Home/HOA/Checking the activities of the HOA

The abbreviation HOA stands for homeowners' partnership. It is represented by a non-profit legal entity carrying out management activities in relation to the housing stock. This indicates that the goal of creating an HOA is not to make a profit, but to create conditions for satisfying the non-material needs of the members of the partnership. Like any legal entity, an HOA is subject to verification measures by various higher-level structures.

Types of inspection of HOA activities

For your information

, the HOA is a multifunctional organization. Today, the partnership conducts 2 areas of activity - economic and financial. The purpose of conducting an inspection of the HOA is to identify the compliance of all activities with established standards and to determine the legality of financial and economic work.

Checking the operation of an HOA involves an extensive classification. According to the planning, it happens:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- planned, carried out regularly, in accordance with the established schedule (usually the frequency is once a year);

- unscheduled, carried out when certain circumstances arise.

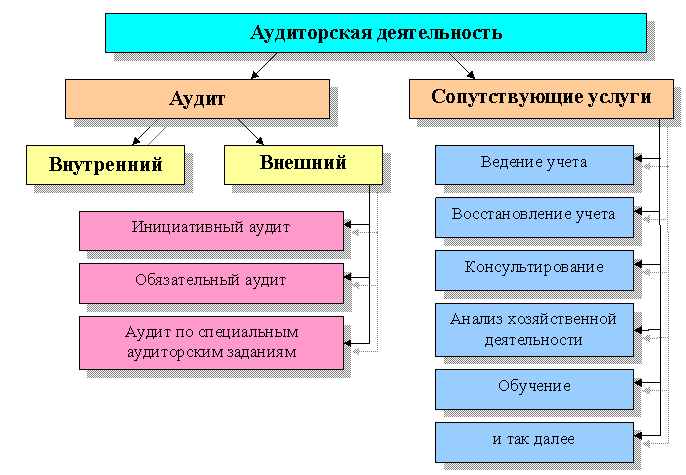

Depending on the persons conducting the HOA inspection, it can be classified into the following types:

- internal - initiated by members of the HOA and structures interacting with it;

- external – carried out by third-party monitoring organizations.

Depending on the completeness of coverage, the verification activities of the homeowners association may be as follows:

- complete: an audit of all documents is carried out; traditionally, this measure is relevant before the visit of employees from important authorities (prosecutor’s office, housing supervision);

- partial: include a minor area (for example, declarations).

Attention

Each type of HOA audit has its own characteristics and nuances.

- Internal. Regulated by the norms of the Housing Code of the Russian Federation. To implement this, an audit commission is created. Within the framework of each partnership, the Regulations are approved, which determines the rights and responsibilities. The purpose of the HOA inspection is to assess the current financial and economic work of the organization and its compliance with the charter.

Despite the fact that the HOA does not have the main goal of making a profit, Art. 246 of the Tax Code of the Russian Federation indicates that the homeowners association acts as a taxpayer, and therefore undertakes to maintain tax reporting. Control is initiated by the tax service, which checks the correctness of filling out declarations, maintaining reporting documents, and the completeness of providing information on taxes paid.

Tax office.- Inspection of the HOA by the housing inspection. The housing committee is in charge of the review. The partnership is notified in advance of the event. Responsibility for detected violations of the law is provided for in Art. 7.22 Code of Administrative Offenses of the Russian Federation “Violation of standards for the maintenance and repair of housing stock” and 14.4 “Provision of low-quality services”, clause 7 of Art. 157. Housing complex of the Russian Federation.

- Inspection of homeowners associations by Rospotrebnadzor. Consumer protection in this regard is stipulated in Art. 4 and the law on STDs. Therefore, in the event of poor-quality services, owners are given the right to file a complaint with this body, which will carry out inspection activities in the HOA.

- Prosecutor's check. Typically, this type of activity is carried out without any special warning, most often in the course of receiving complaints from residents about the unfair work of the governing body.

Reasons for an HOA audit

Large sums of money pass through HOA accounts, so this is one of the reasons to check the activities of the organization

According to the provisions of the Federal Law “On Non-Profit Organizations”, the raison d’être of an HOA is to manage an apartment building. Although the homeowners association's purpose may not be to make a profit, large sums of money flow through its accounts. This circumstance inevitably attracts scammers who want to illegally take possession of the financial resources of residents. In addition to deliberate violation of payment discipline, erroneous settlements with counterparties, as well as incomplete or untimely payment of tax payments, are possible. All these are reasons to conduct both scheduled and extraordinary inspections of the partnership.

Standard schemes for deceiving residents

Most often, unscrupulous management companies launder money using the following schemes:

- Concluding contracts with front and affiliated organizations. In this case, there are several possible scam options. If work is carried out under such contracts, it is usually at prices that are an order of magnitude higher than the services of other companies. Often, a verification contract may turn out to be fictitious, when no work was carried out under it, and the funds for payment were transferred to the contractors’ accounts.

- Signing contracts for work that is not necessary. Moreover, there are often cases when, based on the results of their completion, the papers were reworked, accompanied by additional payment.

- Overpayment of HOA members when, without any justification, the salaries of the management of such organizations increase significantly.

- Withdrawal of funds from trust funds and subsequent opening of a deposit in a bank. The management of the HOA keeps the accrued interest for itself.

- Tax evasion. This scheme is often accompanied by the collection of contributions from owners in cash. The funds received in this way are not recorded anywhere, which means it is almost impossible to prove the fact of dishonest performance of duties by the management company.

- Illegal disposal of common property of owners. Most often it manifests itself in the form of renting out common home areas. The proceeds from such transactions often end up in the pockets of HOA board members.

- The management's negligent attitude towards the performance of assigned duties, which leads to the deplorable state of the courtyard areas and entrances of the house.

The work of the homeowners' association should be organized as transparently as possible. Concealing certain information from the owners is a good reason for initiating an inspection by the management company. If fraud is detected, it is necessary to send statements to supervisory and law enforcement agencies.

Who can initiate a partnership audit?

Responsibility for poor performance of functions or inaction always falls on the shoulders of the chairman of the HOA. But the audit can also be initiated by other interested parties:

- chairman of the HOA;

- owners of residential premises;

- members of the partnership.

Regardless of whether a person belongs to the HOA, as well as whether he holds a certain position in the homeowners’ association, a citizen has the right to order an audit. But, as practice shows, most often the initiator of the procedure is the chairman.

Grounds for checking the HOA

Attention:

Homeowners' association inspections are carried out as a planned event or as an unscheduled process based on complaints from residents or third parties about the failure to provide or poor-quality services.

The idea of checking the HOA must comply with a number of basic principles:

- the chairman's interest in conducting the audit;

- the possibility of holding a meeting of HOA members;

- the likelihood of determining the frequency of reporting from the chairman more often than specified in the law;

- the likelihood of forming a criminal case against officials based on the results of the inspection.

It follows that the purpose of the audit plays a huge role. The goals are:

- determination of the fact and magnitude of discrepancies between reporting and actual materials;

- finding errors in the process of maintaining accounting documents;

- identification of facts of deliberate violation of the law.

The general grounds for holding such events appear in Part 2 of Art. 10 Federal Law No. 294, as well as in part 4.2 of Art. 20 Housing Code of the Russian Federation. In this regard, during the implementation of activities the following issues are resolved:

- procedure for creating an HOA;

- mandatory requirements for statutory documentation;

- procedures for concluding contracts for the supply of services with RNO;

- violation of the terms of the agreement and liability;

- procedure for using the resource base.

This is not the entire list of tasks that one or another audit can solve, but they are the main ones.

The essence of the audit and the reasons for its conduct

An audit of the activities of an HOA is a control measure designed to verify the partnership’s compliance with its obligations established by Article 148 of the Housing Code of the Russian Federation:

- compliance with housing standards;

- timely hiring of workers who must service a multi-story building;

- carrying out major repairs;

- housekeeping;

- maintaining accounting and financial reporting.

The rights of residents to inspect the activities of the HOA are secured by Article 143.1 of the Housing Code of the Russian Federation, according to which they have the right to familiarize themselves not only with the Charter and the certificate of state registration of the organization, but also with income estimates, financial reports, accounting reports, and property documents.

During the audit the following is checked:

- technical documents for multi-apartment buildings;

- estimates for major or current repairs;

- reports on their implementation;

- minutes compiled as a result of meetings of members of an organization.

In addition to documents, the tax office can view all financial transactions of the HOA (receipt and expenditure of funds, agreements with contractors, economic situation of the organization).

Scheduled and unscheduled audits

The subject of verification activities carried out by control and supervision bodies is noted within the 11th paragraph of the Regulations on State. lived supervision No. 493 dated June 11, 2013. And in accordance with Federal Law No. 294 “On the Protection of the Rights of Legal Entities and Individual Entrepreneurs”, scheduled and unscheduled inspections can be carried out.

- Scheduled inspections of HOAs are carried out on the basis of annual plans and schedules developed by state control bodies. Traditionally, these measures are carried out once per year, unless otherwise provided by regional legislation.

- Unscheduled measures are carried out on the basis of the grounds provided for in Part 2 of Art. 10 Federal Law No. 294, as well as Part 4.2 of Art. 20 Housing Code of the Russian Federation.

Please note:

Both types of HOA inspections can be documentary and on-site. In any case, the time period for conducting them cannot be more than 20 working days.

Types of homeowners association reporting

The Partnership, acting as a responsible legal entity, undertakes to annually report on the results of its own activities. A request for a HOA report can be created not only by premises owners, but also by employees of higher authorities.

- Internal reports . They are provided to the owners of the premises within the framework of the annual meeting held on the basis of Art. 45 of the Housing Code of the Russian Federation in the second quarter of the year following the reporting one.

- Report of the chairman of the HOA. It is based on information about the work that has been done and on the fulfillment of the obligations established within the job description. Includes the preparation of estimates, control measures regarding the fulfillment of contract terms, accounting, tax reporting, hiring and dismissal of employees, etc.

- Board report. This is necessary in order to provide the chairman with assistance and support in fulfilling his duties in managing the apartment building. Art. 151 of the Housing Code of the Russian Federation states that the management of the HOA has the right to dispose of collective funds on the basis of the approved budget.

- External reports. As a non-profit organization, the partnership undertakes to comply with applicable laws by providing information about the results of its work. In particular, we are talking about fin. reporting (balance sheet, report on the intended use of funds), tax reporting, statistical reporting (on the number of employees, accounting measures).

IMPORTANT

Within the framework of clause 10 of Art. 161 of the Housing Code of the Russian Federation establishes an obligation to ensure open access to data on the activities of HOAs.

Identification of financial fraud of HOAs during an audit

In Russia, there are often cases when financial audits reveal facts of criminal offenses by management and lead to criminal liability:

- The HOA enters into fictitious contracts for the maintenance and repair of the house, and appropriates the money received from the residents for itself;

- deliberately inflate the cost of construction materials and work in repair estimates, and distribute the difference between the board;

- illegally inflate utility tariffs, resulting in residents paying more than the standards established in the region;

- at its own discretion, spends federal funds allocated for house maintenance;

- illegally rents out premises of an apartment building or spends the received funds not on maintenance of the building, but on his own needs.

If residents suspect the management organization of such fraud, they should contact the Russian Prosecutor's Office with a written statement, or file a complaint on its official website. The audit also involves checking documentation and financial transactions made during the year by the chairman of the HOA, as well as funds received by the organization.

In accordance with Article 151 of the Housing Code of the Russian Federation, the legal sources for the formation of HOA funds are mandatory payments and contributions from members of the organization, government subsidies for repairs, income from the activities of the partnership, rent and other resources.

Inspection of HOAs by the Audit Commission

The Audit Commission is a permanently functioning elected body. Its task is to exercise control over the conduct of legal, financial, and economic activities of the homeowners’ association. In accordance with Art. 150 of the Housing Code of the Russian Federation, its creation for the implementation of control is mandatory. Legal regulation of activities is carried out on the basis of Chapter. 14 Legal status of HOA members, approved by the general meeting of members.

Attention

Any member of the HOA can be elected to the RC, but he must create a special letter of request.

Self-test

In addition to the owners, the audit can be initiated by the HOA itself. A similar possibility is spelled out in Article 150 of the RF Housing Code. For this purpose, the partnership organizes a special audit commission. As a rule, it consists of residents of the building who are not on the board. They conduct regular scheduled audits of the service company's performance. Typically the inspection frequency is 1 year. During this period, each partnership is required by law to report to the owners of residential premises.

The operating procedure of the audit commission has certain features:

- conducts an audit of the financial activities of the partnership for one calendar year,

- the commission sums up the results of the work, but does not have the right to influence decisions made by the management of the HOA,

- draws up consolidated reporting, and also compares income with expenses and makes an opinion on the work of the HOA.

The documents drawn up as a result of the inspection are necessarily brought to the attention of residents. This can happen either as part of a regular meeting or upon receipt of an official request from the owners of residential premises.

Conscientious managers are no less interested in an unscheduled audit than the residents of the house, because The audit helps clarify a number of important points. Based on the identified errors and violations, management can take timely measures to eliminate them. In addition, this is a good opportunity to check the work of the HOA accounting service.

HOA audit report

The document is drawn up by employees of the auditing organization. The text of the HOA audit report must necessarily contain the following data:

- name of the housing association;

- the time period during which the inspection was carried out;

- areas that were tested;

- errors and shortcomings identified during the event;

- possible ways to eliminate them.

The act acts as a confidential type of documentation and is drawn up in two copies, respectively, for the customer and the executor of the HOA inspection.

Order of conduct

The stages of the audit look like this:

- Familiarization with the management structure of the HOA is carried out, auditors delve into the most important features of its work, and the organization’s charter.

- Documentation for the period that must be verified is submitted for inspection and studied. Documentation for previous periods may also be required for comparison. The list of papers must be agreed upon in advance.

- The homeowners association's reporting is reviewed, the planned values are compared with those that actually exist, and any discrepancies are identified.

- A search is carried out for the reasons why discrepancies occurred, if any are found. For this purpose, accounting statements and payment documents are checked.

- An inspection report is drawn up. This document should detail how the audit was conducted, draw conclusions, and make recommendations for improving the HOA's performance.

Inspection of HOAs by the tax office

Although the HOA is a non-profit organization, it is not exempt from replenishing the state treasury by paying taxes. In relation to homeowners' associations, as in relation to any legal entities, scheduled and unscheduled inspections (on-site and desk) may be carried out by the tax inspectorate. During their implementation, the tax reporting of the HOA is reconciled, errors and inconsistencies are identified in it, responsibility for errors or failure to provide papers is determined.

Audit of HOA

Before the audit procedure, all members of the HOA are notified of this. Any person interested in an audit and initiating it undertakes to undergo the following activities:

- familiarization with the main provisions of the charter document of the HOA;

- appointment of a meeting on the basis of which a set of verification works will be carried out;

- if necessary, raise an issue related to changing the procedures for assigning audits;

- familiarization with the final provisions provided by the professional auditor;

- organizing another meeting if any errors were found during the inspection, the deficiencies found will be discussed and certain decisions will be made.

Additional information

The procedures and other nuances of holding a general meeting of a homeowners’ association are reflected in the current legislation - Art. 145, 146 Housing Code of the Russian Federation.

Control methods

If doubts arise regarding the honesty of the chairmen of the partnership, a corresponding complaint should be sent to representatives of the competent authorities. The latter will conduct the necessary inspection of the HOA (audit). Based on its results, penalties will be applied to the organization.

How to conduct a self-check? You should start by contacting the audit committee. You will need to familiarize yourself with the following documents:

- Accounting department reports.

- Results of the last inventory carried out.

- Reports on completed work.

It is necessary to compare the information received and try to identify any discrepancies. If any work commissioned by the HOA was carried out by contractors, find out information about them through the Unified State Register of Legal Entities.

Cost of HOA audit

There are no specific tariffs for the cost of HOA audit services in the legislation or in any specific regulations. Each situation is subject to individual assessment and depends on the complexity and scope of the proposed activities. Traditionally, as practice shows, the size of the remuneration that auditors ask for is in the range from 25 to 70 thousand rubles. An important role is played by the urgency of the implementation of measures and the qualification level of the expert.

What's happened?

The fact is that the Ministry of Finance considers utility payments to be the revenue of the HOA, which it periodically reports in its letters, without forgetting to indicate that they are not a normative act.

So, in particular, this position of officials is set out in letters No. 03-03-07/73652 dated 12/09/2016, No. 03-11-11/4260 dated 01/27/2017, No. 03-03-06/3/50062 dated 08/04/2017 . For an HOA on the simplified tax system with an “income minus expenses” object, this means paying a minimum tax of 1% of payments collected from residents.

Meanwhile, some HOAs use the simplified tax system with the object “income” and do not recognize utility payments as taxable revenue, since the HOA is a non-profit organization and does not make money from “utilities”. For them, following the opinion of the Ministry of Finance means increasing the financial burden on residents by 6%.

Recently, Murmansk tax officials sent out information letters to all HOAs and TSNs, informing them that they would collect tax from them according to the simplified tax system. Shortly before this, the Arbitration Court of the Murmansk Region made a decision in favor of the Federal Tax Service on a dispute between an HOA and tax authorities.

Homeowners association inspection by housing inspection

The State Housing Inspectorate is an independently functioning structural unit of the system of executive authorities. The purpose of its existence is full and comprehensive control over the observance and provision of the rights and interests of citizens in the course of providing housing and communal services to the population.

In relation to HOAs, the housing estate has an extensive list of powers:

- carrying out scheduled inspections and activities at the request of residents;

- control of the appropriate fulfillment of the obligations of the HOA in relation to the operation of the housing stock;

- verification activities regarding documents and conducting a full analysis;

- monitoring the general condition of an apartment building and the territory adjacent to it;

- carrying out administrative work for legal support of a number of technical aspects.

The entire list of powers that this structure has is contained in Government Decree No. 493 of June 11, 2013.

Scheduled inspection of HOAs of municipal housing control

Federal Law No. 93 of June 25, 2012 “On Amendments to Legislative Acts of the Russian Federation” related to issues of state supervision introduced the concept of municipal housing control. It is usually understood as the activities of local bodies that have the authority to organize and carry out inspections on the territory of certain entities to ensure that legal entities comply with the norms of the Housing Code and other legislation. In Art. Section 4 of this document describes the procedure for implementing control measures. The basic standards of implementation are reflected in Federal Law No. 294 “On the protection of the rights of legal entities and individual entrepreneurs” and Art. 20 Housing Code of the Russian Federation.

Regulations on the Audit Commission

The Housing Code establishes the right to organize an inspection of the activities of HOAs (Articles 117 and 145). The need for an audit of the HOA is indicated by Art. 120, which provides for the creation of a special elected commission, which over a 2-year period will be able to conduct scheduled and unscheduled audits.

The concept is defined in Art. 150 of housing legislation with the authorization of auditors to annually or more often carry out actions to audit the HOA, the actions of the board and prepared reports. The powers of the commission (hereinafter referred to as the RC) include drawing up conclusions on estimates of expenses and receipts for the accounts of the partnership. This is established in the provisions of Law No. 123-FZ of June 4, 2011.

Like the creation of a board, for the work of the RC it is necessary to gather apartment owners and conduct a vote. An important limitation concerns the impossibility of including anyone from the board of auditors, which ensures the objectivity of the audit.

What are they guided by?

Like any structure, the activities of the Republic of Kazakhstan are regulated by certain rules - the Regulations on the HOA Audit Commission. The regulatory document describes the terms of reference and responsibilities of the members and is approved by the general meeting of residents by voting.

Download the Regulations on the Audit Commission (auditor) of the homeowners association (sample form) (27.1 KiB, 244 hits)

The actions of the Republic of Kazakhstan described in the Regulations should not contradict the norms of the Civil, Housing Codes and the HOA Charter. If in the process of carrying out activities there is a need to make changes to the document, it is necessary to convene a general meeting of owners.

Who can be an auditor

Unlike members of the board, the composition of the RC is not limited to participation in the HOA or residence on the territory of the apartment building. There is a minimum number of commission members authorized to conduct regular inspections of the work of the board. There must be at least 3 auditors, and the maximum composition is established taking into account the provisions of the Charter.

The leading role in the activities of the Republic of Kazakhstan is played by its leader, selected from among the HOA auditors. The Chairman of the Republic of Kazakhstan is obliged:

- Coordinate the work of the Republic of Kazakhstan.

- Convene internal meetings.

- Represent the interests of the body in other authorities.

- Endorsement of published documents.

The secretary is also given certain obligations for keeping minutes of meetings, document flow in the Republic of Kazakhstan, and signing documents.

A person who is capable of:

- control financial documentation confirming expenditure and receipt transactions on the organization’s accounts;

- determine the correctness of prepared reports and their compliance with actual costs;

- make conclusions on the validity of cost items and amounts spent;

- check the compliance of cash register statements with bank account statements, the correctness of expenses for salaries of the chairman and employees.

Housing legislation determines the maximum period of activity of the selected Republic of Kazakhstan. After 2 years, the auditors cease to act, and the owners elect the composition of a new commission.

According to Art. 147, 150 of the housing legislation, residents have the right to initiate early termination of the work of the current staff. To make such a decision, it is enough to receive at least 25% of the votes from all participants in the organization.

Unscheduled inspection

If the Housing Inspectorate or another body has received information that requires verification in the form of an appeal or application, this indicates that the process of unscheduled inspection activities regarding the HOA will soon begin. An unscheduled inspection of the HOA can be carried out in the following situations:

- when the regulatory authority does not have sufficient information about the person who committed the violation;

- if there is not sufficient data on the fact of violation of mandatory requirements.

There is no need to prepare any documents in advance to prepare for this procedure. The inspector may request only some clarifications - additional materials and information. If during the preliminary inspection violations are identified, they will be followed by unscheduled work, which is prescribed in parts 3.2 and 3.3 of Art. 10 Federal Law No. 294.

Inspection of HOA by the prosecutor's office

Conducting inspections of the HOA by the prosecutor's office is an extreme measure that takes place after violations are identified. The most serious consequence of such an inspection is the liquidation of the HOA and bringing it to criminal and administrative liability. According to Art. 141 of the Housing Code of the Russian Federation, the liquidation of an HOA is carried out within the framework of the procedure established by the Civil Code.

Attention

Based on Art. 61 of the Civil Code of the Russian Federation, an HOA is subject to liquidation by the court if there are violations of the law of a particularly gross nature that are irreparable. Prosecutors, in the course of discovering such phenomena, make an appeal to the court with appropriate statements of claim for the liquidation of the HOA.

What did deputies and officials say?

However, the answer did not please the readers of our forum.

Khovanskaya replied that she is not an expert in the field of taxation, so she cannot clarify this issue. She only quoted the opinion of the Ministry of Finance on this matter. Later, another letter was received from the Housing and Communal Services Committee, informing that the appeal had been redirected to the State Duma Committee on Budget and Taxes (letter attached).

In addition, the author of the message also received clarifications from the Ministry of Finance. In their letter dated 08/04/2017 No. 03-11-11/49885, officials once again stated their opinion: for HOAs, “utility” is taxable income (letter from the Ministry of Finance is attached).

Let us add that the discussion of this communal issue takes place in the forum topic “The court recognized the communal apartment as revenue from TSN and housing cooperatives.”

When does the HOA bankruptcy procedure begin?

Bankruptcy is one of the forms of liquidation of an HOA. The right to recognize the fact that the partnership is unable to fulfill its immediate responsibilities rests exclusively with the arbitration court during the investigation. The interim manager analyzes financial and economic activities, holds meetings with counterparties and determines the source of the debt, and then draws up a report, the purpose of which is to identify ways to improve the financial situation. The main reason for bankruptcy is the debts of the HOA to the RSO and the impossibility of solving the problem on its own.