Free legal consultation by phone:

8

The Russian Federation pursues a socially oriented domestic policy. Therefore, citizens of the Russian Federation have the right to certain benefits. Preferential conditions are varied and apply to most areas of human life.

One of the most significant social areas is human health. The state allows you to return money spent on improving your health through a tax deduction for treatment.

How to get money back for medicines through the tax office

Any working person can return money spent on medicines and treatment through the tax authorities. For unemployed people, as well as for students, maternity leave and pensioners, this service is not available.

The essence of the tax deduction is that funds spent on treatment are not subject to taxes. And since we receive income only after deducting 13% from its amount, this difference must be issued as a refund to the taxpayer.

You can take advantage of the tax deduction and return funds spent on treatment or medicine to yourself and your closest relatives. Close relatives are considered to be spouses, minor children and parents.

To return money spent on treatment, you must provide reporting documents to the tax office. Such documents include:

- Help 3-NDFL. You can download it from the official website of the Federal Tax Service or take it from the tax office;

- Write an application for a refund;

- An agreement for the provision of treatment from a clinic (accepted from both private and public medical institutions) or prescriptions for the purchase of medicine;

- Receipts for payment for services or other payment documents;

- Certificate of income from work.

Refunds will be made within three years, so you should not complete the paperwork in a hurry.

Compulsory medical insurance policy: how to get money back for medicines

Having a compulsory medical insurance policy, a reasonable question arises - how to return the funds spent on the purchase of medicines.

By purchasing a compulsory medical insurance policy or receiving it from an employer, citizens receive the right to purchase some medicines for free.

Medicines that should be provided free of charge are published annually in the list of essential medicines. This list can be found on the Internet or asked from your insurance company.

When purchasing medications from this list at their own expense, a citizen has the right to a refund of the amount spent from the insurance company.

To receive money, you need to provide receipts for the purchase of medications and an extract from the outpatient card about the doctor's prescription. Amounts spent on medications from the list will be refunded in full.

Who can receive compensation

Any citizen of the Russian Federation can receive a tax deduction for personal income tax if he purchased medicines during the reporting tax period and this purchase meets all the conditions for the return of money spent. However, some groups of citizens can use several ways to return money spent.

Child under three years old

Decree of the Government of the Russian Federation No. 890 “On state support for the development of the medical industry...” established that children under three years of age receive all medications free of charge with a doctor’s prescription. The possibility of compensation for costs incurred, however, is not established by the resolution.

In addition, parents of children of any age have the right to apply for a tax deduction on their personal income tax due to the fact that they purchased medicines to treat their children.

Note!

If a child is disabled, he can also count on compensation for the cost of medications by receiving a monthly cash payment.

Pensioner

If a pensioner is not disabled, he can compensate for the costs of purchased medications only by obtaining a personal income tax deduction. However, this is only possible if during the reporting tax period the pensioner had income on which he paid personal income tax. A pension is not taxable income, therefore, if the pension was the citizen’s only income, there will be nothing to compensate.

Disabled person

A disabled person has the right to take advantage of the opportunities described above to receive a monthly cash payment, as well as return part of the personal income tax paid as a deduction if the disabled person worked during the tax period and had taxable income.

How to return money for treatment to a pensioner

Pensioners who have no other income other than pension payments are not entitled to a refund of money spent on treatment, but there are exceptions.

Firstly, the money for their treatment can be returned by their adult working children.

To do this, when providing paid services, all payment documents should be drawn up in the name of a working son or daughter (sons-in-law and daughters-in-law do not have this right). Subsequently, they will be able to apply to the tax office for a deduction.

Secondly, a pensioner can receive official income from other sources, and, accordingly, pay taxes on them. It doesn’t matter whether it was a one-time income or whether it was permanent. Any taxpayer, regardless of age, has the right to a tax deduction.

The nuances of receiving a deduction: payment to relatives

There are situations in life when medications from the established list are intended to treat a child or another loved one. Then, a document confirming the degree of relationship will be added to the designated list. The age of treated children who are subject to applying for a tax deduction must be strictly under 18 years of age. The exception is for children who are disabled and completely dependent.

Children for whom you can get a deduction for medications also include those who are adopted and under guardianship. Spouses can also pay for each other's medications and receive a deduction.

Amounts of funds paid for the treatment of a grandparent cannot be recovered through a social deduction.

There is an option to use money if the medicines were purchased by a friend, acquaintance or cohabitant. To do this, you need to write a power of attorney requesting the purchase of medicines. Notarization is not required.

Medicines for a child under 3 years old - how to get your money back

A small child is not required to have a health insurance policy, but his parents should have one. The insurance policy allows you to return money spent on medicines for your child.

Be careful and better print out the list of free medications in advance so that you can purchase exactly these medications. If the medications on the list were purchased with personal money, these amounts can be returned by submitting the appropriate documents to your insurer.

As for ward treatment provided, any working parent can receive a tax deduction from it.

List of medicines for treatment with deduction

When compiling the list for allowing the claim of a tax refund, the Government of the Russian Federation took into account only international non-proprietary names. Each drug can be produced by different companies. When producing a drug based on one active ingredient, manufacturers can give it different trade names. In order for people to have more opportunities to receive a deduction, the Ministry of Health annually publishes a list of drugs that, although they have different names, have the same pharmacological properties.

If a doctor prescribes a medicine that is not on the list, the patient is deprived of the opportunity to take advantage of the tax deduction.

Here are some of the drugs on the approved list.

Anesthetics and anesthetics

- for anesthesia (hexobarbital, ketamine, halothane);

- local (lidocaine).

Group of analgesics and non-steroids

- drugs containing narcotics (morphine, fentanyl, pyritramide);

- aimed at pain relief (diclofenac, ibuprofen, meloxicam).

Antiallergic medications

This category will include the list: ketotifen, chloropyramine, quifenadine.

Group of drugs affecting the central nervous system

- anticonvulsants (clonazepam, phenytoin, ethosuximide, carbamazepine);

- treating Parkinson's disease (amantadine, biperiden, levodopa in combination with benserazide, trihexyphenidyl);

- aimed at treating a psychotic illness (haloperidol, phenazepam, parphenazine, pipotiazine, lorazepam, sulpiride);

- sedative effects with antidepressant properties (mianserin, fluoxetine, citalopram);

- to restore sleep function (zolpidem);

- for the treatment of drug addiction (naloxone).

Group against infectious positions

- antibiotic (ampicillin, cefipime, cefaclor, amikacin);

- anti-tuberculosis drugs (isoniazid, ethambutol, ethionamide);

- against viral infections (acyclovir, stavudine, nevirapine, didanosine);

- for antifungal therapy (clotrimazole, terbinafine, intraconazole);

- antimalarials (metronidazole, chloroquine).

Is it possible to get money back for medicines for disabled people?

Disabled people are socially protected by the state and many medications are free for them, and some are required to be sold at a 50% discount. It may be that the funds provided by the insurance company for treatment and the purchase of medications have been exhausted, but there is still a need for them.

In this case, you should take the necessary documents, namely: prescriptions, doctor’s orders, receipts for the purchase of medicines and contact the insurance company with them.

Having reviewed the documents provided, the insurance company will have to compensate for losses incurred in terms of purchasing medications from the vital list.

How to get a deduction for medications

Crediting a tax refund after purchasing medicines involves collecting the necessary documents:

- Declaration 3-NDFL.

- Certificate of salary amount 2-NDFL.

- Doctor's prescriptions with a note indicating that they were written specifically for the tax authority.

- Payment and settlement documents confirming the fact of purchase of medicines.

There is no maximum deadline for submitting medications only. The declaration comes with information about wages for the previous year.

The submission period is the previous three from the period in which the expenses for medicines were made. The return is preceded by a desk audit conducted by the tax authorities. The money goes to the current account within a month after the verification is completed.

Get your money back for dental treatment through the tax office

Resolution 201 contains a list of medical procedures that are subject to tax deduction. This list also includes dental treatment and prosthetics.

We draw the attention of taxpayers that pensioners who retired in the last three years and can provide a certificate of income for at least some period of these three years can also count on a tax deduction on their own.

Dental treatment is not considered an expensive procedure. The main thing is that the clinic in which the paid service was provided has a license to operate. Otherwise, no tax deduction will be provided. The procedure for completing and submitting documents to the tax office is similar to that previously described.

How to get your money back for poor-quality dental prosthetics

Having received a procedure of inadequate quality, there is no point in contacting the tax or insurance authorities; you should only contact the organization that provided the service. Responsibility for poor-quality dental prosthetics lies with the performer, that is, the prosthetist.

Often, the procedure for returning money for poor-quality dental prosthetics takes a lot of time and effort, but it is still worth dealing with this issue. You can start by writing a complaint to the clinic. The medical institution is obliged to return the money within 10 days.

If they refuse to do this, it is necessary to contact an independent expert to obtain an official conclusion about the provision of low-quality service. With this document, you can demand compensation for damage or receive a secondary, but free service. As a last resort, you can go to court.

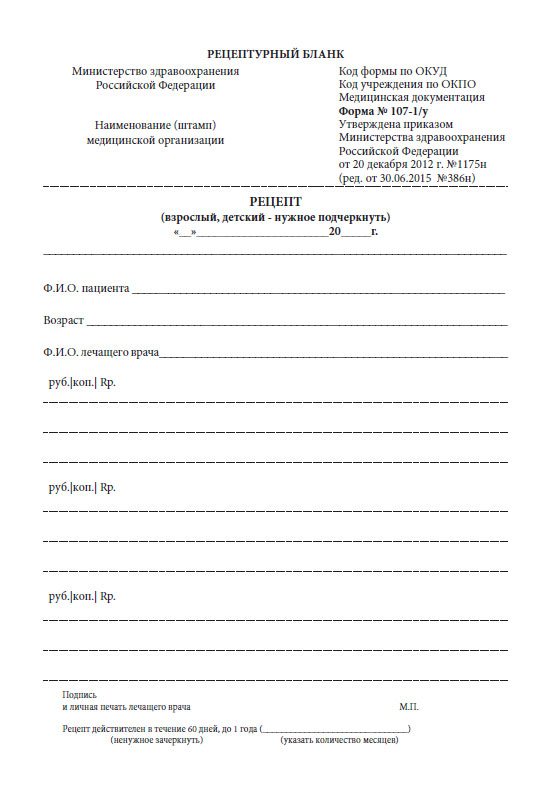

About recipe forms

In medicine, they contain the names of drugs in Latin, while the method of using the drugs is indicated in Russian. Special forms have been developed for registration. Corrections to them are not allowed. A prescription for drugs from the List is written in two copies. One is given to the pharmacy, and on the second the doctor leaves Fr.

The prescription has a validity period, which is indicated by the doctor and is up to 3 months.

The completed document must be taken to the registry office to be stamped by the medical institution. There is a recommended prescription form for receiving a social deduction - No. 107-1/u. Such a form will be accepted even after the expiration of the 3-year tax period, and the attending physician will also be able to prescribe it after the lapse of these three years. In this case, it is necessary to indicate the date of prescription of the medicine. The basis for issuing a prescription of this form with missed tax deadlines will be an entry in the patient’s medical record.

How to get some money back for treatment

Having received treatment that was paid for out of pocket, the taxpayer is entitled to a tax refund in the amount of 13% of the amount spent.

In addition, a working citizen has the right to receive partial compensation from the organization in which he works.

The amount spent, however, is limited to 120,000 rubles. All funds spent in excess of the specified amount will not be taken into account.

Refunds for treatment are regulated by Article 219 of the Tax Code of the Russian Federation. It also stipulates the right to a refund for working citizens.

How is this process regulated?

In 2021, issues regarding the provision of privileges to pensioners are regulated by a separate regulatory act, which also includes a list of medicines.

Medicines that are eligible for deduction must be prescribed by the attending physician when providing medical care.

Pensioners who do not have a disability group and did not take part in hostilities have the right to receive a 50% discount on the purchase of medicines. If a person has a certificate, then he has the right to take advantage of special preferential medications.

The state also provides compensation for the purchase of medicines by citizens who have reached retirement age. The amount of compensation payment is limited to 13% of the cost of purchased drugs and cannot exceed 15,600 rubles per year. Payment of funds and provision of discounts is made only if several conditions are met:

- The clinic where the person was treated has a license to carry out activities to provide medical services.

- All medications purchased by a person must be prescribed by the attending physician.

- Drugs must be included in a special preferential list of drugs, which is approved at the federal level.

Tax legislation clearly states that the amount of payment to a pensioner cannot be unlimited. The maximum amount of monetary compensation is 13% of the amount spent on medicines.

On a note! This requirement always applies, except for a few exceptional cases in which an individual approach to calculating the amount of compensation payment is applied.