In life, one way or another, situations arise when you have to lend. But few people understand how to do it correctly. There is a separate category of people who do not intend to repay this debt or they simply do not have the funds to do so. To avoid going to court, you can file a claim for debt payment. If it is drawn up correctly, it can convince the defaulter to return the money.

How a claim for debt collection is drawn up, what the filing rules are, we will raise all these questions in this material.

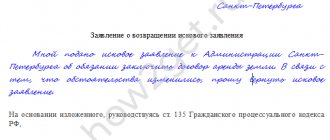

Response to a claim for debt payment: sample

The general scheme for drawing up such a response to a claim does not have much specificity. There can be two options in the content of the letter - full and partial consent.

In the first case, after the heading “response to the claim”, phrases may be placed stating that when considering the information received about the debt under the contract (identification data), the counterparty came to the following conclusion (decision on full or partial consent). The delay in payments was caused by circumstances that for our organization are of a force majeure nature.

Expert opinion

After agreeing with the total amount of debt and the terms of its repayment, a phrase about disagreement, for example, with the amount of the penalty, can be given. In this case, you should provide your own calculations as a counterargument.

With full agreement, you can only apologize, explain the reasons for the delay in payments, and inform about the date of repayment of the debt.

Download and review a sample response to a claim for debt payment.

Document structure

The best answer would be to offer a peaceful resolution to the conflict that has arisen. To compile the document, you should adhere to the general plan:

- Details of the debtor company, position, full name of the director;

- Place and date of document preparation;

- Outgoing number and date of filing the claim;

- Main part: informing the counterparty about the acceptance of the claim for consideration, as well as about the decision made. It is worth indicating the reason for the debt, as well as the timing of its repayment. You can apologize. This will show your desire to continue cooperation;

- Signature, initials of the manager.

Correspondence with the counterparty is part of the official document flow, and therefore is subject to mandatory registration in the Outgoing Correspondence Journal. You can certify the document with a seal. This will show your respect for the applicant, as well as the solution to the stated problem at the “highest” level.

Do I need to respond to the complaint?

The claims procedure for resolving disputes involving citizens, as a rule, is not mandatory. And sending a letter demanding to repay the debt means that the other party is trying to resolve the issue amicably and not bring the matter to court. And for the debtor, this scenario is preferable - there is no need to incur legal costs and waste time on the proceedings.

Your decision whether to respond to a pre-trial debt claim or not; it all depends on your agreement or disagreement with the demands put forward and further tactics.

- make the required payment if you recognize the demands as fair and also do not want to take the matter to court;

- respond to the complaint if you do not agree with something in it, ask to defer payment, explain the payment mechanism, etc.;

- ignore the request. In this case, the issue of debt collection will most likely go to court.

Nuances of drafting in various situations

According to the reconciliation report

If the creditor has a reconciliation report signed by the debtor, filing a claim is simplified. After all, the debtor has already admitted the fact of the debt, and there is no need to convince him of its existence.

Therefore, a link to the reconciliation report is simply given, indicating the amount of debt, the deadline for a response and the deadline for repaying the debt.

Common in the practice of economic relations is a form of act consisting of two halves:

- Compiled by the party initiating the act - this part must be completed. Here are the documents confirming the history of the debt: amounts, dates, numbers, acts, invoices and payment orders.

- Part to be filled out by the other party to the act - here the counterparty is given the opportunity to present his vision of the debt in chronological order of receipt of documents for goods/work and payments.

This procedure for drawing up a reconciliation report helps to compare calculations, check whether all documents are taken into account by the parties, and come to the same vision of the amount of debt. The act must be signed in any case. Even if the party does not agree with the amount under the deed. The following list of documents accepted for settlement is intended to help the parties express their point of view.

Under contract

The general type of claim under the contract is discussed above. In the claim, the creditor indicates the date and number of the contract, its subject matter, and reminds the debtor of his obligations under the contract.

Attaches a calculation of fines and penalties, referring either to a clause of the contract or to an article of the Civil Code of the Russian Federation.

Bailiffs

An appeal to the bailiffs with a demand for repayment of the debt by the debtor is made after the court decision on the claim. A letter must be written if the debt has not been repaid within the deadline set by the court.

In this case, the details of the court case and the court decision are indicated. The essence of the requirements is stated. And an appeal is written to the bailiff service for forced collection of the debt from the debtor, referring to the relevant article of the Law “On Enforcement Proceedings”.

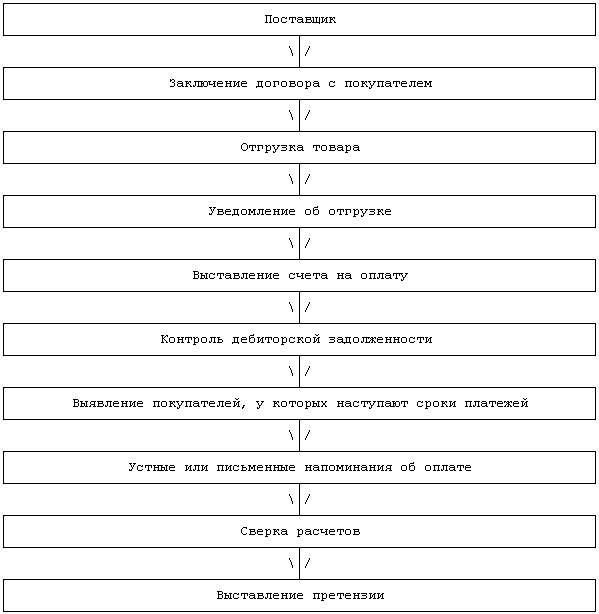

Collection of receivables within the framework of pre-trial settlement has the same features as collection of debt under a contract.

It is good if there is a reconciliation act signed by the debtor confirming the existence of receivables on a specific date. If there is no act, then together with a letter of demand to repay the debt, a reconciliation act is sent to the debtor.

It happens that the repayment period of obligations is coming to an end, but there is no way to pay the debt. In this case, we recommend that the debtor company, without waiting for a claim, send a letter to the creditor proposing its debt repayment schedule.

In such a letter, in addition to all the necessary details, indicating the circumstances of the debt (link to the contract, list of supplies and payments, link to the reconciliation report), it is necessary to indicate the circumstances that prevent the debtor from paying off the debts in a timely manner.

With payment schedule

The debt demand letter may contain a payment schedule proposed by the creditor if he agrees to receive payment in installments. It is better for the debtor to initiate the preparation of a debt repayment schedule on his own, without waiting for the end of the payment period and the creditor’s right to claim.

The payment schedule must be realistic. Violation of the payment schedule proposed by the organization itself will play against the debtor in court if the case cannot be resolved without it.

Drawing up a payment schedule allows the debtor to break the debt into parts and receive a deferment in payment.

In what cases can a letter to the bank lead to pre-trial debt collection:

- If a bank guarantee has been issued for the fulfillment of obligations under the contract, upon the occurrence of circumstances specified in the bank guarantee agreement. The bank repays the debt under the agreement for the enterprise for which it is the guarantor. When carrying out public procurement, all aspects of providing a bank guarantee are described in Art. 45 of the Law of 04/05/2013 No. 44-FZ.

- If the creditor is a fiscal authority (tax authority, Pension Fund of the Russian Federation, Social Insurance Fund, Treasury).

To the tenant

The letter to the tenant about repayment of rent arrears includes all nine parameters and details of the parties listed in the article. It differs from a regular letter of repayment of debt under an agreement in that, in addition to legal consequences for the debtor, there is a risk of losing the right to use the leased property.

This often entails more serious consequences for the debtor than a trial, so a reminder of the relevant clause of the contract speeds up the payment process and simplifies negotiations with the debtor.

For product

Commodity relations are not always formalized by contracts. A sufficient document confirming the fact of delivery of goods is an invoice (or bill of lading), or an acceptance certificate signed by the buyer or his authorized representative. Copies of documents are attached to the letter.

Requirements for repayment of debt when purchasing goods may be supplemented by a requirement to pay or return the goods. Some groups of goods are not subject to exchange or return. You can familiarize yourself with the list of such goods in Decree of the Government of the Russian Federation dated January 19, 1998 No. 55.

The requirement to repay a debt for another organization can be sent only to an enterprise or individual acting as a guarantor or guarantor in the transaction.

In this case, the requirement includes details of the surety agreement or guarantee agreement. The fact of violation of obligations by the debtor, the progress of negotiations or correspondence is described, the debtor’s refusal to pay, a reconciliation report, and copies of other documents confirming the creditor’s right to demand repayment of the debt from the guarantor or guarantor are attached.

We invite you to read: Retrenchment of a mother with a disabled child. Retrenchment of an employee whose child is disabled

Founder

The founders of LLCs and joint stock companies are not liable for the obligations of the legal entities they founded. This is always true except in certain circumstances, the most common of which are:

- when the contribution to the authorized capital of the enterprise by the founder is not fully paid (in the amount of unpaid capital);

- when the founder is a guarantor or guarantor for transactions of the enterprise.

In the first case, the liability of the founder is determined in court. In the second case, everything comes down to the previous paragraph of this article.

If the debtor is not an LLC or JSC, then the founder may be liable for the debts of the enterprise if it has the form:

- individual entrepreneurship - an individual entrepreneur is liable with all his property for the debts of the individual entrepreneur;

- general partnership - the participants of such an enterprise are liable with all their property for the obligations of the partnership;

- limited partnership (liability within the framework of its contribution);

- production cooperatives or artels, the founders of which bear additional responsibility in cases provided for by law.

All demands for debt repayment sent to the debtor are in the nature of pre-trial settlement. If the debtor ignored the demand and did not respond to it within the allotted time, then only the creditor has the right to go to court.

The debtor who has repaid the debt has the right to send a letter to the creditor with a request to confirm in writing that the latter has no claims regarding the repaid debt.

This must be done in order to finally reconcile all calculations and not give the opportunity to an unscrupulous creditor to re-collect the paid debt or part of it, or to calculate penalties or fines after the fact of resolving the conflict.

How to send a response to a claim for debt repayment

The claim is sent in writing, and a sample response to a claim for debt payment is prepared in the same way - and there are 2 delivery options:

- By mail with acknowledgment of delivery and a description of the contents.

- By courier with delivery to the authorized person of the claimant against signature.

The response is sent to the address indicated in the first request. If the address is not specified, then you should refer to the contract. In it, the parties sometimes agree on a special address for sending correspondence. A universal option is to send it to the legal address of the organization or place of residence of the individual.

Exchange of letters is also possible by email. The Supreme Court of the Russian Federation confirmed the legality of the exchange of electronic messages in paragraph 65 of the Resolution of the Plenum of the Supreme Court of June 23, 2015 No. 25. In this case, the ability to accurately identify the sender and recipient is mandatory.

Some types of letters

"), from the first person plural ("Request"), from the third person singular (in this case, nouns with a collective meaning are used: "The management asks.

", "The administration is asking. ", "The Labor Council is asking. ", etc.), from the third person plural, if several nouns with a collective meaning are used.

Here is a sample request letter on the letterhead of a private enterprise: Currently, the partnership is not provided with raw materials and is forced to stop supplying products for.

We compose an answer according to the sample

A standard written sample response to a claim for debt payment is drawn up in any form, but in compliance with the general rules for document preparation:

- In the upper right corner, indicate the addressee - the name of the organization or data of the individual who presented you with the payment request, your data: full name, address and telephone number.

- In the text itself, indicate the arguments on the merits of the case. For example, a fairly common example of a claim for debt collection against an individual is a demand from a supplier organization to pay for utility services. In this sample, you can indicate that you consider the calculation to be incorrect, indicating the reasons. Or acknowledge the debt, but ask for a deferment or installment plan for its repayment.

Send the answer by registered mail or hand it to the addressee personally against signature.

Please pay the outstanding debt

Letter 1 Dear Ivan Ivanovich, I would like to remind you once again that by July 25, 2013, our legislation does not directly provide for this type of document, but its presence additionally confirms the obligations assumed by one of the parties. Form and rules for writing a letter A letter of guarantee does not have any mandatory form and is drawn up by the interested party in any form.

This document must have the date and place of preparation. Please tell me how the judicial practice develops on this issue and is the “continuing offense” argument legitimate in this case?

Sincerely, Lera, your region Payments for housing and communal services are periodic payments (monthly). Sprinkling of driveways begins immediately from the beginning of snowfall to put sand under

According to the agreement No. [number] dated [date] concluded between LLC [name of the organization] (hereinafter referred to as the Customer) and LLC "Delopis.ru" (hereinafter referred to as the Contractor), work was performed for the Customer in [name of work] for the amount of [amount] rubles.

This document can later be used in court as evidence of an attempt to peacefully resolve the conflict. If the attempt is unsuccessful, the borrower is sent a third document - a claim.

The basis is the enrichment of the creditor resulting from an erroneous payment. In most cases, guarantees are nevertheless drawn up in case of violation of the deadlines for fulfilling monetary obligations, when the defaulter, trying to avoid legal proceedings, sends this document to his creditor.

In heavy snowfalls, the driving speed is increased to improve productivity.

Snow banks are separately cleared after the passage of snow removal vehicles at street intersections, so that the resulting bank does not interfere with normal traffic. Then, if they don’t pay it off voluntarily, suing is practically useless. A reconciliation act is needed. How to write a letter to a supplier about the return of funds according to the reconciliation act, the debt has been hanging since last year. You can also write that according to the reconciliation act, as of such and such a date, your company had accounts receivable.

The question is essentially simple, but we have reached a corner!

What to pay attention to

If you ignore a written request to repay the debt, wait for a subpoena.

Keep in mind that debt collection for housing and utilities is now carried out on the basis of a court order, which is issued by a single judge, without calling the parties. Therefore, a letter of claim for payment of debt, a sample of which we examined, is sent to the debtor immediately before filing a claim in court. And if you haven’t answered it and haven’t paid off the debt, then the next document you receive will be a court order that has the force of a writ of execution

This is important to know: Complaint to the FSSP through State Services

Methods for sending such a letter

Correspondence between the parties on the issue of debt repayment can take place in the form of simple letters if the creditor does not intend to go to court, but simply reminds the forgetful debtor of his obligations.

It is better to have confirmation of the fact of delivery of the demand to the recipient. This can be a registered letter confirming the signature on the second copy of the letter of the person who accepted it in the organization, an electronic letter, if it is possible to sign electronically and confirm the fact of receipt of the letter by the addressee.

How to write a document correctly

The response to the claim is created in free form, subject to certain rules for writing such documents. That is, the appeal must be written in an official business style. It should not contain rude expressions, insults or everyday language. Corrections and errors are not allowed in the response to the complaint. Before sending it, you should carefully analyze the document for any inaccuracies.

The written answer must be reasoned, complete and concise. All arguments must be accompanied by correct references to relevant regulations, departmental instructions, rules and other acts that may come as a surprise to the author of the complaint.

The response must certainly contain all the required details that give the document legal force.

If the response is created by a legal entity, then it must be written on official letterhead.

The structure of the response to the claim is as follows:

- in the upper right part you should indicate the addressee: the name of the organization or the full name of the citizen presenting his demands for debt payment. This part also contains the details of the legal entity, address, information about the sender and his contacts;

- the descriptive part of the response contains the defendant’s arguments: why issuing the debt is unfair, for example, there is an indication that payment has already been made under the agreement. He can also admit the existence of a debt and ask for an installment plan or deferment due to unforeseen circumstances (for example, loss of a job, etc.). In the latter situation, a person indicates an obligation to “close” the debt before a specified date or proposes a schedule for transferring funds. In addition, the debtor can indicate his own calculation of the debt or penalty;

- At the bottom there is a signature and its decoding, as well as the date of compilation.

The answer is sent by registered letter with a list of attachments or delivered directly to the addressee against signature. If the latter case is used, the document must be drawn up in two copies. When sending a response by an organization, it should be certified in advance with the company’s seal and the date and number of outgoing correspondence must be affixed.

Documents that confirm the accuracy of the information provided are attached to the response to the claim.

This may be a copy of the passport, a copy of the agreement, copies of payment documents certifying the fact of payment, reconciliation acts, etc.

Watch the video. How to write an official letter to a bank:

Why is it necessary to send a letter of claim for debt repayment?

The tradition of legal resolution of economic disputes today is at the stage of active development. On June 1, changes to the Arbitration Procedural Code of the Russian Federation came into force (Law No. 47-FZ dated March 2, 2016, hereinafter referred to as Law No. 47-FZ).

Now all disputes between enterprises, enterprises and individuals, enterprises and the state must undergo pre-trial settlement.

There are two types of settlement of arbitration disputes before going to court:

- through negotiations;

- with the help of an arbitration court.

The negotiated claims process for pre-trial resolution of business disputes most often takes the form of business correspondence, the initiator of which can be either the person who is owed for services rendered, work performed, goods supplied or prepayment made, or the debtor.

Arbitration is the conduct of negotiations with the help of a third party who is trusted by the creditor and debtor. Today in Russia the institution of arbitration courts is being created under arbitration courts.

The basis for active changes in this area are two legislative acts:

- Federal Law of December 29, 2015 No. 382-FZ “On Arbitration (Arbitration Proceedings) in the Russian Federation” (hereinafter referred to as Law No. 382-FZ);

- Federal Law No. 409-FZ of December 29, 2015, amending the laws on arbitration proceedings (hereinafter referred to as Law No. 409-FZ).

Three legislative acts that came into force in 2021 (Laws No. 47-FZ, No. 382-FZ and No. 409-FZ) introduced significant changes to the previously existing system of arbitration proceedings.

The process of pre-trial settlement of arbitration disputes has become mandatory. The parties must make efforts determined by law to reconcile and resolve disputes without the participation of the Arbitration Court. There are two ways to do this: through claims work and through arbitration.

When the question of sending an application to the tribunal complete with a note is firmly raised, it is strongly recommended that you follow this rule: never send a sample letter of claim in the form of a computer file.

There are no strict requirements or rules for the design and writing of a letter. The bank has the right to write it in a form that is free and understandable to the client. The only main criterion here will be precise adherence to business style.

You shouldn’t focus on the name either, it doesn’t play a role here at all, only the content is important, which will be emphasized by the court and the client, who must understand it in order to return the funds.

- The reason the client refuses is because there is no option. If the conditions were not met or violated in any way, then it is necessary to list the property that the debtor left as collateral;

- Amount of debt. Please note that the final amount cannot be specified. All its components must be taken into account. If there are also fines, criteria are indicated, based on which you need to get rid of fines. Also, do not forget to enclose the payment document;

- The time during which the client undertakes to repay the debt. The time allocated to the client is definitely in the summary;

- Fines and sanctions. Their size and reasons for their occurrence are located on the pages of the agreement.

Do I need to answer?

In situations where the debt is not paid for an extended period, debtors may receive a collection claim created in accordance with current legislation. It should not be ignored, because otherwise a lawsuit may be filed in court. Sending an appeal demanding payment of debt is a pre-trial method of resolving a dispute.

The creditor will wait for a response to the sent claim and further fulfillment of its obligations. If all his demands are not met, a statement of claim and the start of a legal battle may follow. To avoid such a course of events, it is better to resolve the conflict peacefully.

Claims are of the following nature:

- must be presented;

- subject to presentation under an existing contract;

- subject to the expression of will of either party.

Note! A claim in civil proceedings does not act as a mandatory element, unlike arbitration proceedings. Therefore, submitting a claim is the creditor’s step towards resolving the conflict situation before the court hearing. You need to respond to such a message in any case.

The purposes for which the creditor sends a claim are:

- encourage the debtor to repay the debt, preferably pre-trial;

- obtain the right to appeal to a judicial authority;

- intimidate the debtor.

Depending on the purpose sought by the complainant, the type of response will depend. It can be created according to a specific template.

For example, a claim from a customer under a contract agreement most often focuses on eliminating operational deficiencies. The parties have the right to indicate in the contract that the response is mandatory, but responsibility, as a rule, is not prescribed. Therefore, the requirement must be fulfilled immediately.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

What types of penalties are there?

A creditor can claim a debt in several ways:

- Pre-trial, with a warning.

- Directly to the court.

However, it is worth paying attention to the fact that these options cannot be considered as separate ways of resolving the conflict. They are interconnected and sequential. But there are cases when you can go to court without a preliminary pre-trial settlement. For example, conflicts regarding freight transportation, transport expeditions.

Mandatory pre-trial procedure must be specified in the contract. We recommend including it in the conditions, as this can greatly save money and time, and will also significantly relieve the workload of court workers.

The litigation scenario looks like this: the plaintiff files a statement of claim in court. Next comes the consideration of the case. At the end of the process, the judge issues a writ of execution.

The applicant applies to the bailiff service with this document. They, in turn, begin lengthy enforcement proceedings to enforce the court order. As you understand, all this takes months, or even years. Do you agree that this is not the best option for a lender?

Supply contract

In case of delivery of products, debt may arise from both the buyer and the seller. In the first case, it appears if he has not fulfilled his obligations to pay for the goods, although its delivery has occurred.

This often occurs when the contract includes deferred payment. That is, the buyer pays the amount only after the seller has actually delivered the products.

In this case, the claim will contain a requirement to pay for goods that have already been delivered. Reference here must be made to articles number 485, 486, 489, 500, 516 of the Civil Code of the Russian Federation.

A completely different story can happen if the goods were pre-paid or an advance payment was made for it, and the supplier is in no hurry to deliver it. In this case, the buyer will demand termination of the contract and a refund. Here the warning letter will be based on article number 487.3 of the Civil Code of the Russian Federation.

Work agreement

This type of relationship also has a number of pitfalls. A contract involves the performance of specific types of work on the instructions of the customer. Here both parties can violate the terms. The contractor may incur debt as a result of non-fulfillment of prepaid work. The customer's debt arises if he has not paid the amount for the work done according to the act.

If there is no signed act of acceptance and transfer of work, then there are no formal reasons for collecting funds. Two options are allowed here:

- Submit your work in writing in advance based on the primary documentation.

- Or write this requirement in the claim for payment.

In this case, it is necessary to refer to article number 711 or number 746 of the Civil Code of the Russian Federation.

Payment for services

This area of commercial activity can include many things: transportation, consulting services, catering, and other types. If a situation arises where the client has not paid for the service provided, then the contractor has the authority to draw up a warning demanding that he repay the resulting debt, referring to article number 781 of the Civil Code of the Russian Federation.

It is important to note here that by the time the warning is presented, all services must be accepted according to the transfer deed, the deadline for paying the final amount has come to an end, and there is also a delay.

The customer has the right to demand the advance payment made under the contract and terminate the contract. This is possible if the contractor greatly delays the execution of the service. If the customer does not intend to refuse the services of the contractor, then in the claim he can request urgent fulfillment of the stated items.

Lease contract

If the tenant, for various reasons, does not make mandatory payments under the lease agreement, then the owner of the premises has the right to send him a warning about payment of the debt, referring to article number 614 of the Civil Code of the Russian Federation.

The peculiarity of such relationships is that the lessor may demand not only repayment of the debt, but also payment of rent for subsequent periods (no more than two).

The basis for a warning may be, for example, constant delays in using the premises or lack of payments for several months in a row.

Filing a claim here depends on the regulations for closing the amount of the principal debt and the procedure for paying interest.

In other words, if the terms of the contract stipulate a repayment in a lump sum at the end of the loan period, then the warning itself must be sent at the end of the period for using the bank’s credit funds. That is, if the borrower fails to fulfill a debt obligation.

A claim for interest payment may be made much earlier than the end of the loan term. When the terms of the contract provide, for example, for monthly payment of interest.

If the parties to the relationship have a debt repayment plan, then if the borrower defaults on the payment at least once, the creditor has the authority to send him a letter of claim.

It is worth noting that the lender also has to demand payment of fines on the principal debt, even if the loan was repaid before the warning was prepared. If the borrower does not pay only interest, then this also serves as the basis for issuing a warning.

Who can make a claim for payment?

Claims for payment of debt may be made by:

- credit institutions for loans;

- utility organizations;

- mobile operators in the presence of debt for services provided;

- microfinance firms in case of loans;

- pawnshops;

- institutions involved in public transport.

Debt obligations can appear not only between organizations, but also between citizens.

In certain cases, the response to a claim is an acknowledgment of the debt. This kind of response takes the form of a letter of guarantee for payment when one of the parties does not fulfill its financial obligations.

A letter of guarantee allows you to perform the following tasks: informs the counterparty, the creditor about problems with funds, acts as a basis for revising the debt payment schedule, and is a confirmation of future repayment.

How to send a claim to a debtor?

Before going to court, the creditor is obliged to carry out a procedure called “Pre-trial dispute resolution”, so there must be strong evidence of this work on hand. Judicial practice shows that two methods of sending claims to the debtor have serious weight:

- Sending by registered mail with notification;

- Handing over the letter under the personal signature of the debtor.

If the letter of claim is delivered to the debtor personally, then you must have 2 copies of the document on hand. The first is handed over to the debtor, and on the second letter he is required to put his signature and date of delivery. Important! The date indicated on the letter plays a significant role, since it is from this date that the countdown begins for both the creditor and the debtor.

If the debtor is a legal entity, then when delivering the letter it is important to correctly identify the person responsible for accepting the correspondence. In most cases, these functions are assigned to the secretary. In practice, no one will show the letter's presenter either their job descriptions or their passport. Therefore, if the legal entity is small, then it is better to achieve a personal meeting with the manager and hand him a letter. This will save you from misunderstandings in the future.

The most reliable evidence of claim work is a postmark on the notification that the letter has been delivered to the debtor. Judicial practice shows that the judge does not take into account the debtor’s statement that he did not receive the letter of claim because it was signed by a person not authorized to receive the correspondence. It is assumed that the delivery of letters along with other correspondence occurs from the postman into the hands of a person authorized to receive mail. If you choose this method of sending a letter, then there will be no problems with fixing the date.

There is one BUT here! If a person deliberately avoids delivering a letter of claim for debt repayment, then the postman will not search for the addressee, so the paper will simply remain undelivered. In this case, the creditor, along with the statement of claim, brings to the court envelopes that were sent to the debtor (individual) at the registered place of residence or to the legal entity at the legal address of the company. During the court hearing, the place will already be clarified, where exactly the defendant is located.

Response Content Forms

The addressee of the claim has several options for how to respond to the document received:

- satisfy in full. In such a situation, the text must state that the complaint sent by the creditor has been accepted, the monetary demands indicated in it are legal and will be fulfilled at the specified time and in the required amount;

- satisfy in part. The claim is recognized only in part, and a letter is sent to the creditor setting out other conditions;

- refuse completely. This is done in situations where the creditor's demands for the return of funds are unfounded due to certain clauses of the agreement or provisions of the law. The response should include specific references to regulations, results of examinations and other documents. At the end, the author of the complaint should be invited to contact the court.

When drawing up a response, the main task is to express an opinion regarding the claim expressed by the opposite party and present it with your decision.

We ask you to pay the debt in the amount

amounts to ________ (_______________) rubles. The calculation is attached. Calculation of rent arrears.

We kindly ask you to sign the reconciliation report and pay off the existing debt by July 15, 2013.

For the Customer, work was performed on [name of work] for the amount of [amount] rubles. As of July 15, 2013

the Customer's debt is [amount] rubles. Various enterprises, organizations, institutions, individual entrepreneurs (IP) enter into transactions with each other and/or with individuals to sell goods, carry out various works or provide services.

The second important point is the rights and obligations of the parties.

Dear Viktor Aleksandrovich, I remind you once again that by 04/01/2014 you are obliged to repay the debt in full under all existing contracts. If you are unable to do this, please arrange for us to meet with the director of your company before the specified date.

Didn't find the answer to your question?

In what cases are claims rejected?

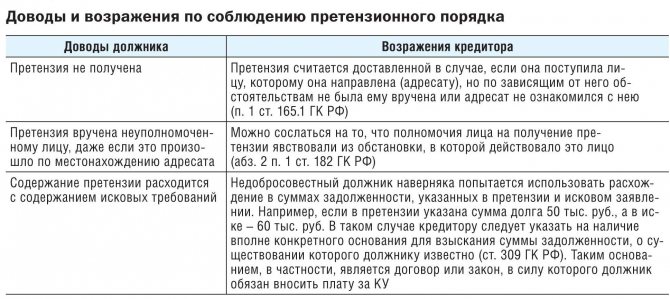

The addressee of the complaint has several options on how to respond to it. In what cases does the debtor have the right to reject the demands put forward?

Note! There are four reasons :

- absence of the debtor’s fault in the circumstances leading to the failure to fulfill obligations. Such situations are described in the “Force Majeure” clauses of the agreements;

- failure to fulfill an obligation occurred due to a situation that, although not force majeure, cannot be controlled;

- the addressee is incorrectly specified;

- the demands made by the creditor are unlawful or were not recorded in the agreement.

This is important to know: How to appeal a traffic police fine through State Services

In certain situations, despite a correctly written response to a claim, it is not possible to avoid litigation. But the very fact that the answer was provided within the required time frame will be another plus for the debtor. Otherwise, he would have to pay all legal costs even if the outcome was positive.

Writing deadline

According to current legislation, a response to a claim for repayment of debt obligations must follow within the established time frame, which is adopted in accordance with the following principles:

- as a rule, complainants use Article 452 of the Civil Code and set the minimum time for drawing up a response to a pre-trial complaint regarding a debt obligation - this is thirty days from the time of its filing;

- in exceptional cases, when creating a response to a claim requires a long time due to various circumstances, the applicant has the right to fix his own individual time period in the text of the document itself, for example, forty-five or sixty days;

- when the term in the claim is not fixed, but only the date of its preparation, then it is recognized as minimal by law, that is, equal to one month. If the sender does not even indicate the date of writing the document, it is considered void and has no legal force;

- if an employee calls on the head of the organization to pay arrears of wages, the response time to such an appeal can be reduced to seven days. The same applies to those situations where one of the parents forces the ex-spouse to pay his child support obligations.

Expert opinion

The period during which the applicant waits for a response must be justified and fully justified by the number of actions for drawing up a counter document.

Later, if the judge decides that the plaintiff gave too little time to the debtor to respond, he will have the right to reject the claim due to a violation of the pre-trial dispute resolution mechanism.

Please pay off the debt

Law firm Your reliable lawyer will help you collect penalties from the developer.

The request to repay the debt is sent to the debtor by certified or registered mail, and it is handed over against receipt. The date the reminder was received corresponds to the date of the postal receipt or the borrower's dated signature on the claim copy. A claim with demands to repay the debt is sent to the borrower by a valuable letter, which is handed over personally against signature.

According to paragraph 1 of Art. 711 of the Civil Code of the Russian Federation, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and within the agreed time frame.

In accordance with Art. 310 of the Civil Code of the Russian Federation, unilateral refusal to fulfill an obligation and unilateral change of its conditions are not allowed. To accommodate you, we are extending the payment deadline until (date) / while fulfilling your new orders. If you do not pay the debt by (date) and do not send a check showing payment, we will be forced to temporarily suspend the execution of all your deputy broadcasts.

Features of preparing a letter to the management organization

Often claims demanding repayment of debt are sent to management companies.

In such situations you should:

- determine the period of debt;

- compare tariffs, meter readings, payment receipts;

- find out why the complaint was submitted at this particular moment.

If the management organization does not want to provide more detailed information regarding the existing debt, a reference should be made to Government Resolution No. 731 of September 23, 2010, which specifies its obligation to provide such information.

Watch the video. How to respond to a letter of complaint:

Dear readers of our site! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free! Or call us at :

Moscow, Moscow region

St. Petersburg, Leningrad region

Federal number for other regions of Russia

If your question is lengthy and it is better to ask it in writing, then at the end of the article there is a special form where you can write it and we will forward your question to a lawyer specializing specifically in your problem. Write! We will help solve your legal problem.

Collection through court

Collection in the judicial authorities is made through filing a claim. The plaintiff in the claim for collection of rent debt is the management company, which was not paid receipts for housing and communal services on time. The statement of claim should be submitted to the district court at the debtor's registered address. On the Internet you can often find advertisements “We collect expired debts” from law firms. If you wish, you can contact them.

Documentation

In order to collect a debt in court, the following documents are required:

- Copies of the claim.

- Receipt for payment of state duty.

- A document certifying the authority of the person representing the plaintiff.

- A copy of the charter document of the management company.

- Copies of notices of the defendant’s debt and receipts of their dispatch.

- Management or rental agreement.

The claim is written in free form, and the conclusion on it is rendered in favor of both the management company and the defaulter.

Simultaneously with the claim, a statement of security is also submitted, so that the defendant does not sell or transfer the apartment to another person during the trial. This application is examined on the day of filing, but the debtor does not know about it, and he cannot file complaints or claims about it.

The court's decision

The decision can also be made in absentia; a copy of this is sent to the debtor within 3 working days. The defendant may file a counterclaim within 10 days. Both the management company and the defaulter can challenge the decision.

>

Writing Requirements

The law does not put forward clear requirements for a sample response to a claim. Most often, the letter is drawn up on the company’s official letterhead. If there is no form, the letter is drawn up on white A4 paper. To make it official, such a document must contain information about the company (name, details, contact address and telephone number).

The response letter must be certified by the signature of the director or authorized employee.

The prepared response is delivered to the addressee personally against signature or sent by mail via a recommended letter with notification.

There are three options for the debtor's response:

- Agree completely. At the same time, the defendant indicates that he fully recognizes the stated requirements and undertakes to satisfy them within the prescribed period;

- Agree partially. The stated demands are partially accepted by the defendant; he formulates his own settlement of the conflict, which he sets out in the response;

- Refuse. This is possible if the applicant’s demands are unreasonable by law or contract. The response letter contains confirmation that the counterparty is right, references to regulations, clauses of the agreement, and the results of the expert assessment. You can also invite the applicant to go to court.

The main thing when drawing up a response letter is to clarify your own opinion regarding the requirements set out in the complaint and communicate it to the counterparty.

What points should be reflected in the claim:

- Grounds for debt. In case of violation of contractual terms, the claim letter indicates the details, as well as the sections that are used to calculate the debt.

- Amount of debt. Here you need to register not only the total amount, but also its component parts. If penalties are subject to accounting, then the rule for their calculation is prescribed. It would be a good idea to include a debt calculation.

- The time allotted to the debtor to fulfill obligations. The deadline is also stipulated for a reasoned refusal to repay the debt.

- Penalties that will be applied to the debtor if he does not fulfill his obligations within the agreed period.

You can use a ready-made sample claim letter as a basis, filling out the necessary fields for your specific case. It will be necessary to determine the legal relationship in which the debt arose.

It should be understood that a claim is not an analogue of a statement of claim, therefore there is no need in the paper to refer to laws and regulations. But if these points are taken into account, the weight and seriousness of the letter will increase significantly. If the debtor receives such a letter, he must clearly understand that the creditor is ready to take extreme measures to collect the debt and file a claim in court.

Features of writing an answer

Most often, a debt claim is sent when the payment deadline stipulated by the contract for products received, work performed or services rendered is overdue.

Failure to respond on the part of the recipient of the claim is the reason for the creditor to seek protection of his rights in court. Therefore, the response letter must be reasoned, competent and drawn up on time. The period for responding to a claim is from ten to thirty days from the date of its receipt.