Home/Complaint/Bailiffs withdrew money from a Sberbank card, what should I do?

None of us are immune from money write-offs from personal cards. But it’s one thing when funds are withdrawn to pay off a debt. This is, of course, unpleasant, but legal. And it’s another matter when bailiffs withdrew money from a Sberbank card without any reason, or withheld funds from an account where child benefits or alimony payments are received. What to do in such a situation? First, you need to figure out why the bailiffs wrote off the finances from the Sberbank card.

Can bailiffs withdraw money from a Sberbank card?

Employees of the Federal Bailiff Service (FSSP) have the right to seize funds from the debtor’s account. It does not matter whether it is a Sberbank credit card, savings card or salary card. Department employees act in accordance with court verdicts on debt collection and fines that have entered into legal force.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

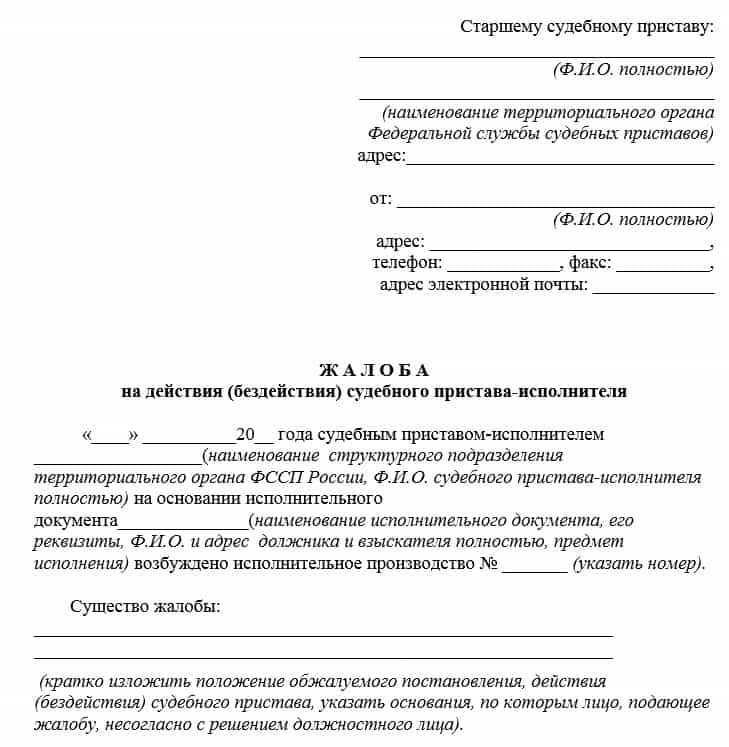

How to write an application correctly

An administrative complaint is written in compliance with the requirements for documents of similar content. In communication, it is important to clearly formulate what actions of the official led to the violation of the applicant’s rights.

A complaint against the actions of a bailiff in connection with the illegal write-off of funds should consist of several sequential parts:

- Description of the situation;

- A message about the actions performed by the bailiff;

- List of violated rights;

- Requests to eliminate the violation.

Attention! Among other information, it is advisable to indicate a contact telephone number so that a service representative can contact the applicant to clarify important circumstances or schedule an appointment.

The law does not provide for a special form of application to the Federal Bailiff Service. When drawing up a complaint, it is not necessary to refer to specific provisions of federal law. It is enough to clearly and meaningfully state the essence of the problem and your requirements.

Where to go if the bailiffs cannot collect the alimony debt?

Can bailiffs seize parents' property for children's debts? Read here.

Do bailiffs have the right to seize child benefits? Read the link:

However, when drawing up administrative complaints submitted to the senior bailiff, prosecutor or judicial authorities, it is necessary to take into account important nuances, namely:

- A complaint submitted to the head of the bailiff department must contain an indication of specific actions that the bailiff must take;

- In a complaint addressed to the prosecutor, it is necessary to express your disagreement with the actions of the bailiff or his inaction, and also state the requirement to conduct an inspection, identify and punish the perpetrators, and restore the violated rights of the applicant;

- A complaint to the court must necessarily contain the applicant’s demand to recognize the actions or inaction of the bailiff as illegal, as well as the obligation of the official to eliminate the violations committed. To prove the validity of the stated demands, you must provide the court with documents confirming the fact of the violation (this could be your application to the service, a response refusing to satisfy the demands, and other evidence of the official’s guilt).

Normative base

The activities of the bailiff service are regulated by Federal Law No. 229 “On Enforcement Proceedings”.

- In particular, Chapter 2 of the above law defines the executive documents on the basis of which bailiffs carry out collections of funds.

- Chapter 5 defines the procedure and deadlines for initiating, completing and suspending enforcement proceedings.

- Chapter 8 regulates the right to recover the property of a defaulter. This implies the seizure and sale of the debtor's property to pay off financial obligations. Bailiffs writing off funds from a Sberbank card is one of the tools for transferring the defaulter’s money in favor of the plaintiff.

- Federal Law No. 118 “On Compulsory Enforcement Bodies of the Russian Federation” dated July 21, 1997, defines the powers and responsibilities of bailiffs, including work with writing off funds from debtors’ accounts on the basis of enforcement documents.

Where can money be withdrawn from?

The execution by the bailiff of his official duties involves close cooperation with other government bodies that have comprehensive information about the presence or absence of funds and property from the debtor.

Upon official request, credit institutions provide information:

- On the availability of accounts and deposits opened in the name of the citizen, indicating the balance of each account;

- About the presence of other valuables of the debtor stored in the bank.

Currently, there are no credit institutions on the territory of the Russian Federation that do not cooperate with the FSSP. At the same time, a bank with which the federal service has entered into a cooperation agreement does not have the right to hide information about its clients if it receives an official request. For failure to comply with the requirements of the bailiff, the bank faces administrative punishment.

Federal legislation allows the write-off of funds located:

- On the debtor’s salary and debit cards;

- On personal accounts of electronic wallets;

- On stock accounts.

In addition, federal government employees have the right to write off funds from citizen’s credit accounts and cards. All property obligations of the debtor are repaid from the written-off funds.

Why can bailiffs withdraw money from a Sberbank card?

According to Art. 12 Federal Law No. 229, bailiffs withdraw funds from a Sberbank card on the basis of the following executive documents:

- court decision on collection of debts and debts;

- court decisions imposing a fine;

- court order or writ of execution for alimony payments;

- notarial agreement.

At the same time, FSSP employees are obliged to inform the citizen for what reason the funds were debited from the Sberbank card. The bailiffs must issue a resolution to the debtor to initiate enforcement proceedings.

How to return illegally withdrawn money?

Bailiffs operate within the framework of the laws governing their work. Consequently, any action they take that is contrary to the law can be appealed.

How can you return money from a card that was withdrawn by bailiffs without warning? You need to appeal their actions that violate the law.

As a rule, the following characteristic violations in the work of bailiffs are most often encountered:

- Banks provide information only about the availability of funds in your accounts without indicating their origin. Thus, the bailiff often writes off money that is not recoverable by law. So, they can withdraw children’s money from the card.

- Inaction in the work of the bailiff.

- Money written off from the cards first goes to a special FSSP account, and later is sent to the creditor’s account. The movement of funds between accounts is often delayed. This leads to situations where bailiffs withdraw money from a bank card for an unpaid fine 2 times.

- The bailiff does not notify you of the decision to initiate enforcement proceedings. Because of this SMS message from the FSSP about the write-off of funds, it leaves you in shock.

To return funds, you must write a corresponding application addressed to the head of the bailiff service unit.

It is necessary to indicate your contact details, full name, passport details and enforcement proceedings number. Copies of documents confirming the illegality of the write-off of funds must be attached to the application. This could be, for example, a certificate from the social fund about the targeted nature of the cash receipts, an account statement about the payment of a fine that was repeatedly withheld. The application is submitted in two copies to the service department against the signature of the official who accepted the application. The bailiff is obliged to issue a decision within 7 days to cancel the previously issued decision, indicating the return of the written-off funds.

A sample application looks like this:

To the head of the State Public SP of the Industrial District of the Amur Region, V.A. Pchelintseva. from Sviridov Sergei Semenovich debtor salary. at the address: Amurkya region, Industrial district, Portnoy village, st. Lenina, 45 passport series: 4503 number: 037845, issued by: District Department of Internal Affairs of the Industrial District of the Amur Region, date of issue 04/06/2003 tel. 89060234587

statement.

I ask you to return the illegally written off funds in the amount of 10,000 rubles. 00 kop. (ten thousand rubles 00 kopecks) according to payment document No. 00937 dated 03.23.2021 from my personal account, belonging to me by right of ownership due to voluntary repayment of debt in full according to the FS writ of execution 09487564 dated 02.22.2021 to writing off erroneous funds.

Please transfer funds to:

Personal account No. 40712415845122

Name of bank Vozrozhdenie OJSC, Amur branch

Bank BIC 0124578

The following are attached to the application:

- copy of bank receipt No. 76767 dated February 22, 2021 for the amount of RUB 10,000.

- copy of payment document No. 00937 dated March 23, 2021

03.26.2021 ___________Sviridov S.S. (signature)

If the bailiffs do not voluntarily return the illegally debited funds to you, you have the right to file a claim in court. The claim must indicate not only the amount collected by the bailiff, but also damages, moral damages, and remuneration for the lawyer who drafted the claim. The claim is filed at the place of registration of the FSSP department.

Also, regarding the illegal write-off of funds by bailiffs, you have the right to write a complaint to the prosecutor's office.

If you transferred alimony payments or child benefits to other accounts, for example, to a deposit account with interest in a bank, then the status of your funds changes. Consequently, the bailiff can foreclose on these amounts.

For advice from a lawyer on how to return the money withdrawn by the bailiffs, watch the video from the second minute:

Does Sberbank provide account information to bailiffs?

According to Article 69 of Federal Law No. 229, the bailiff service has the right to request from Sberbank information about the availability of existing accounts of the defaulter, and the financial institution is obliged to provide FSSP employees with this information. At the same time, department employees have the right to obtain data on all the debtor’s valuables that are stored in the bank branch. Information is provided by the financial organization within 7 days from the date of receipt of the request from the FSSP employee.

Sberbank has the right not to comply with the order of the bailiffs if the debtor’s accounts are empty or the card was previously blocked

Where can FSSP employees write off money from?

FSSP employees have all the tools in their hands to write off the defaulter’s money from the Sberbank card. In this case, the executor has the right to foreclose on various types of income of the debtor (Chapter 11 of Federal Law No. 229):

- wage;

- long service or old age pension;

- scholarships;

- debit cards;

- electronic wallets (Yandex-Money, Qiwi, WebMony).

IMPORTANT

If the debtor has alimony obligations in relation to minor offspring, then the list of cash receipts that can be written off by bailiffs from a Sberbank card is expanded (The list is regulated by Government Decree No. 841 of July 18, 1996)

How to find out that bailiffs have withdrawn money from a Sberbank card?

A defaulter may find out that money was debited from a Sberbank card by bailiffs completely by accident:

- the debtor receives an SMS message (from number 900);

- the person from whose account the funds were debited cannot make a purchase in the store because the Sberbank card is blocked;

- accidentally discovers that there are much less funds in the account than it should be.

In such cases, it is best for a citizen to call the Sberbank hotline and clarify information about the funds written off. An employee of a financial organization must provide information about why the money was withdrawn (case number, on the basis of which document the withdrawal of funds was made and the full name of the executor).

If a citizen has any debts or suspects their existence, then in the bailiffs database you can find information about enforcement proceedings and measures to implement collections.

Unconscious purchases

It happens that cardholders accidentally agree to purchase a service, for example, for a monthly subscription to a website or automatic antivirus update. A one-time purchase of a product online may require periodic or annual subscriptions and repeated withdrawals. In this case, contact support; usually the site administration returns the written-off money.

Microfinance organizations that issue small loans at high interest rates may also be involved in money fraud. At the same time, clients often do not notice clauses in microloan agreements stating that the debt will be written off from any linked bank cards of the borrower. Moreover, without notifying the debtor about the withdrawal of funds. This situation cannot be corrected in any way, since the client signed the contract with his own hand. Lawyers recommend paying off the debt and no longer dealing with such unscrupulous institutions.

The procedure for writing off money by FSSP employees

The bailiff service notifies the defaulter that enforcement proceedings have been initiated against him. If within 5 days after receiving the document in hand the person has not started paying the debt voluntarily, FSSP employees begin the procedure for writing off funds from the violator’s Sberbank card (Clause 12, Article 30 of Federal Law No. 229). This happens in the following order:

- The bailiff is searching for the person.

- Information is requested from Sberbank about the availability of the debtor's account with a positive balance.

- The person is notified that enforcement proceedings have been initiated against him, and a warning is given about the withdrawal of money from the Sberbank card forcibly.

- If the debtor refuses or is unable to pay off material obligations within five days, a resolution is sent to the bank to force the funds to be written off to pay off the debt.

- An employee of a financial organization is obliged to comply with the order of the bailiffs immediately and inform the FSSP employee about this no later than 3 days (Clause 5 of Article 70 of Federal Law No. 229).

- Having received information about the receipt of money into the account of the claimant, the bailiff closes the case. If the funds were partially debited from the Sberbank card, then enforcement proceedings will last until the total amount of the debt is repaid.

Recommendations for protecting non-cash money

To avoid falling for fraudulent tricks, follow certain recommendations:

- Learn all PIN codes and passwords for cards. Don't write them down on pieces of paper. If you do write it down, do not leave the notes where anyone can see them. Avoid compromising your card.

- Never share CVC/CVV or card PIN codes with third parties, as well as one-time passwords that are sent to an authorized phone.

- Keep cards with a magnetic stripe close to your body or in places where a thief cannot reach.

- If you pay in stores or restaurants with a card, make all payment transactions yourself or at least be present at them. Do not allow the card to be taken to other premises or lose sight of it.

- Buy products only from trusted sites. Make sure that the secure protocol https is entered at the beginning of the address bar. Such sites are more concerned about protecting user rights than those that begin with http.

- Set a security password not only on your smartphone, but also on the bank application that is downloaded to your mobile phone.

If security rules are not followed, then responsibility for withdrawing money from a Sberbank card falls entirely on the user. It is very difficult to prove your own non-involvement in fraud.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Where can I go to get back the money that the bailiffs withdrew from my Sberbank card?

The grounds for forced debiting of money from a Sberbank card by bailiffs are the provisions of Federal Law No. 229. FSSP employees withhold the amount in accordance with the executive document. At the same time, no one is protected from erroneous debits of money from the account.

A citizen has the opportunity to return material funds that were withdrawn by bailiffs from a Sberbank card in the following cases:

- withdrawal of funds occurred from payments that are not subject to collection (Article 101 of Federal Law No. 229);

- the amount exceeds the required amount of withholding (Article 99 of Federal Law 229);

- when bailiffs mistakenly write off money from a Sberbank card (for example, from the debtor’s namesake);

- in case of a technical error;

- if the effect of the executive document is challenged and cancelled.

IMPORTANT

To return illegally written off money withdrawn by bailiffs from a Sberbank card, you must draw up a corresponding application. A petition is written addressed to the head of the FSSP of the executive employee who made the withdrawal of funds. The appeal is drawn up in 2 copies. You can submit an application to the bailiff service in person. At the same time, a mark indicating the receipt of the document is placed on the second copy of the petition, indicating the date and signature of the employee who accepted the document. If it is impossible to deliver the application directly to the head of the department, the application can be sent by registered mail with notification.

In a situation where the money written off by the bailiffs from the Sberbank card has already been transferred to the creditor’s account, an application for return is presented to him. If a party refuses to return funds illegally withheld by FSSP employees, it bears administrative responsibility. In addition, you can file a lawsuit against the creditor and receive not only your unfairly written off money, but also compensation for losses and moral damage.

Is it possible to challenge the withdrawal of money from my account?

Following the provisions of the Federal Law “On Enforcement Proceedings”, the injured party has the right to file a complaint against the actions of the bailiffs. The complaint can be sent to the territorial department of the FSSP, to the prosecutor's office or to the judicial authority at the place of residence.

Documents to challenge the actions of bailiffs:

- Complaint about illegal withdrawal of money from an account or legal action.

- Refusal document to provide a collection order (if the bailiffs refuse to issue it).

- Information about debiting money from the account in excess of the norm.

- Bank receipt for repayment of debt (term, amount, stamp).

- A copy of the agreement with the lender.

- Other documents.

Having received the statement of claim, the court begins to consider it. After rendering a verdict to satisfy the complaint of the injured party, the court sends a copy of the decision to the FSSP. Next comes the procedure for unlocking and returning previously debited funds from the account.

It is best to learn from competent lawyers about how best to draw up a complaint and where to file it.

Author of the article

Dmitry Leonov

Work experience 15 years, specialization - housing, family, inheritance, land, criminal cases.

Author's rating

721

Articles written

712

about the author

Useful information on bailiffs

- How long after the trial do the bailiffs arrive?

- Can bailiffs withdraw money from a Sberbank bank card?

- How much can bailiffs deduct from salaries?

- Can bailiffs withdraw money from a salary card?

- Seizure of a car by bailiffs, is it possible to drive?

- If the bailiffs are inactive, a complaint against the bailiffs

- Who can you complain to about bailiffs?

- Submission of a writ of execution to the bailiff service

- Can bailiffs describe parents' property for children's debts?

- Actions of bailiffs on a writ of execution

- Sample complaint to the prosecutor's office against the bailiff

- Can bailiffs seize a credit account?

- Inquiry about the progress of enforcement proceedings

- The paid traffic fine was handed over to the bailiffs

- Do bailiffs have the right to withdraw money from pensions?

- Do bailiffs have the right to open an apartment without the owner?

- How to negotiate with bailiffs to pay the debt in installments

- The bailiffs do not comply with the court decision, what should I do?

- Can bailiffs seize a salary card?

- Terms of enforcement proceedings with bailiffs

- Does a bailiff have the right to seize a pension?

- Can bailiffs seize child benefits?

- Can bailiffs seize the only home?

- Can bailiffs seize a car?

- Can bailiffs seize a Sberbank card?

- Car arrest

- Can bailiffs describe property without a court order?

- How do bailiffs find out the debtor’s place of work?

- What property can bailiffs describe?

- How to remove a lien from an apartment

- Seizure of property not belonging to the debtor

- If the debtor does not pay according to the writ of execution

- Information about arrests of bailiffs

- How to revoke a writ of execution from bailiffs

- How not to pay bailiffs according to a court decision

- How to find out fines from bailiffs

- Can a bailiff withdraw money from an account without notice?

- How to submit a writ of execution to bailiffs

- What accounts cannot be seized by bailiffs?

- Search for debtors by bailiffs

- How to remove a car from being seized by bailiffs

- What to do if you receive a letter from the bailiffs

- Find out the debt from the bailiffs of the Altai Territory

- Amur region

- Arkhangelsk region

- Astrakhan region

- Belgorod region

- Bryansk region

- Vladimir region

- Volgograd region

- Vologda region

- Voronezh region

- Transbaikal region

- Ivanovo region

- Irkutsk region

- Kaliningrad region

- Kaluga region

- Kamchatka region

- Kemerovo region

- Kirov region

- Kostroma region

- Krasnodar region

- Krasnoyarsk region

- Kurgan region

- Kursk region

- Leningrad region

- Lipetsk region

- Magadan region

- Moscow region

- Moscow

- Murmansk region

- Nizhny Novgorod region

- Novgorod region

- Novosibirsk region

- Omsk region

- Orenburg region

- Oryol region

- Penza region

- Perm region

- Primorsky Krai

- Pskov region

- Republic of Bashkortostan

- Republic of Mordovia

- Republic of Tatarstan

- Rostov region

- Ryazan region

- Samara region

- St. Petersburg

- Saratov region

- Sakhalin region

- Sverdlovsk region

- Smolensk region

- Stavropol region

- Tambov region

- Tver region

- Tomsk region

- Tula region

- Tyumen region

- Udmurt Republic

- Ulyanovsk region

- Khabarovsk region

- Khanty-Mansi Autonomous Okrug

- Chelyabinsk region

- Chuvash Republic

- Yaroslavl region

Required package of documents

To demand the return of money illegally debited by bailiffs from a Sberbank card, you must submit the following documents:

- Application for refund of written-off funds.

- Applicant's passport.

- Evidence that the bailiffs withheld the money illegally. This could be certificates from social security authorities that child benefits are transferred to this Sberbank card. Information about income or a document on termination of enforcement proceedings in connection with the reversal of a court decision. In general, any information confirming the legal basis for a refund.

Application for refund

Having in hand evidence of the illegal debiting of money from the Sberbank card by the bailiffs, an application is drawn up for the return of funds to the citizen’s account. The application process is completed as follows. In the right corner of the sheet the name and position of the head of the bailiff service is indicated. Further information about the applicant: full name, address, contact details. The text of the statement sets out the essence of the issue. It is important not to forget to indicate the number of the enforcement proceedings. Complete the description of the requirements with a list of attached documents. Under the text, put the signature of the applicant and the date of the application.

A sample complaint against a bailiff can be found

How to find out why you were removed

Information can be obtained in several ways. To do this, you will have to perform certain operations, since all data on withdrawal is provided only in the resolution sent to the debtor. No further warnings will follow. You will receive an SMS notification from the bank about the fact that your debt has been written off. However, it may arrive with a delay.

There are three ways to find out why the bailiffs withdrew money from a Sberbank card:

- You can send a request to the bank. In response, he will send a printout with detailed information about debits from the account. The specific data that is indicated in it reflects the date and time of the transaction, the details of the recipient, as well as the number of the writ of execution or the number of the court decision.

- If the reasons why the write-off occurred are not clear, then you can find out everything you need by contacting the bailiffs directly. The application must be sent to the department located at your place of residence.

- It is possible to obtain information on the official FSSP resource on the Internet. By indicating the number of the enforcement proceedings in the appropriate column, you can find out the reasons for the seizure of banknotes.

The procedure for returning money withdrawn by bailiffs from a Sberbank card

If a bailiff illegally wrote off money from a Sberbank card, the funds can be returned. To do this you need:

- Receive a document confirming that the amounts were debited from the Sberbank card by an employee of the FSSP unlawfully. You can get a certificate from the bank detailing the account and the source of funds. Information can also be obtained from the organization that transfers these funds to the debtor’s account.

- Write an application addressed to the head of the FSSP.

- Attach the required papers.

- Expect the withdrawal of the writ of execution from the bank or the transfer of funds from the creditor.

What to do if the bailiffs do not return the money?

It happens that a citizen wrote an application for the bailiff to return illegally debited funds from a Sberbank card, and attached all the necessary evidence. However, the FSSP employee is in no hurry to send the money or refuses to issue it. In this regard, a complaint is filed against the performer to his immediate supervisor. The appeal must describe the problematic situation, characterize the actions of the bailiff, list the violations that were committed by the FSSP employee, and at the end make a demand for the elimination of all shortcomings.

For your information

But if the situation regarding the return of the money written off by the bailiff from the Sberbank card has not moved forward, the citizen has the right to file an application against the FSSP officer in the district court. A petition with an administrative complaint is drawn up and sent to the court at the location of the territorial department of bailiffs. An administrative claim must be filed within ten days after receiving a response to the complaint from an FSSP employee (Clause 2 of Article 219 of CAS Federal Law No. 21 of 03/08/2015).

The application must be accompanied by:

- copy of passport;

- document on initiation of enforcement proceedings (if any);

- a certificate of the bailiff debiting money from a Sberbank card;

- evidence of the illegality of transferring funds to the claimant’s account;

- a copy of the refund request;

- a complaint against the bailiff to his supervisor and the response to it.

What to do if it's stolen

If it turns out that money was written off from a Sberbank card without your initiative on the client’s part, you should quickly make attempts to protect the remaining amount and return the stolen money. For such situations, the banking organization has developed instructions for returning funds written off from the card account. The scheme consists of several stages. If you do them correctly, then the probability of restoring the amount on the balance is much higher than when the client acts chaotically.

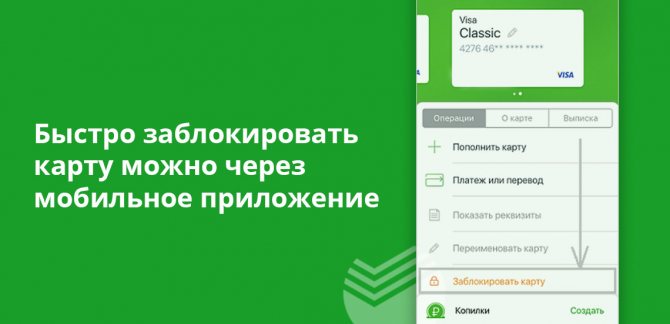

Locking plastic

To prevent attackers from accessing the money in your account, block the plastic. It can be done:

- In the mobile application. Find the card you need in the application, select the blocking function in the settings.

- In Internet banking. Open your personal account, find the blocking operation, indicate the card and confirm the action using the one-time code from the SMS notification.

- Via SMS. Send the text “blocking” and the last 4 digits of your card number to number 900.

- At a bank branch. If a bank branch is located nearby when the loss is discovered, you can not only block the card, but also immediately fill out an application.

- Through the contact center. The contact phone number is indicated on the back of the plastic and on the official Sber website. Tell the employees the necessary information, and they will block the card after identifying the caller as the card owner.

The next step is to write a statement about the theft of money from a bank office.

Registration of a refund

The financial institution will restore the lost funds to its balance sheet while simultaneously fulfilling two obligations:

- the owner reported the debiting of money from the account no later than the next day;

- the card holder did not violate security rules: he did not provide data to the thieves, did not store the code on a piece of paper next to the plastic card, and did not tell anyone the PIN code.

The procedure for reporting theft is specified in the contract; the most convenient way to do this is by phone. But you still have to visit the office to write an application. You can also register it at the police station.

The banking organization conducts an independent investigation, and the payment system is also involved. First, the bank finds out who withdrew money from the plastic card. If the theft was committed on the territory of the Russian Federation, the investigation will last about 30 days. If the operation was carried out abroad, the investigation continues for up to 60 days. When the search for information is completed, bank employees will contact the cardholder and inform the decision.

In a situation where the fact of theft is confirmed, and the owner of the card account has fulfilled all the conditions put forward to him, the bank will return the funds.

The bank's consent or refusal to return the amount

If the bank agrees to return the money, then within the period specified in the agreement the funds are credited to the account. If after this period the money has not been sent, go to court. Sometimes the terms are not specified in the contract, then the Civil Code of the Russian Federation comes into force. The client can fill out an application requesting a refund, indicating a period of up to 7 days and referring to the Civil Code of the Russian Federation.

If a banking organization refuses to refund your finances, request a written explanation for the refusal. If the bank did not issue the paper or the reason turned out to be unconvincing, go to court. Provided that the client has complied with all the bank’s requirements, the court will take his side.

How to protect a Sberbank card from write-offs by bailiffs?

The most effective way to protect a Sberbank card from writing off funds by bailiffs is to fulfill debt obligations. That is, you need to at least start paying off the debt so that the FSSP employee has no reason to withhold money from the account.

However, if the debt, although recognized by a citizen, is not possible to pay at the present time, you can go to the bailiff service and agree to send a resolution on enforcement proceedings to the organization’s accounting department to withhold part of the income.

Attention

The bailiff does not always know where the money on the debtor’s Sberbank card comes from. If, for example, child benefits, social payments or alimony are transferred to an open account, then they do not have the right to write off the finances. To avoid further red tape with the return of money, it is better to immediately provide the FSSP employee with evidence of the illegality of these deductions.

What funds are subject to and are not subject to seizure?

According to the Federal Law “On Enforcement Proceedings”, bailiffs can seize funds, but not the account itself. In other words, performers have the right to withdraw money, but cannot block use of the account, because this is contrary to their authority.

Attention! Need protection from bailiffs? in the form, go to the online lawyer help , go, free !

Bailiffs impose arrest:

- to the debtor's accounts without determining their features;

- to bank cards (salary, credit, payment, etc.);

- for deposits and deposits.

The bailiff is not obliged to take into account the intended purpose of the account. But at the same time, the law clearly states that the arrest cannot extend to funds received by the debtor as child benefits and other social payments.

The list of money not subject to seizure is enshrined in Art. 101 Federal Law “On Enforcement Proceedings”. Here they highlight:

- compensation for harm, injury and other troubles;

- finances paid to the debtor in connection with the loss of a breadwinner;

- alimony payments;

- insurance amounts;

- maternity capital and other benefits for children.

It is important to understand that bailiffs seize all current accounts of the debtor, regardless of their purpose. Challenging collections from the accounts to which the above payments are transferred rests with the debtor himself. This is especially true when the debtor did not receive notification from the bailiffs and did not know about the write-off. In this case, it is appropriate to prepare to protect your legitimate interests.

In what cases are bailiffs prohibited from withdrawing money from a Sberbank card?

Article 101 of Federal Law No. 229 regulates all types of income from which bailiffs are prohibited from writing off a Sberbank card. Thus, collection of debt cannot be applied to:

- alimony;

- all benefits from the state related to the birth of children and paid for their maintenance (maternity capital, one-time and monthly payments);

- benefits for caring for a disabled person;

- survivor benefits;

- preferential cash payments to certain categories of citizens;

- amounts paid for injuries and injuries to an employee in the performance of his official duties, as well as to family members in the event of his death;

- funds issued for compensation for damage caused;

- various types of compensation determined by labor legislation (travel allowances, financial assistance, compensation for wear and tear of employee equipment, etc.);

- funeral funds;

- compensation payments for vouchers and travel to and from the place of treatment;

- one-time financial assistance related to a state of emergency (terrorist attack, natural disasters).

However, as noted earlier, the bailiff does not always know the history of the receipt of funds on the debtor’s Sberbank card. In this regard, illegal debits from the account often occur. If it is discovered that a FSSP employee has withdrawn funds to repay a debt, you must write an application for the return of money addressed to the head of the government agency and provide evidence of the illegality of the withdrawal.

Problems and nuances

There are a number of nuances that citizens should take into account when bailiffs write off money from a Sberbank card:

- An FSSP employee has the right to choose only one account for withdrawing funds from the debtor on the basis of enforcement proceedings. If for some reason this account needs to be replaced with another, the bailiff must revoke the writ of execution and submit a new one to the credit institution.

- If there are not enough funds in the account, the amounts will continue to be debited as they are received on the Sberbank card.

- More than 50% of income cannot be taken to pay off debt. However, under some circumstances, the volume of money written off from the card by bailiffs reaches 70% quite legally (clause 3 of Article 99 of Federal Law No. 229). This happens in case of malicious alimony debt or if there are 3 or more children in the family, one of whom is disabled.

Comments Showing 0 of 0