+2

Each of us has a bank card. This is a reliable way to store money and a convenient tool for making payments. At the same time, this is a tasty morsel for scammers. And we all risk losing our income as a result of criminal acts.

I suggest you figure out what to do if a fraudster has withdrawn money from your card.

What to do immediately - algorithm of actions

As soon as you determine that someone has used funds from your card, you immediately need to:

- Call the servicing bank, set a block and report illegal use of funds.

- Go to the office of a credit institution with your passport and draw up a document stating your disagreement with the transaction.

- File a police report about the theft of money from your card.

The bank is conducting an investigation within a month. If the bank’s decision regarding the return of funds is negative, you can submit documents to the court.

How to protect yourself

As you can see, with just one number, anyone can find out almost everything about you. However, you can insure yourself against such developments in advance; just follow a few simple rules. Do not leave personal data and photos in messengers, close profiles on social networks and prohibit them from being indexed in searches, use various short links to personal pages, and delete old advertisements.

The ideal option is to get an additional phone number and not link it to social networks, instant messengers, or anything else at all. You can freely leave an unlit number without fear that they might find out something unnecessary about you through it.

On topic: Scammers have become more active on WhatsApp. The scheme is simple, but many are underway

How to protect yourself from scammers

- Keep your personal data (passwords, PIN codes, account numbers) secret.

- Do not respond to SMS demanding to send card data, especially if the sender’s number is suspicious.

- Ensure the security of the computer from which you log into your personal bank account.

- Cover the keyboard when entering your PIN code when operating an ATM, terminal, or paying for a purchase in a store.

- Before making a transaction, inspect the ATM for any suspicious devices.

- Do not place orders or pay in online stores that are not trustworthy.

- If you change your mobile number, notify your financial institution.

Common ways to steal money from mobile phones

What methods have scammers come up with to steal money - not only from bank cards, but also from the accounts of mobile operator subscribers! Surely you yourself have more than once received SMS with congratulations, where it was reported that you won an entire car - no more, no less. At the same time, without taking part in any competitions or promotions!

Agree, how can you resist the temptation and not fulfill all the requirements that are a prerequisite for receiving a valuable prize! And for an unsophisticated person, this most often ends with a trip to the ATM and a money transfer to the specified number. Or by debiting a tidy sum from your mobile phone balance.

But still, in this situation, common sense can prevail. It’s hard to believe in such a huge happiness that fell out of nowhere. Even when the SMS contains a link to a website where your number is listed in the list of winners, and on the main page there is a brand new car tied with a red ribbon with a huge bow on top.

It is much more difficult to recognize the deception that takes us by surprise in the most ordinary everyday situations, on the run of life, so to speak. This is exactly what happened to me.

How scammers can withdraw money from a bank card

Criminals know a large number of methods for stealing capital from their victim’s plastic card. And sometimes the holder of the payment instrument himself turns out to be to blame for the theft or contributes to its commission through his imprudence.

Skimming

This is the theft by bandits of information from a card in the process of withdrawing money or paying for a service at an ATM using a special invention - a skimmer. The device can be made in the form of an overhead keyboard or inserted inside a card reader.

ATMs: from fakes to missing ones

Scammers are buying back ATMs previously used by banks and equipping them with skimmers.

When a customer inserts a card and tries to make a transaction, the machine refuses to complete the transaction, and the fraudsters get the data they need. Fake ATMs can masquerade as devices from well-known banks and can be difficult to detect.

Sometimes criminals steal ATMs. True, this happens infrequently.

POS terminals

Fraudsters install devices or software in payment terminals that read card data and then use them for personal purposes. Another option: an unscrupulous employee of a store or cafe adds small amounts to the paid invoice in the hope that the buyer will not pay attention.

Using their own wireless terminal, criminals can withdraw money from their victims through clothing or bags in crowded areas.

Cashless payments

Fraudsters create fake online stores in which only one way to purchase products is possible - 100% prepayment via bank transfer. The buyer transfers money to the card number of an unscrupulous person, but the goods are never sent to him or a counterfeit product arrives.

When making payments on trading platforms, you can suffer from robbers. The card owner uses the received link to go to the cybercriminals’ website, where information about his bank card becomes available to them.

Unsafe applications

Such programs include “Mobile Bank”. Having stolen the phone, the criminal can log into the application and use the card to pay for something or make a transfer.

Free wifi

Cyber criminals can create fake Wi-Fi networks, disguising them as free ones. When the owner of a gadget connects to such a network, all the data on his device ends up in the hands of scammers. Such free networks are most often used in bars, restaurants, airports, etc.

Mysterious messages

These could be SMS supposedly from relatives in an unpleasant situation, about a win, about a card being blocked, about an accidental top-up of a mobile account by a stranger demanding a refund, etc.

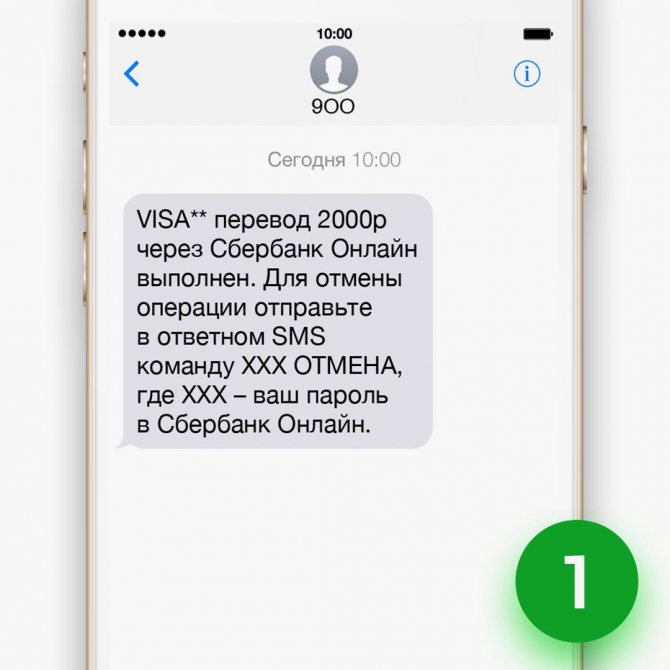

Very often, thieves send SMS messages from fake bank service numbers demanding a card PIN code or other confidential information.

Fake sites

Scammers create fake web pages similar to the official websites of well-known banks and oblige cardholders to leave their confidential information. Having received the data, the attackers steal money.

Phishing

This is the deception of payment card data from their owners. For example, a person calls based on your advertisement for the sale of something, who offers to make an advance payment and asks for card details, without being at all interested in the very characteristics of the product.

We bring to your attention the video “Bank card fraud”:

How to return money written off by scammers? Recommendations of the Bank of Russia.

In 2021, fraudsters made about 572,000 illegal transactions on the bank accounts of Russians and stole 5.7 billion rubles.

Fraudsters manage to lure secret information from cards using various psychological tricks. In 70% of cases, people themselves provided confidential data: full card details, including the three-digit number on the back, as well as passwords and codes from SMS. It is worth noting that in these cases the bank does not compensate for the stolen money. But scammers can also use other schemes.

What to do if money was stolen from a bank card.

You received an SMS message that money was debited from your card, but you did not buy anything, did not make transfers and did not withdraw cash. The card or its data probably got into the hands of fraudsters. Your actions:

-immediately block the card;

- notify the bank via the hotline about the theft of money and write a statement of disagreement with the operation at the bank branch;

- all this must be done no later than the next day after the bank notified you about the operation that you did not perform.

If you followed the rules for using the card (did not store the PIN code with the card and did not disclose its details to anyone), then there is a chance to return the stolen money.

How to block a card?

To cut off fraudsters' access to the remaining money on the card, it must be blocked immediately. This can be done in different ways:

-via the bank’s mobile application. If you have it installed and there is an option to block the card, find the desired card in the application and select the “Block” command;

- by calling the hotline. The emergency number is indicated on the back of the card and on the bank’s official website. It is better to save this number in your phone in advance so as not to waste time searching. The technical support operator will ask you for your passport details, code word or code from the SMS message that he will send you. After this, the bank employee will block the card;

-in online banking. Go to your personal account on the bank’s website, find the “Block card” option and confirm your action with the code from SMS;

-by SMS. Some banks allow you to block cards via SMS. Usually, to do this, you need to send a code word (for example, “blocking”) and the last four digits of the card number, separated by a space, to the bank’s short number. If you have only one card, then you don’t have to enter the numbers - the bank will already understand which card you are talking about. You will receive a code that must be sent again to the bank number to confirm the blocking;

-at a bank branch. If a message about an illegal transaction on your card caught you near a bank office and you have your passport with you, then you can not only block the card, but also immediately write an application for a refund.

How to apply for a refund?

By law, the bank is obliged to return the money if you meet two conditions:

- notified the bank about the theft of money from the card no later than the next day after the bank notified you about the suspicious transaction. If you don’t have time, the bank has the right to refuse you;

- did not violate security rules when using the card. In particular, you did not provide the card details to the scammers, did not store the PIN code along with the card, did not write the code on the card itself, and did not allow anyone to make photocopies or take photographs of your card. If the bank proves otherwise, it will not return the stolen money to you.

How exactly you should report the theft - by phone or in person at the branch - is specified in your contract. In order not to waste time, it is better to immediately call the bank and clarify the procedure with the operator.

But in any case, you will have to go to a bank branch to write a statement of disagreement with the operation and demand a refund. Keep a copy of the application with a note indicating that the bank accepted it.

Since stealing money is a criminal offense, file a police report. Perhaps your information will help quickly identify and catch criminals.

The bank will conduct an internal investigation. The payment system will also take part in it. If the fraudsters operated on the territory of Russia, then by law the official investigation can last a maximum of 30 days, if the operation was international - 60 days.

Based on the results of the investigation, a bank employee will contact you and inform you of the decision. If the bank is convinced that you did not violate the rules for using the card and at the same time protested the operation on time, you will receive your money back.

The bank agreed to return the money, but is delaying the transfer of funds. What to do?

Banks often indicate the repayment period in the contract. For example, it could be 30 or 60 days. If during this time the bank has not replenished your account, you can go to court.

If the agreement with the bank does not establish deadlines, then the bank must comply with the requirements of the Civil Code. Article 314 requires everyone (including banks) to fulfill their obligations “within a reasonable time.” You and the bank may understand this “reasonable period” differently. But there is a clarification in the code: obligations must be fulfilled within seven days from the moment you present your demands.

In other words, you can wait a couple of weeks, if during this time the money is not returned, then go to the bank to write a statement. In it, with reference to the Civil Code, you must demand to transfer the stolen amount within seven days.

The bank refused to return the money. What else can I do?

In this case, the first thing you need to do is demand a written refusal from the bank explaining why it does not agree to return the money. If the bank does not issue such a refusal, or does issue it, but the justification seems unconvincing to you, you should go to court. If you did not violate the agreement with the bank and reported the illegal transaction on time, most likely the court will rule in your favor and the money will be returned to you.

The bank did not notify me about the illegal transaction. Is it possible to get the money back in this case?

By law, the bank is required to notify you of all card transactions. Exactly how he does this is specified in your contract. This could be SMS alerts, emails or other methods.

If fraudsters stole money from your card, and your bank did not inform you about the transaction, then by law it is obliged to compensate for the losses. Even if you did not discover the theft of money from your account immediately, but a month or a year after it occurred.

In this case, you first need to write an application to the bank demanding the return of the illegally withdrawn money. If the bank refuses to transfer them, then you can go to court.

Is it still possible to protect the money on your card from scammers?

Yes, you can. Follow the rules:

-Control account transactions. For example, activate the SMS notification service for all your active cards. Then you will immediately receive notifications about each card transaction;

-Do not tell anyone your PIN code, CVC/CVV code (secret code on the back of the card), card expiration date and other information;

-Do not let sellers and waiters take the card out of your sight. Always cover the payment terminal or ATM keyboard with your hand when entering your password. It is also worth making sure that security cameras do not show you entering the PIN code;

-Go only to trusted sites and never click on links from letters from unknown “well-wishers”;

-Check any information about card blocking, transaction refusal or other problems with the card. To do this, call the bank’s hotline - and only that. The emergency telephone number is always indicated on the back of the card and on the bank’s official website.

Important information.

From September 2021, banks can suspend money transfers and card payments if they look suspicious. A payment in another country may raise doubts in the bank, especially if the client has not traveled abroad before. Or they try to write off an unusually large amount from the card. And if suddenly a “fan” transfer simultaneously occurs from the same card to several other cards at once, this is definitely a reason for the bank to stop transactions and temporarily block the card.

The Bank of Russia has identified the main signs of suspicious transactions, and banks have the right to supplement them with their own criteria based on the results of monitoring the behavior of their clients.

If the transaction is considered suspicious, the bank is obliged to immediately contact the client to find out whether he really consented to this payment or transfer.

If the bank does not receive a response within two days, it will unblock the card and carry out the transaction. If the client confirms the transaction, the payment and the card will be unblocked immediately. Well, if the card owner reports that he did not make this payment, the bank will cancel the operation and offer to reissue the card.

Answers to frequently asked questions

Let's look at the answers to the most popular questions about predatory methods in relation to payment instruments.

The fraudster knows the card number and mobile phone number - should you be afraid?

Theoretically, yes. But it is very difficult to overcome the bank’s security systems, so robbers often use simpler methods.

They are trying to withdraw money from a Sberbank card - what to do?

Immediately contact the hotline 8-800-555-55-50 to block the plastic. If the money has already been withdrawn, file a claim of disagreement with the transaction and demand the return of your finances.

How scammers withdraw money from a bank card via mobile banking

This can happen if a mobile device with the Mobile Bank utility is active is stolen or lost, or if the phone number is changed, provided that the service remains assigned to the previous one.

Can scammers withdraw money from a card using a phone number?

This is possible if the card is connected to the Internet bank and to the phone. Using a mobile number, scammers obtain card details and carry out transactions without notifying the holder.

How scammers withdraw money from a bank card without a PIN code

To do this, they need the CVV code recorded on the back of the payment instrument. Fraudsters can get it when you make purchases on the global network.

How money is stolen through outgoing calls

Previously, I have more than once heard complaints from acquaintances who, in search of work, called numbers from advertisements, and among them were paid phones. You make a call and money begins to be debited from your account.

Naturally, you won’t find a job at the other end of the line. But you will pay in full for the conversation. Fortunately, such numbers differ from ordinary mobile phones - in code, length and other characteristics. And recognizing them by sight is not very difficult.

Personally, I got caught in another scam. On the street, a quite trustworthy lady of respectable age approached me. And she asked me to call my daughter. She didn't even pick up the phone. She simply dictated the number and asked her to inform her relatives that her phone was dead and she herself was delayed so that the children would not worry.

I don’t know how she realized that it was I who would not refuse such a simple request. I called, the beeps went off for a long time, but no one picked up the phone. The woman thanked her, got into the transport and left.

And only then did I discover that a large amount had been debited from my account. And the call, as it turned out, was made to a paid number. And the debiting of money began from the moment of the first beep. While I was calling the swindler's fictitious daughter, the scammers withdrew money from my phone account.

How income is divided

People who worked in such schemes anonymously reported that the caller receives up to 20%

from the amount if one works.

If one person opens a deal and the other closes it, then both receive 10%

.

The rest of the money is the salary of the organizers of the schemes, payment for the “roof”, purchase of equipment, rent of offices. Money is needed to purchase data: a unique database will cost a couple of thousand dollars

, access to the general one is half the price.

Money is withdrawn through cards issued to random people. “Drops” withdraw them from ATMs.

But lately, scammers are increasingly using cryptocurrency

. It does not have legal status in the Russian Federation and often does not allow tracking transactions (especially if it is an anonymous coin like Monero or ZCash or a mixer service is used).

A large city may have several dozen firms

who engage in this type of fraud. Imagine the turnover yourself.

How black scam call centers work

Recruiting staff for such a call center is not difficult. You don’t need to be a brilliant psychologist when there are manuals and scripts honed on real victims.

Most likely, you have even seen advertisements for similar vacancies. “An employee is required for a new call center, work in the financial sector, salary from $1000 + bonuses

” – sound familiar? They can write whatever they want in the ad. Sometimes the call center is not even mentioned.

People who want quick and easy money go to work in call centers. True, the turnover is huge. Those who are ineffective are immediately fired.

Some people can't stand it. Some people can't do it. Someone starts spending money on alcohol and drugs.

Newcomers are told to “open trades.” They are trained to speak from scripts

– pre-prepared scenarios.

More experienced ones “close deals.” They put pressure on clients not to leave.

People from prisons also sometimes work for such call centers. Especially if you already have experience. But there are relatively few of them.

Can money be stolen from a contactless card?

If a contactless card ends up in the hands of fraudsters, then yes, they can. More precisely, not to steal, but to pay for several purchases with it up to 1 thousand rubles each in retail stores. Also, all the fraud schemes described above work with contactless cards, except for data theft through ATMs, if you do not insert a card reader.

There is a rumor on the Internet that money can be stolen from cards with NFC technology by touching the terminal to a bag or pocket, for example, in public transport. Technically, this is very difficult to do, since the distance between the card and the terminal should be no more than 4 cm, and the attacker will only have a few seconds to complete the write-off procedure while the device is active.

How does this type of scam work?

The scammers' goal is to take your money.

. To do this, it is enough to receive your full card details (number, expiration date and CVV/CVC code), create a transfer from it and confirm it with a code from an SMS that will be sent to your phone.

The most popular way to do this is to call and introduce yourself as a bank employee

. The reason could be any:

▪ aggressive: your card is blocked;

▪ neutral: we need to clarify your data, confirm the transfer from the card, etc.;

▪ seductive: you have received a transfer for several thousand, to receive it, provide your card details.

The number of options depends on the imagination of the organizers of the scheme. It is beneficial for them to change the format so that victims do not get used to it.

How to avoid becoming a victim of scammers?

There are several simple rules, following which will maximally protect a citizen from possible fraud:

- Do not download software from third-party resources. Programs, mobile applications, media files should be downloaded only from the official websites of distributors;

- Use only those ATMs that are located in public and well-monitored places - in bank branches, in administrative buildings, and so on. This way you will protect yourself from skimming;

- Scan all downloaded files through an antivirus;

- Before entering any data on a site, check its email address: if it does not match the real (real) site address, you have phishing content;

- Remember - a bank employee will never ask you for either a CVV code or a PIN code for your card. If someone, under the guise of help, asks you to provide this information, this is a scammer.

In addition, if you are suddenly “pictured” of a dangerous situation in which there is no time to think, do not take any action (for example, you are told that your card is supposedly blocked and to unblock it you urgently need to send a response SMS), try to check the information.

Why is it so difficult to understand that a scammer is talking to you?

Because they are trained specialists

. And an amateur will almost always lose to a professional.

For the creators of such schemes, breaking through bank clients is just business. Which does not stand still, but grows and develops.

Scripts are being improved. Techniques of psychological pressure are being honed. More and more detailed databases are being purchased. They work with the most vulnerable people.

Besides, not everyone reads your internet.

. A simple experiment: you can call ten elderly friends, introduce yourself as a bank employee and ask for their card details. You can write in the comments how many CVV/CVC codes you received.

Often call centers disguise real bank numbers with similar combinations of letters and numbers. As a result 900

turns into

9OO

- 9 and two letters “O”, for example.

Fraudsters use pre-recorded clips to convince you that the system is serious. Here's an example:

Similar examples are here, here and here. There are thousands of such videos on YouTube

.

But this is not a story about high technology. And about the methods of social engineering. And about trust in a person endowed with, albeit small, power. Especially if he pretends that he wants to help.

Previously, the scammers worked more clumsily, pressed with authority, and threatened. Now this is a “team of professionals”.

Each of them is ready to spend 10-20 minutes

time or more. Simple arithmetic: divide the balance on your card by 5 (20% of the amount is the income of the black call center employee). You almost certainly won’t earn that much in 10-20 minutes.