What is the Central Bank of Russia and what functions does it perform?

So, the Central Bank of the Russian Federation (Bank of Russia, Central Bank, Central Bank of the Russian Federation) is the main regulatory body of the country’s credit system. Simply put, this is the main Russian bank, which is responsible for the security and stability of the ruble in relation to other currencies of the world, the development and strengthening of the banking system, supervision of the activities of other banks, issuance and revocation of licenses.

Let us note the specific differences and features of this organization:

The Central Bank of Russia is a legal entity, but its goal is not to make a profit;

The Bank of Russia is accountable to the State Duma of the Russian Federation;

In carrying out its functions, the Central Bank is obliged to develop and implement policies to prevent, identify and manage conflicts of interest;

The Chairman of the Bank bears full responsibility for the activities of the Bank of Russia (since June 24, 2013, this position has been held by Elvira Sakhipzadovna Nabiullina);

The regulatory, control and supervisory functions of the Bank of Russia in the field of financial markets are carried out through a permanent body - the Financial Supervision Committee;

The Central Bank has the right to file claims in the courts in the manner prescribed by the legislation of the Russian Federation;

At the same time, regulatory acts of the Central Bank of the Russian Federation can be appealed to the court in the manner established for challenging regulatory legal acts of federal government bodies.

Case practice

The Central Bank often holds commercial banks accountable for violating anti-money laundering requirements. This is precisely what is associated with the facts of reinsurance of financial institutions and suspension of transactions with money, requirements from clients to confirm the legal method of receiving funds.

Banks that are subject to sanctions are filing lawsuits against the Central Bank . Thus, the Arbitration Court of the Primorsky Territory considered the application of a credit organization that was subject to a fine. The reason is that when registering a transaction, the passport data of individuals was indicated, and not the name of the legal entity that took part in the transaction.

According to employees of the territorial division of the Central Bank of Russia, such actions are a violation of the legislation on combating money laundering and the financing of terrorism. The unlawful acts committed are recorded in a protocol on administrative violation.

The management of the credit institution considered the resolution and presentation illegal and appealed to the arbitration court demanding their cancellation. During the meeting, the fact of entering false data about the persons who made the transaction was confirmed.

Therefore, the conclusion drawn and the punishment in accordance with the specified legislation, as well as the regulations of the Central Bank, were considered fair. The claims were rejected, appeal and cassation left the decision of the first instance unchanged.

In what cases can you file a complaint with the Central Bank?

Today, the subject of a complaint to the Central Bank of the Russian Federation can be almost any violation on the part of your bank. For example:

- Bank card blocking;

- Account blocking;

- High commission when withdrawing funds from an ATM;

- High interest rate on the loan;

- High fines, commissions and penalties on the loan;

- Adding an individual's phone number to the auto-dial database;

- Imposing additional services when concluding a loan agreement;

- Violation of deadlines for issuing a bank card;

- Violation of deadlines for transferring funds;

- Failure to deposit/withdraw funds through an ATM;

- Non-crediting/debiting of funds through the payment terminal;

- Incorrect information in the credit bureau;

- Wrongful issuance of a loan (for example, if a loan was issued using a stolen passport or an incapacitated citizen);

- Illegal actions of collectors;

- Refusal to return deposit/interest;

- Refusal to conclude a bank account/deposit agreement;

- Refusal to open/close an account;

- Refusal to perform an operation;

- Refusal to issue loan documents;

- Refusal to restructure and refinance loans;

- Problems with the operation of Internet banking;

- Problems related to quality of service;

- Disclosure of personal data;

- Write-off of funds without the client’s consent in order to repay a loan, etc.

Who can I complain to the Central Bank of the Russian Federation?

According to Article 4 of the Federal Law “On the Central Bank of the Russian Federation”, the Central Bank exercises supervision over the following financial organizations:

- Credit organizations and banking groups.

- Insurance organizations.

- Microfinance organizations.

- Pawnshops.

- Housing savings cooperatives.

- Credit consumer cooperatives.

- Agricultural credit consumer cooperatives.

For an insurance company

Attention. The regulatory and supervisory function over the activities of insurance companies is carried out by the Insurance Market Department, a special division of the Central Bank.

Since there are many situations in which the policyholder can write a complaint against the activities of the insurer, the Central Bank has identified the main ones:

- The insurance company refuses or evades concluding a contract on the basis of Federal Law 40 “On Compulsory Insurance”.

- An insured who wants to obtain a compulsory motor liability insurance policy is forced to impose unnecessary additional services.

- The insurer refuses to pay the insured amount or pays an underestimated amount.

- Failure of the insurance company to comply with deadlines for considering applications from the policyholder and paying insurance amounts.

- Refusal of the insurer to accept applications from the policyholder for compensation of losses and to issue a document in the event of an insured event.

- Carrying out low-quality repairs, charging inflated insurance premiums for CASCO insurance.

- Violations when issuing an electronic MTPL policy.

- Incorrect calculation of the discount that is awarded for accident-free driving.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-14-90

On bank actions

In case of non-compliance with Russian legislation and violation of the rights of clients by a banking organization, the Central Bank is authorized to resolve controversial issues in the following situations:

- Violation of banking secrecy by a credit organization (disclosure of client data, loan amount, payment schedule).

- Incompetence of bank employees.

- Imposition of paid services.

- Financial transactions with customer accounts without their knowledge.

- Refusal to comply with the client's legal requirements.

- Illegal increase in interest rate on a loan.

- Changing the terms of the contract unilaterally.

- Incorrect use of the client's credit history by the bank.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-14-90

How to write a complaint to the Bank of Russia? Legal advice

When preparing a written complaint to the Central Bank of the Russian Federation, do not forget to adhere to the basic rules of business correspondence:

Firstly, the complaint must be written in an official business style. Try to ensure that your appeal to the main bank of the Russian Federation is written as correctly as possible and not too emotional. The presence of insults, threats and obscene language may become grounds for refusal to consider the complaint.

Secondly , the complaint must be concise. Excessive verbosity will distract attention from the essence of your message;

Thirdly , the complaint must be signed by the applicant. The Central Bank (like almost any other institution) does not respond to anonymous letters.

We recommend that you include the following information in your complaint:

- Last name, first name and patronymic of the applicant (if the applicant is an individual);

- Name, INN and OGRN (if the applicant is a legal entity);

- Contact phone number;

- Postal address or email address;

- Method of submitting a response (by email/e-mail and postal address/response is not required);

- The organization with which your application is related;

- Description of the situation that became the reason for filing a complaint with the Bank of Russia;

- Applicant's requirements/proposals;

- List of documents attached to the complaint (if necessary);

- Date the complaint was filed.

complaints to the Central Bank of the Russian Federation (on behalf of an individual)

complaints to the Central Bank of the Russian Federation (on behalf of a legal entity)

Note! If you have questions or encounter any difficulties when preparing a complaint to the Central Bank, you can always seek free legal advice from the specialists of the CenterSoveta portal. The average waiting time for a response from a lawyer is 15 minutes.

Central Bank complaint against insurance company

Filling out a complaint and submitting it to any government agency is clearly a necessary measure. Russians often try to resolve a dispute with the insurance company on their own, but this does not always work out. In order to quickly and efficiently achieve what they want and defend their rights, citizens file a complaint against the insurance company with the Central Bank, FSSN, RSA and the court.

There are frequent cases of citizens turning to banking organizations for the return of funds transferred by mistake to other persons. It is possible to return the money if the recipient voluntarily returns it to the account, or you will have to go to court and file a civil lawsuit for unjust enrichment and recovery of incorrectly transferred money. We will tell you whether bank employees have the authority to collect funds from the cards and accounts of erroneously gifted citizens, and we will determine what to do in the event of an irreparable transfer. Also in this article we will look at what the reality is - how the courts react to claims for the return of funds.

Procedure for filing a complaint with the Central Bank of Russia

The public reception of the Bank of Russia is located at the address: Moscow, Sandunovsky per., 3, building 1.

- Opening hours of the public reception of the Central Bank of the Russian Federation: Mon-Thu from 10:00 to 16:00, lunch from 12:30 to 13:30

- You can make an appointment for a personal appointment by calling:

Postal address for written requests: 107016, Moscow, st. Neglinnaya, 12, Bank of Russia.

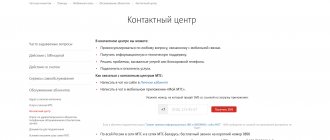

Note! If you want to leave an oral request, we recommend contacting the Contact Center of the Bank of Russia by phone (24 hours a day, free for calls from Russian regions) or (24 hours a day, the call is paid in accordance with the tariffs of your operator).

How to submit a complaint to the Central Bank via the Internet? Step-by-step instruction

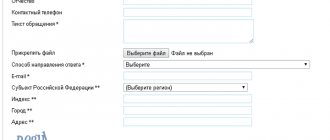

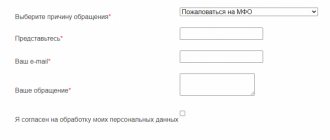

Another way to contact the Central Bank is to file a complaint using the online reception on the official website of the Central Bank of the Russian Federation. To do this, you will need to fill out a simple application form:

Step one: select the topic of the complaint (for example: Imposition of additional services when concluding a contract);

Step two: indicate the name of the organization with which your appeal is related;

Step three: fill out the “text of complaint” field;

Step four: fill out information about yourself;

Step five: indicate the desired method of receiving a response.

Ready! The complaint has been sent to the Central Bank. If your appeal falls within the competence of the Central Bank of the Russian Federation, then it will certainly be considered along with other written appeals.

Unlawful actions of financial organizations

Most often, clients encounter such violations:

- Suspension of payment;

- Introduction of a commission unilaterally under a deposit agreement, unlawful withholding of it;

- Change in interest rate under a loan agreement, etc.;

- Introducing a ban or deliberately restricting clients’ right to repay their debt early;

- Transfer of data to third parties without the consent and notification of debtors, depositors, etc.;

- Other violations of current legislation, including antitrust, consumer protection, etc.

For example, in 2010, institutions such as Uniastrum Bank, SKB Bank and Investtorgbank prevented clients from replenishing deposits at interest rates in accordance with previously concluded agreements. These financial structures made a marketing move by signing agreements with investors at the most favorable interest rates for them, and then unilaterally changed the conditions. Their actions were recognized as illegal and a manifestation of unfair competition.

Another case is allowing clients to replenish a time deposit for free when concluding an agreement with Transportny Bank, and then deducting a 5% commission . Similar violations were observed in other financial institutions, including the nationally known bank Tinkoff. In these cases, it was possible to eliminate the violations pre-trial, saving clients from lengthy and expensive legal proceedings.

The most pressing issue has become the suspension of financial transactions with signs of legalization of illegally obtained money. Based on the regulation of the Central Bank No. 375-P of 2012, banks are required to take measures to identify dubious transactions in the activities of clients. The result is that during the period from January to October 2021, 480 thousand transfers were suspended for a total amount of about 200 billion rubles.

Reasons for this situation:

- Formal approach of bank employees when checking monetary transactions;

- Making a decision based on one or two signs;

- Ignoring the provisions of civil legislation prohibiting such actions (clause 3 of Article 845 of the Civil Code).

As a result, the courts satisfy the claims in three out of five cases. This means that it is possible and necessary to defend violated rights before banks, thereby preventing their further illegal actions. And the process needs to begin with a pre-trial settlement of the conflict, including an appeal to the Central Bank.

General information about where to complain about a bank is described in a special material. Recommended reading.