The product from the supplier may be of poor quality or not correspond to what is stated in the documents. For example, they brought the wrong quantity or in the wrong container. Create a “Return to Supplier” document in VLSI, indicate the items you want to return and their prices.

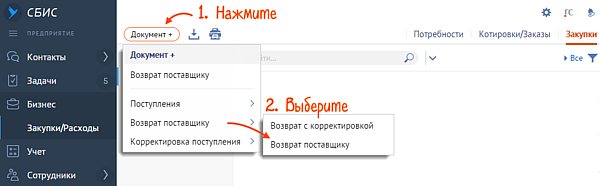

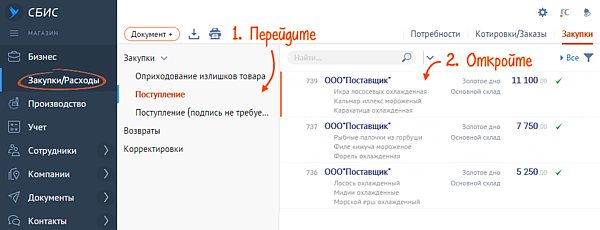

You can issue a return in the “Business/Purchases/Expenses” section on the “Purchases” tab from the “Returns” block or from the receipt document.

In the “Business/Purchases/Expenses” section

From the document “Receipt”

- In the “Business/Purchases/Expenses” section on the “Purchases” tab, go to the “Returns” block.

- Click "+Document" and select "Returns" and then "Return to Supplier."

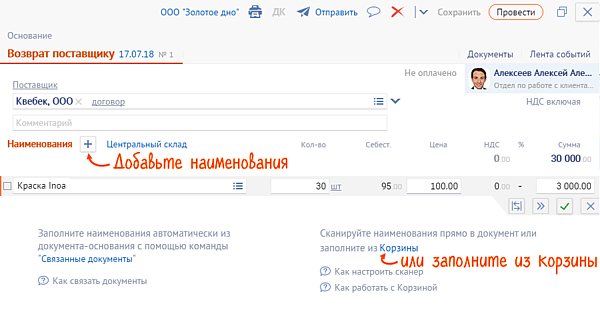

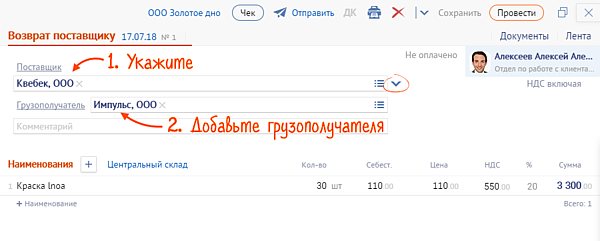

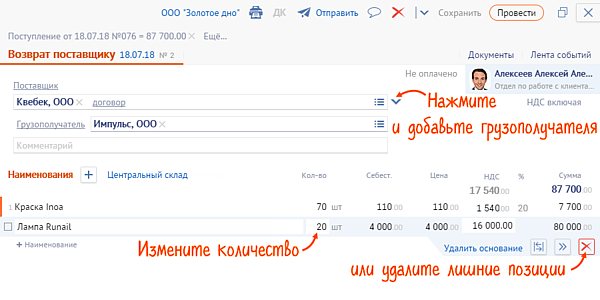

- In the "Supplier" field, select an organization. If the buyer and consignee are different companies, click and indicate the counterparty to whom the goods will be shipped. VLSI will assign the tax system to the document, which is specified in the accounting policy settings. The document will have the status “with VAT” or “without VAT”;

- Click and select a name. You cannot add “Excluding” items to a document, such as works, services or non-exclusive rights.

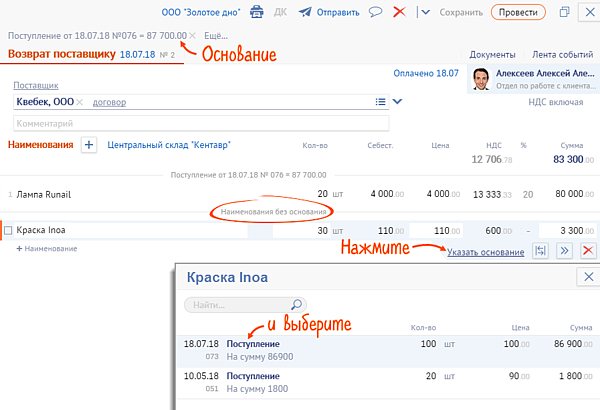

- Please indicate the reason for return:

- general - for goods from one batch;

for each position - for products from different sales.

- Click “Post” - the product will be written off from the warehouse. VLSI will calculate the VAT amount based on the rates in the item types of the selected items.

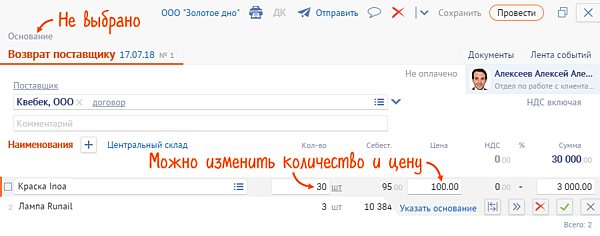

Check the name and quantity of the product. Adjust them if necessary. You cannot edit the price if the basis is specified in the document.

If the basis is not selected, then enter the purchase price in the “Price” field. It will go into “Mutual Settlements” (Reconciliation Report). The cost will be calculated as the average for the balance of the warehouse selected in the document.

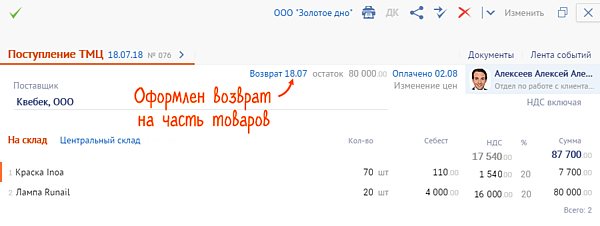

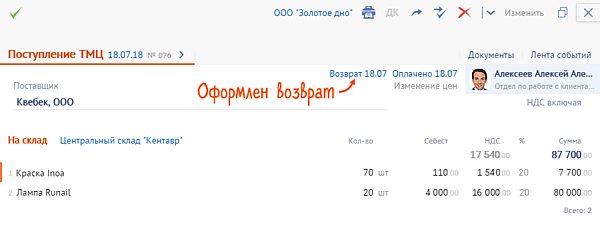

A link to the return document will appear in the “Receipt” document.

Returns to the supplier can be made through linked documents or the bulk transactions panel.

What you need to pay attention to when returning to the supplier in 1C 8.3

Registration of a return transaction to a supplier in 1C 8.3 Accounting depends on some nuances:

- whether the Organization (buyer) is a VAT payer;

- whether the goods are registered before they are returned.

In this case, a quality or low-quality product is returned, does not affect the design.

Returning materials to a supplier in 1C 8.3 is no different from returning goods, so the step-by-step instructions for returning goods to a supplier in 1C 8.3 are also suitable for returning other goods.

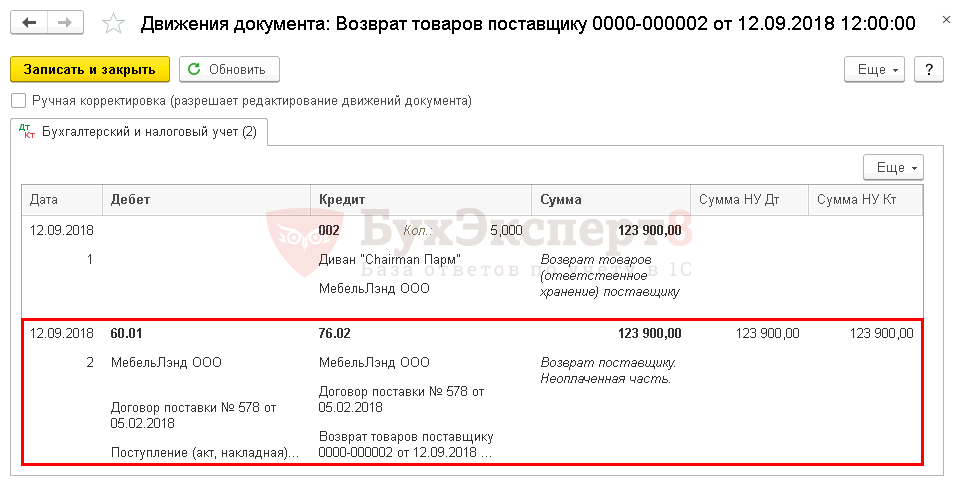

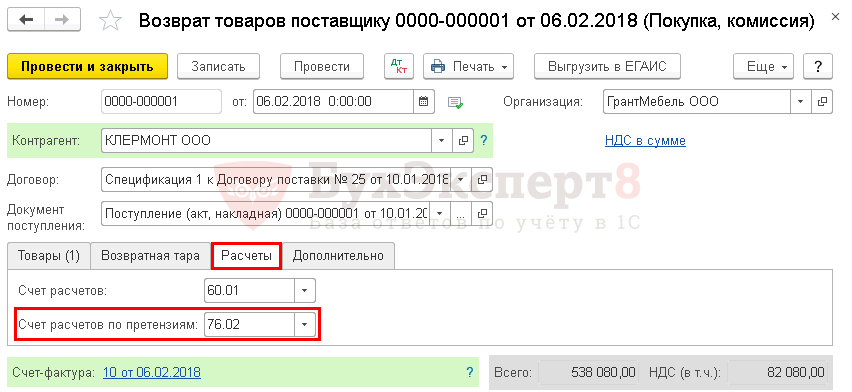

The return of goods to the supplier is reflected according to Dt 76.02 “Calculations for claims” (chart of accounts 1C). If the returned goods have not previously been paid for, then when returning to the supplier in 1C 8.3, an additional entry Dt 60.01 Kt 76.02 is created, which automatically reduces the debt to the supplier by the cost of the returned goods.

Next, in step-by-step instructions, we will consider how to process the return of goods to the supplier in 1C 8.3 in various circumstances and what transactions are generated by 1C Accounting 8.3 in each case.

When can I return an item?

According to the current civil legislation, the customer has the right to return goods and materials to the supplier in a number of cases:

- non-compliance of the received goods with the terms of the contract in terms of quality, packaging, configuration (clause 2 of Article 475, clause 3 of Article 482, clause 2 of Article 480 of the Civil Code of the Russian Federation);

- expired shelf life of supplied goods and materials;

- impossibility of use and implementation;

- updating the customer's assortment, etc.

The customer checks the compliance of quantitative and qualitative characteristics during the acceptance of goods and materials or upon acceptance within the period established by law or contract (clause 2 of article 513, clause 2 of article 474 of the Civil Code of the Russian Federation).

Reflection in 1C 8.3 of the return of goods not accepted for registration to the supplier

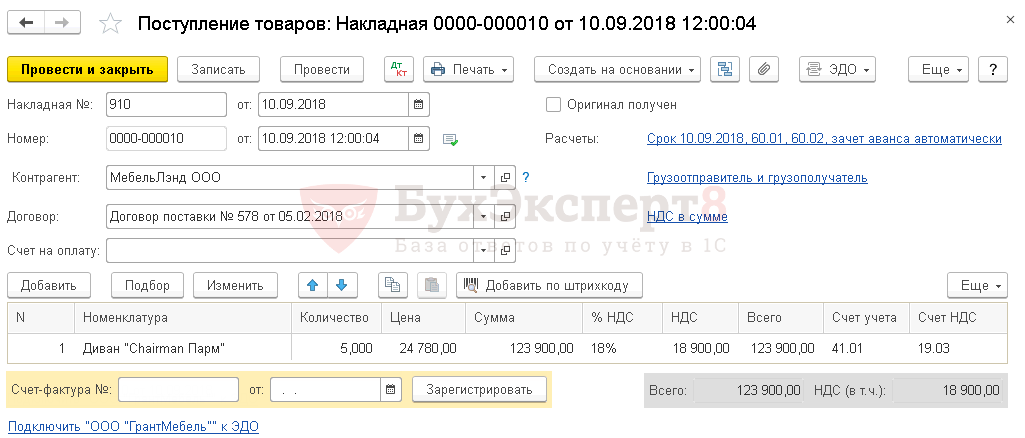

On September 10, the organization’s warehouse received the goods “Chairman Parm” Sofa (10 pcs.) from the supplier MebelLand LLC in the amount of 210,000 rubles. (including VAT 18%). Upon acceptance of the goods, a defect was discovered (5 pieces).

On September 12, the defective product was returned to the supplier.

If a defective product is taken into custody or only part of it is returned, then the low-quality product is first registered and then returned to the supplier.

Purchasing goods

Document the receipt of goods at the warehouse with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipt (acts, invoices).

If you are returning only part of the goods, then issue 2 documents Receipt (act, invoice) : one - for the receipt of goods accepted for registration, the second - for the receipt of goods not accepted for registration.

Fill in the data of primary documents in 1C (invoice and invoice) in the same way for both documents, according to the primary documents.

Receipt of registered goods

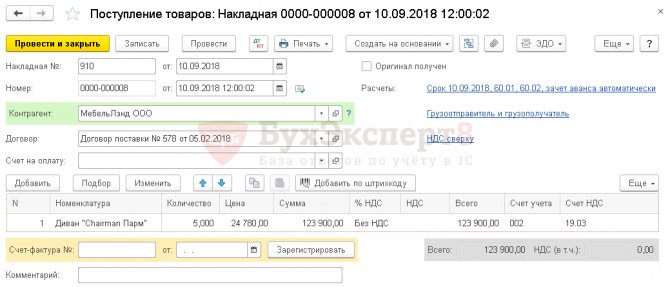

Receipt of goods not accepted for registration

In the form we indicate:

- Invoice No. from - number and date of the primary document;

- Amount - the total amount including VAT for the defective product;

- % VAT - Without VAT ;

- Accounting account - 002 “Inventory assets accepted for safekeeping.”

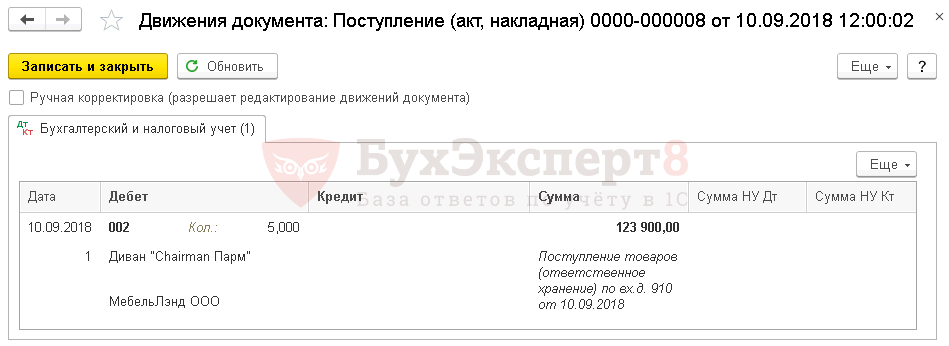

Postings upon receipt of goods not accepted for registration

Wiring is generated:

- Dt 002 - reflection of goods not accepted for registration.

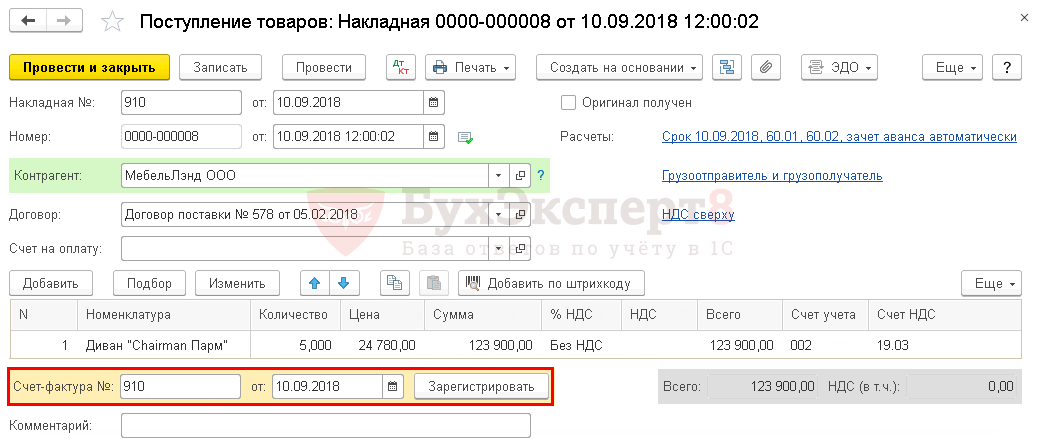

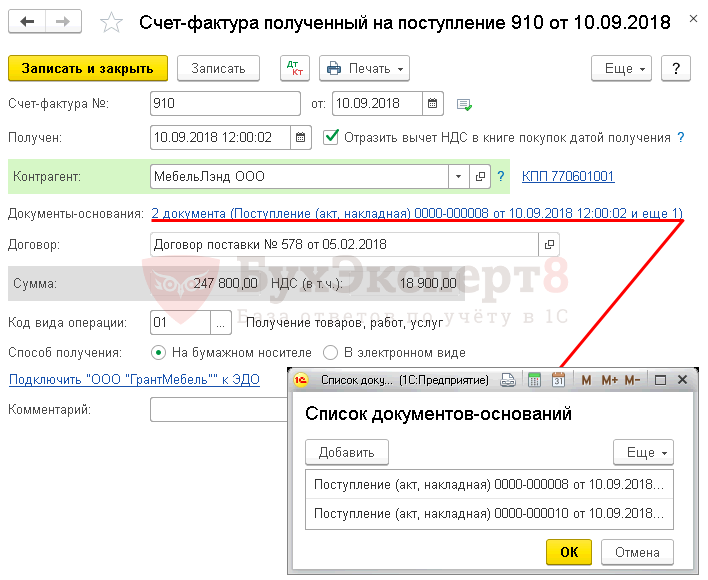

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

The List of supporting documents must contain both documents: receipt of goods accepted and goods not accepted for registration.

Returning goods to the supplier

For the return to the supplier of goods that have not been accepted for registration, fill out the document Return of goods to the supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

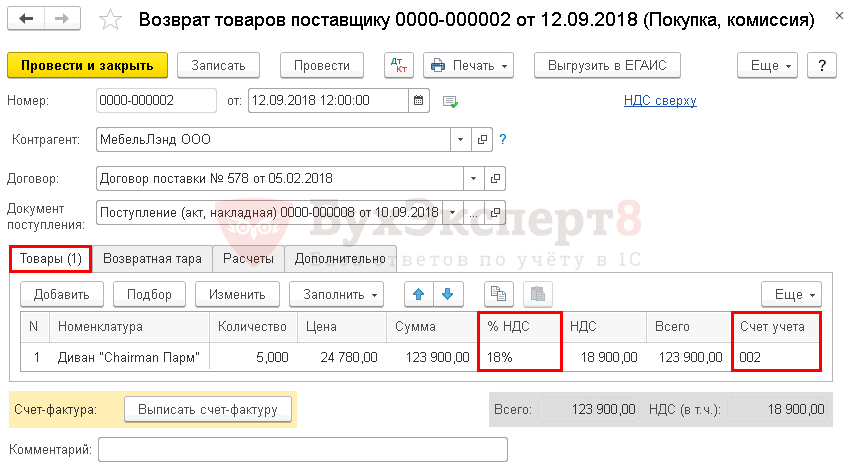

In the form we indicate:

- Receipt document - the document from which the batch is returned. May not be indicated if it is not known from which batch the item is being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Price, Amount - according to primary documents;

- Quantity - the number of returned goods;

- % VAT - VAT rate according to primary documents;

- Accounting account - 002 “Inventory assets accepted for safekeeping”, because the goods were not accepted for accounting.

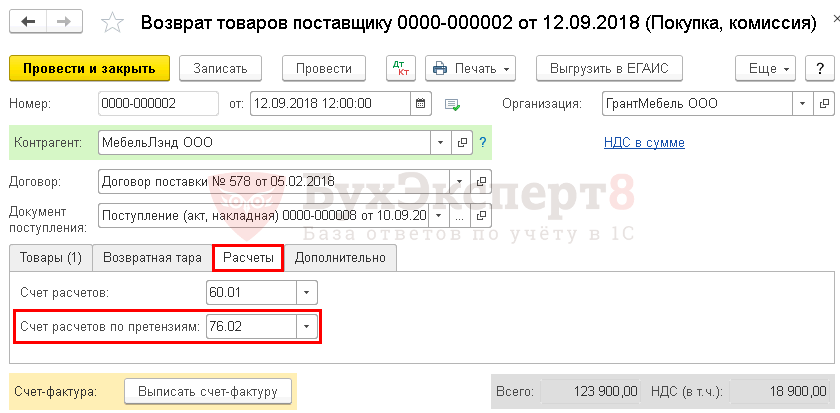

Calculations tab unchanged.

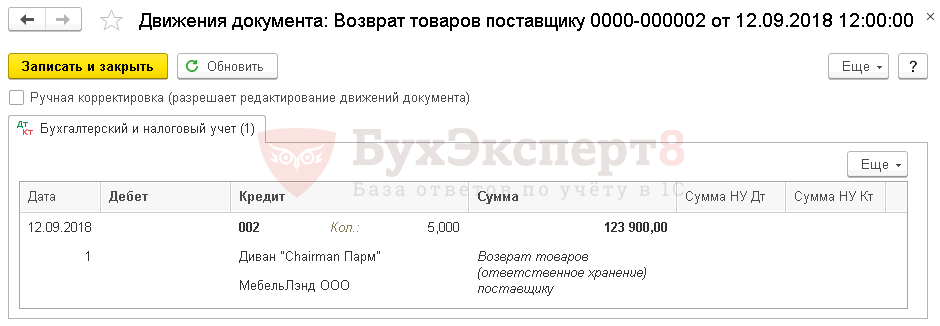

Postings

Postings are generated:

- Kt 002 - goods returned to the supplier, not accepted for registration;

- Dt 60.01 Kt 76.02 - the debt to the supplier for returned goods has been reduced.

An invoice for the return of goods not accepted for accounting is not issued. An adjustment invoice from the supplier issued for a partial return of goods is not registered in the purchase book (Letter of the Ministry of Finance of the Russian Federation dated February 10, 2012 N 03-07-09/05).

How to issue a return

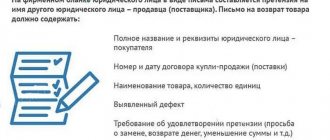

If discrepancies were discovered by the customer during acceptance, before registering the goods, the parties sign a discrepancy report, which is a return delivery note, form TORG-12.

If the customer organization accepted the goods and materials for accounting and subsequently discovered discrepancies, then a return invoice is drawn up, which clearly indicates the basis for the return: inappropriate quantity, quality, hidden defects. Supporting documents such as an act, claim, letters must be attached to the return invoice. Additional information about discrepancies is provided in the return documentation.

Returning goods accepted for registration to the supplier in 1C 8.3 - step-by-step instructions

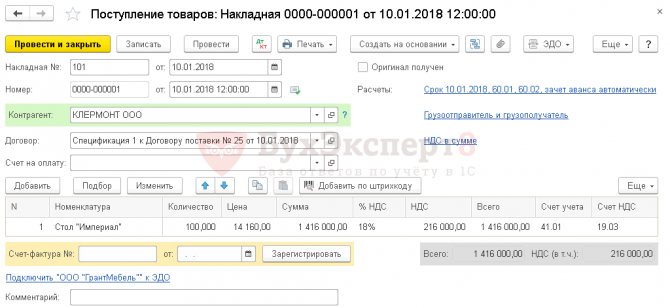

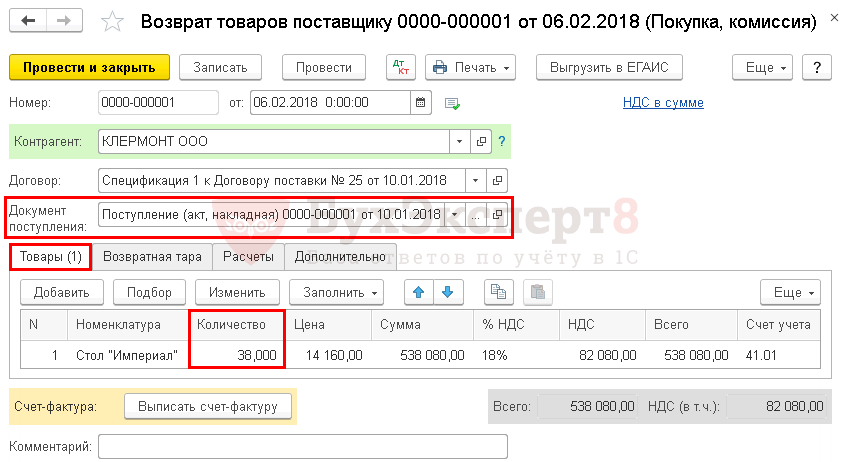

On January 10, the Organization purchased the “Imperial” Table (100 pcs.) from the supplier “CLERMONT” LLC for the amount of RUB 1,416,000. (including VAT 18%). On the same day, the goods arrived at the warehouse and were accepted for accounting.

On February 6, part of the goods (38 pieces) was returned due to a defect.

Purchasing goods

The purchase of goods is documented with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipt (acts, invoices).

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

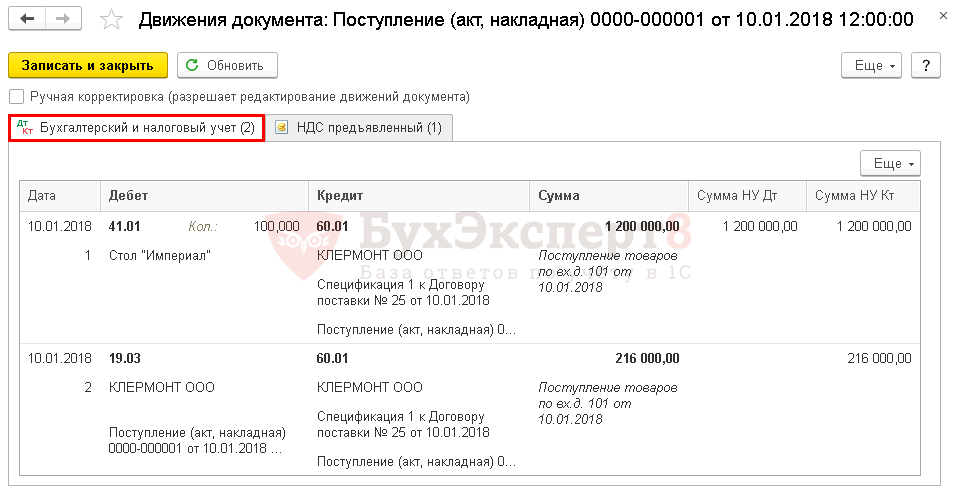

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

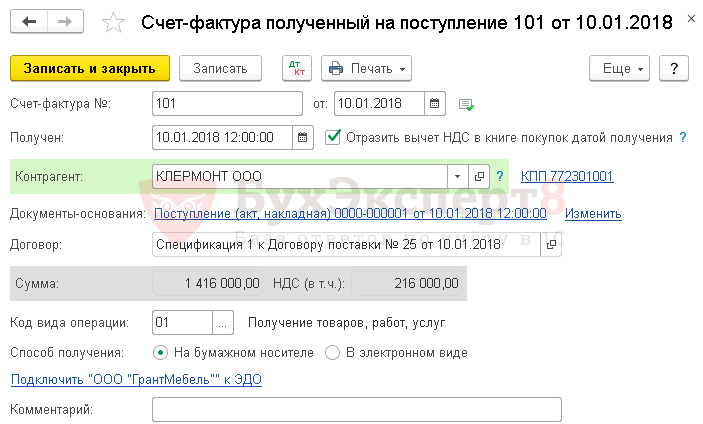

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

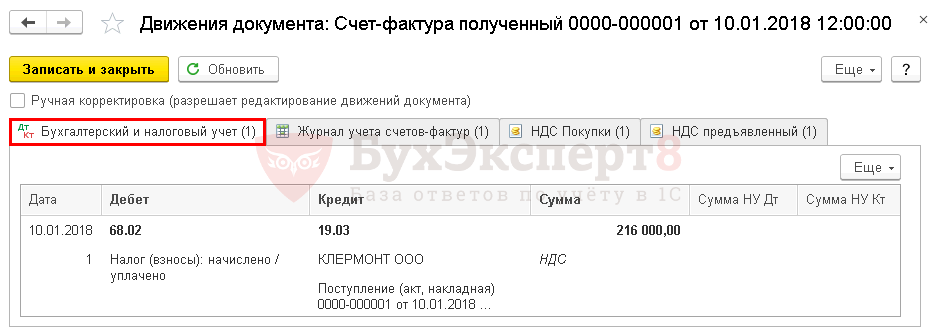

Postings

Wiring is generated:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Returning goods to the supplier

Fill out the return of goods accepted for registration with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

It does not matter whether part of the goods or the entire batch is returned.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of the MPZ; if the Receipt Document is specified, then the price is filled in automatically from the document; if not specified, then the last purchase price is indicated;

- % VAT - 18%, since the return of goods accepted for registration is a reverse sale.

Calculations tab unchanged.

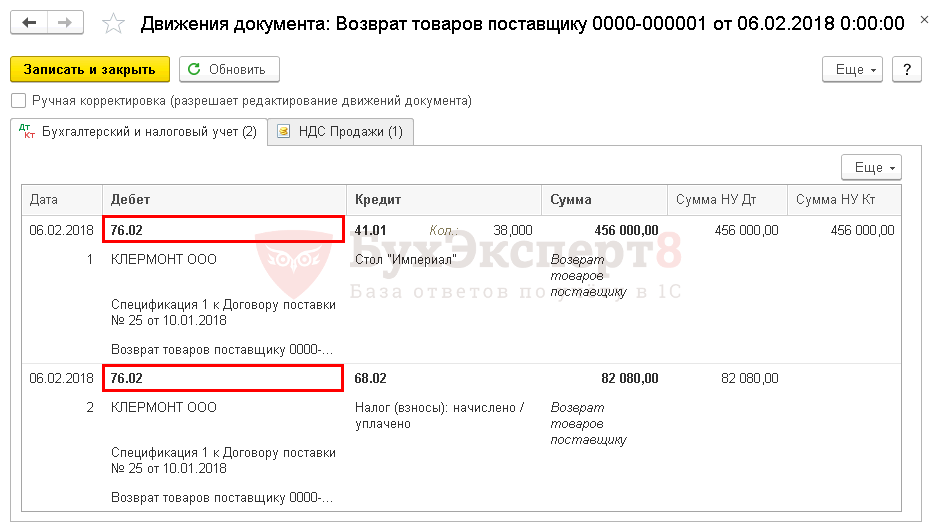

Postings

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 76.02 Kt 68.02 - VAT is charged on the returned goods.

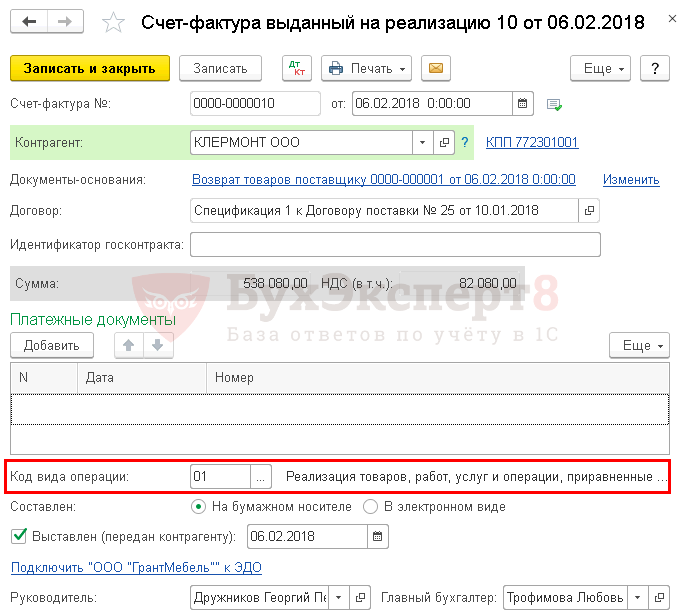

Issuance of invoices for return to the supplier

If goods already accepted for registration are returned to the supplier, then issue an invoice for their return at the bottom of the document form Return of goods to supplier .

Invoice issued for sales will be automatically created .

- Operation type code — .

Return of goods by VAT non-payer

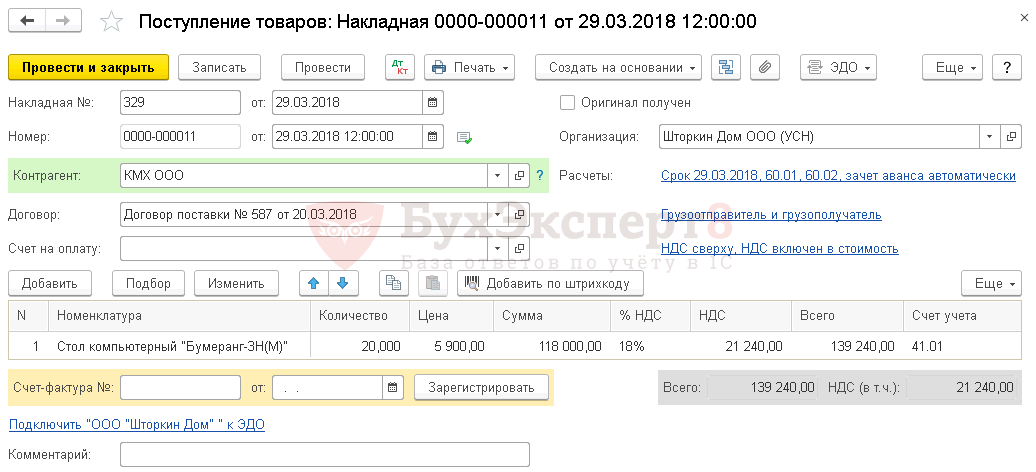

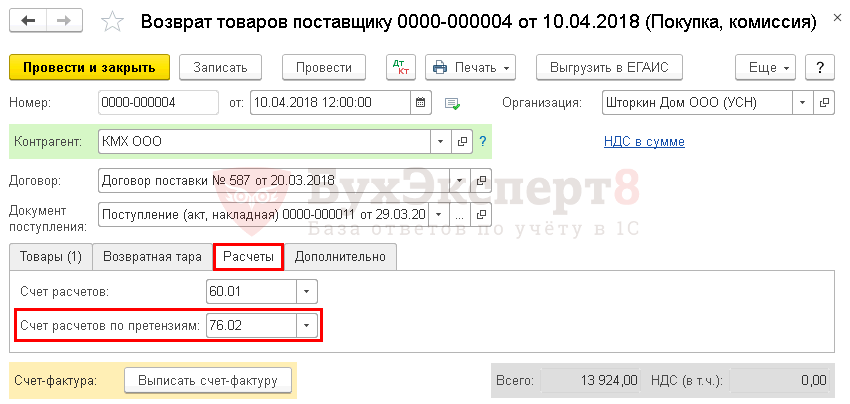

On March 29, the organization’s warehouse received the goods Computer desk “Boomerang-3N(M)” (20 pcs.) from the supplier KMH LLC in the amount of 139,240 rubles. (including VAT 18%).

On April 10, part of the goods (2 pieces) was returned due to a defect.

Purchasing goods

Reflect the purchase of goods in the document Receipt (act, invoice) type of transaction Goods in the section Purchases - Purchases - Receipts (acts, invoices) - Receipt button.

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

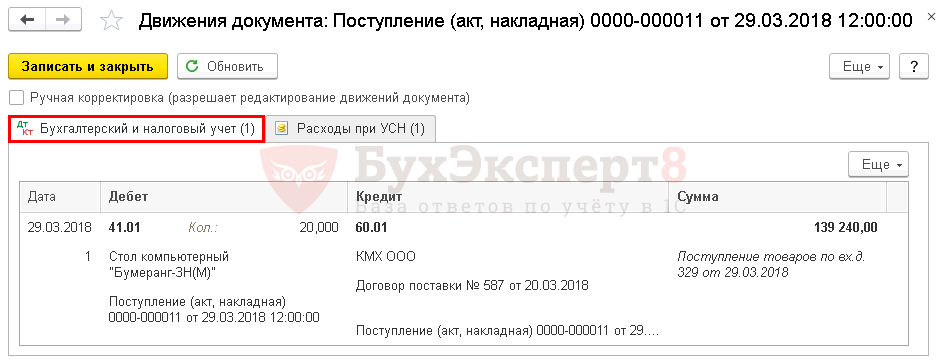

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

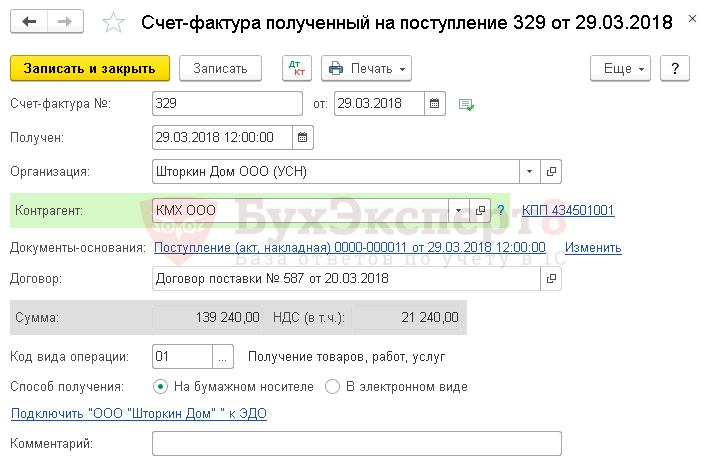

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

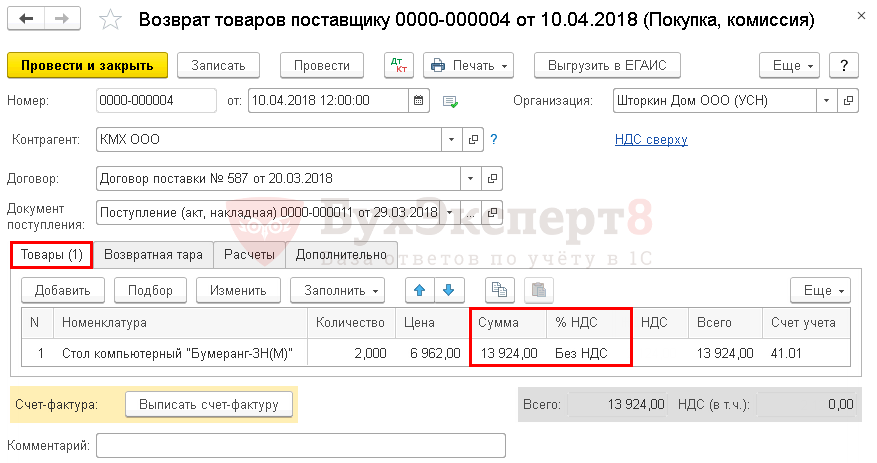

Returning goods to the supplier

Fill out the return of goods with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of MPZ including VAT;

- % VAT - Without VAT , because a company using the simplified tax system is not a VAT payer and does not issue an invoice (clause 5 of article 168 of the Tax Code of the Russian Federation).

Calculations tab unchanged.

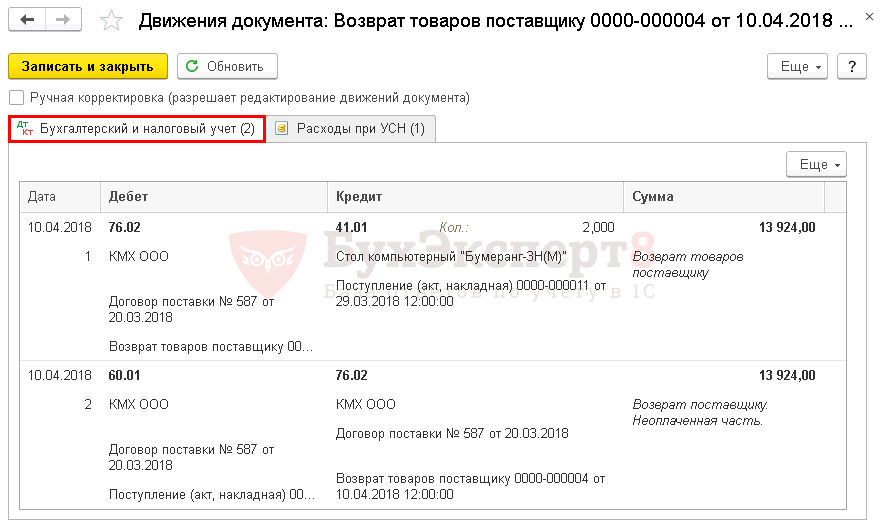

Postings

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 60.01 Kt 76.02 - the debt to the supplier was reduced by the amount of the returned goods.

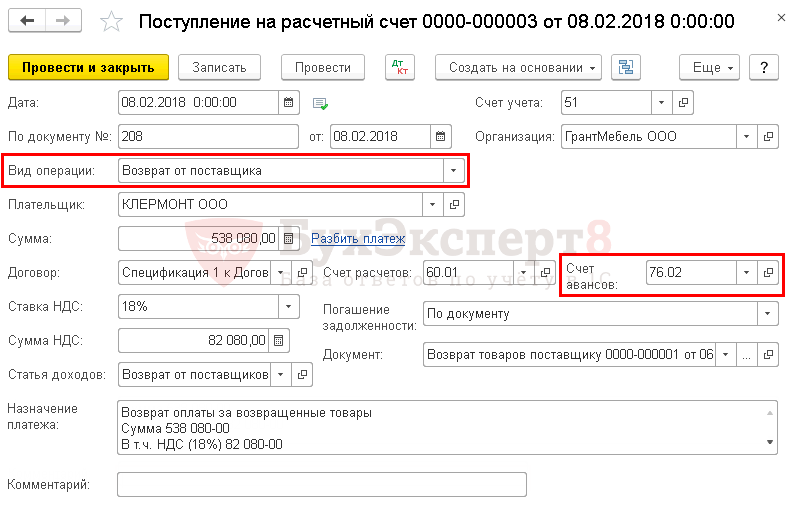

Refunds from the supplier: postings in 1C 8.3

On February 6, part of the goods (38 pieces) was returned due to a defect.

On February 8, payment was received to the bank account for the returned goods in the amount of RUB 538,080.

The return of funds from the supplier is documented using the document Receipt to the current account, transaction type Return from supplier in the Bank and cash desk - Bank - Bank statements section or based on the document Return of goods to supplier the Create based button .

In the form we indicate:

- Advances account - 76.02 “Calculations for claims.”

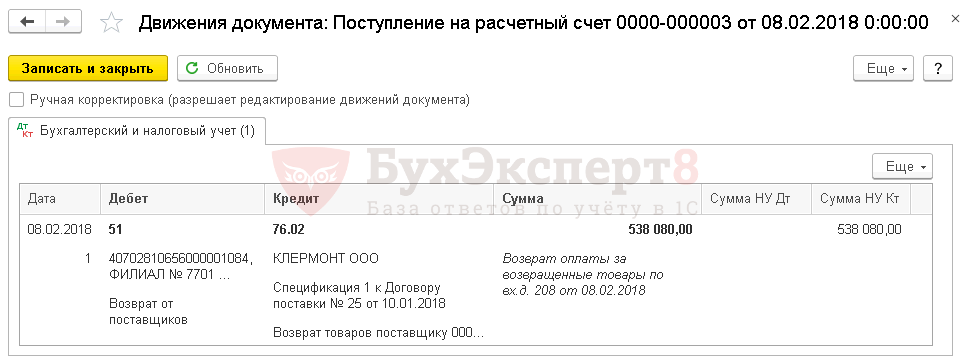

Postings

Wiring is generated:

- Dt Kt 76.02 - refund from the supplier for returned goods.

Issue a return from related documents

- In the “Business/Purchases/Expenses” section, go to the “Purchases/Receipts” block and select the document according to which you received the goods.

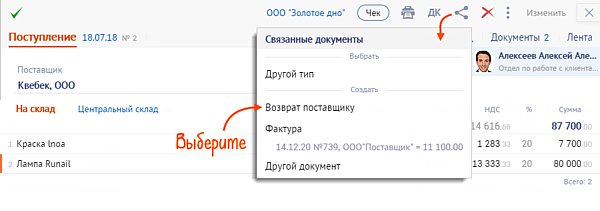

- In the receipt, click and in the “Create” block select “Return to supplier”. VLSI will create a document and upload all products, their quantities and prices.

- In the “Supplier” field, indicate the counterparty. If the buyer and consignee are different companies, click and select the counterparty to whom you are shipping the goods.

- In the “Items” block, leave only those items that you are returning.

- Click “Post” - the product will be written off from the warehouse. A link to the return document will appear in the “Receipt” document.