How to get money back from scammers?

In this article we will look at one of the most pressing topics: how to return the money that you transferred to scammers? Deceived citizens approach our agency with this question almost every day. There is no clear answer here. It all depends on the specific circumstances: did you know the scammer personally, or transferred money to a virtual card to an unknown online scammer; the amount of damage incurred; documentary evidence of money transfer. And yet, we have formulated several general points that will help you save time, nerves and money remaining in your accounts.

How can I cancel a transfer and when will it be possible?

Cancellation of a transfer is possible only before the money is credited to the recipient's account. If the transfer is made through the internal system of one bank, most transfers are completed instantly. Technical problems can prolong this juice for up to a day. According to the system of external transfers between credit institutions - from two to five days.

To cancel, you need to immediately call the bank's hotline, find out the status of the payment and demand immediate freezing of the transaction if it has not yet been executed by the system.

If the money is already in the recipient’s account, without a voluntary decision of the account owner or court enforcement documents, the bank does not have the right to withdraw funds by virtue of Article 27 of the Federal Law on Banks and Banking Activities.

Can Sberbank return the money?

Sberbank, like other banks, is subject to the requirements of Federal and regional legislation. The credit institution itself does not have the right to withdraw money from the account of the person to whom the payment was received. If the person transferring money manages to call 900 and cancel the transfer, then everything will end well. If not, then you will have to go through a difficult path to get your money back.

Procedure and ways to solve the problem

Initially, after discovering an error, you must contact the bank with a statement informing about the erroneous transfer. The application must be prepared in advance. The two copies must be identical to each other. On the client's copy, the bank employee must put a mark on acceptance of the application indicating the date of acceptance.

The text of the document contains the following information:

- Last name, first name and patronymic of the applicant.

- Basic contact information (mobile phone number, email address).

- Passport series and number, by whom, when the document was issued.

- Permanent registration address.

- Address of actual residence (if it does not coincide with the address of permanent registration).

- Date and time of the failed transaction.

- Details of the card to which the transfer was made.

- The amount of the transaction made.

After receiving the application, the bank employee contacts the cardholder and notifies him that an erroneous transfer has been received to his details. The person to whom the funds were transferred will be notified of the need to return the amount received. From the point of view of legislation, there was an unjust enrichment of a citizen (Article 1102 of the Civil Code of the Russian Federation).

You can obtain information about the progress of the application, the actions taken by the bank and their results on the hotline of the credit institution or at the bank office where the application was registered.

Under optimal conditions, a bank employee will contact the cardholder, who will immediately return the funds. However, often it is either impossible to contact the owner, or he refuses to return the money. In this case, you will have to take a long bureaucratic route. The appropriateness of action depends on the size of the erroneous translation. Initially, you should write a statement to the territorial department of the Ministry of Internal Affairs (police).

Know the scammer by sight

To take money from a fraudster, you need to establish his identity - otherwise there will be no one to file a claim with. Finding criminals is the direct task of law enforcement agencies. However, it is not possible to initiate a criminal case in every case of fraud. Every day thousands of people transfer or simply hand over their money to scammers. The police are physically unable to investigate every instance of deception—hence the refusal to initiate criminal cases. It makes sense to count on the help of law enforcement agencies if you have a specific invoice in your hands: promissory notes, signed agreements, and preferably also a photocopy of the fraudster’s passport. It’s good if there are witnesses to the crime or recordings from surveillance cameras, and you, among other things, know the address of residence and work of the swindler. But such cases are rather rare.

conclusions

There are situations in which you will actually be able to freely use money that unexpectedly came to you from an unknown sender. In particular, when no one applied for the return of the transfer, and the statute of limitations - 3 years - had completely expired. Otherwise, the decision to spend someone else’s money will be on your conscience and can lead to unpredictable legal consequences. Don’t take risks, don’t follow anyone’s lead and immediately contact the bank.

Topic: 5 main mistakes of bank card owners. Never do this

Non-refundable amount

When we are asked if we can help return money stolen by scammers, we ask a counter question: how much is the theft? It is important to understand that searching for scammers and recovering stolen funds is an expensive proposition. If you are counting on the help of a private detective, compare the amount of damage and the expected costs of finding the deceiver. It is quite possible that it will be more profitable for you to abandon the idea of \u200b\u200bsearching for a criminal. If we are talking about an amount of up to a million rubles, you risk spending exactly the same amount or even more on searches. Usually our Customers are people who have lost at least 3-5 million rubles. Although there are also people of principle for whom it is important to take money from the scammer at any cost. The motivation of such Customers is not material gain, but the desire to demonstrate and reinforce the thesis: “no one has ever managed to deceive me with impunity.”

Is it possible to return money transferred to a fraudster’s card?

Oddly enough, in most cases it is easier to return money to the card if you make a mistake with the number than in case of fraud. Although, it would seem, in this case we are talking about a crime.

And instructions on the Internet often confuse victims even more. We studied several banking sites, and, for example, from Sberbank alone we found two official, but directly contradictory messages - that the money will not be returned if you yourself transferred it to the scammers, and that you will return all of it -it’s possible.

What nuances need to be taken into account?

- Not all cases are covered by insurance - in 90% of cases the refusal occurs precisely because the victim, without understanding it, tries to apply the account insurance program. It is only valid if funds were transferred from the account by a third party. If you made the transfer yourself, the insurance does not apply. Does this mean that the situation is hopeless? No. You can return money transferred to the fraudster’s card.

- use the instructions above - call the bank or visit the office and write an application for a refund. If the funds have not yet left the bank, they will be returned to the account. True, the card will be blocked because it is considered compromised, and you will have to wait 1–2 weeks for reissue. But, you see, this is a small price.

- file a police report - this is an option in case the transferred amount still managed to go away. Often we are talking about a transfer to another bank or even to some kind of Internet wallet, and a banking institution simply cannot arbitrarily take and “withdraw” funds from another organization.

Found - what next?

Let's assume that you managed to identify the fraudster yourself, with the help of law enforcement agencies or private detectives. The further course of events can develop both within the legal field and outside it. The chances of taking money from a fraudster through court are usually minimal. The same can be said about collectors. From this moment, the most critical stage of recovery begins: the choice of a further behavior strategy. The Legion agency has a service called “creative collection” - this is our author’s way of talking with debtors and scammers in a language they understand.

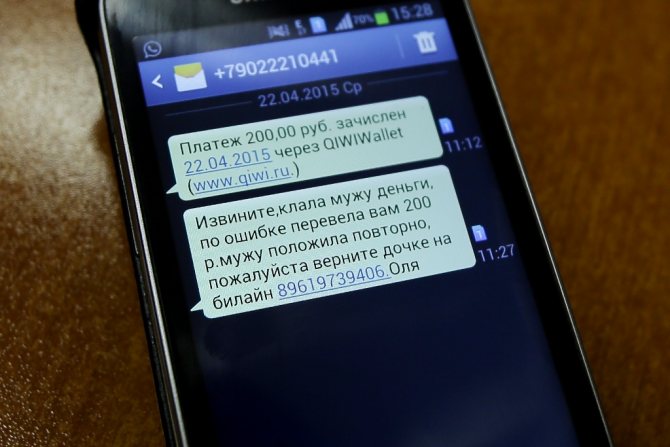

What to do with the translation

So, you are in a situation where clearly someone else’s money has been deposited into your account. To begin with, it’s worth saying what you definitely shouldn’t do. Under no circumstances should you try to return this money yourself. Even if, immediately after the transfer, a kind old lady called your phone and told a sob story about how she made a transfer for her sick daughter, made a mistake by one number and is now begging you to make a reverse transaction.

Fraudsters are actively working according to a similar scheme, and perhaps the transfer to your wallet was made by some poor fellow from Avito, who was scammed for bail. Your card will become a transit card - a transitional link between the victim and the scammers, and it will be you who will be under suspicion from law enforcement officers. The attacker can simply challenge the transaction, after which he will return his money, and receive yours on top. Therefore, it is better to immediately notify the bank about a transfer for an unknown purpose, so you will insure yourself against any possible problems.

An erroneous transfer is not your problem, but the bank and the owner of the funds. Therefore, they must understand the situation. But this will happen exactly until one moment - until you decide to spend other people's money. This should not be done for a number of reasons. And these reasons are articles in the criminal and civil codes. From illegal enrichment to fraud.

You have no right to dispose of such money; the bank will in any case force you to return it, if not immediately, then through the courts. Moreover, the latter will definitely charge you interest for using someone else’s money and force you to compensate the other party for legal costs. You definitely don’t need such problems, so let the money lie where it was and calmly await its fate.

We will continue to act

How do we manage to recover money from scammers? First, we find out whether the criminal has funds. After all, it is possible that he simply spent what he stole on a beautiful life, and now there is nothing to recover from him. Investing in real estate or business is not considered waste - it is an investment. If we find out that the fraudster has the money, the next step is to begin work on collection. But not with money, but with a person. Yes, yes, because money has no fear, no plans for life, no favorite hobby or business. Only man owns all this. These puzzle pieces make up his comfort zone. Our task is to create unbearable living conditions for the fraudster. Moreover, we are not talking about vulgar crime at all. Here is a simple example of our tactics: a fraudster has a beloved woman, a cottage abroad where he goes on vacation with her, and a small legal business. But what if travel abroad is prohibited for him, the business begins to suffer losses, and there is no time left for a loved one? Let the scammer get the impression that after he deceived you, a dark streak suddenly came in his life. Rest assured: he himself will quickly realize that this bad streak can be interrupted by returning the debt to you.