What is a court order

This is an executive document (at the same time a decision on the case), which is drawn up and signed by the magistrate after the creditor applies. The bank does not have the right to apply for it in any case: only if the loan amount is no more than 500 thousand rubles and the case can be considered in a simplified manner. Of course, not every debt meets these conditions. Most often we are talking about consumer loans, in which applications from banks for orders are just common: a simplified review procedure is faster and simpler than a traditional court. However, in general, practice does not replace enforcement proceedings, but only simplifies debt collection in some cases.

What can you do after receiving an order?

The first question that people who receive a copy of this document usually start asking is how to pay off a debt under a court order. De facto, the borrower can follow one of two strategies:

- pay the debt using the creditor’s details, which must be indicated in the court order;

- challenge the document by filing a counter-application to cancel the decision.

The fact is that the order does not take effect immediately. According to Article 129 of the Code of Civil Procedure of the Russian Federation, within 10 days from the date of receipt, the borrower has the right to challenge it, but bailiffs during this period do not yet have the right to begin debt collection measures. If you have grounds to object to the judge’s decision, you can write a corresponding statement and thereby cancel the order.

In what cases is a decision made?

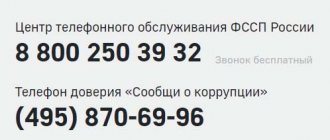

After the bailiff has received a writ of execution from the claimant, he is obliged to initiate proceedings within three days by issuing an appropriate order. This cannot be done without a court decision.

After this, photocopies of the form are sent to the parties on the same day. Within five days, the debtor has the right to voluntarily transfer money to the account of the FSSP branch. If he does not take advantage of the opportunity, the bailiffs move on to the stage of forced implementation of the orders.

You need to know: Refusal to initiate enforcement proceedings

The process of executing a court order

The procedure is as follows. The creditor decides to collect the debt from the client and goes to court using a simplified procedure. After which the judge, having checked the correctness of filling out the form and the availability of evidence on the part of the creditor, issues a court order within five days. The further procedure is as follows:

- within 10 days from the date of receipt of the order by the defendant, objections are expected;

- if there is no response, the document is transferred to the bailiff service, and enforcement proceedings are opened;

- the contractors pay a visit to the borrower, assess his financial condition and the possibility of repaying the funds;

- The debt collection process begins.

It is not always reached the last stage: there are cases in which the borrower repays the loan even before the order is transmitted to the bailiffs. In such situations, it may also be necessary to submit an application to cancel the document in order to avoid possible errors and misunderstandings.

Simplified procedure

Difference from lawsuit:

- the attached documents serve as evidence;

- the parties do not appear in person to participate;

- The judge makes a decision alone.

The housing and communal services organization, homeowners' association applies for the issuance of a court order, observing the requirements for the details set out in Art. 124 Code of Civil Procedure. In terms of jurisdiction, such cases belong to magistrates (like a court of first instance); the site is selected according to the defendant’s registration or the address of the debtor organization.

Attachments – documents confirming the requirements; if a representative signs the application, then additional documents certifying his right to sign. In the application, you can ask to send the order immediately to the bailiff, then the court secretariat will send it to the bailiffs immediately after it comes into force.

Methods of debt collection by bailiffs

Unlike collection agencies that have received the right to a loan under an assignment agreement, which can meet the client halfway and offer more favorable conditions than the bank, bailiffs do not always act in the interests of the borrower. The peaceful option for the development of events is that he independently repays the debt, using the details specified in the document. More serious consequences occur if actions on the part of the borrower are not followed and bailiffs begin to forcibly collect obligations. In this case, confiscation of property is possible, to which bailiffs have the right according to the law. The borrower's property is sold against the debt through an auction. This is obviously not the most optimal way out of the situation, but in most cases it can be avoided. The main rule is not to panic and not to do rash things. A rational line of behavior will help resolve the issue in the mildest possible way.

What you need to know about paying off debt through a court order

The filing of claims with the magistrate and the entry into force of the order are surrounded by a number of requirements that must be fulfilled. The borrower should know about them: the information will help to identify possible errors in enforcement proceedings in a timely manner.

Duty.

When filing an application, the claimant is obliged to pay a state fee in the amount of 50% of the amount that he would have paid by applying to a court of general jurisdiction and registering a statement of claim not in a simplified form.

Deadlines.

As soon as 10 days expire and the document comes into force, it is not immediately transferred to the bailiff service. Usually several months pass between these events. The time for the start of work of the executors after the transfer of the order to them is regulated by 229-FZ “On Enforcement Proceedings”, the maximum period for the start of actions is two months.

Period of validity of the order.

The deadline for submitting a document to the FSSP is calculated individually in each case, since it can be interrupted or restored. In order to correctly calculate the period of validity of an order in a specific situation, it is worth taking into account the specifics and circumstances of each contract.

Is it possible to cancel a court order?

This is possible if the defendant files a statement of disagreement with the conditions specified in the order. Typically, this document can be submitted within 10 days of receipt. In exceptional cases, the period is extended if the borrower provides evidence that he could not apply to cancel the order earlier. It is necessary to immediately note a nuance: the simplified procedure implies that the consideration of applications will be quick. Almost always, the decision is made in favor of cancellation, regardless of what reasons the defendant provides (the main thing is that they are present and reasonable). But if the debt really exists, was not accrued by mistake, and its amount corresponds to the real one, canceling the order is only a postponement of further actions on the part of the creditor.

What happens after the order is cancelled?

Typically, borrowers cancel the document in one of the following cases:

- the loan does not belong to them, the paper was sent by mistake;

- there is an error in the debt data, the amount is indicated incorrectly;

- a delay is necessary to find funds to repay the loan and resolve the issue directly with the lender.

After the order is canceled, the plaintiff has the right to go to a court of general jurisdiction and file a full-fledged application, initiating a trial. The duration of such a process is much longer than in writ proceedings, and it itself is associated with financial and time costs on the part of the plaintiff. It is important to understand: cancellation of the order does not imply release from obligations, it only provides a chance to avoid interaction with the FSSP and, if possible, negotiate more favorable terms with the creditor.

What a utility organization needs to do before going to court

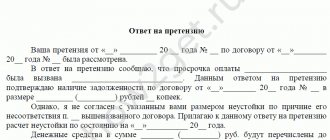

Issue a warning, give a notice to the consumer - about the accrual of penalties, about the possible disconnection of services; it is then possible (but not necessary) to actually stop supplying the resource (such as electricity, water or sewerage). Before submitting documents to the court, it is necessary to follow the pre-trial procedure, that is, draw up a written claim to the debtor, indicating important points, namely:

- About the presence and amount of debt.

- Offer to voluntarily deposit the missing amount using the specified details before a certain day.

- Indicate the place, address, telephone number where payments can be verified.

- Provide a calculation of penalties for late payment.

- Warn about possible enforcement measures.

In addition, it makes sense to approach the debtor with a proposal to conclude an agreement on installment payments that suits both parties, because the main goal is to receive the money owed.

Penalties are charged in the amount of the refinancing rate (Article 155 of the Housing Code[3]):

- 1/300 – from 31 to 90 days;

- 1/150 – from 91 days to the maturity date.

The claim must be handed to the debtor against a receipt, or sent by a valuable letter with an inventory.

What else can the creditor do?

Not every bank, after canceling a court order, goes to a court of general jurisdiction. The costs may be too great to be cost-effective, so the organization often decides to take other measures. One of them is transferring the debt to a collection agency, which in turn will try to come to an agreement with the client. This turn of events frightens many more than communicating with bailiffs, but in reality, bona fide debt collectors are much more loyal to the client than the federal service. The agency has the right to write off part of the debt, offer a convenient individual repayment schedule, and accommodate the borrower halfway, especially if he agrees to cooperate. If you find yourself in such a situation, don’t worry or be afraid. With rational actions on your part, the debt will be repaid, and you will not have to face more serious collection measures.

Send a sample of objections to a court order to the Magistrates' Court for the collection of housing and communal services debts

Author: Anatoly Antonov, January 21, 2021 at 16:04 Good afternoon!

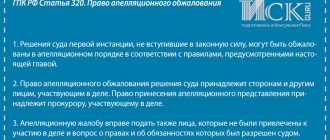

According to Articles 128-130 of the Civil Procedure Code, the judge sends a copy of the court order to the debtor, who, within ten days from the date of receipt of the order, has the right to submit objections regarding its execution. The judge cancels the court order if the debtor raises objections regarding its execution within the prescribed period. In the ruling on the cancellation of the court order, the judge explains to the claimant that the stated claim can be presented by him in the manner of claim proceedings. Copies of the court ruling to cancel the court order are sent to the parties no later than three days after the day it was issued. If the debtor does not submit objections to the court within the prescribed period, the judge issues to the claimant a second copy of the court order, certified by the official seal of the court, to present it for execution. At the request of the claimant, a court order may be sent by the court to a bailiff for execution, including in the form of an electronic document signed by a judge with an enhanced qualified electronic signature in the manner established by the legislation of the Russian Federation. In case of collection of state duty from the debtor for the income of the corresponding budget, on the basis of a court order, a writ of execution is issued, which is certified by the official seal of the court and sent by the court for execution in this part to the bailiff. A writ of execution may be sent by the court for execution to a bailiff in the form of an electronic document signed by the judge with an enhanced qualified electronic signature in the manner established by the legislation of the Russian Federation. Requirements for the formats of court orders sent for execution in the form of an electronic document are established by the Government of the Russian Federation. According to Article 112 of the Civil Procedure Code, persons who missed the procedural deadline established by federal law for reasons recognized by the court as valid, the missed deadline may be restored. An application for restoration of a missed procedural period is submitted to the court in which the procedural action was to be performed and is considered at the court hearing. Unless otherwise provided by this Code, persons participating in the case are notified of the time and place of the court hearing, but their failure to appear is not an obstacle to the resolution of the issue brought before the court. Simultaneously with filing an application for restoration of a missed procedural deadline, the necessary procedural action must be taken (a complaint has been filed, documents submitted) in respect of which the deadline has been missed. Application for restoration of the missed procedural deadline for filing a cassation appeal, presentation, respectively, to the presidium of the supreme court of the republic, regional, regional court, court of a federal city, court of an autonomous region, court of an autonomous district, district (naval) military court, established by part two of Article 376 of this Code , is filed with the court that considered the case at first instance. A missed procedural deadline for filing a cassation appeal or presentation to the judicial panel of the Supreme Court of the Russian Federation, established by part two of Article 376 of this Code, and a missed procedural deadline, established respectively by part two of Article 391.2 and part two of Article 391.11 of this Code, may be restored by a judge of the Supreme Court of the Russian Federation Federation. A missed procedural deadline, established respectively by part two of Article 376, part two of Article 391.2 and part two of Article 391.11 of this Code, can be restored only in exceptional cases when the court recognizes valid reasons for missing it due to circumstances that objectively exclude the possibility of filing a cassation or supervisory appeal to established period (serious illness of the person filing the complaint, his helpless condition, etc.), and these circumstances occurred within a period no later than one year from the date the appealed court decision entered into legal force. The court's ruling on the restoration or refusal to restore the missed procedural period may be appealed. Thus, since the reason for missing the deadline is valid, the deadline can be restored. To do this, you need, along with an application to cancel the court order, to submit a petition to the court to restore the missed deadline. A sample application to cancel a court order can be found at the link: https://pravo163.ru/obrazec-zayavleniya-ob-otmene-sudebnogo-prikaza/. After the court order is canceled, the case is considered from the beginning in the general manner, including summoning you to court. Answer