Why do you need an application to the Federal Tax Service for the return of state duty to the tax office?

In accordance with the provisions of Art.

333.40 of the Tax Code of the Russian Federation, an individual or legal entity that has paid state duty to the Federal Tax Service has the right to return it or offset it (against subsequent similar payments). The return procedure is possible if:

- the duty has been paid in a larger amount than required;

- legally significant actions for which the fee was paid have not been carried out;

- the person who paid the fee did not actually contact the state authorities;

- a fee has been paid for a passport or refugee document, but its issuance to the applicant has been refused;

- the applicant withdrew the application for state registration of intellectual property items in the manner regulated by clause 1 of Art. 330.30 Tax Code of the Russian Federation;

- the court terminated the administrative proceedings or left the administrative claim without consideration.

The fee is not refundable if it is paid:

- for unclaimed services of civil registry offices;

- Rosreestr services, but the agency refused to register the property.

How to return the state fee?

The refund of the duty is processed by sending to the Federal Tax Service an application for the refund of the state duty in the form approved in Appendix 8 to the order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8/ [email protected] From January 9, 2019, this form is used as amended by the Federal Tax Service order dated November 30 .2018 No. ММВ-7-8/ [email protected]

The taxpayer must submit an application for refund of the state duty to the Federal Tax Service within 3 years from the date of payment of the duty to the budget.

ConsultantPlus experts explained whether the state duty is refunded if the claim is abandoned. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Let's study the features of filling out this application.

Is it possible to return state duty from the tax service?

Answering the main question of our article, we can say with confidence that the state duty paid by a citizen of the Russian Federation can be received back:

- in full;

- partially.

However, you need to understand that such a return becomes possible only if certain special conditions are met.

1. So, you can get your money back if you overpaid for the duty and contributed more than the required amount. However, in this case, not the entire duty is returned, but only the difference that you overpaid.

2. You can also return the state fee if you drew up in the name of a notary or a judicial authority:

- complaint;

- statement.

Provided that you submitted the above papers, but subsequently the provision of services was refused, you have the right to receive back the money paid.

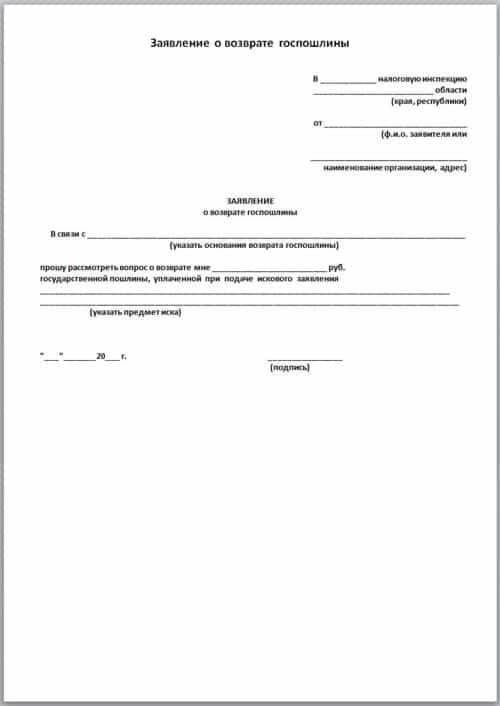

Application for refund of state duty

To return the duty from the Federal Tax Service, you need to fill out a refund application

3. Provided that you have received notification that all proceedings in your case have been terminated, you also have the right to contact the tax service for a refund.

4. Provided that you have paid the fee for resolving your case in court, however, a settlement agreement has been concluded between you and the other party to the process, drawn up and signed even before the court made and announced any decision on your case, you also have the right to a refund of state duty. However, it will not be possible to return it in full, but only half.

5. A refund of money paid as a state fee can also be made if the citizen who initiated the receipt of any service never applied for it.

However, you need to understand that there are also situations in which a duty refund is not possible.

- So, for example, provided that the defendant voluntarily decided to satisfy the plaintiff’s demands, the state fee paid in advance as legal costs cannot be returned.

- You will also not be able to get your money back if you used it to make changes to any acts drawn up at the civil registry office.

- Provided that you paid the fee for registering a civil status act in relation to you, the money cannot be returned either. We are talking about performing such procedures as:

- Marriage registration;

- effecting a divorce;

- change of first or last name.

So, taking into account all the nuances listed above, you must understand whether or not you can refund the state duty from the tax office. For those who received a positive answer to their question, we present below a guide on how to return state duty from the tax office.

Letter for refund of state duty to the tax office: where are the applications and its sample

To correctly fill out an application for a refund of state duty to the tax office, you can download a sample on our portal. You have access to a document that fully complies with legal requirements.

In addition to the application itself, additional documents should be sent to the Federal Tax Service to confirm the expenses incurred. If the courts or magistrates made decisions or determinations on the return of state duty, then payment documents must be attached.

Regarding payment orders or bank receipts, there is one feature that should be taken into account when preparing the package: if the applicant intends to return the full amount of the state duty, then the originals of the payments are sent; if in partial amounts, it is allowed to send copies of the orders, since the originals will be required to claim the rest of the state duty.

From January 1, 2021, there is a rule according to which if the state fee is paid in non-cash form, then to return it to the application you must attach a copy of the payment document. The Ministry of Finance of the Russian Federation clarified whether, for example, an accountant is required to certify a copy of such a payment slip. Get free trial access to the K+ system and find out the opinion of officials.

Who pays the state duty?

An ordinary citizen on his own behalf, an individual entrepreneur, or a legal entity of any legal form can pay the state duty. Confirmation of the fact of payment of the state duty will be an official receipt of the established form or a payment order with a bank seal confirming the execution of the payment.

Individuals pay state duty when:

- Submitting documents for opening an individual entrepreneur, LLC, JSC;

- Requesting information about the status in the all-Russian unified register;

- Using the term “Russia” in their names;

- Cases of termination of business activities of a businessman.

Legal entities or their official representatives additionally apply to courts of any instance, arbitration or constitutional, while paying a state fee. Also, it is required to pay for the actions of government services to issue permits, licenses, tests or approbations.

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

Results

The state duty paid to the budget on the grounds prescribed in Art. 333.40 of the Tax Code of the Russian Federation, the taxpayer has the right to return from the budget. To do this, he needs to send to the Federal Tax Service an application drawn up in the prescribed form for the return of the state duty within 3 years from the date of payment of the duty.

You can find other useful information about state duties in the following materials:

- “Which BCC should I pay the state fee for registering a company or individual entrepreneur?”;

- “Payment order for payment of state duty - sample 2019-2020”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Legislative regulations

Refund of state duty is regulated by Article 333.40 of the Tax Code.

It specifies the grounds on which funds can be re-credited from the state account to the taxpayer's account.

The article also sets out the conditions under which amounts of money will remain in the state budget.

Also, Articles 78 and 79 of the Tax Code indicate actions for the possible inclusion of state duty amounts in subsequent applications, as well as refunds.

When a return is not possible

There are a number of circumstances under which a refund of state duty is not possible:

- any registration actions in the registry office;

- if, after filing the claim in court, the defendant fully accepted the applicant’s claims;

- refusal to register rights to real estate;

- when working with a mark on jewelry (analysis, testing, installation).

If more than 3 years have passed since the payment of this obligatory payment, then there is no point in filing an application, the application will be refused.

But one application for a refund is not enough. Attached are documents proving your case. For example, a check confirming excess payment, a court decision to terminate proceedings, etc.

By law, government bodies must respond to requests from citizens and legal entities within 30 days. The same applies to filing a duty refund application. The application will be considered for a month. Afterwards a decision will be made on whether to return or refuse.

Watch the video. How to get back overpaid taxes:

Step-by-step instruction

How to return state duty from the tax office:

- Establishing the basis and amount of the refund: full, partial, or offset of the deposited amount on subsequent requests. These applications must be no later than three years from the date of payment of the state duty.

- Drawing up a return application. The header of the document must indicate the organization to which the application is being sent, as well as from whom exactly it was drawn up: full name, passport details, address. The text sets out the basis for returning the amount; if this is a lawsuit, then you need to indicate the subject of the claim, the plaintiff and defendant, and the amount of the fee. The request for return and a list of documents attached to it must be written down. The document must be signed by the applicant. The date must be entered.

- Providing a receipt for payment of the state duty. An original is required for a full refund. For partial payment, a copy of the receipt is sufficient. You should also attach additional documents, if any. For example, a refusal to consider a case in court, a court ruling rejecting the consideration of a case, a certificate from a judicial authority about the decision to reimburse funds, a photocopy of a bank card or a book with the details of the personal account to which the money should be transferred.

- To refund the state duty, you need to send your letter with documents to the organization in whose favor the funds were transferred. A decision on return is made within 10 days.

- Payment of the amount by transfer to the bank account specified in the application. The payment period is set at 30 days. If it is violated, then interest is charged for each day of delay.

Application for refund of state duty to the tax office: sample.

According to Article 45 of the Tax Code, the taxpayer must pay the tax fees himself. It is he who can become an applicant in the situation of returning funds for state duty.

Provided that a citizen who has decided to demand a refund of funds cannot himself submit an application form to the required government agency, he can be represented by an authorized person.

Moreover, the representative must have a power of attorney, notarized.

The state fee may be paid not by the applicant himself, but by another person. In this case, another person does not have the right to demand a refund of the paid fee under Article 45 of the Tax Code.

Form of power of attorney for the tax office.