honest Sign” system, it is necessary to label all goods received for sale from citizens. There are concessions for commission agents: you can describe the product not according to all parameters, but only according to four:

- TIN

- type of shoe

- material

- size

This information must be transferred to Honest Sign for the system to issue a unique GTIN code. Next, you can order the required number of labeling codes for your goods, print them on the label and put the goods into circulation.

A convenient solution for working with marking shoes and clothing. We will help you order and receive marking codes from the “Honest Sign” and put them into circulation.

Send a request

How to sell products?

The same rules apply here as for everyone else. You remove the product from circulation through the cash register, that is, you punch the sales receipt and scan the labeling code. The data is received by the fiscal data operator (FDO), and he then delivers it to the Honest Sign system.

If you do not work with OFD, you can carry the goods through the cash register in the same way and scan the codes. All information will remain in the fiscal storage. But only once every 30 days you will have to download sales data and upload it manually into the Honest Sign system.

Some of the goods accepted for consignment were not sold and must be returned

When returning goods to individuals, the commission agent must remove the goods from circulation. To do this, in his personal account “Honest Sign” he indicates in it the reason “Return to an individual”. After this, the seller scans the marking code, and the Honest Sign system thus receives a signal that the product has been returned to the owner because it was not sold.

You can do the same from the commodity accounting system if it is integrated with the Honest Sign system. Or you can manually compile a file “Withdrawal of goods from circulation” and upload it to the “Honest Sign” system.

How to do it?

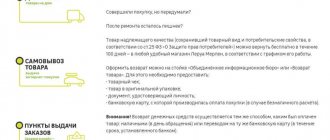

If, after purchasing a used product, a defect was discovered about which the consumer was not notified or there was a need to return it for another reason, the following procedure should be followed.

Preparing the item to be purchased and collecting evidence

To issue a return without any problems, you must pack the item in the same packaging in which it was purchased. Find a payment receipt that will confirm the purchase (if there was one).

If the receipt is missing, this does not mean that the seller has the right to refuse the buyer. Evidence such as witness statements and video footage can also serve as facts to support the transaction.

In addition to the receipt, the consumer can present as evidence a warranty card (it must contain the date of the agreement and the seller’s signature), a coupon for a cash receipt order, a product registration certificate (read about how to return or exchange a technically complex product here). Sometimes even the way the product is packaged is enough. If the goods are large (for example, a cabinet), and you had to pay for the services of movers at your own expense, the store is obliged to reimburse such expenses.

Contacting the store

Upon arrival at the store, you must state the reason for returning the goods or indicate a defect that was not previously specified. If the seller agrees with the consumer’s decision, then the only thing left to do is return the money spent. If there is a refusal to accept the used product, a return application must be filled out.

The Commission Trade Rules do not provide precise instructions on the return of items in proper condition, which is what entrepreneurs try to take advantage of. But regarding goods of poor condition, paragraph 29 of Government Decree No. 569 of 06/06/1998 clearly states that the consumer has the right to return the consignment product or demand that its defects be eliminated at the expense of the seller.

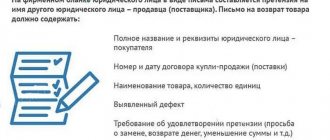

Therefore, in case of refusal, a claim for the return of goods of inadequate quality is written:

- This document is written in the name of the general director of the retail outlet, indicating the name of the store and its address.

- Then the applicant indicates his data and information about the transaction (date of purchase, cost, product details).

- The product defect is clearly described (for example, the phone turns off spontaneously).

- Next, they state their demands (exchange the faulty item for an analogue or return the money).

- To show the seriousness of intentions, they refer to the legislation (you can indicate Article 18 of the Civil Code of the Russian Federation, it specifies the rights of clients, Articles 309 and 310 of the Civil Code of the Russian Federation say that the seller must fulfill accepted obligations, Article 503 of the Civil Code of the Russian Federation repeats the provisions of the Civil Code of the Russian Federation).

The document indicates the presence of a check (if there is one). All facts are presented as accurately as possible, but clearly . A sample form for filling out a claim can be found on the Internet. Sometimes it makes sense to contact a lawyer who will help draw up the document in such a way as to avoid repeated refusal.

The application is drawn up in two copies, one is taken by the buyer, the second remains with the seller.

Attention! A return claim is processed within 3 days. If a positive decision is made, the money must be returned to the client within 10 days.

The beginning of all beginnings

The buyer has the right to return products of both proper and inadequate quality. The procedure for returning products is established by law. Consequently, the taxpayer who received the return of the goods must make an appropriate reflection of the transaction performed in accounting.

How to proceed?

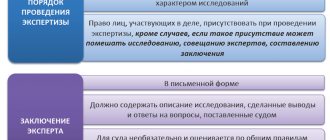

According to general rules, fulfillment of the terms of the contract and transfer of quality products is considered a sale. If the seller is on OCH, then he needs to record the receipt of the returned goods.

The basis for this operation is the TORG-12 consignment note issued by the person who made the purchase.

The seller, in turn, issues an adjustment invoice, which must subsequently be recorded in the purchase book at the time the returned products are accepted for accounting. After this, the buyer has the right to declare VAT withholding.

If the seller violated the terms of the agreement or delivered defective products, then such a return is not considered a sale. As a result, the buyer returns the goods on the basis of the invoice. Whereas the seller makes a counter-entry for the previously completed shipment, and also issues an adjustment invoice (hereinafter referred to as the invoice). Based on this document, it will be possible to accept VAT withholding. Transactions are displayed in taxpayer accounting as follows:

Proceeds from the sale of commodity mass to the buyer are considered income:

- Kt 90 “Sales” (subaccount 90–1 “Profit”) Dt 62 “Settlements with customers...”.

In parallel, the cost of sold products should be written off from credit account 41 “Goods” to debit account 90 (subaccount 90–2 “Cost of sales”). Separately, it is worth considering the situation when the terms of the agreement were fulfilled in full, and the return of the goods occurred after it was actually accepted for registration by the recipient.

Such operations are called reverse sales, where the former buyer acquires the status of a supplier, and the organization becomes a buyer of the product.

Consequently, the current supplier must issue a TORG-12 consignment note to the former seller. Returned products are accepted for accounting by the recipient at cost, i.e., an amount of money that is equal to the actual costs of its purchase.

Posting for goods receipt is carried out as follows:

- Dt 41 “Goods” Kt 60 “Settlements with suppliers...”.

At the same time, according to the fiscal authority, the return of products is considered a sale if at the time of return it was fully capitalized by the buyer. Therefore, the transfer of ownership of the commodity mass is subject to VAT.

But, if the person who bought the product is not a VAT payer, for example, due to the application of the simplified tax system, then no tax is charged when returning the product.

In such circumstances, the Ministry of Finance advises suppliers to issue an adjustment invoice. As for the seller, he has the right to withhold VAT on returned products.

To capitalize the received delivery note, the person selling the goods must use the 1C document “Return of goods from the buyer.” Then, based on the initial sale, you must enter the “Sales Adjustment” document. Here the seller displays the adjustments made, then switch the switch to “VAT”.

Large merchants do not like to return money for goods. Find out how to return goods to Yulmart. The procedure for returning goods within 14 days requires the presence of markings and labels on it. Find out how to perform the procedure.

The final step is to enter the adjustment account data. As a rule, the specified invoice is issued by the seller within 5 days from the date of provision of the necessary documents (Article 168 N of the Russian Federation). One of such documents is a product return agreement. In addition, it is the responsibility of the invoicing seller to record the document in the purchase ledger. The corresponding statements are displayed on the day the returned products are accepted for accounting.

If the buyer uses the simplified tax system, then he must have two accounts:

- primary invoice for the cost of purchased products;

- an adjustment invoice for the cost of the item that was returned.

The indicated documents will become the basis for fixing the actual amount of VAT in relation to the products purchased by the buyer.