Home / Protection

Back

Published: 10/26/2019

0

4

- 1 How to write 1.1 Sample

- 5.1 Sample

Where to send a complaint

In fact, the list of authorities to which a complaint can be filed against the actions of debt collectors is quite large. The Internet claims that the list includes the Bailiff Service, the National Association of Professional Collection Agencies and the Central Bank.

Of course, you can write anywhere, but it is desirable that writing a complaint gives the desired result. Therefore, we will give a short overview of the recommendations regarding the addressees of the complaint, dividing them according to the criterion of expediency.

- Central Bank. In fact, the powers of the Central Bank extend to the activities of banks and microfinance organizations. Therefore, it is advisable to write a complaint to the Central Bank either against the bank that sold the debt, or against the actions of a bank employee in collecting the debt.

- NAPKA. The National Association of Professional Collection Agencies is a non-profit professional organization. You can file a complaint against debt collectors directly on the association’s website.

- FSSP. The bailiff service and collection agencies are connected by the fact that the FSSP maintains a state register of legal entities that collect problem debts, and also has the right to control their activities.

- Police. The principle “Call the police in any unclear situation” also applies in this case. A complaint to the police about the actions of a collector can be very effective, since the collector’s activities themselves can be separated from criminal activities by a very thin line, upon crossing which the collector turns from a respectable office employee into a criminal.

- Prosecutor's office. In general, you can contact the prosecutor’s office for any reason, including a complaint against debt collectors. In this case, we can talk, as in the case of the police, about a fine line between collection and criminal activities. In any case, a response to the complaint will be received, and a conversation will be held with the head of the collection agency.

- Rospotrebnadzor. This organization has the right to consider complaints against debt collectors and, if necessary, initiate administrative proceedings.

- Roskomnadzor. The powers of this body extend to the area of personal data protection. If the collectors disclosed information constituting the personal secret of the debtor, then a complaint to Roskomnadzor will be effective.

- Other government bodies. There are recommendations on the Internet for sending complaints to ombudsmen, deputies, the Government of the Russian Federation, etc. Let's say right away that this will be a waste of time. The complaint, of course, will be accepted, but will not be considered, since it will be immediately forwarded either to the prosecutor’s office, or to the police, or to Roskomnadzor.

What actions of debt collectors are considered illegal?

The concept of illegality stems from the rule that guides lawyers when interpreting the legality of a particular offense: it is permissible to do everything that is not prohibited by law. Following this rule, it is not difficult to establish which actions of collectors are lawful, and which a borrower whose rights have been infringed can safely complain to regulatory authorities. This can be determined by clause 1 of Art. 4 of Law No. 230-FZ, which lists the rights of collectors. There are few of them:

- make calls;

- meet with the debtor in person;

- send SMS or voice notifications;

- send postal correspondence.

As I wrote above, the activities of collectors are regulated by the law on collectors. Accordingly, after you become familiar with the basic provisions of the law, you will be able to determine whether debt collectors are breaking the law or not. If they violate, you need to collect evidence. Such evidence can be any facts and factual circumstances.

A statement to the police can warn debt collectors against possible violations of the law.

However, I have heard that debt collectors often threaten to report the debtor to the police. I believe that in this case the debtor has nothing to fear, unless, of course, the debtor commits some kind of crime. Therefore, as a rule, statements from debt collectors that they are going to contact the police are simple threats.

I advise you to read the article on how to get rid of debt collectors? Perhaps you will learn something important for yourself.

If collectors act completely illegally, make threats, etc., then it is definitely necessary to contact the police.

If the collectors continue to act lawlessly, you can contact the bailiff service. The fact is that the bailiff service maintains a unified state register of collectors, and also exercises control and supervision over the activities of bailiffs. Therefore, a complaint to the bailiffs can be quite effective.

Complaints to the FSSP may serve as a reason for conducting an unscheduled inspection of the activities of a collection agency. It is desirable that the complaint be justified and contain an indication of a violation of the law on the part of the collection company.

https://www.youtube.com/watch?v=8oYpvn1WCRc

The prosecutor's office is a “universal” government body that exercises control and supervision over the implementation of laws not only by state and municipal authorities, but also by commercial structures. Therefore, I believe that a complaint to the prosecutor's office would be quite appropriate.

The prosecutor may issue a motion to eliminate violations of the law. This is a very effective prosecutorial response mechanism.

I believe that these government bodies can limit the list of addressees of complaints and applications. Of course, a wide variety of situations may arise that will require a completely unusual solution. So, for example, if a debt collector damages your property, you may be able to seek appropriate civil compensation. But that will be a completely different story.

Methods for filing a complaint and deadlines for consideration

Complaints against debt collectors can be filed using any of the existing filing methods, provided that the addressee accepts this filing method. Thus, a complaint can be filed:

- personally;

- by post with return receipt requested;

- online, if the recipient’s website provides such an opportunity.

The time frame for consideration of a complaint will vary depending on the authority to which it is filed and the circumstances of the case.

Thus, if a complaint is sent to the police or prosecutor’s office and the collector’s actions can be qualified as a criminal offense, the investigative body is obliged to make a decision on the complaint within 10 days and either initiate a criminal case or refuse to initiate it.

NAPCA responds to complaints within 7 days.

In other instances, the period for consideration of complaints is close to the standard, equal to one month. A response will be received much faster if the complaint is forwarded by the addressee to another competent authority.

What actions are considered legal and what are not?

How to file a complaint against an appeal ruling?

Where to complain about Rosreestr?

How to complain about Tricolor TV?

How to write a complaint against a kindergarten teacher

Where can I complain about the work of the MFC?

How to file a complaint to the prosecutor's office about the inaction of bailiffs

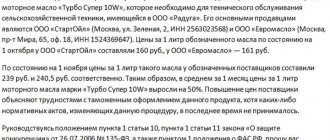

Collection activities can be differentiated by the degree of pressure exerted in the debt collection process. So, it differs:

- Soft impact (calls, mobile messages, letters). At this stage, collectors do not come into direct contact with debtors, but apply light pressure from afar.

Info

According to the Law “On Collection Activities”, collectors do not have the right to disturb the debtor more than twice a week. In this case, calls must be received strictly within the following time period: from 08:00 in the morning and 22:00 in the evening on weekdays and from 09:00 to 20:00 on weekends.

- Exposure of moderate severity (personal visit to home/work);

In accordance with the Law, a personal visit to the debtor should occur no more than once a week.

- Harsh influence (causing harm to health by beating, rape, etc.);

This measure of influence on the debtor is considered illegal and must be prosecuted by law.

- Judicial (filing a claim against the debtor in court);

In this case, the debtor will have to not only repay the debt, but also pay for the services of a lawyer who will provide competent legal support during the legal proceedings.

Drawing up a complaint

Expert opinion

Popov Yuri Ivanovich

Practicing lawyer with 6 years of experience. Specialization: family law. Knows everything about the law.

As part of this article, we have developed and made available for download a standard sample complaint against debt collectors. In the lines provided for completion you will need to enter:

- personal data of the applicant;

- information about the collector and collection agency;

- information about the powers of the collection agency on the basis of an assignment agreement or an agency agreement;

- information about the collector’s illegal actions, indicating the date and accompanying circumstances;

- list of attached documents. The attachment may include letters from the collector, notes, explanations of witnesses, video and audio recordings, photographs, etc.;

- date of filing the complaint and signature of the applicant.

Fill out the form to contact anti-collectors to deal with debt collectors easily and naturally. Competent lawyers will take care of the entire process of interaction with debt collectors and prepare the necessary complaints about their threats and illegal methods of work.

Determining whether collectors have the right to demand something from you is accompanied by many variations. It’s one thing if the debt is not yours and you are bothered by an answering machine or regular demands to fulfill obligations in your mailbox (the issue can be resolved simply by informing and confirming that you have no relationship with the debtor).

The situation is completely different if collectors get personal and threaten you and your family, pestering you with calls and visits for extortion. In each case, there is a different way to stop claims and the fastest way to get rid of problems with debt collectors is to complain about them.

How to write a complaint

Writing a complaint requires compliance with some of the requirements for writing official correspondence. Both handwritten and typed complaints are accepted. It is important that its contents make it clear:

- to whom is it addressed;

- who is the complainant;

- where he lives and how to contact him;

- who is the defendant in the complaint;

- where is;

- what are the facts of the offense on the part of the collectors (from the applicant’s point of view);

- what the applicant is asking for;

- confirmation of the identity of the complainant - personal signature;

- indication of the date the complaint was written.

Some information may be unknown to the applicant. For example, the last name or first name of the agency head, the last name or first name of the collector who committed the violation, their contact information (telephone numbers). This is not difficult to establish, so they can be ignored in the complaint.

Care should be taken to describe the nature of the violation. The description will allow you to qualify its severity. Each statement addressed to agency employees should be supported by evidence:

- references to witnesses;

- recordings of conversations on a voice recorder;

- video recordings;

- printouts of phone calls or SMS received from a telecom operator;

- a description of the damage that must be confirmed by appraisers or recorded by police officers;

- if physical harm to health is caused, attach the results of an examination by a doctor (bruises, abrasions, etc.).

To whom and where should I complain about debt collectors?

The debtor has the right to choose the following authorities as the addressee of the complaint:

- Central Bank of the Russian Federation;

- Rospotrebnadzor;

- prosecutor's office;

- police;

- NAPCA and other professional unions of collectors.

You can submit your application to them simultaneously or separately. The prosecutor's office protects the legality and interests of borrowers, Rospotrebnadzor takes care of the observance of consumer rights, the Central Bank monitors compliance with banking legislation and the correctness of the transfer of obligations by credit institutions to third-party firms, law enforcement agencies fight against those debt collectors who have broken the law, and professional associations monitor compliance with collection ethics activities.

Goals and priorities of NAPCA

In order to effectively return all kinds of debts to the country’s economy, a certain apparatus is needed that would regulate all these processes, and also comply with aesthetic norms of expression. This is considered the main and strategic goal of NAPCA - the formation of a new, more transparent market for debt collection services with the help of borrowers, which could ensure effective debt collection. Of course, after creation there must be professional development in this area.

Other equally important goals of NAPCA:

- approval of an inflated level of standard quality for the services they provide;

- creation of an information platform and its promotion for more favorable conditions in the development of the collection business; — support for special legislative initiatives.

NAPCA is trying in every possible way to promote the infrastructural development of the collection services business in Russia - this is considered the main task of the Association. In addition, NAPCA actively interacts with government authorities.

Such cooperation will make it possible to create new bills or improve existing ones in the field of debt repayment. There is also active monitoring of all members of the Association to ensure that each of them complies with all the necessary standards of business ethics.

You can look at the tasks of NAPKA in more detail:

- Improving the regulatory framework . Public authorities are informed about all current issues in this area. Special additional regulations are being created that would affect the interests of NAPCO member agencies. New professional standards are also being developed.

- Popularization of standards . Consumer rights are being protected in the financial services sector. Special events are being carried out, the purpose of which is to increase certain financial literacy of the ordinary population. In addition, special materials are being created that could teach this.

- Support for economic and legal aspects of the activities of NAPCA member agencies . A more comfortable environment for running a collection business is being created, and for this, the Association is interacting with the authorities. In addition, work is being carried out to improve modern technologies in the specific area of collection.

What to write in a complaint to Rospotrebnadzor, the Central Bank or NAPCA?

A complaint can be sent to the Central Bank regarding the actions of a credit institution. If the bank transferred information about the client related to personal data and bank secrecy to third parties (collectors) without the consent of the borrower himself, then this must be contested.

First, you need to prepare an application to the relevant bank with a request to partially withdraw your personal data, after which the creditor can contact the client only by mail, sending letters to the permanent registration address - no calls from collectors to your home, work, or relatives. The application to the Central Bank of the Russian Federation will contain a requirement to send an order to “your” bank so that the bank secrecy law is not violated and your personal data is withdrawn by the creditor.

You can also complain to Roskomnadzor, which exercises control in the field of personal data protection.

You can send a complaint to Rospotrebnadzor about violation of consumer rights and the claims can relate to everything - incorrect procedure for assigning rights of claim, lack of notification about the change of creditor to collector, disclosure of personal data, etc. Such applications are accepted online – on the department’s website, but be sure to indicate your contact information.

There is no obvious violation of the law, but the actions of the “debt collectors” are intrusive? You can complain about a violation of professional ethics to the Association of Collectors (NAPKA). Complaints are accepted on the official website of the organization when specifying a specific collection agency.

Association of Collectors NAPKA: why it was created and list of participants

Reading time: 4 minutes Many of our compatriots know that you can complain about an unscrupulous collection agency to the NAPKA collectors association. Today we will talk about what this organization is and how it can help in the fight against collection arbitrariness.

Why NAPCA was created and how it can help in the fight against debt collectors

NAPKA - what is it?

History and Leadership: What You Need to Know

NAPCA is an acronym for the National Association of Professional Collection Agencies. This institution is neither a commercial nor a government organization.

Important: NAPKA was founded by the leaders of the Russian collection market in 2007.

In terms of the collection industry, the National Association of Professional Collection Agencies is the largest professional association in our country. Currently there are 44 participants focused on improving the debt collection market in the Russian Federation.

Among the participants there are not only Russian, but also international companies operating in Russian, European and partly Asian territory.

The main goal of NAPCA is the formation of a transparent market for debt collection services.

In addition, the Association declares the following goals of the organization:

- approval of high quality standards;

- creation of an information platform;

- support for legislative initiatives.

NAPCA considers the main task to be promoting the infrastructural development of the collection business. The organization exercises strict control over all members of the Association in terms of compliance with the necessary standards of business ethics.

NAPCA’s tasks also include:

- improvement of the regulatory framework;

- creation of additional regulatory legal acts in relation to NAPCA members;

- development of professional standards;

- popularization of standards;

- consumer protection in the financial services sector;

- increasing financial literacy of citizens.

Boris Voronin - director of NAPKA

Since January 1, 2015, the director of the National Association of Professional Collection Agencies is Boris Borisovich Voronin.

From 2001 to 2005, Voronin worked at the Ministry of Economic Development of the Russian Federation, where he took an active part in the development of the Federal Law “On Credit Histories” and was the executive secretary of the working group for the preparation of the law. From 2005 to 2011, he held the position of head of the Central Catalog of Credit Histories, and from 2011 to 2015, he was deputy head of the Central Committee for Credit Histories.

Council members

Among the members of the NAPCA Council are such personalities as:

- Bogomolov Maxim Vladimirovich - General Director of the Judicial Collection Agency;

- Dmitrakov Anton Aleksandrovich - General Director of EOS in Russia;

- Teplitsky Dmitry Vladimirovich - General Director of "Active Business Collection";

- Shpeter Sergey Eduardovich - General Director of the Agency for Legal Recovery and Support;

- Art Yan Aleksandrovich - President of Information, Vice-President of the Association of Regional Banks of Russia;

- Mekhdiev Elman is executive vice president of the Association of Russian Banks.

Which collection agencies are included in NAPCA?

Today, the members of the National Association of Professional Collection Agencies include only 44 collection agencies, while in our country there are about a thousand organizations for the collection of overdue payments.

Full list of participants:

- National Collection Service

- Collection agency "Sequoyah Credit Consolidation"

- JSC "Financial Agency for Collection of Payments" (FASP)

- LLC "Bank Refund Agency"

- "Filbert Collection Agency"

- LLC "Agency Credit Finance" (AKF)

- LLC "ASD"

- LLC "Judicial Recovery Agency"

- FINANCIAL AND LEGAL SECURITY AGENCY

- LLC "Agency of Legal Recovery and Support"

- LLC "ActiveBusiness Collection"

- Collection agency "ACCEPT"

- LLC "Debt Recovery Bureau"

- LLC "Debt Agency "Center for Credit Security" (LLC "DA-TsKB")

- LLC "Debt Agency "Delta M"

- LLC "DG Finance Rus" (DG Finance Rus)

- LLC Debt Center MKB

- LLC "Collection Agency "Ilma"

- Inter-Prime LLC

- LLC "Capital Nadzor"

- KIT Finance Capital LLC

- LLC "Clover"

- LLC "Credit Inkaso Rus"

- LLC "Creditexpress Finance"

- LLC "L-COLLECTION"

- LLC "M.B.A. Finance"

- LLC "GC Financial Services"

- First Collection Bureau

- Primokollekt LLC

- LLC "Collection Service "Redut"

- LLC "ROS Debt Agency"

- LLC "Credit Security Bureau "RUSSKOLLECTOR"

- Sentinel LLC

- LLC "Stolichnoe AVD"

- LLC "Trust"

- Finkollekt LLC

- LLC "USB Center"

- Collection Agency "FORTIS"

- LLC "CZ Invest"

- Federal Collection Agency "Everest"

- LLC "EOS"

- LLC "ETAP"

- LLC "YurBusiness-M"

- DDM Group AG

All members of the Association have certain norms and standards. Data for each organization is displayed on the official NAPCA portal, indicating the necessary information about each agency, such as:

- actual and legal address;

- Contact details;

- link to the official portal;

- full name of the company.

In order to familiarize yourself with the current list of Association participants, you must follow the link https://www.napca.ru/ob-assotsiatsii/uchastniki/.

Where and how to file a complaint against debt collectors?

If a collection agency that is a member of NAPCA puts all possible pressure on the debtor, uses obscene language in communication, makes threats or violates human rights in other ways, then an official complaint can be filed against the organization with the National Association of Professional Collection Agencies

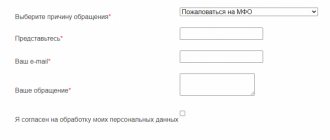

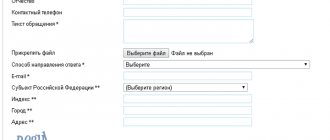

The complaint is accepted through a special submission form on the company’s official website.

To file a complaint against a member of the Association, you must follow the link https://www.napca.ru/napravit-zhalobu/ and fill out the complaint form, carefully entering the information in the fields marked with an asterisk.

The functionality of the site allows you to attach an audio or video file to your appeal that proves an offense on the part of the agency.

Consideration of the application takes 5-7 business days, after which the Association makes a decision on further actions.

Is there any point in filing a complaint with the Association of Collection Agencies?

The National Association of Professional Collection Agencies will not be able to provide assistance in the fight against a collection organization that is not a member of the Association. But NAPCA exercises strict control over participating companies and closely monitors compliance with all established norms and rules.

Official site

The official website of the Association is located at www.napca.ru.

On this portal, the user can get acquainted with complete information about the company’s activities, as well as the latest updates and changes. The “Questions and Answers” category allows you to get answers to the most frequently asked questions from users.

Information about upcoming events is published in a specialized event section.

Hotline phone number and address in Moscow

To receive a free consultation, you need to call the number.

A separate telephone line has been allocated for the media: +7 (903) 593-61-11.

The office of the non-profit organization “National Association of Professional Collection Agencies” is located at the address: Moscow, Kotelnicheskaya embankment, building 17.

Important:

Citizens are received on Thursdays from 11:00 to 17:00 by appointment by email [email protected]

Reviews: does it make sense to contact NAPKA

Most of the reviews about filing a complaint against a collection agency with NAPCA indicate that the Association either sends some kind of formal response in response, or does not send an official response at all. Most likely, the problem is that NAPCA can provide assistance in the fight against the dishonesty of collection agencies that are members of the Association. Today there are only forty-four such companies, and there are many more active collection agencies. Therefore, out of ignorance, people send complaints to all companies involved in collection activities.

As practice shows, filing a complaint against debt collectors with NAPCA is most productive only if you simultaneously contact law enforcement agencies: the prosecutor's office, the police, Roskomnadzor and the court.

There are practically no reviews that the Association single-handedly resolved the problem of intrusive and unreasonable attention from collectors, from which we can conclude that the most effective way to combat collector arbitrariness is still the prosecutor’s office.

Did this article help you? We would be grateful for your rating:

5 2

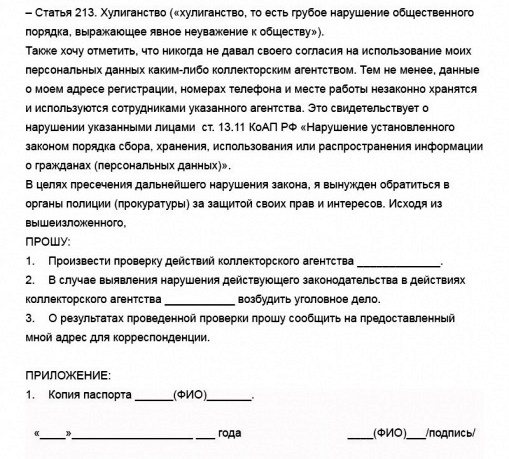

What to write in a statement to the police.

In cases where collectors go too far and instead of working together to find a compromise with the debtor, they begin to threaten over the phone or in person, you will have to go on the offensive.

You should call the local police officer if a representative of a collection agency tries to enter your house or apartment, despite the lack of your consent.

You need to send a statement about extortion from debt collectors to the police station if they threaten violence against you or your loved ones. This must be supported by witness testimony or audio/video recording. Written threats must also be recorded and presented to the police.

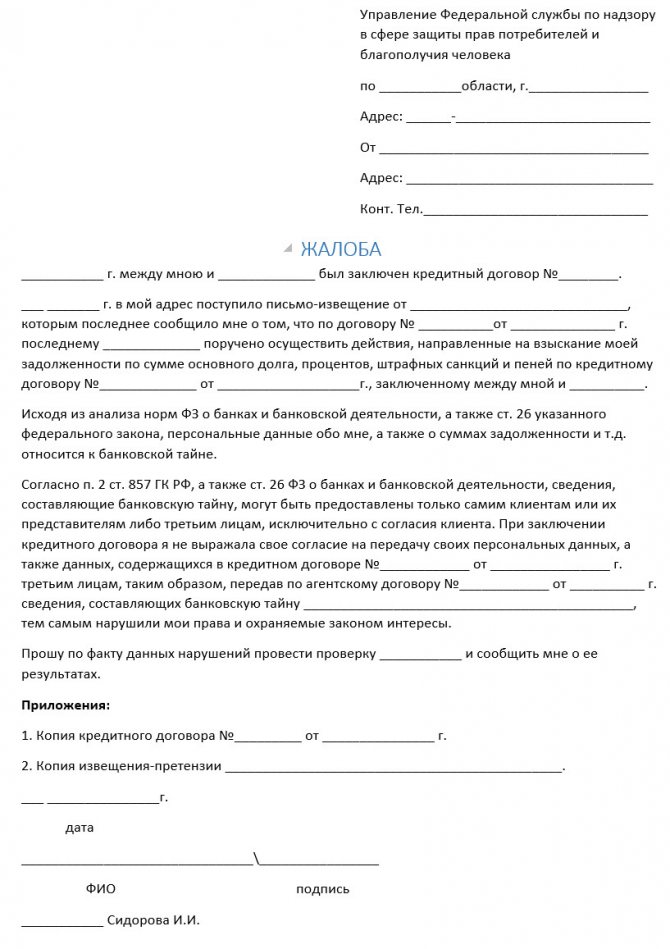

What to indicate in a complaint to the prosecutor's office

It’s worth contacting the prosecutor’s office when all other authorities have ignored your complaints against debt collectors, and you should no longer complain about the “debt collectors” themselves, but about the inaction of law enforcement agencies. But you can also tell the prosecutor that the collectors have encroached on bank secrecy, the debtor’s information rights and his personal data.

The content of such a statement is similar to all other complaints - all details of the parties (debtor and collectors), the essence of the claim, and unlawful actions of the parties to the conflict must be indicated here.

Debt collection specialist

When applying for a loan, the borrower does not always fully understand the consequences of late payment of debt obligations. In contracts, banks stipulate the conditions under which debts are transferred to third parties.

And this is where the “arbitrariness” of the collectors begins, the violation of the rights of citizens, even threats to life and health. An attempt to escape from the pressure of collectors is to file a complaint with the prosecutor's office against the debt collectors.

However, before expressing dissatisfaction and contacting various authorities, you should understand what the responsibilities of a collector are.

Is there any point in filing a complaint with the Association of Collection Agencies?

The service for collecting overdue obligations is obliged to work in compliance with the law. It regulates the number of calls per day and week, the number of personal visits, and the rules for communicating with the defaulter. Abuse of authority includes:

- Threats and use of physical force, psychological pressure.

- Calls at night, weekends.

- Transfer of information about the borrower to work, his friends, relatives, if he did not give permission to do so.

- Visits to the defaulter’s home in his absence, opening the apartment without his consent.

When calling, the collector must introduce himself and name the organization for which he works. The number must correspond to the company information; it is not allowed to hide it.

It makes sense to file a complaint on the official NAPCA website if the agency violates your rights, specialists threaten you, or disclose private information about you. This can only be done if the organization is a member of this association. Your case will be reviewed. If the data is confirmed, the collection agency expects recovery; moreover, it may be excluded from the participants and considered unreliable.

Articles:

Register of FSSP collection agencies and their rating

How to write a complaint to the FSSP against debt collectors

How to properly file a complaint

SRO NAPKA makes it possible to leave requests online. To do this, it is recommended to go to the official website in the complaints section. Next, fill out the form with detailed information. Please provide the following:

- Your full name..

- Location address.

- Contact number.

- E-mail address.

- The name of the organization against which the complaint is being made.

- Official website of the company, TIN.

- The region in which you live.

- Message text. In this field, briefly but succinctly indicate the essence of the unlawful behavior (threat of physical violence, obscene language, transfer of personal information).

Please attach an audio or video file or text document to your request. They will act as evidence on your issue. This point is not mandatory, but desirable to confirm that you are right.

The period for consideration of a complaint is up to one week. Next, representatives of the Association will decide on further actions regarding the agency. The result will be sent to you by email.

If these measures do not produce results, file a complaint with the court. The appeal must be submitted in writing, either electronically or by registered mail. Attach evidence to the document. This could be photographs, medical examination results confirming the harm caused to health, message printouts, call details, videos of the debt collector’s behavior. If the decision is made in your favor, the court will award you financial compensation for the damage caused.

The powers of collectors and the new law

In 2021, a new federal law came into force aimed at regulating relations between representatives of collection organizations and debtors.

The main responsibility of debt collectors is to return overdue debts. The lender provides such functions to third parties. The creditor receives the right to conduct telephone conversations and organize personal meetings with persons in debt on the loan.

The main purpose is payments on loans and borrowings provided by a bank or other financial institutions.

Persons working to ensure payment of debts can send telegrams and mail to debtors. Other actions of debt collectors must be regulated by a special agreement containing an indication of specific methods of interaction. In this case, the debtor has the right to withdraw from this agreement at any time.

According to the new legislation on collectors, abuse of power is:

- Use of force on the debtor.

- Threat to commit murder if debt is not repaid.

- Use of methods that pose a danger to health or life.

- Psychological pressure.

- Misleading a person in debt.

- The collector's affiliation with the authorities.

- Unlawful infliction of damage to the debtor.

- Transfer of a debt case to a court not provided for by the contract.

- Unilateral increase in interest and amount of debt obligations.

If one of the above factors caused a violation of the rights of citizens, then you should file an application against collectors with the regulatory authorities. In these cases, filing a complaint is justified, especially if there is a threat to the life of the debtor.

However, before legally stopping the actions of collectors, you should contact the bank or other creditor with a request to withdraw your personal data. This step will allow the debtor to assert his right to protection. In addition, when personal information is withdrawn, the bank is required to remove the debt case from the collection agency.

And here’s how to file a complaint about the inaction of police officers.

Follow the link for information on how to file a complaint with the FAS.

Responsibilities of collectors

The collector should begin communication with the debtor by providing information:

- Full name, position;

- about the creditor and the organization it represents;

- about the size and structure of debt.

The debtor has the right to find out the collection agency's license number. The collector should talk to the citizen in a business style. Physical or psychological pressure and threats are not allowed. The debtor must not be misled about the legal consequences of his actions.

Reference! The collector has the right to call only the phone number that was received from the financial institution.

In accordance with Art. 7 of Law No. 230-FZ of July 3, 2016, the debt collector must comply with the following restrictions when interacting with a citizen:

- telephone calls 2 times a week;

- 1 personal meeting in 7 days;

- 4 messages per week, but no more than 2 per day.

A personal meeting is allowed only by agreement with the debtor. Calls and messages are time limited. On weekdays, collectors should not disturb the debtor from 22.00 to 8.00, on weekends and holidays - from 20.00 to 9.00.

Agency employees can send information on debt by mail.

The document must indicate:

- information about the creditor or the person who represents his interests;

- details of contracts or other documents confirming the existence of debt obligations;

- size and structure of debt;

- Full name, position of the citizen who sent the document.

In the request, the creditor must indicate the details of the bank account where funds will need to be transferred to repay the debt.

Contacting the prosecutor's office is a necessary measure

If the attempted revocation of personal data did not have the desired impact, and the collectors continue to pester you, then you should file a statement against the collectors with the prosecutor’s office. The complaint is doubly justified if the debtor has received threats of violence. The body is vested with great powers to take effective measures against violators of the rights of borrowers.

An appeal to the prosecutor's office must contain information about the body to which the applicant is applying. Next, you should indicate the personal information of the applicant, address of residence. After this, the applicant begins to describe the circumstances that led to the application. In this part, it is important to follow chronology and avoid an outburst of emotions, to present exclusively facts.

The main thing is to fully indicate the actions of the collector and their sequence. In addition, it is necessary to justify their abuse of power and refer to the rules of law that were violated.

Expert opinion

Popov Yuri Ivanovich

Practicing lawyer with 6 years of experience. Specialization: family law. Knows everything about the law.

The application to the prosecutor's office must contain the debtor's demands and a request to notify the applicant of the decision made. The complaint is accompanied by documents that will serve as evidence of these facts.

If the prosecutor's office, based on the results of the audit, discovers violations of the law in the actions of the collectors, government officials will independently initiate an appeal to the court.

After receiving a response from the prosecutor's office, the applicant has the right to file a claim with the justice authorities if he is not satisfied with the decision of the supervisory authority.

In what cases should you file a complaint against debt collectors with the prosecutor's office?

There are several options where you can complain about debt collectors. It is recommended that you first try contacting the head of the collection agency.

In resolving all legal issues, pre-trial settlement of disputes is a priority.

Unlawful actions of collectors are classified as an administrative offense, subject to a fine of 0.5 to 2 million rubles.

If there are threats or other gross violations of the law in the work of collectors, then the company risks losing its permits.

The next places to turn should be the authorities whose competence includes regulating interactions between borrowers and financial institutions.

These are the following divisions:

- Prosecutor's office.

- Financial Ombudsman.

- To the police.

- To the Central Bank.

- In the FSSP.

- NAPKA.

- Roskomnadzor.

Not everyone clearly understands the functions of the prosecutor's office, its powers and the methods by which it influences violators of the law. As a supervisory body, the prosecutor's office is deprived of the power to directly influence the violator, unlike the police, which can quickly stop the unlawful actions of debt collectors. The task of prosecutors is to prevent offenses that have not yet been committed by indicating the inadmissibility of committing any actions.

In order for the complaint to be justified, you must first try to resolve the conflict situation:

- with a bank that, in violation of the terms of the agreement, sold the debt to collectors;

- to Rospotrebnadzor if personal information is disclosed;

- to the police - if collectors damaged property, caused bodily harm or publicly insulted the debtor (third parties);

- FSSP in case of violation of methods or time of interaction.

We invite you to read: Stages of obtaining citizenship under the resettlement program

Roskomnadzor guards personal information

Personal data protection implies non-disclosure of information about the debtor. However, if collectors call neighbors and provide information to other persons about the existence of a debt and its size, this is a direct violation of the law.

Often, despite the revocation of personal data, the bank still transfers the debt to the collector. If in such situations the debtor is tormented by telephone calls and threats from collectors, the consumer can write a statement to Roskomnadzor.

The grounds for appeal are non-compliance with the procedure for using and storing information about debtors, as well as encroachment on privacy.

Illegal actions of creditors, namely the use of a telephone number to make threats, calls to relatives and friends of the borrower, entail punishment.

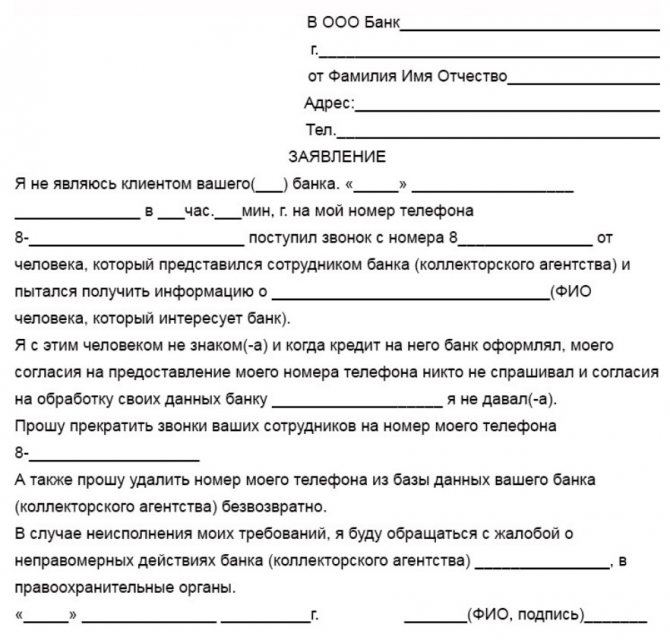

A complaint to Roskomnadzor against debt collectors is submitted both in person and online. The application is filled out on the organization’s website and contains the following information:

- applicant details;

- email information and region of residence;

- subject of the appeal - personal information;

- the essence of the problem.

Next, you need to upload documents or recordings of negotiations, enter the security code and send the application. A complete list of requirements for a complaint can be found on the organization’s website.

After reviewing the document, information about the results and the decision made will be sent to the applicant’s email address. The established time limit for processing a complaint is one month.

Roskomnadzor has the right to apply administrative penalties to violators. The punishment is the imposition of a fine and the issuance of an order to eliminate the violation. However, such enforcement measures are applied when the supervisory authority discovers violations of citizens' rights in the actions of collectors.

If the supervisory authority’s response is negative, the applicant turns to the justice authorities, attaching Roskomnadzor’s response.

It often happens that before applying strict measures, debtors try to come to an agreement with collectors. However, it is practically impossible to reach an agreement, since these companies receive monetary rewards for repaying debts. Therefore, collectors take all possible measures to obtain results.

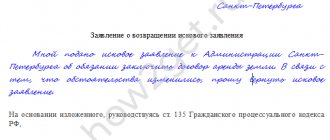

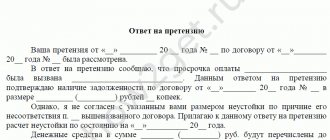

Form and examples of applications, complaints against collectors and the bank regarding someone else’s debt and constant calls

Here are examples of ready-made complaint forms that you can use to file your appeal.

General application form

The document can be sent to any authority by entering the necessary information.

Sample application to the Police against debt collectors for fraud, extortion, hooliganism

Sample application to the Prosecutor's Office or law enforcement agencies against debt collectors in case of constant calls, threats, extortion, disclosure of bank secrets and personal data

Sample application to Rospotrebnadzor regarding the actions of the bank and debt collectors

The document looks like this:

Application form to a banking organization to remove a phone number from the database and stop calls regarding someone else’s debt

As practice shows, in order to get rid of collectors, you need to act comprehensively and cooperate with different authorities.

Use these forms, fill out your complaint and send it to an authority that can hold violators accountable and stop their unlawful actions.

Still have questions? Just call us:

St. Petersburg 8; Moscow 8

Latest articles

Commission, deposit, deposit, prepayment, deposit when renting an apartment - what should the owner and renter keep in mind

Many people know from experience what renting an apartment is and how to arrange it correctly. However, newbies join this field every year who are at a loss when determining a deposit, security deposit, prepayment, commission for renting an apartment, and do not know what it is, why, and what they guarantee.

Expert opinion

Popov Yuri Ivanovich

Practicing lawyer with 6 years of experience. Specialization: family law. Knows everything about the law.

Today we will explain these concepts and tell you how to pay and register correctly so as not to lose money to either the tenant or the owner of the apartment.

How to rent an apartment correctly and safely - through an agency or without intermediaries

Renting an apartment or room is the most popular service in the real estate market. At the same time, you can rent housing from the owner or through an agency, by advertisement or through third parties, daily or for a long period.

Rental conditions can be very different, and manipulations with housing during rentals, direct or indirect methods of deceiving the tenant, and even outright fraud are not uncommon. How to protect yourself when renting a home, what to consider, what documents to check and draw up?

Registration of an apartment purchase and sale agreement in the MFC - list of documents and instructions for the MFC purchase and sale of an apartment

Previously, real estate transactions had certain difficulties and required a lot of effort and time for complete turnkey execution. Currently, the process has been significantly simplified by the centralization of information about real estate, digital data processing and the start of the work of Multifunctional Centers, which have taken over most of the bureaucratic procedures.

In this article we will tell you how to process and register the purchase and sale of an apartment in the MFC.

Since 2021, collection activities have become fully regulated by law. And now the borrower has the right to complain about the actions of collectors if they violate established standards. For example, you can write a complaint to Roskomnadzor, the FSSP or to the court.

Reasons for appeal

Roskomnadzor is a government agency that oversees the use, storage and dissemination of information. Therefore, you should not write a complaint here if the actions of the collectors are not related to violations of the procedure for using and distributing your personal information.

As a rule, the grounds for filing a complaint against debt collectors with Roskomnadzor are :

- Unfulfilled application for withdrawal of personal data from the organization;

- Invasion of privacy and non-duty information;

- Distribution of personal data to third parties, including relatives.

The most common reasons for contacting Roskomnadzor with a complaint against debt collectors are their calls to strangers who have nothing to do with the borrower as a debtor. Remember: the creditor does not have the right to call relatives, colleagues, friends and neighbors and disseminate information about the consumer and his obligations.

Legislative regulation

Until 2021, the activities of collectors were not regulated by any law. But on July 3, 2021, the President of the Russian Federation approved the Federal Law “On Collection Activities,” which defines the procedure for relations between the debtor and the debt collection employee, as well as approving a list of actions that collectors can take in the process of debt collection.

Now, according to the Federal Law “On Collection Activities”, debt collection can only be carried out by specialized collection services or agencies that have the appropriate license. You can get one by entering your company in a special register.

Preparing a letter

Of course, one statement with the borrower’s words about the violation will not be enough. In order for the department to take measures to protect your rights, you should prepare evidence of the illegal dissemination of information about you in advance. For example, an excellent solution would be to record a telephone conversation with an agency employee.

Sample

The borrower can submit a claim to a government agency in writing, submitting it by mail or through an employee of the department, by contacting the organization’s branch in his city. It is necessary to make two copies of the letter, one of which will remain with the applicant.

A complaint against collectors is being filed with Roskomnadzor according to the following plan:

- We write the header of the application (to whom and from whom the application).

- We describe the essence of the problem: violations of collectors and their actions.

- We draw up the grounds: we provide evidence of the dissemination of information.

- We indicate requirements to suppress the dissemination of personal data.

After receiving an application from the borrower, the supervisory authority is obliged to carry out work on the application within 30 days. If necessary, this period may be extended, but only after notifying the applicant. If the complaint falls within the competence of other authorities, then Roskomnadzor can redirect your letter to the appropriate authority.

Feeding features

One of the features of filing a complaint against debt collectors with Roskomnadzor is the ability to submit a letter via the Internet . Just go to the organization’s website and write a request in a special section.

On the website, the applicant will also be able to attach the necessary files with documents or evidence. Remember: if there are no grounds, it is almost impossible to punish debt collectors.

What will be the result?

After receiving a request from a citizen, Roskomnadzor is obliged to conduct an inspection. As a rule, the decision is determined on the basis of evidence provided by the applicant that the debt collectors distributed personal information in violation of the law.

of the department's decision by regular letter or email response within one month . If a violation is detected, the agency faces a fairly large fine, inspection and order. And if the complaints are not isolated, then such a company may even be deprived of its license.