Where to complain about scammers on the Internet

The Russian Ministry of Internal Affairs has a special department for combating crime on the Internet, codenamed “K”. To quickly respond to online fraud, it is advisable to contact us directly.

This can be done in the department “K” of the region or online on the official website of the Ministry of Internal Affairs in the “Acceptance of applications” section.

Attention! You can file a complaint against a fraudster anonymously using the Ministry's hotline. But such calls are not considered grounds for opening a case, so they are sometimes ignored.

If you don’t understand where to go, just bring a report of Internet fraud to the nearest police department. By law, the document is required to be registered and sent where required. But then you will have to wait from a week to a month until the law enforcement agencies of Department “K” begin to consider your application.

Answers to frequently asked questions

Let's look at the answers to the most popular questions about predatory methods in relation to payment instruments.

The fraudster knows the card number and mobile phone number - should you be afraid?

Theoretically, yes. But it is very difficult to overcome the bank’s security systems, so robbers often use simpler methods.

They are trying to withdraw money from a Sberbank card - what to do?

Immediately contact the hotline 8-800-555-55-50 to block the plastic. If the money has already been withdrawn, file a claim of disagreement with the transaction and demand the return of your finances.

How scammers withdraw money from a bank card via mobile banking

This can happen if a mobile device with the Mobile Bank utility is active is stolen or lost, or if the phone number is changed, provided that the service remains assigned to the previous one.

Can scammers withdraw money from a card using a phone number?

This is possible if the card is connected to the Internet bank and to the phone. Using a mobile number, scammers obtain card details and carry out transactions without notifying the holder.

How scammers withdraw money from a bank card without a PIN code

To do this, they need the CVV code recorded on the back of the payment instrument. Fraudsters can get it when you make purchases on the global network.

Is it possible to get my money back?

Attention! Regardless of the amount involved in the deception, the victim has the right to return the funds through the court.

During a standard fraud investigation, only amounts considered significant by law are returned - from 2,500 rubles. However, they are collected from the fraudster, so the police do not guarantee their return.

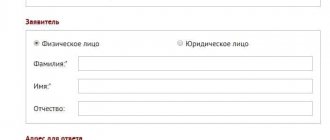

How to write a statement correctly

An application for online fraud contains a standard header (who is being addressed and where), the word “Application” in the middle of the sheet (type of document), a statement of facts, a date, and a signature. Basic information should include:

- scam site;

- name of the online store, full name of the owner/nickname of the criminal on the forum;

- account number where the money was sent;

- phone number, email address, other contacts of the scammer;

- a detailed description of the fraud that occurred.

It’s great if there are witness statements, material evidence, photos or videos. All this must be added to the application and listed in a list after the additional line “Attached to the complaint.”

Deception in an online store: variations on the theme of fraud

There are not many standard deception schemes, and each one is quite easy to identify at the purchase stage. The most unpleasant thing that awaits the client is the situation when, after receiving the money, the online store simply stops responding to letters and calls. Here, the fact of fraud is easy to prove if you have screenshots of letters and a completed order form. But there are also less obvious schemes that are revealed only after you make a purchase:

- the order is incomplete;

- additional payments arise (not specified during registration);

- the product does not correspond to the description on the website;

- they sell you a counterfeit or low-quality product;

- Delivery deadlines were missed.

What to do if you are deceived in an online store

In case of fraud committed in an online store, you should write a complaint to the contact address indicated on the website page of the same name. You need to outline the essence of the fraud, your proposals for its resolution, and your requirements. It is advisable to do this not only electronically, but also send the document to the office address.

If the complaint is ignored, it is correct to complain about the online store to department “K”. However, this is only possible in case of obvious fraud (the goods are paid for, but not delivered).

If you receive low-quality products with a defect or not the one you ordered, the appeal should be addressed to Rospotrebnadzor. He deals with violations of consumer rights.

Attention! If you were deceived by a seller on the trading platform, you need to notify the site’s arbitration.

In most cases, the money is returned or compensated, and the fraudster’s account is deleted. But sometimes the site administration says that it has nothing to do with the sellers and is not obliged to compensate for the damage. Then all that remains is to contact law enforcement agencies. And you know where exactly to write about Internet fraud.

How scammers can withdraw money from a bank card

Criminals know a large number of methods for stealing capital from their victim’s plastic card. And sometimes the holder of the payment instrument himself turns out to be to blame for the theft or contributes to its commission through his imprudence.

Skimming

This is the theft by bandits of information from a card in the process of withdrawing money or paying for a service at an ATM using a special invention - a skimmer. The device can be made in the form of an overhead keyboard or inserted inside a card reader.

ATMs: from fakes to missing ones

Scammers are buying back ATMs previously used by banks and equipping them with skimmers.

When a customer inserts a card and tries to make a transaction, the machine refuses to complete the transaction, and the fraudsters get the data they need. Fake ATMs can masquerade as devices from well-known banks and can be difficult to detect.

Sometimes criminals steal ATMs. True, this happens infrequently.

POS terminals

Fraudsters install devices or software in payment terminals that read card data and then use them for personal purposes. Another option: an unscrupulous employee of a store or cafe adds small amounts to the paid invoice in the hope that the buyer will not pay attention.

Using their own wireless terminal, criminals can withdraw money from their victims through clothing or bags in crowded areas.

Cashless payments

Fraudsters create fake online stores in which only one way to purchase products is possible - 100% prepayment via bank transfer. The buyer transfers money to the card number of an unscrupulous person, but the goods are never sent to him or a counterfeit product arrives.

When making payments on trading platforms, you can suffer from robbers. The card owner uses the received link to go to the cybercriminals’ website, where information about his bank card becomes available to them.

Unsafe applications

Such programs include “Mobile Bank”. Having stolen the phone, the criminal can log into the application and use the card to pay for something or make a transfer.

Free wifi

Cyber criminals can create fake Wi-Fi networks, disguising them as free ones. When the owner of a gadget connects to such a network, all the data on his device ends up in the hands of scammers. Such free networks are most often used in bars, restaurants, airports, etc.

Mysterious messages

These could be SMS supposedly from relatives in an unpleasant situation, about a win, about a card being blocked, about an accidental top-up of a mobile account by a stranger demanding a refund, etc.

Very often, thieves send SMS messages from fake bank service numbers demanding a card PIN code or other confidential information.

Fake sites

Scammers create fake web pages similar to the official websites of well-known banks and oblige cardholders to leave their confidential information. Having received the data, the attackers steal money.

Phishing

This is the deception of payment card data from their owners. For example, a person calls based on your advertisement for the sale of something, who offers to make an advance payment and asks for card details, without being at all interested in the very characteristics of the product.

We bring to your attention the video “Bank card fraud”:

Where to report a violation other than the police

You can report fraud not only to the police. For example, in electronic payment systems (WebMoney, Yandex, Qiwi, etc.) a security service operates promptly. It blocks the fraudster’s wallets and provides his passport information if necessary.

There are services where you can add a site to the “Black List”. The largest of them, where resources that have proven themselves to be Internet scammers are listed, are as follows:

- https://www.google.com

- https://analysis.avira.com

- https://virusdesk.kaspersky.ru

Money will not be refunded on such services, but scammers are unlikely to be able to continue their activities.

What punishment awaits scammers?

Responsibility under the Criminal Code of the Russian Federation arises for theft of 1000 rubles or more. The minimum punishment for an Internet fraudster provided for by law is an administrative fine. In some cases, arrest for up to 15 days and compulsory labor are considered.

If there are aggravating factors, the punishment for an Internet fraudster is increased to 4 months or more. Particularly large amounts are punishable by up to 10 years and confiscation of property.

Which article provides for liability?

The main article under which Internet fraudsters are held accountable is No. 159 of the Criminal Code of the Russian Federation, part 6. In addition to it, the case can be qualified based on the totality of articles as:

- Fraud (#159). It covers any situation in which a citizen has lost his money or property by fraud.

- Extortion (No. 163). This article is suitable when a fraudster blackmails you into revealing personal data to the public if he does not receive a ransom for it.

- Violation of the rules for operating a PC or information networks (No. 272–274). This is how illegal hacker actions that lead to system/software failures and computer breakdowns are classified.

For example, if a computer is hacked by a group of people with the intention of stealing personal documentation and extorting money for it, the scammers will suffer the maximum punishment. It amounts to at least 10 years of maximum security imprisonment. But only the court has the right to choose the appropriate punishment.

Where can I contact?

Crimes committed on the Internet are subject to the same penalties as crimes committed in real life. In this case, this is Article 159 of the Criminal Code of the Russian Federation “Fraud”. Fraudsters may be additionally charged with other offenses:

- illegal business;

- crimes in the field of computer information;

- blackmail;

- extortion, etc.

Each case has its own unique characteristics. Depending on the situation, the victim should contact one of the following units of the Ministry of Internal Affairs of the Russian Federation:

- The police are searching for the intruder.

- The prosecutor's office establishes the guilt of the offender and controls the work of the police.

- The court determines the preventive measure and decides to return the money to the victim.

- Directorate “K” (cybersecurity) is a special unit of the Ministry of Internal Affairs for combating crimes in the field of information technology.

- Department for Combating Economic Crimes (OBEP) – fights illegal acts in the financial sector.

- Roskomnadzor is a service for monitoring the IT and mass communications sphere.

- Virtual payment system support service - if you transferred money to a fraudster to an electronic wallet.

- Bank hotline - if money has been debited from your account.

How to Prevent Internet Scams

To avoid being deceived online, carefully check the sites and users you come into contact with. The lack of reliable information, real photographs, the interlocutor’s reluctance to share receipts or other evidence of rational spending of funds (in the case of donations) should raise red flags.

Financial pyramids, “Nigerian letters”, and other methods of electronic fraud are easily verified. Enter the name of the organization or one of its members into a search engine and read the results.

There are special sites that reveal such fraud. Many ordinary users leave angry reviews on their pages on social networks/blogs after falling for scammers and similar scams.

Replacing the payment page

You want to purchase something on a well-known website. The seller invites you to pay for your purchase online and sends you some kind of link. He claims that the buttons for placing an order, delivery or payment do not work on the site itself and hurries to follow the link sent to him. This is always a lie that is uttered for the sole purpose of luring you away from the real site to a fake version. Do not follow the link, much less enter your data there, even if its address is similar to the original one, and the page you land on looks exactly like the site you were on.

“If you buy or sell something on Avito, then the link can only be to the Avito website - www.avito.ru. If the address is similar, but not the same (for example, avitopayments.ru, avito-dostavka.ru, avitto.ru) - this is fraud. Moreover, you do not need to follow the links, since everything is already inside the avito.ru website. There is simply no need for an honest seller or buyer to send you a link. Attackers create Internet pages that are very similar to the payment section of a well-known website. After paying on such a page, at best you will not see either money or goods; at worst, other funds will be withdrawn from your card. Our security team monitors what happens on our platform, we warn the user when he receives a link that under no circumstances should he click on the links. However, if the buyer leaves using the link, we can no longer influence the transaction,” explains Kirill Lavrov.

In this way, not only buyers, but also sellers are deceived. When a person displays a product, he receives a call from a buyer who supposedly needs this product very urgently, finds out his details and sends a link - supposedly he has already transferred funds through the payment system or the internal service of the site. You just need to click on a button like “receive funds” or “deposit”.

Large online platforms are designed so that it is convenient for the seller and buyer to communicate and complete a transaction without going to third-party sites. In the built-in messengers of such platforms, it is often not even possible to insert an external link into the text of the message. If your interlocutor tries to take you to another site under various pretexts, refuse the deal. On a fraudulent site, you are not protected by anything and will not even be able to contact technical support for the trading platform you left.