"AlfaStrakhovanie" - which policies cannot be returned?

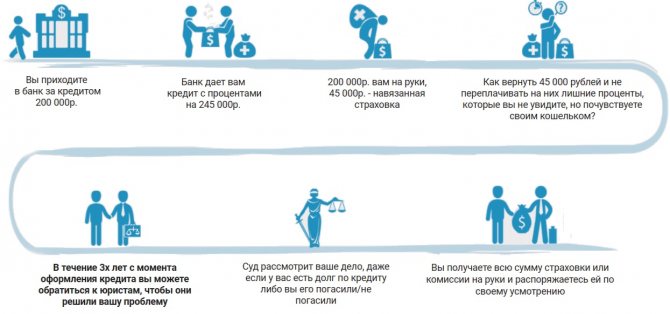

A banking organization, on the basis of Federal Law No. 353-FZ, has the right to offer the borrower a number of services to insure credit obligations when applying for a loan, but does not have the right to oblige the borrower to agree to additional conditions.

The legislation provides for a strictly defined list of loans for which credit insurance is mandatory, these include:

- Insurance against loss of property rights (title) to housing when purchasing real estate on the secondary market. The period of compulsory insurance is limited to three years, since according to the provisions of the Civil Code of the Russian Federation, after this time the limitation period expires.

- Car loans, a prerequisite for which is the issuance of a compulsory motor liability insurance (CASCO) policy. Without consent to insurance, the borrower is guaranteed to receive a refusal.

In other cases, the issuance of an insurance policy in accordance with current legislation is voluntary and cannot be forcibly imposed on the borrower without the right to refuse such services.

Taking out a policy is necessary for banking organizations, since it guarantees the return of borrowed funds in the event of disability or death of the borrower, therefore lenders often offer clients improved conditions:

- A reduced interest rate, which can be significantly lower than the standard rate by 2-2.5% depending on the type, size and term of the loan;

- Preferential conditions for obtaining a loan, which involve calculating the interest rate based on the amount of the actual debt, and not the total size of the loan, which allows you to reduce the rate for the entire term of debt obligations by 1.5-2 times;

- A longer lending period, which allows you to reduce monthly payments on obligations and other more favorable conditions.

The AlfaStrakhovanie group combines several divisions of the company engaged in different types of insurance activities, including AlfaStrakhovanie-Life LLC and AlfaStrakhovanie JSC.

When it is not possible to disable insurance at Alfa-Bank

Mostly, the purchase of an insurance policy is viewed negatively, but it helps reduce the risk when using borrowed funds for both the bank and the borrower.

Alfa-Bank invites you to insure your life and health, loss of source of income, property, and purchase a comprehensive insurance policy when applying for:

- targeted loan;

- car purchases;

- mortgages;

- credit card.

Alfa-Bank has the right to require the purchase of only a policy that insures property, both movable and immovable. Other types of insurance are voluntary.

This means that it will not be possible to disable insurance when purchasing a policy is mandatory, when the object of purchase itself or the collateral is insured. This happens with car loans and mortgages.

According to current legislation in Russia, refusal to draw up an insurance contract cannot affect the receipt of bank approval for issuing a loan and the provision of loan conditions. But commercial banks have the right to refuse a loan without explaining the circumstances. As practice shows, Alfa-Bank reduces interest rates precisely for those people who purchase policies, as this reduces the risk in case of non-payment of the loan.

Alfa-Bank employees can offer you more loyal insurance programs, but they have no right to force you to enter into an agreement. Don’t make hasty decisions; insurance may be beneficial not only for them, but also for you. Study all the nuances of the agreement, consult with an Alfa-Bank employee if you have any questions. And remember that you can cancel your insurance within two weeks.

Conditions for returning loan insurance to AlfaStrakhovanie

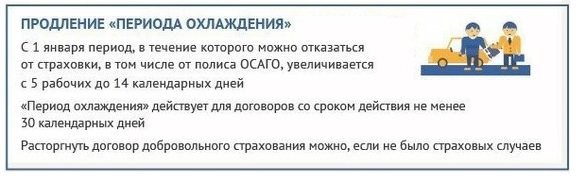

The main condition for the return of 100% of the insurance premium is to notify the insurance agent within the period established by law for terminating the agreement. The insurer, on its own initiative, has the right to increase the period for canceling the agreement.

According to the Directive of the Central Bank No. 4500-U dated August 21, 2021, amendments were made to the Directive of the Central Bank No. 3854-U dated November 20, 2015 to increase the period of the “cooling period”. The minimum period for requesting cancellation of the agreement is two weeks (14 calendar days).

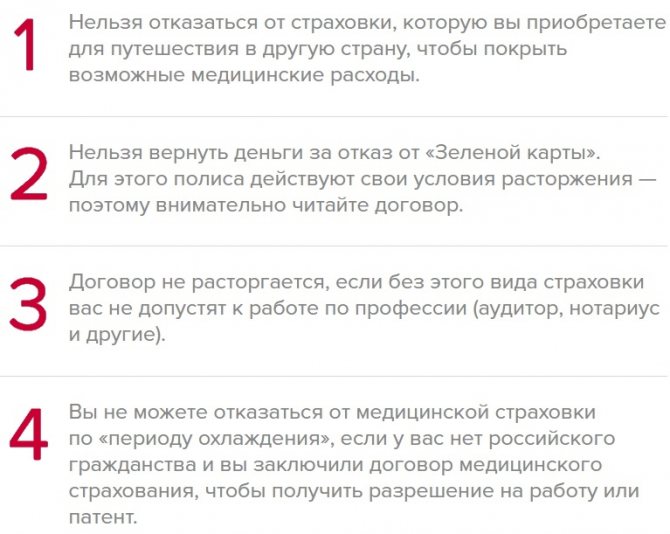

This grace period applies to most types of insurance, with the exception of:

- purchased for travel outside the country (to cover medical expenses if necessary);

- Green Card policy, for which separate cancellation rules are established (specified in the concluded agreement);

- required to carry out a specific professional activity (for example, notaries, auditors, etc. will not be allowed to work without an insurance contract);

- absence of Russian citizenship when a health insurance agreement is drawn up, if it was concluded to obtain a patent or for employment.

Receiving a loan is not included in the specified list of exceptions, so the return of insurance is possible and legal.

The deadline for applying for a refund of the insurance payment paid by a citizen under the AlfaStrakhovanie program is also two weeks or 10 working days. An increase in the deadline for filing an application is not provided, unless otherwise reflected in the contract or other acts of the insurance company.

As a rule, a standard contract for the provision of services is concluded between a citizen and IC AlfaStrakhovanie, therefore an increase in the cooling-off period is not provided for.

To return the insurance premium paid in accordance with the agreement with the company, the borrower must simultaneously comply with two conditions:

- Contact the insurer with a request to terminate the agreement within a period not exceeding two weeks from the date of actual payment for its services.

- To prevent the occurrence of an insurance situation in which the insurer is obliged, on the basis of a concluded agreement, to make payments in favor of the insured person.

Any signs of an insured event recorded by the insurance organization, as well as the omission of the legally established deadlines for filing an application for cancellation of a previously concluded agreement, are grounds for the insurer’s refusal to return the premium received.

“AlfaStrakhovanie-Life” – return of insurance during the “cooling off period”

Agreements between individuals and AlfaStrakhovanie-Life LLC come into force from 00:00 on the day of payment of insurance obligations.

The deadlines for cancellation of agreements between the policyholder and the insurance company apply to the following insurances:

- Life (health), regardless of the reason for concluding the agreement - processing a loan or the personal desire of a citizen with periodic insurance payments;

- Movable property – car;

- Real estate and property with declared value, for example, objects of art;

- Liability of owners of movable property in case of an accident;

- Liability of the insured for causing any harm to other persons or their property;

- Medical insurance, etc.

Despite the legislative establishment of a voluntary registration procedure, most banking institutions force their clients to sign an agreement with insurance companies.

To waive insurance and receive your funds, you just need to contact the bank where the loan was issued (Alfa-Bank) and submit an application for waiving insurance.

If the creditor is another financial organization, the application for refusal should be sent directly to.

Refunds must be made no later than 10 business days from the date of the client’s request or receipt of a written application.

Bank account details for transferring funds are indicated when filling out the application. This period includes the acceptance of an application for refusal of insurance, its consideration and the transfer of funds (if a positive decision on the application is made).

Who can apply

Only its owner or the persons specified in the contract as heirs can cancel an AlfaStrakhovanie car policy. In other words, if the policyholder dies, his relatives also have the right to apply to the insurance company for a refund of the premium paid.

Reference. In exceptional cases, if appropriate documents are available, his legal representative may act on behalf of the policyholder.

If the policyholder does not have the opportunity to visit the AlfaStrakhovanie office in person, it is recommended to fill out an application, attach all copies of documents and send them by mail. The starting date for the return of the premium will be the day the letter was sent (it must coincide with the date of the application).

Submitting an application to AlfaStrakhovanie for a refund of loan insurance

An application for termination of a previously concluded agreement with IC AlfaStrakhovanie is possible during a “cooling off period”, which is 14 calendar days from the date of payment of the insurance premium by an individual.

AlfaStrakhovanie does not provide for an extended cooling-off period, so the policyholder cannot count on a longer period of reflection and decision-making regarding cancellation or retention of insurance.

There are several ways to express your desire to terminate the insurance agreement:

- In a written form. This type of application is carried out through a personal visit to the institution by the policyholder or by sending documents using the postal service.

- In electronic form on the AlfaStrakhovanie website or by sending an application by e-mail.

There are no other ways to notify the insurance company of termination of the contract at the initiative of the policyholder. A sample application is provided by the insurer on the official website or in person.

Written statement

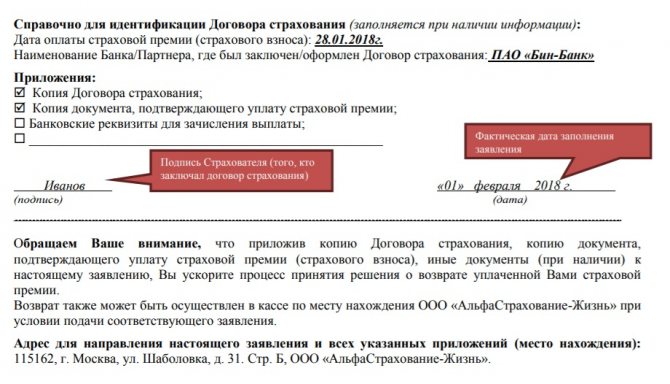

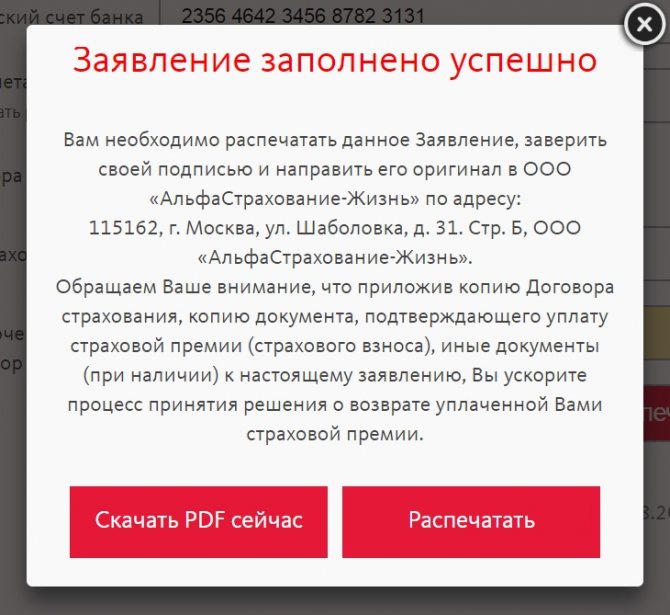

The application for refusal of the insurer's services must be filled out in accordance with the sample presented on the AlfaStrakhovanie IC website and sent to the company's address for receiving correspondence: 115162, Moscow, st. Shabolovka, house 31, building B.

The completed application form can be printed and filled out manually ( drive.google.com/file ) or filled out all the necessary data on the AlfaStrakhovanie website[/anchor] and printed. AlfaStrakhovanie JSC leaves the choice of the type of application for termination of the contract to the policyholder.

In the document sent to AlfaStrakhovanie for insurance refund, you must indicate:

- personal information about the applicant: full name, passport data (series, number, when and by whom it was issued), address, contact information (telephone number and email address);

- date of conclusion of the contract;

- the fact of familiarization with the conditions of early cancellation of insurance;

- details for sending funds in full (full full name of the recipient, current and correspondent account numbers, bank name and BIC);

- date and signature of the applicant.

Filling it out shouldn't be too difficult. But still, if they occur, a sample ( aslife.ru/shablon_zayavleniya_otkaz ) to help:

After printing out the application or using the usual form, the policyholder can contact AlfaStrakhovanie with a request to terminate the insurance policy when visiting the institution in person, as well as when sending documents through the postal service.

To provide documents in person, the applicant must come to the office of the insurance company and register an application. After registration, the citizen must be given a document confirming the acceptance of the application for consideration.

Note! A third party can also submit an application, but he will need a power of attorney from the policyholder, certified by a notary.

If sending documents by mail, you must:

- Compose an application according to the template presented on the company’s website;

- Attach the necessary documents to the application, which include: a copy of the contract and a copy of the receipt for payment of the insurance premium;

- Send by registered mail at Russian Post with a stamp indicating the date of acceptance of the letter for forwarding; the average delivery time for correspondence varies from 3 to 7 days;

- Wait for the documents to be delivered to AlfaStrakhovanie’s address and receive a response that the application has been accepted for consideration.

Often the insurance company refuses to confirm the fact of the client’s application. Therefore, sending by registered mail will be the most reliable method of filing an application for waiver of insurance.

IC "AlfaStrakhovanie" must transfer funds to the policyholder's account within 10 days from the date of receipt of the application for consideration, however, the agreement is considered terminated from the moment the documents on its cancellation are sent.

Online application

The easiest way to return loan insurance to IC AlfaStrakhovanie is to fill out an application form on the company’s website. Unfortunately, it will not be possible to send a request through your personal account for consideration, since the insurer needs the original documents.

To fill out an application online, you need to log in to the insurer’s website, then select the “Cancellation of insurance” section.

After this, the policyholder must go to the “ Ask a Question ” and only after that select the “Cancellation of the Insurance Agreement” ( aslife.ru/otkaz-ot-dogovora ) in the right corner of the screen.

To fill out the application, do the following:

- follow the link: aslife.ru/forma-otkaza-ot-dogovora-strakhovaniya;

- fill in all empty fields.

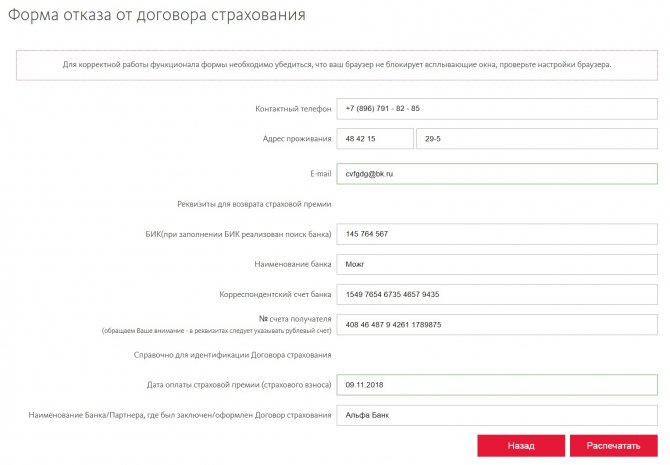

On the presented page there is a standard application for refusal of insurance, as well as a sample of its completion, the following information is indicated there:

- Personal data of the policyholder – full name, date of birth, contact phone number;

- The contract number is indicated in a separate paragraph, and it is important to take into account the rules for filling it out if there are CCC or GVA codes; the possibility of considering the application depends on this;

- The citizen’s residential address, which was indicated when applying for insurance;

- Email address for sending a response to the request;

- Details for transferring funds from the insurer’s account to the applicant’s account;

- Date of payment of the insurance premium or actual commencement of the insurance agreement;

- The name of the banking institution that issued the loan.

After filling out all the fields, click “Print” or “Download PDF now.” You can view information about which address to send papers about termination of the agreement. You cannot send an application from your personal account.

Ready! As a result, you do not need to fill out the application yourself - the system itself generated the completed form.

Another way to send documents is to contact the policyholder directly by e-mail - However, you cannot send the initial request there - it can be ignored. Such circumstances will lead to missing the deadline for terminating the contract.

It is recommended to contact AlfaStrakhovanie by e-mail after sending documents by Russian Post, since regardless of the method of drawing up the application and citizens’ appeal, the insurer will need the original documents to cancel the agreement.

The application for refusal can be made in writing or electronically. Regardless of the form of the document, when submitting it to the insurance company, it is imperative to save a second copy.

It will be used as confirmation of compliance with the “cooling off period” and other legal requirements for the process of returning unnecessary insurance from AlfaStrakhovanie.

U. As a rule, their divisions are located in Alfa Bank or other partner banks.

Therefore, all questions regarding insurance can be resolved in customer support by calling the hotline: 8 800 333-84-48 (daily from 08:00 to 20:00, calls within Russia are free or by filling out the appropriate form in the “Ask a Question” section on the website.

What is insurance at Alfa-Bank

Insurance can be a kind of salvation for the borrower. After all, we don’t know what might happen to us tomorrow. “Fell, lost consciousness, woke up, cast.” This situation will result in long-term sick leave, but how to pay off the loan? We were laid off at work, and it will take a lot of time to find a new place. It is from such cases that Alfa-Bank wants to protect itself and reduce the risk of non-repayment of borrowed funds. So, you can receive an insurance payment under the “Life and Health Insurance” and “Credit Card Owner’s Insurance” policies in the following cases:

- You were fired from your job at the initiative of your employer . Dismissal at one's own request is not an insured event. You can expect three monthly loan payments.

- In case of temporary disability caused by an accident or illness . Insurance companies will only offer their assistance if your sick leave lasts more than 20 days.

- Death of a client and establishment of group 1 disability. In this case, the insurance will fully cover your loan . No more than 500 thousand will be paid under the Credit Card Owner Insurance program. Suicide is not an insurance event.

Having taken out a mortgage from Alfa-Bank or any other bank, it is better to insure your life and health so as not to worry that your heirs will have to repay the loan, and they will be able to calmly enter into an inheritance. Even if you are forced to buy this kind of policy, remember that you are not obligated to do this, but insurance can contribute to approval and obtaining more favorable loan conditions.

A mandatory condition of a loan agreement with Alfa-Bank is insurance of the property for which you are applying for a mortgage or loan. For example, when buying a car on credit, you are required to buy a comprehensive insurance policy, and if you take out a mortgage on your home, you need to insure the property against the risk of loss or damage. In other cases, you must decide for yourself whether it is profitable for you to purchase insurance. Carefully study the insurance contract and think about how beneficial it is for you, pay attention to all the pros and cons.

“AlfaStrakhovanie” – is it possible to return insurance if the “cooling off period” has passed?

After the expiration of the application period, the law does not provide for the return of the insurance payment paid to the insurer for the provision of services. Civil legislation establishes the right of the insurance company to return part of the funds to the client, but does not force compliance with this rule.

Insurers, guided by current legal norms, do not return funds if the deadline for submitting an application for cancellation of an insurance policy is missed. The relevant provisions are specified in the agreement between the insurance company and the individual.

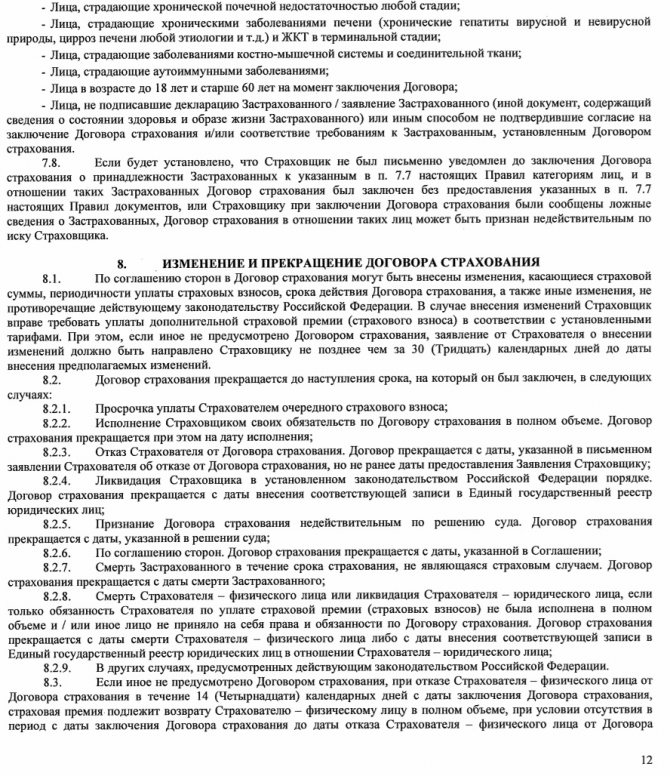

Standard Conditions No. 2 of Alpha Insurance in Section 7 provide for the following grounds for termination of the agreement:

- Fulfillment of the obligations assigned to the insurer to pay funds or fulfill obligations in the event of an insured event;

- Termination at the initiative of the policyholder;

- Liquidation of the insurer's organization;

- Recognizing the clauses of the agreement as unlawful through legal proceedings;

- In other circumstances established by the legislation of the Russian Federation.

According to the provisions of clause 5.5 of Section 5 of Conditions No. 2 for life and health insurance, if the policyholder has not terminated the contract with the insurer during the “cooling off period,” then its provisions are considered fully fulfilled, regardless of the loan repayment period or the absence of insured events.

In such a case, the refund will be issued through the court. It should be borne in mind that you should not count on a large amount, because:

- the legal process takes time;

- the company will claim that funds during the contract period were used to provide insurance.

However, some amount will be returned, and exactly how much money will be transferred depends on the cost of insurance and the number of days that have passed since the conclusion of the contract.

To protect your interests in court, you can refer to the fact that the fact that insurance was included in the loan amount was unknown to you, or you can point out that the service was imposed.

But these facts are quite difficult to confirm. Success is possible if the credit agreement or loan application already contained consent to insurance.

In this case, the insurance premium is automatically included in the amount of borrowed money issued. In other cases, you will need evidence of the imposition of the service or the absence of information about it. Their role may include witness testimony, audio/video recordings, etc.

How to calculate the refund amount

If you return the insurance policy within the first 14 days after purchasing the policy, the amount paid under the contract is returned 100% of the amount. If the policyholder terminates the contract at a later date, a commission of 23% is deducted from the insurance premium, as well as insurance services for the period of validity of the policy.

Reference. The 23% commission, which is deducted from the refund amount regardless of the reason for termination of the contract, includes payment for the company’s insurance services (20%) and compensation to the Russian Union of Auto Insurers (3%). Even if the policyholder returns the policy on the 15th day of its validity, the return amount will be reduced by 23%.

Refund of insurance when selling a car or in other cases provided for by the law of the Russian Federation should be carried out immediately after their occurrence. For example, a driver sold a car on July 2, and applied for insurance on September 10. In this case, the return period will be counted only from September 10. For the period from the date of sale to the day of filing the application, the paid insurance premium will not be refunded.

It is easy to calculate the amount of the premium refund:

- if the contract is terminated in the first 2 weeks after purchase, the insurance company will return 100% of the cost of the policy;

- in other cases, 23% and payment of insurance services for the days during which the policy was active should be deducted from the amount of the premium paid.

How to calculate exactly how much the insurance company will return? To do this, just use a simple formula:

SV = (SP – 23%) × (ND/SD) , where

SV - the amount that is due to be returned;

SP - insurance premium paid by the driver;

ND - unused days.

SD - the period of validity of the policy under the contract.

"AlfaStrakhovanie" - termination upon early repayment of the loan

In accordance with Art. 958 of the Civil Code of the Russian Federation, the client can return the insurance premium upon early repayment of his loan obligations only in one case - if such a right is enshrined in the agreement.

Alfastrakhovanie does not include such a clause in its contracts, so it will not be possible to return the money by closing the debt ahead of schedule.

Refund of the insured amount when concluding an agreement with IC AlfaStrakhovanie is possible only during the first 14 calendar days from the date of commencement of the contract. The starting point is considered to be 00 o'clock on the day when the full payment of the insurance premium was made.

In accordance with the provisions of clause 7.4 of Section 7 of Conditions No. 2 of Alpha Life and Health Insurance of a citizen, in case of early repayment of loan obligations, the insurance premium is not refundable, and clause 5.5 of Section 5 establishes that the insurer’s obligations are fulfilled in full.

These provisions contain additions “unless otherwise provided in the insurance contract,” however, the composition of the standard agreement has no exceptions and additional provisions, the Policy offer is valid on a general basis without refund of the insurance premium.

Civil legislation enshrines the right of the insurer not to return the premium amount to a citizen if he filed a claim after the “cooling-off period.” The policyholder retains the right to terminate the agreement before the end of its validity period without receiving compensation.

The policyholder also retains the right to appeal to the court. The basis is any discrepancy between the provisions of the contract and current legislation, as well as infringement of the rights and legitimate interests of an individual by the insurance company.

- There are also precedents (successful legal disputes)

- Continuation

Particularly interesting is the Determination of the Judicial Collegium for Civil Cases of the Armed Forces of the Russian Federation dated May 22, 2021 No. 78-KG18-18 in the case of one citizen who repaid her loan ahead of schedule.

The bottom line is this: the insurer did not return her premium in proportion to the “unused” days. The citizen appealed to the court of first instance - it refused to satisfy her demands, then to the court of appeal, which also refused.

And only the Supreme Court of the Russian Federation did not agree with the decisions made and ordered the insurer to pay the premium for “unused” days.

When rendering its verdict, the Supreme Court noted that, according to the terms of the insurance contract, the insured amount is equal to 100% of the amount of debt under the loan agreement.

Since at the time of early repayment this debt became zero, the insured amount also became zero. This means that there is no point in insurance, in which the payment of insurance compensation is impossible.

It is also interesting that the RF Armed Forces noted that the norm of Part 1 of Art. 958 of the Code is still dispositive, not imperative. That is, not only the destruction of property or termination of business activity is the basis for proportional compensation of the insurance premium.

In relation to this case, this norm should be interpreted as “disappearance of insurance risks” (since the insurer no longer has the obligation to provide insurance compensation).

"AlfaStrakhovanie" - Refusal of Insurance within 14 Days

The best option is to contact the insurance company during the “cooling period.” In this case, the insured person can return 100% of the amount paid. An exception is the occurrence of an insured event within 14 days from the date of registration of the contract: in such a situation, you cannot claim payments from the insurer.

When applying during the “cooling-off period,” the contract terminates on the date of filing the application or any other time, but no later than 14 calendar days from the date of its conclusion.

This requirement is mandatory for compliance by all insurers (including AlfaStrakhovanie), except for the cases specified in clause 4 of the Central Bank Directive No. 3854-U dated November 20, 2015 “On the minimum…” (hereinafter referred to as the Directive).

That is, the “cooling period” may be less than 14 days, or not provided at all, for the following types of insurance:

- voluntary insurance of foreign citizens, if required to carry out work activities in the Russian Federation;

- insurance of travelers, citizens of the Russian Federation for trips abroad;

- "green map";

- voluntary insurance, which is a mandatory condition for allowing an individual to carry out professional activities;

- purchasing a policy operating within the framework of international insurance systems.

Funds cannot be returned even during the “cooling off period” for any of the specified types of insurance. Mortgage insurance is also not refundable, because real estate is the subject of collateral, and the obligation to insure it is assigned to the borrower at the legislative level.

As you can see, loan insurance is not included in this list of exceptions, which means that a borrower who has an insurance policy with Alfa can, in any case, return his money at least within 14 days from the date of conclusion of the insurance contract.

- Example

Let's look at a practical example...

The contract was concluded on March 10th. The borrower received the loan on the same day. On March 11, he contacted the bank to claim a bonus of 50,000 rubles.

Having considered the application, the Investigative Committee decided to transfer funds in full. The contract was terminated from the date of receipt of the documents, i.e. March 11, despite the fact that the decision was made only on the 17th.

Important! Alfastrakhovanie IC in most cases offers individual rather than collective insurance, so the return procedure here looks much simpler. If the agreement were collective, obtaining money would be complicated by the participation of the bank itself.

Is it possible to return money after 14 days to AlfaStrakhovanie?

In ab. 2 hours 3 tbsp. 958 of the Code clearly states that the insurer is not obligated to return the premium after the “cooling off period”.

Exceptions are presented in Part 1 of Art. 958 Code. It says that the insurer is obliged to return part of the premium in proportion to the “unused” days only in cases where:

- the property is insured, and its destruction occurred for reasons other than the insured event;

- business risk is insured, and the businessman has ceased such activities in the prescribed manner (there is a precedent for these exceptions, details below).

In clause 8.4. The rules say the same thing - the insurance premium is not refundable after the “cooling off period”.

However, a reservation was immediately made that this norm is dispositive, that is, the parties may well agree and include in the contract a condition that the premium will still be returned in other cases.

Refunds are allowed if the client repays the loan before the end of the loan term, and the terms of compensation are provided for in the contract.

Payments are calculated in proportion to the duration of the insurance. IC Alfastrakhovanie offers several different programs for clients, so the conditions for concluding contracts, receiving compensation and payments may vary.

- Example

Let's consider an example from practice...

On April 1, a citizen received a loan and purchased a policy, paying a premium of 30,000 rubles. one time for 1 year. On June 10, they repaid their debt ahead of schedule; the “cooling off period” had long passed.

The insurer calculated the amount taking into account the expired period of insurance. Based on the results, 22,500 rubles were transferred to the citizen.

If the agreement states that the money will not be returned upon early cancellation of debt obligations, it will not be possible to receive funds (Article 958 of the Civil Code of the Russian Federation).

Is it possible to return the premium when closing a loan from AlfaStrakhovanie?

Timely repayment of the debt is also not a basis for the return of insurance from AlfaStrakhovanie if the “cooling off period” has already expired. If in ordinary cases, when closing a loan early, one can refer to the elimination of the insurance risk, then in this case this is impossible.

As a rule, insurance is issued for 1 year or until the end of the debt obligation. Timely repayment of the loan, as opposed to early repayment, does not give the policyholder the right to claim a premium.

In clause 7.4. The rules say that the borrower insurance contract is concluded:

- for any period;

- but not less than 1 month.

At the same time, the Rules do not contain any requirement that the insurance contract must be concluded specifically for the term of the loan.

Simply put, it all depends on the bank's requirements. That is, the lender may require that the insurance contract and the loan contract have the same validity period, or may not require it.

In addition, the insurance contract, as a rule, is concluded for the period of use of borrowed funds, so the company’s obligations in this case are fully fulfilled. Thus, the refusal of the insurance company to return money after timely repayment of the loan is legal.

Accordingly, two options are possible:

| Situation | Is it possible to return the premium? |

| Both the loan and insurance contracts have the same validity period | It is impossible in any cases (except for cases established by the contract), since all days under the insurance contract will be used, which means that it will not be possible to receive a premium even in proportion |

| The insurance contract ended before the loan contract | According to the general rules, you can return for “unused” days (as follows from the precedent discussed above), or it cannot be returned (if you interpret the norm of Part 1 of Article 958 of the Code as mandatory), or you can return the entire amount of the premium, if this is established agreement between the parties (this is unlikely to happen in practice - editor's note) |

If the loan is closed on time, the insurer’s obligations are considered fulfilled, and the premium cannot be returned under any circumstances.

Is it possible to return AlfaStrakhovanie insurance if the loan is closed on time?

In accordance with clause 5.5 of Section 5 and clause 7.4 of Section 7 of Conditions No. 2, when issuing an AlfaInsurance Policy Offer, payment of loan obligations on time without the occurrence of an insured event is not the basis for returning the amount of the insurance premium to the policyholder.

The agreement between an individual and the insurer terminates on the basis of clause 7.1 of Section 7 of Conditions No. 2, and contractual obligations are recognized as fully fulfilled. Refunds of insurance premiums are not permitted.

Similar provisions are established by federal legislation, so court proceedings regarding such disputes can only end with a decision refusing to satisfy the applicant’s claims.

Cash is the income of the insurer.

Thus, the refusal of the insurance company to return money after timely repayment of the loan is legal.

Average fee for a policy

Comprehensive protection costs about 1-2%, where only 0.38% is life insurance.

The annual insurance premium (Part 2 of Article 954 of the Civil Code of the Russian Federation) for coverage up to one hundred thousand rubles is 3,000 rubles, and for coverage up to three hundred thousand rubles - 6,000 rubles.

The total premium is paid once for the entire loan term, or is included in the monthly payment.

When the insurance premium is included in the monthly payment, interest will be charged on it, which does not contradict the law in accordance with clause 3 of Article 6.1 of the Law “On Consumer Credit (Loan)” N 353-FZ.

The conditions and methods of payment for insurance are negotiated individually, taking into account the conditions of the insurer.

Moreover, if the insurance is voluntary, it can be waived both before signing the loan agreement, at the approval stage, and during the cooling-off period (up to 14 days).

It is much more difficult to recover the cost of insurance if you pay it off early. Neither the law nor the terms of the contract usually provide for such a possibility. However, there are precedents for returns.

"AlfaStrakhovanie" - refund of money for insurance through the court

Refunds for obtaining insurance through legal proceedings are carried out after all other methods have been exhausted, when the insurance company has refused and the policyholder has no other options to return the remuneration paid.

The grounds for going to court are:

- Early repayment of loan obligations;

- Inability to use an insurance policy;

- Cancellation of the Policy offer with the insurance company, in which the Insurer refused to return the reward received;

- Compulsory insurance when applying for a loan.

The advantages of going to court are that the following factors are taken into account:

- lack of explanation to the plaintiff about the procedure for refusing insurance and his ignorance of his rights;

- automatic inclusion of insurance in the loan agreement;

- imposition of services by bank employees when applying for a loan.

When considering the case on the merits, the court may require the provision of other documents and evidence from the plaintiff or defendant in order to make the most fair decision on the stated dispute.

The policyholder will need the following documents:

- Statement of claim;

- Passport or other identification document;

- Loan agreement;

- Insurance policy;

- An extract on loan repayment, if the basis for going to court was the refusal of the insurance company to pay part of the insurance premium for early repayment of the loan;

- A copy of the policyholder's application for termination of the agreement between him and the insurer;

- Official refusal of the insurer to return the funds paid by the citizen;

- A receipt or other document confirming payment of the state fee.

Civil law does not prohibit independent representation of one’s interests, however, if there are conflicts between citizens and insurance companies, a lawyer is needed. Citizens will not be able to file a claim, and it will also be difficult to compete with the insurer’s professional lawyers.

If the statement of claim is drawn up in violation of the current civil procedural legislation, it will be rejected, indicating the justifications and errors. It is not a fact that when filing a new claim, other inaccuracies and errors will not be discovered.

A qualified lawyer will help you defend your rights and increase the likelihood of success in your legal case. If a line of defense is built and all the necessary documents are collected to convince the judge that he is right, the plaintiff not only will not lose anything, but will also be able to make money from the insurance company’s reluctance to follow the letter of the law.

Procedure for obtaining insurance

To obtain insurance, you must report the occurrence of an insured event. This is done by calling 8 800-333-75-57 (free 24/7 customer support number).

For Muscovites the number is 7 495 788-0-999. Next, the client must collect a package of documents: a receipt for payment of the insurance premium, a policy, an application, a certificate from the insurer. Payment is made to the client's bank account.

Insurance cases

Insured events depend on the chosen insurance program; they are prescribed in the rules, contract and insurance policy provided to the client. The company offers more than 100 types of different services with different insurance cases.

How to terminate the insurance of IC "AlfaStrakhovanie Life" - features

Banking organizations may establish a mandatory condition for obtaining a loan - concluding an agreement with an insurance company. In the presence of such a situation, it is almost impossible to cancel bilateral obligations with IC AlfaStrakhovanie without any sanctions from the bank.

Credit insurance can be provided in several ways:

- Conclusion of an agreement between an individual (borrower of funds) and the insurer;

- An agreement between a lender and an insurer in which the borrower joins an existing group insurance program.

Cancellation of an insurance policy when concluding a separate contract will not entail negative consequences. If there is a mandatory insurance provision, the refusal of which may be considered a violation of the terms of the loan, can seriously change the attitude towards the borrower.

The lender can initiate the cancellation of the loan agreement and oblige the borrower to repay the borrowed funds before the specified period, as well as change the terms of the loan, for example, raise the rate.

The borrower has the opportunity to cancel the agreement with the insurance company voluntarily or in court, so you must first write an application to the bank with which the loan obligations have been established and to the insurance company.

You must contact us within two weeks. Usually banks accommodate clients halfway, and the loan amount is reduced by the amount of imposed insurance obligations, but if this does not happen, then the borrower needs to go to court and resolve the dispute there.

When is an insurance contract considered terminated?

If the parties voluntarily agree to cancel the insurance policy, the contract for the provision of services is considered terminated from the moment the application is submitted by the citizen. If the institutions refuse to terminate, the court will decide the end of the dispute.

If the court takes the borrower’s side, then the contract is considered terminated either from the moment the corresponding application is filed in the name of the insurance company, or from the date the statement of claim is filed. It all depends on whether the citizen files a claim with the insurer.

What to do if your life insurance claim is refused?

As we have already indicated above, within 14 days you can safely cancel the life insurance contract and get back the entire amount of the premium paid.

If the application was submitted by the policyholder or his representative by proxy in accordance with all the rules, the entire set of documents was attached, the insured event did not occur within these 14 days, but still a refusal was received, then it is necessary:

- draw up a pre-trial claim demanding elimination of violations of the law;

- At the same time, you can complain to the regulator (button “Make a complaint"(cbr.ru/Reception/Message) in the Internet reception on the official website of the Central Bank of the Russian Federation).

- write a negative review on the website banki.ru : banki.ru/insurance/alfastrahovaniezhizn (usually the insurance company monitors its reputation and will quickly return the funds).

After following the pre-trial appeal procedure and in the absence of a decision on payment from the insurance company, there is only one way - to court.

If AlfaStrakhovanie refuses to return the insurance premium, the dispute must be resolved in court. The legislation does not provide for other ways to resolve the conflict regarding paid funds.

To go to court, you need to collect the necessary package of documents and pay a state fee, which is calculated based on the amount of funds being returned. The amount of state duty in cases of insurance return varies from 400 to several tens of thousands of rubles.

The calculation is made based on the provisions of paragraphs. 1 clause 1 art. 333.19 Tax Code of the Russian Federation.

Does AlfaStrakhovanie really comply with legal requirements?

To answer this question, it is necessary to analyze the Rules for voluntary life and health insurance of borrowers, approved by Order of the General Director of AlfaStrakhovanie-Life LLC A. V. Slyusar dated December 4, 2021 No. 196 (hereinafter referred to as the Rules).

In clause 8.3. The rules say that within 14 days from the date of commencement of the insurance contract, the policyholder has the right to refuse to fulfill it - and return the funds.

A prerequisite is the absence of insured events that occurred from the date of conclusion of the agreement to the date of submission of the application for refusal.

Refunds are made within 10 working days using the method chosen by the policyholder:

- in cash at the insurer's office;

- non-cash to bank details.

As we can see, Alpha fully complies with legal requirements (judging by the Rules), but sometimes violates the deadline for the refund procedure.

How much money will the insurance company return?

As mentioned above, the insurance refund and the amount that can be credited to the applicant’s account directly depends on the availability of insured events during the specified period and the time when the application was submitted.

After the loan is issued

Although the bank will not issue a loan without purchasing compulsory insurance, the client can apply to cancel the contract on the same day after receiving the loan. To do this, you also need to fill out an application and transfer the policy back to the insurance company. The transferred funds will be returned to your account within 10 days.

Within 14 days (“cooling off period”)

The “cooling off period” begins the day after the loan is issued. Having received applications for termination of insurance, the insurance company is obliged to return the funds in full.

In case of early repayment

Now it’s worth paying attention to the possibility of getting your insurance premium back after the “cooling off period”. Although it was said above that such a scenario is impossible, there is a loophole.

According to the Civil Code of the Russian Federation, Article 958, if the borrower repays the loan ahead of schedule, he has the right to apply for a refund of the contribution, since in the absence of debt, the obligations of the insurance company have no legal force.

Note! You should not expect a full refund. The insurer will deduct from the amount its premium for the period while the debt existed.

You can calculate what amount of payment to expect yourself using the formula Sv=t/T*S, where:

Sv – total amount to be returned;

S – the amount of the fee paid by the client;

t – how many days are left until the expiration of the insurance period;

T – time of the insurance period;

Note! If the paid amount does not add up, the client has the right to request a calculation algorithm.

In case of normal debt payment

In this case, it is impossible to count on a refund. Even if during the entire period of repayment of the loan no insured events occurred, the insurance company in fact fulfilled its obligations, which means it does not owe anything.

The only chance to receive any payments is if the insurance contract lasts longer than the loan payments. Then the previous point comes into play.

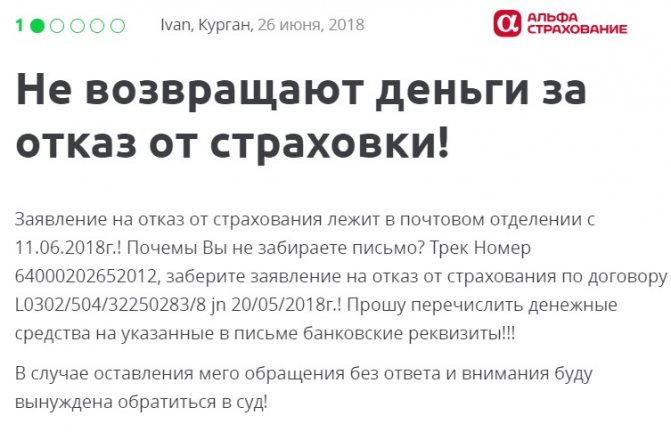

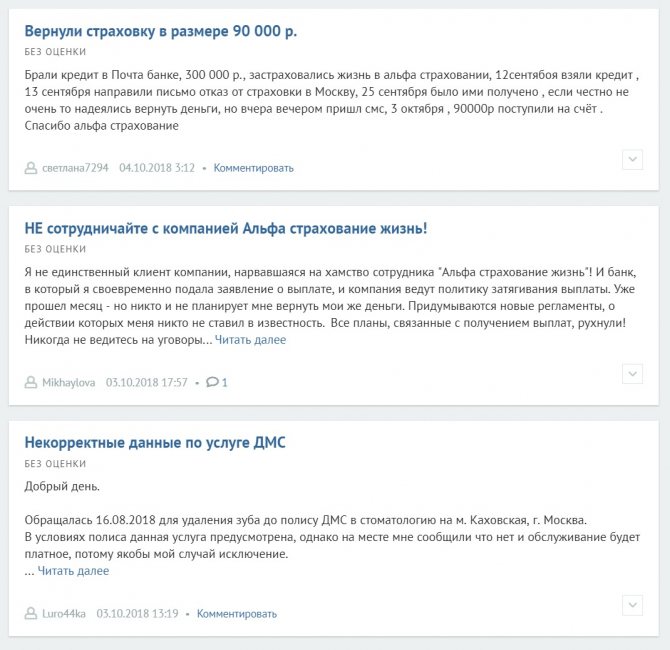

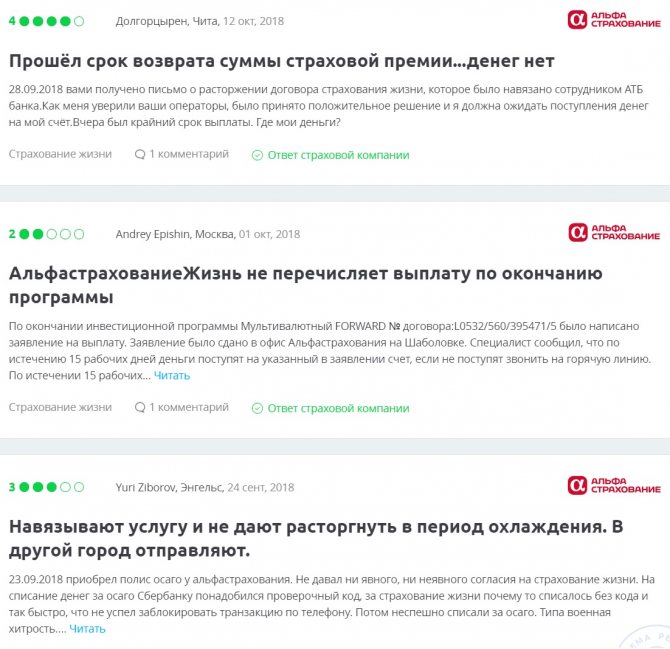

Reviews about the return of insurance "AlfaStrakhovanie"

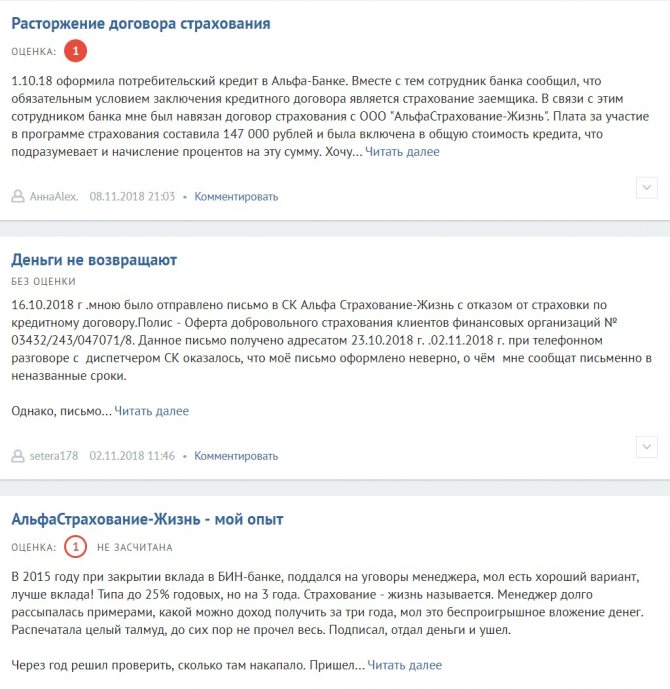

Customer reviews are an important indicator of an insurance company. As for this company, they are mostly negative. Most clients complain about:

- refusal to return insurance;

- lack of response from the company to the application for termination of the contract;

- failure to comply with deadlines for consideration of requests to annul the agreement;

- misrepresentation by company employees;

- policy of delaying payment.

For example, one person writes (spelling and punctuation of the authors of the reviews have been preserved - editor's note) that Alpha employees, who are responsible for receiving and processing incoming correspondence, simply do not pick up the application for refusal of insurance from the post office.

Here is another borrower who says that 4 days after the loan and insurance were issued, he refused the latter.

Almost a month (the review was published on June 24, and the insurer received a registered letter on May 29) has passed since the refusal was received, but Alfa has not taken any measures to return it.

The citizen intends to go to court to force the recovery of illegally retained funds.

Despite a lot of negative reviews, there are also positive ones. For example, one citizen writes that he had already mentally prepared for litigation, but everything went smoothly.

Many cannot reach the hotline number listed on the official website of AlfaStrakhovanie; others expect a refund more than 10 days after receiving the insurance documents, which is a violation of current legislation.

Most often, difficulties are resolved when policyholders contact the insurance company by email, as well as when leaving negative reviews on the Internet portal Banki.ru, which is an independent portal about banks and banking organizations.

You can view reviews or leave your own on the portal: banki.ru/insurance/alfastrahovaniezhizn.

You can view reviews or leave your own on the portal: sravni.ru/strahovanie-zhizni/otzyvy.

Procedure for the policyholder

Summarizing the above, we can structure the procedure for the borrower:

- Fill out an application for termination of the contract.

- Collect additional documents listed above.

- Check the current address of the insurance company (you can call the hotline number).

- Submit a package of documents by registered mail or complete everything through an online form.

Afterwards, wait for a response from the insurance company or for funds to be credited to the account specified in the details.