Submit an appeal to SRO NP "Mir"

You should contact the organization provided that your MFO has entered into an agreement with it. For example, NP MIR includes 80 MFOs. SRO "Mir" accepts complaints about violations by microfinance organizations on its website and, after reviewing the application, offers options for eliminating them. You need to fill out a special form by clicking on the “Hotline for Consumers” link on the official website. In your application, be sure to indicate the reason for your request and briefly state the problem.

In 90% of cases, the issue is resolved without litigation by restructuring the loan (the term is increased, the commission or fine is reduced).

- You can submit an appeal via the link: https://www.npmir.ru/feedback/

- Hotline: 8 (800) 775–27–55

- You can check microfinance organizations in the register of members of SRO "MiR" at the link: https://npmir.ru/about/sro-mir/members_sro.php

Submit an appeal to SRO NP Mir

Complain to the financial ombudsman

The financial ombudsman is a special authority whose competence includes resolving disputes arising between creditors and borrowers. He acts as an intermediary between the MFO and the client during pre-trial proceedings.

You can send an appeal only in cases where the property claims do not exceed 500,000 rubles and you previously sent a request to the microfinance organization, but did not receive a response or you were not satisfied with it.

- Written requests are accepted at the address: 119017, Moscow, Staromonetny lane, 3.

- Toll-free contact center number: 8 (800) 200–00–10 (working hours: Mon-Fri, from 09:00 to 21:00 Moscow time).

- Form for filing electronic complaints: https://finombudsman.ru/lk/login

Complain to the financial ombudsman

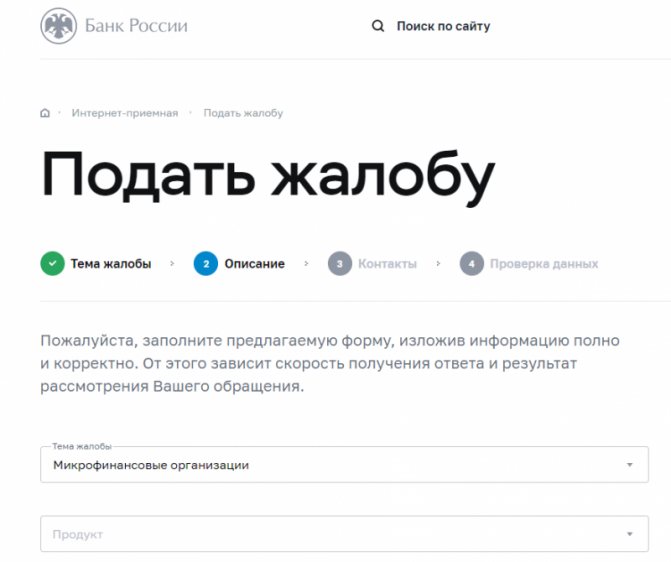

Complaint against microfinance organizations to the Central Bank of Russia

If an MFO has serious violations, the Central Bank of the Russian Federation has the right to revoke its license, after which the company will not be able to continue to engage in microfinance.

It is advisable to contact the Central Bank:

- If the microfinance organization does not have permission to operate, fines.

- The penalty or interest rate exceeds the maximum possible.

- When the terms of the contract change without warning and in a number of other cases.

The Bank of Russia recommends that borrowers first contact the MFO with a complaint and receive a response, so that the decision on the issue is as objective as possible.

- Toll free contact center number: 8 (800) 300–30–00

- Additional number (payment according to the tariffs of your operator) +7 (499) 300–30–00

- Free short number from mobile phones 300

- Form for electronic complaints: https://cbr.ru/Reception/Message/Register?messageType=Complaint

- Personal visit to the branch at the address: Moscow, lane. Sandunovsky, 3, building 1 (reception hours: Monday from 10:00 to 18:00, from Tuesday to Thursday - from 10:00 to 16:00).

Complaint against microfinance organizations to the Central Bank of Russia

Where and how to complain about microfinance organizations

The activities of microfinance organizations are regulated by various federal laws, regulations, information letters and instructions from the Central Bank of the Russian Federation and other departments. However, sometimes MFOs can behave more uninhibitedly than the law allows: dictating their own rules when concluding an agreement, using tricks for their own benefit, collecting debts using non-standard methods. A borrower who is confronted with such behavior by a lender must be prepared to protect his interests. The most effective method of influencing companies is a complaint to the authorized bodies. Let’s figure out what bodies these are and how to file a complaint against an MFO yourself.

A complaint is an official appeal that gives a chance to resolve the situation without bringing the matter to court. Currently, you can send an appeal to the Central Bank of the Russian Federation (CB), a self-regulatory organization (SRO), of which the company is a member, Rospotrebnadzor, the Federal Bailiff Service (FSSP), the Federal Antimonopoly Service (FAS) and the financial ombudsman. If there are signs of a criminal offense, in particular threats to life and health, one can and should resort to the help of the prosecutor’s office. Now let's get started!

Where to write a complaint against an MFO

1. In microfinance organizations

The first step should be to file a complaint with the organization itself. Often the problem can be resolved on the spot, and then no further action will be necessary. If it is impossible to resolve the situation amicably, the borrower has the right to appeal to higher authorities - a self-regulatory organization, the Bank of Russia, Rospotrebnadzor, the bailiff service, etc.

According to the laws “On Consumer Credit” and “On Microfinance Activities and Microfinance Organizations”, from July 1, 2021, the maximum loan repayment cannot exceed 2 times the loan amount, and from January 1, 2021 – 1.5 times.

Therefore, if the rate on a microloan is higher than acceptable, there are signs of incorrect interest calculation, or the maximum payment ultimately exceeds twice the loan amount, you should first contact the microfinance organization and find out if there is a technical error in the accrued amount, advises Yulia Kombarova

, General Director of Legal Bureau No. 1. MFOs have standard rules in contracts; the likelihood of an error is small, but it still exists.

It is worth remembering that for a positive decision the complaint must be justified. Sometimes MFO clients, having already received a loan and signed all the documents, try to challenge certain terms of the agreement because they seem incorrect to them.

“If an MFO operates within the framework of the current legislation, an unfounded complaint will bring losses primarily to the client himself, since it will increase the period of use of the loan, and, consequently, the amount due”

, warns

Natalya Gurtskaya

, head of the legal department of MCC Urgent Money LLC.

2. To the Central Bank

– a thunderstorm of the financial market, the main regulatory body. It is he who is capable of expelling a company from the market - for gross violations, of course. The regulator accepts requests related to any illegal activities of both microfinance companies (MFCs) and microcredit companies (MCCs). It is necessary to send a complaint in case of non-compliance with the requirements of federal laws, regulations of the Russian Federation, regulations of the Central Bank, and other documents regulating the activities of MFOs. You should complain thoughtfully, having carefully prepared all the documents and evidence.

Reasons for contacting the regulator:

- loans are provided by a company not included in the Central Bank register;

- the total cost of credit (TCC) exceeds the average market size by more than a third - the Central Bank publishes the maximum amounts every quarter;

- a fine is charged for early repayment of a microloan or a fee for additional services without the borrower’s consent - for example, a fee for extending the loan term;

- information on borrowers has not been transmitted to the credit history bureau;

- illegal methods of collecting overdue payments are used;

- the percentage ceiling has been exceeded;

- disclosure of confidential data to third parties;

- the company unilaterally increases the interest rate on the loan, shortens the repayment period, and introduces commissions;

- illegal issuance of a loan (including issuance using lost passports, issuance to an incapacitated citizen).

You can submit an application through the online reception, in person through the public reception of the Central Bank or by mail to the address: 107016, Moscow, st. Neglinnaya, 12.

As the Central Bank notes, a large share of complaints are claims under old contracts that no longer have retroactive effect. Such empty complaints take a lot of time, so the regulator wants such issues to be resolved at the SRO level, preferably without the participation of the Central Bank. The SRO also recommends that borrowers who are dissatisfied with the activities of microfinance organizations should contact them first. The SRO “MiR” said that, firstly, a significant part of the claims received by the Central Bank and related to violations of consumer rights are still then “downstreamed” for consideration by the SRO. But with a time delay. Secondly, it is the SRO of the MFO, which is in constant direct contact with its members, that is, as a rule, able to solve the problem that has arisen as quickly as possible.

3. In SRO

Each microfinance organization is a member of an SRO to carry out its activities. SROs “MiR”, “Unity” and the Union “Microfinance Alliance” are currently operating in the microcredit market.

Citizens dissatisfied with the activities of microfinance organizations have the right to contact the SRO or the Central Bank of Russia to conduct an inspection and eliminate violations that lead to negative consequences, noted Daut Khairullin

, Chairman of the Council of SRO "Unity".

SROs mainly consider situations related to violations of the Basic Standards, as well as Federal Law No. 151 “On microfinance activities and microfinance organizations.”

MFO clients can contact SRO “Unity” via email [email protected]

indicating the name of the organization and TIN, as well as through the SRO website (on the main page of the site there is a tab about illegal lenders).

In case of violation of Federal Law No. 353 “On consumer credit (loan)” and other regulations governing the activities of microfinance organizations, citizens have the right to contact the Central Bank of Russia. The regulator considers requests within 30 days following the day they are received, added Daut Khairullin.

MFO borrowers can contact SRO "MiR" using a special form on the website, which contains mandatory lines (full name of the consumer of the financial service, number and date of the agreement, name of the MFO) and the ability to describe the situation in any form in main part. Mandatory data is necessary in order to contact a person as quickly as possible, request data on him from the microfinance organization about which he is complaining, and provide advice, said Elena Stratyeva

, Director of SRO "MiR".

All appeals received by SRO “MiR” are accepted and processed on the same day, then transferred to the official who will “manage” this appeal. As part of the inspection, documents are requested for each complaint; they can be requested from both the MFO and the applicant (if necessary).

The maximum time for considering a complaint from a consumer of a financial service according to the rules of the SRO is one month from the date of registration, this period includes the time required to request and receive clarifying documents. An exception is made for complaints that do not require additional inquiries and verifications: for them, the maximum response time is set at 15 working days.

A consumer of a financial service can submit an appeal to SRO “MiR” in several ways:

- by postal address;

- through the application form on the SRO “MiR” website;

- official voice message via the hotline.

Detailed information on the procedure for filing an appeal is presented on the website in the section “For Borrowers” - “Procedure for working with appeals and complaints from citizens and organizations.”

SRO "MiR" is obliged to consider complaints only against members of the organization. But if the SRO receives an appeal regarding a company that is not part of it or illegal lenders, the borrower will be told where to go in this case and will be recommended further steps.

Important: sometimes it is not easy to determine where to write a complaint against an MFO in a specific case. However, there is no need to fear that the application will be addressed to the wrong recipient. A written appeal containing issues the solution of which is not within the competence of the government agency is sent to the appropriate competent government agency or official, with the citizen notified that the appeal has been forwarded.

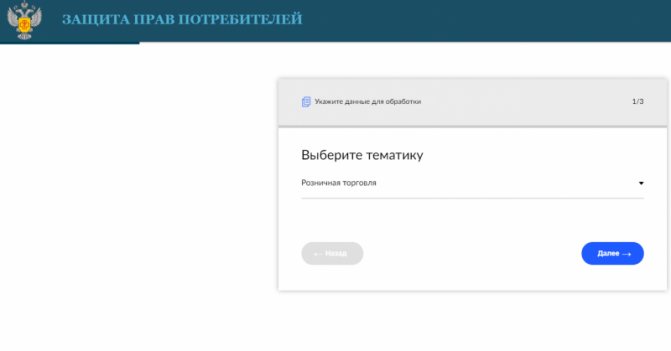

4. To Rospotrebnadzor

Since MFO clients are ordinary citizens, and funds are issued for personal needs, microfinance providers are required to comply with the requirements of the law “On the Protection of Consumer Rights.” It makes sense to complain to Rospotrebnadzor if the company does not provide the necessary information or the text of the contract with the company includes conditions that infringe on the rights of the consumer. For example:

- illegal fees are prescribed, including for early repayment of the loan, for changing the terms of the loan agreement in terms of exemption from life insurance, as well as excessive interest, penalties and fines;

- there is no provision in the agreement about the possibility of prohibiting assignments to collectors;

- the agreement allows filing claims only at the location of the organization; the borrower's right to choose a court is limited.

Submitting a complaint is possible through the website of the Rospotrebnadzor Office, as well as in writing by mail: 127994, Moscow, Vadkovsky lane, building 18, building 5, 7.

Previously, Zaim.com talked about what advice Rospotrebnadzor gave to MFO borrowers.

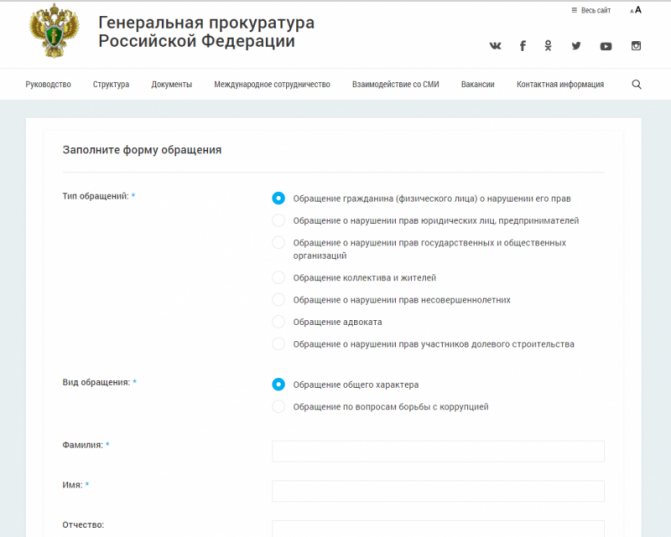

5. To the prosecutor's office

You need to go to the prosecutor’s office when creditors make threats, call at night, “lurk” on the street, and the like. A statement about the commission of a crime can be submitted in writing or orally, regardless of the amount of the loan received from the microfinance organization. This can be done, among other things, through the government services website. Before filing a complaint, it is advisable to find out the full name. specific annoying employees. The police can also help in the situation, but contacting the prosecutor’s office is often more effective.

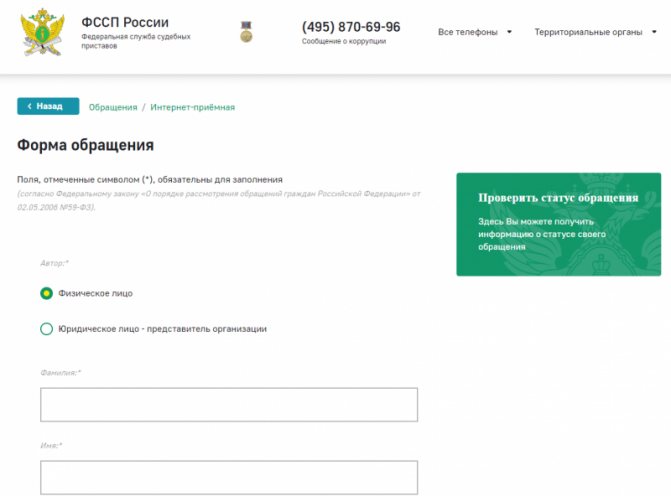

6. In the FSSP

When an incorrect procedure for collecting overdue debt is carried out against a borrower, the main regulator is the bailiffs. Reasons for contacting the FSSP:

- exceeding the permitted number of calls and messages: more than once a day, twice a week and eight times a month, on weekdays from 22:00 to 08:00, on weekends and non-working holidays from 20:00 to 09:00;

- calling loved ones despite refusing to interact;

- calls to the debtor after filing an application for interaction through a representative lawyer;

- threats of harm to life and health;

- demanding someone else's property to pay off a debt;

- psychological pressure.

Filing a complaint is possible through the FSSP online reception. Address for sending written requests: 107996, Moscow, st. Kuznetsky Most, 16/5, building 1.

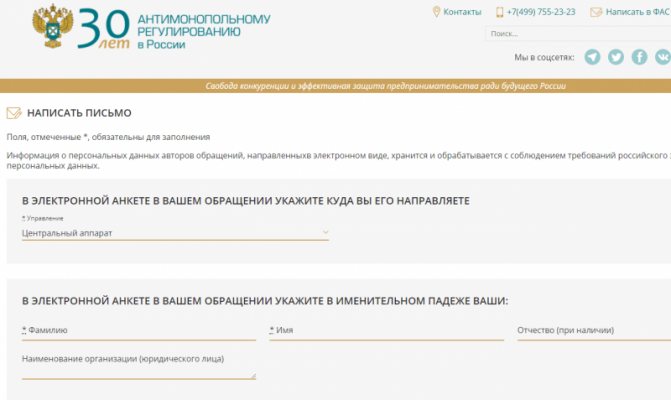

7. At FAS

The antimonopoly service is capable of punishing those who illegally provide microloans. A complaint is filed if the MFI misleads clients with advertising or violates competition laws. You can write a letter with a complaint to the address 125993, Moscow, st. Sadovaya-Kudrinskaya, 11, or send through the service website, by email [email protected]

or through the government services website.

8. Financial Ombudsman

The Financial Ombudsman will begin to consider requests from consumers of financial services regarding microfinance organizations from January 1, 2021. He will deal with requests for satisfaction exclusively of property-related claims made by the borrower to the organization. At the same time, the size of claims for the collection of monetary amounts should not exceed 500 thousand rubles.

Before filing a complaint, you must first submit a claim to the creditor with whom the dispute arose, in writing or electronically. If the answer is not satisfactory or was not given, you can contact the authorized person.

Important: claims are considered by the Ombudsman, provided that no more than three years have passed from the day when the borrower learned or should have learned about the violation of his rights. This deadline can be restored by the authorized person if it was missed for valid reasons.

An appeal in free form is sent electronically through your personal account on the website of the financial ombudsman or by letter to the postal address: 119017, Moscow, Staromonetny per., 3. Copies of the application to the financial organization and its response (if availability), as well as available copies of the contract and other documents on the merits of the claim.

Microfinance providers are required to comply with the decisions of the Ombudsman. Meanwhile, if either party disagrees, it can be challenged in court.

So, the borrower has more than enough opportunities to complain about the MFO. It must be remembered that the complaint must be justified, contain as much information as possible, and in the appeal you must indicate your contact information.

Subscribe

Contact Rospotrebnadzor

In case of illegal actions on the part of MFO employees, transfer of debt to collectors without your consent, disclosure of personal data, or charging of an unreasonable commission, you can contact the territorial department of the Federal Service for Supervision of Consumer Rights Protection and Human Welfare (Rospotrebnadzor).

- Phone for information: 8 (499) 973–26–90

- Personal reception of citizens is carried out at the address: Moscow, Vadkovsky Lane, 18, building 5, 7.

- Submission of appeals on the official website in the subsection “Appeals from citizens”: https://www.rospotrebnadzor.ru/feedback/hotline2.php

Contact Rospotrebnadzor

Complaint to the Federal Antimonopoly Service

FAS provides assistance in cases of misleading borrowers through advertising that does not correspond to reality. For example, an MFO advertises some conditions, but specifies others in the loan agreement. Another reason for applying may be that the company has not received registration from the Central Bank of the Russian Federation, but is engaged in advertising and offers to issue a microloan.

- Multi-channel telephone line: +7 (499) 755–23–23

- Address: Moscow, st. Sadovaya-Kudrinskaya, 11

- Contacts of territorial offices: https://fas.gov.ru/pages/kontakty_territorialnye_organy

- Write a letter: https://fas.gov.ru/approaches/new

- Applications are also accepted through State Services

Complaints are written in any form or in accordance with the electronic form indicated on the website of a specific service. You must provide your details (full name, registration address, passport series and number), the essence of the problem, date, signature. Experts recommend attaching a copy of the agreement with the microfinance organization and copies of payment documents to the complaint.

Complaint to the Federal Antimonopoly Service

Complaint to the prosecutor's office

The employees of the MFO Security Service began to threaten, blackmail you, bother you with calls in the evening and at night, put moral pressure on you and constantly look for a personal meeting? In this case, you can immediately go to the territorial body of the Prosecutor's Office and write a statement. Clearly state the essence of the problem, if possible, confirm the facts of violations with audio files, photo or video materials, and testimony of witnesses. Applications are accepted during a personal visit, through the online reception or by registered mail.

Official website of the General Prosecutor's Office of the Russian Federation: https://genproc.gov.ru/

Internet reception where you can submit an application electronically: https://ipriem.genproc.gov.ru/contacts/ipriem/

Phone number for inquiries: 8 (495) 987–56–56

Complaint to the prosecutor's office

Where else can you go for protection?

A complaint to the prosecutor's office is not the only way to protect your rights. Debtors may also use other methods:

- sending a claim or statement to the collector . You can submit a refusal to process personal data or demand the cessation of illegal actions;

- police . This body considers the case if we are talking about crimes committed by employees of the collection agency, for example, the collector threatened the debtor or his family members with violence or damaged property;

- Central Bank of the Russian Federation . It can help with direct violations in the banking sector, for example, if the organization does not have membership in an SRO.

If the complaint is sent to the prosecutor's office, when in fact the issue should be dealt with by another body, the document will be transferred according to jurisdiction.

Complaint against microfinance organizations to the FSSP

If illegal methods of debt collection are used, you can contact the Federal Bailiff Service (FSSP). Submit your complaint in person, when visiting the regional office of the FSSP, send it by registered mail or through the online reception. In your appeal, indicate the essence of the complaints against the work of the MFO, and, if possible, attach evidence. 30 days are allotted for consideration of the complaint.

Internet reception: https://fssp.gov.ru/form/

Helpline: 8 (495) 870–69–96

Call center: 8 (800) 250–39–32

View the address and telephone number of the territorial authority on the map: https://fssp.gov.ru/form/

Complaint against microfinance organizations to the FSSP

Where can I complain about a microfinance organization?

You can complain to several different authorities about the MFC or MCC where you encountered problems or violations. Complaints against them are accepted by the Central Bank, SRO, Financial Ombudsman Service, FSSP and other organizations. The choice of authority depends on the problem you are facing. For example, it is better to report violations of laws on microfinance activities to the Central Bank, and illegal collection methods to the police, prosecutor’s office and the FSSP.

Depending on the problem you are facing, you can file a complaint against the MFO with the following authorities:

- To the Central Bank. The regulator accepts complaints about most problems related to the activities of microfinance organizations. You can contact us here if the company violates operating standards

- for example, charges interest at a rate higher than 1% per day, charges hidden fees, transmits data to the BKI with errors, or changes the terms unilaterally. You can also report to the Central Bank about a company that issues loans illegally - without an entry in the state register or being excluded from it - In SRO.

Like the Central Bank, self-regulatory organizations consider complaints related to

violations of standards for the activities of microfinance companies

. You can contact them, for example, if the company inflates interest rates, changes the contract unilaterally, or transfers personal data to third parties. If such problems arise, try to contact the SRO first. Often they can be solved at this level. If the issue is beyond their competence, then the SRO specialists will tell you where it is best to address it and help pass the message to the right authority.

To find out which SRO the organization you want to complain about is a member of, look on its website or ask the office for a certificate of membership. Most of the MFCs and MCCs presented on our website are members of three organizations - MiR, Unity and Microfinance Alliance.

- To the Financial Ombudsman Service. Since January 1, 2020, the financial manager has been considering complaints against microfinance organizations. In this case, appeals should concern only claims of a property nature

- for example, an incorrectly calculated overpayment or unaccounted for payments. Fraudulent actions of the lender, harsh collection methods, violations of confidentiality and similar problems are beyond the competence of the manager. Please note that the ombudsman reviews controversial situations free of charge if the size of the claim does not exceed 500,000 rubles - To Rospotrebnadzor. You can contact us here if the company has violated the law “On the Protection of Consumer Rights”

- for example, it imposes additional services and fees, charges fines that are not stipulated by the terms, or provides incomplete information about loans. You can also complain to Rospotrebnadzor if the agreement does not provide for the prohibition of assignment of rights or does not allow legal proceedings to be held at the borrower’s place of residence - At FAS. Here you can report an organization that violates advertising and competition laws

. For example, the IFC, which in its advertising does not disclose the full cost of the loan or indicates conditions that differ from the actual ones. You can also report to this authority about an illegally operating microfinance organization, but it is advisable to simultaneously send such complaints to the Central Bank - In the FSSP. The Bailiff Service examines complaints about the actions of debt collection services

. You can contact us here if debt collectors violate restrictions on the number and time of calls, call relatives and friends despite refusing to interact, or apply psychological pressure. Also here you can appeal the unlawful actions of the bailiffs themselves - To the police and prosecutor's office.

You can turn here if you are faced with

threats and extortion from debt collectors

. Before doing this, it is advisable to find out the names and positions of those from whom you receive such messages. You can contact one of the authorities or both at once, but the prosecutor’s office works with such complaints somewhat more efficiently

You can contact any of the authorities in person at one of the branches or representative offices at your place of residence, by mail or through the online reception on the official website. Specify in advance the form of appeal and the procedure for their consideration. Prepare evidence that will confirm the existence and seriousness of the problem - copies of contracts, recordings and details of calls, responses from a microfinance organization, and others. The more information you provide about what happened, the higher the chances of a positive outcome.

If violations occur, especially minor ones, try to first send a complaint to the microfinance organization itself. Perhaps they were related to internal problems of the company - for example, technical errors. If it was not possible to resolve the issue with the IFC or MCC itself or you have not received a response to your request, you can contact higher authorities.

Recommended for you

- How some microfinance companies deceive borrowers

- Russia has developed a unique system to combat cyber fraud

- Help from the Financial Ombudsman

Yuri Muranov Editor-in-Chief of #VZO. Has been working on the site since its inception. All texts go through Yuri before being posted on the site. Quickly delves into the topics on which authors write, including finance, and monitors the quality of published materials.

(15 ratings, average: 4.8 out of 5)

Legitimate reasons for complaints against microfinance organizations

It is not always the case that the microfinance organization is wrong. Below are possible situations where violations on the part of an MFO are obvious.

- Unilateral increase in interest rate (without notifying the borrower).

- Refusal to repay the loan early.

- Incompetence of MFO employees.

- Refusal of the microfinance organization to issue a certificate of full fulfillment of debt obligations by the borrower.

- Refusal to reimburse commissions and insurance.

- Non-compliance with bank secrecy, disclosure of personal data.

- Connecting additional paid services without notifying the client.

Separately, I would like to say about calls and threats from collection agencies. Any bank and microfinance organization has the legal right to transfer debt to third parties. This is stated in the Civil Code and mentioned in the loan agreement. However, with the entry into force of Law No. 230 “On the protection of the legitimate interests of individuals when carrying out activities to repay overdue debts,” the activities of such organizations are clearly regulated. If you start receiving night calls, threatening calls, or you don’t like the persistence with which the debt collection organization’s employees act, contact the police. In this case, the law is completely on your side.

Let's sum it up

The actions of debt collectors are not always legal. In some cases, collectors cross the line by threatening debtors with violence, making calls at any time of the day or night, forging papers or signatures, and exerting psychological pressure. Any illegal actions must be punishable, therefore, if such situations arise, it is recommended to contact the prosecutor’s office or another authority, depending on the situation.

Read: How to challenge a court decision on a loan

When not to complain about a microfinance organization

You shouldn’t always immediately run to complain about the company - it may turn out that it is the client who is wrong in the current situation. There is a high probability that a misunderstanding has arisen and it is much easier to resolve the problem directly with the MFO peacefully.

There is no point in filing complaints with higher authorities if the microfinance organization has not violated anything. Keep in mind that it will take approximately 1 month to wait for a response to your complaint. As a result, the issue will not be resolved in your favor, and the amount of the penalty will only increase.

We also do not recommend immediately writing appeals to the prosecutor’s office or the Central Bank of the Russian Federation. A full inspection of a microfinance organization clearly will not contribute to a peaceful solution to the problem, if you were counting on it.

Below you can familiarize yourself with reliable microfinance organizations that have certificates from the Central Bank of the Russian Federation, and choose the most favorable loan offer for you.

In this article, I have grouped frequently asked questions related to loans from citizens in microcredit organizations (MFOs). By the way, during the pandemic, most of the questions that came to the “Public Reception” of “Chance” were about this. Most likely, the isolation period forced both sides of borrowed obligations to become more active.

MICRO-CREDIT ORGANIZATIONS HAVE A NEW “CHIK” – INSURING BORROWERS. WHAT IS THIS AND HOW TO OPT OUT?

An analysis of documents received by borrowers from some microfinance organizations shows that there is no trace of any insurance. There is only one line in the loan agreement stating that the insurance is 1000 rubles. Neither the name of the insurance company, nor the insured events, nor the insurance rules are specified in the contract. The borrower is not issued an insurance policy either. Consequently, all this insurance is nothing more than a fiction and an extra thousand rubles on which interest will be charged.

Therefore, as soon as a line about insurance appears in your contract, refuse it. But remember that you can cancel only within 14 calendar days from the date of receiving the loan. During this period, write a written application to the microfinance organization and to the insurance company (if it is specified in the contract) and inform about your refusal of insurance. Send the application by registered mail to the legal addresses of the companies, keep the postal receipt as proof that you refused insurance within the time limits established by law.

If you refuse, go to court. In this case, the court will recover not only insurance, but also moral damages and a penalty in the amount of 3% per day of the amount of unreturned insurance, interest for the use of someone else’s money, as well as the amount of a fine.

CAN A MFO INCREASE THE INTEREST RATE ON A LOAN WHEN CANCELLING INSURANCE?

Banks have this right, MFOs do not have such a right. After all, the legislator has banned issuing loans at more than 1% per day starting from 2021. Therefore, if your loan agreement specifies 1% per day, then there is nowhere to increase it. Otherwise it will be a violation of the law.

WHAT TO DO IF THERE ARE DELAYS ON THE LOANS AND THERE IS NOTHING TO PAY?

If you can't pay, don't pay. After all, in such a situation, the main thing for you is housing and communal services and food. The others will wait. It is clear that calls will begin, but there is no need to react and be afraid. MFOs do not have any powers to block accounts, withdraw part of pensions, salaries or seize property. The only thing they can do is go to court. And let the court decide how much you owe them. And you owe them 1.5 times the loan amount - and no more. Moreover, regardless of the period of delay.

Remember that if you are late (whether you paid one payment or not at all), the “1.5X rule” will always apply. This means that the MFO is obliged to stop charging interest on the loan, fines and penalties after your debt reaches 1.5 times the loan amount. That is, if your loan was 5,000 rubles and you did not pay it, then you can only recover 5,000 (the body of the loan) + interest and 1.5 times the interest on the loan (2,500 rubles).

SO IT IS MORE PROFITABLE NOT TO PAY?

This is true, but if you are not bothered by a damaged credit history.

The main thing in case of delay is not to enter into new contracts and do not give in to persuasion that you need to pay off at least the interest on the overdue contract, and the loan will be extended for another 15 days. Remember that in this case you are entering into a new agreement at “draconian” interest rates, without receiving any money.

I WAS DECLINED BANKRUPTCY, BUT THE MFO SAID TO COURT AND AGAIN COLLECTED THE WRITTEN OFF DEBT. WHAT SHOULD I DO SINCE THE COURT HAS WRITTEN ALL MY DEBT AWAY?

There are particularly zealous creditors who, even after writing off all debts, again file a claim in court and collect it. This happens most often due to the creditor’s dishonesty, his carelessness or simple ignorance that his debtor has gone bankrupt. This is also the fault of the borrower himself. He either does not receive correspondence and learns that the creditor has collected from him the debt written off by the court only from the bailiffs, or he does not appear in court at all, hoping for chance.

Meanwhile, as a general rule, after completion of bankruptcy, all debts are written off from a citizen, even those that were not declared in bankruptcy. All creditors are obliged to write off the debt and not bother the debtor anymore.

But if this happens, then don’t hesitate and start acting.

❶. Upon receipt of a subpoena, send to the court a petition to terminate the proceedings on the statement of claim, attaching to it a judicial act of the arbitration court, which completed the bankruptcy procedure and wrote off all your debts. The court is obliged to terminate the proceedings.

You can not write such a petition, but file a counterclaim demanding that the creditor be obliged to write off the debt in full. Again, a copy of the judicial act of the arbitration court must be attached to the application. The court will grant your claim and oblige the creditor to write off your debt.

❷. If enforcement proceedings have already been initiated against you, you should try to cancel the court order and at the same time submit a request to the bailiffs to terminate the initiated enforcement proceedings. Deliver such a request in person or send it by registered mail with notification.

MFOs REFUSE TO ISSUE LOAN DOCUMENTS, INCLUDING PAYMENT RECEIPT, WHICH I HAVE LOST. WHAT TO DO?

By law, MFOs are required to provide complete and accurate information on the loan. This includes a loan agreement, an account statement of all payments made by the borrower, certificates of debt, and other documents at the borrower’s request.

However, be prepared for the fact that unscrupulous microfinance organizations, which have a lot of irregularities in their calculations, will most likely refuse to provide documents, citing ridiculous reasons and excuses.

Request the documents and account statements you need in writing. Send your request by mail, registered mail with notification. In this case, the MFO will be obliged to respond to your request and provide all documents. Otherwise, she will face a fine and administrative liability, as well as compensation for moral damage and other legal expenses.

WHERE TO COMPLAIN ABOUT MFIS?

❶. Financial Ombudsman.

I have already written about it (you can find the article on our website in the “Let’s Understand” section). This is a kind of peacemaker who will help resolve the conflict and give recommendations to the borrower on further actions. The complaint can be sent by email – This email address is being protected from spambots. You must have JavaScript enabled to view it.

or at the address: Moscow, Skatertny lane, 20, building 1.

❷. Central Bank.

This subject is most dangerous for unscrupulous MFOs. After all, an inspection may be initiated based on your complaint. A complaint can be submitted directly on the Central Bank website: https://www.cbr.ru or sent by registered mail (107016, Moscow, Neglinnaya st., 12).

❸. Rospotrebnadzor.

This body, as a rule, considers violations related to the terms of the loan agreement, with refusal to provide documents, certificates, and extracts. That is, issues of violation of consumer rights.

Residents of Khakassia can send complaints to the Rospotrebnadzor office for the Republic of Khakassia at the address: Abakan, st. Marshala Zhukova, 5A.

Remember, these are not the only leverage you have against negligent creditors. You can also write statements to the prosecutor's office or police and go to court. But still, first I advise you to send a complaint to the microfinance organization, perhaps they will come to their senses and solve your problem without further checks and litigation.

Dear residents of Khakassia and the Krasnoyarsk Territory, if you have problems with microfinance organizations, please contact the “Public reception of the weekly magazine “Chance”. We are waiting for you at the address: Abakan, st. Khakasskaya, 27. Come or call: 8-902-996-88-91 (Tatyana Cherednichenko). All consultations are free.