Procedure for blocking funds

To remove the arrest, you need to follow step-by-step instructions. First you need to contact the bank. Further actions are determined by the legality of the blocking. Bailiffs have the right to block the card of Tinkoff and any other bank.

Client contacting the bank

If the bailiffs have seized the card, you need to contact the bank to find out the number of the writ of execution and receive an account statement. The paper confirms the source of funds - wages, pensions, social benefits, etc.

Collection of documentation

Then you need to collect the necessary papers. It is important to officially confirm the status of the account. For salary cards, the employer takes an extract from the company’s accounting statement and a copy of the work book. The documents are sent to the bailiffs. If a social card is blocked, a request is sent to the bank to unblock it. In the case of a salary account, the SPI sends a request to the debtor’s work in order to withdraw a certain amount from wages to pay off the debt.

Airat Flyurovich

Lawyer for work with bailiffs. Work experience more than 12 years

Ask a Question

In accordance with Part 2 of Art. 99 of the Law on Enforcement Proceedings, the maximum amount of recovery from a salary card, as a general rule, cannot be more than 50% of the employee’s income.

Application for a reduction in the amount of the deduction or for the removal of the seizure completely

The bailiffs have no information regarding the seized debit card. In addition, the account is not always a salary account, which leads to significant write-offs. To prevent such an outcome, you can spread out the debt by submitting a request to reduce the amount of the deduction. If you managed to pay off the debt immediately, you will need to fill out an application for a complete lifting of the seizure.

Which card account cannot be blocked by bailiffs?

According to current legislation, bailiffs can write off funds from the card where a citizen’s wages are received. In its absence, a request is sent directly to the citizen’s place of work. Debts can be collected from pensions, business income or freelancing. First, SPIs check the availability of cards from Alfa Bank, Sberbank and other large organizations.

Bailiffs can withdraw remaining funds from a credit card if this option is provided for in the agreement. By law, you can write off no more than half of your monthly profit. It is permitted to confiscate shares, deposits, and securities in full.

Which accounts are prohibited from being blocked (Federal Law No. 229, Article 101):

- Amounts paid as compensation.

- Preferential and social payments (disability benefits, compensation for the loss of a breadwinner, etc.).

- Funds that are withdrawn from the account each month as child support.

- Money allocated for a business trip or replacement of work tools.

- Finances allocated by organizations in connection with the death of relatives, the birth of a child, etc.

- Insurance payments (with the exception of ordinary pensions).

Procedure for removing seizure from a bank card

If bailiffs blocked a salary card and acted within the framework of current legislation, then the easiest way to unblock the account is to pay off the debt. If there are no funds to pay off the debt, you can write an application addressed to the head of the FSSP body with a request to pay off the debt in installments or to collect a certain amount from the salary. When the debt is fully repaid, the bailiff sends a Resolution to the bank with instructions to unblock the card.

If the seizure of funds is illegal, then you need to contact the FSSP with a statement about the unlawful actions of the bailiffs. The document is drawn up in two copies. One of them is stamped with a stamp indicating that the paper has been accepted for consideration (this copy remains with the applicant). Along with the application, you must provide a certificate confirming the source of the money. After reviewing the documents, the card is immediately blocked.

In case of an unreasonable refusal (or ignoring) of an application to remove the seizure from a bank card, we recommend that you urgently seek the help of a lawyer in the field of enforcement proceedings.

Deadline for lifting the arrest

To unfreeze an account, it is important to demonstrate interest in repaying the debt. If you have funds, you can pay the debt immediately or provide confirmation of payment of the amount in several payments.

The average period for unlocking a card is 2-3 banking days.

Correct design

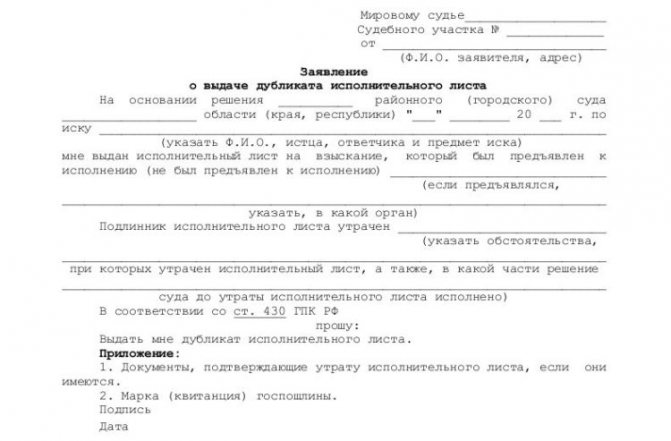

The law of Russia in 2021 established the form of such paper. And it is precisely this that should be filled out in printed form, not in writing.

Fill out the header in the upper right corner. We write down the full name of the service to which we are submitting the document. Last name, first name and patronymic of the head of this institution. Next, we indicate the full details of the person submitting the application. If it is from an individual: last name, first name, patronymic, registration, telephone number and bank account. If the application is from a legal entity: the name of the organization, in full, which it represents, registration number, current addresses of the company.

Next comes the text. In the middle of the sheet we write the word “Statement”. And its text. Here we enter information about the writ of execution issued by the court: its number and date. All possible information for contacting the defendant, his addresses, accounts, telephone numbers, etc. We describe the reason for filing the document, including the amount of the debt. It is worth indicating a list of attached documents.

This paper is accepted on the same day it is submitted. It is recorded in the log of received correspondence.

The above-mentioned papers are written in the same way.

How to find out who wrote off money from the card

People usually learn about the blocking of funds in an account from an SMS about the debiting of money or the arrest of a bank card. Problems are also indicated by the inability to carry out any operation, a significant decrease in the balance, etc.

To find out who blocked the account, you need to contact the bank. Upon request, an employee of the institution provides the number of the enforcement proceeding, the amount written off, and the name of the FSSP employee who issued the resolution. You can also check information about debts online. After this, it is enough to compare the details of the provided document with the information on the official website of the Federal Executive Bailiff Service.

How much money can they hold?

If there are enough funds on the card to repay the debt, then the entire required amount is withdrawn. First, the money goes to the FSSP, and then is transferred to the recipient (creditor, tax service, individual, management organization, etc.). The citizen learns about the debiting of funds from an SMS notification.

If there are not enough funds in the account, it is blocked . The entire amount is debited from the account, and then 50% is charged from each receipt. The consequences of arrest are blocking the card until the entire amount of the debt is written off.

No unlocking. What to do?

For a bank to unblock a card, it must receive a formal request from the regulator. Judging by reviews on the Internet, this takes on average 2-3 days. If the account remains inaccessible, then a notification must be sent to the FSSP with a request to provide an explanation as to whether the order to lift the arrest was sent to the bank.

Then obtain confirmation of no claims directly from the debt collection initiator and provide it to the financial institution. If the unlocking of the card continues to be delayed, you need to file a complaint and go to court.

Filing an administrative claim against the actions of a bailiff in court

An administrative claim against the actions of a bailiff is filed with the district court at the location of the bailiff service, the official whose actions are being appealed. The administrative claim is accompanied by a copy for the bailiff.

If a decision on a complaint against a bailiff may affect the rights of another party to enforcement proceedings, then a set of documents for this party is attached to the administrative claim, and it is indicated in the application as an interested party.

Applicants are exempt from paying state fees to the court when filing an administrative claim against the actions of a bailiff.

Ways to receive salary when an account is frozen

Bailiffs send requests to all banks where there may be cards of the debtor or his employer. No more than 1/2 of income is deducted from wages. To get the other half, the account holder can use a few helpful tips.

Ways to receive the second half of your salary when your account is frozen:

- Make a new MIR card or open an account in any other bank, which the executive service will not find out about soon.

- Ask the employer to hand over part of the salary through the organization’s cash desk.

But the first option is regarded by the bailiffs as concealment. In addition, the enforcement service quickly detects all cards in the name of the debtor. Receiving cash in an amount that will not exceed 50% of wages is absolutely legal, but not all employers agree to this arrangement.

If all the money was debited from the account or the card was unexpectedly blocked, most often users turn to lawyers for advice online. The most frequently asked questions are standard and have legally valid answers.

FAQ

Why are bank accounts immediately seized? How else can you pay off your debt?

By law, bailiffs immediately seize non-cash accounts, as this is the fastest and most effective mechanism for repaying debt. Only then is the property confiscated. If you immediately take away movable and immovable assets, then the duration of debt payment is delayed, since first the property must be found and then sold.

Why don’t bailiffs notify of their intentions? How should I know if my account is blocked?

Cards are not seized by bailiffs without notice. The order to collect the debt is sent to the individual and the banking organization by mail. But by the time the notice reaches the addressee, the bank has already managed to fulfill the court’s order.

Can they not notify about collection of funds at all?

An arrest without warning occurs if the creditor personally contacts the bank directly with a court order. This is a completely legal event.

Do they write off the money right away or do they block the card first?

The bailiff has the right to simply seize the account. But this is not necessary if you can immediately withdraw the amount of debt and transfer it to the creditor.

How long will I not be able to use my bank card?

If there is an amount in the account that can cover the debt, then the bailiffs immediately write it off and the citizen can continue to freely use the card. When there are not enough funds to repay the debt, the account is blocked. The arrest continues until the debtor satisfies the claimant's demands. In addition to the debt, the enforcement fee, which is indicated in the court order, is written off. The enforcement fee is equal to 7% of the amount of debt, but not less than 1,000 rubles from a debtor-citizen or debtor - individual entrepreneur and 10,000 rubles from a debtor-organization.

What to do if a card with maternity capital, disability pension or other government payments is blocked?

By law, you cannot write off money from a survivor's pension card or other social security accounts. If this happens, you need to contact the FSSP by writing a corresponding statement and documenting the source of funds. The bailiffs do not have detailed information about the accounts. After receiving confirmation of the source of the charges, the FSSP department sends a resolution to the bank with instructions to unblock the social card.

Deadline for filing a complaint against the actions of a bailiff

Before filing an administrative claim, please note that the time limit for filing a lawsuit is limited to 10 days. 10 days begin to flow the next day after the bailiff performs some action or makes some kind of decision. These deadlines are applied by the court independently; this does not require a separate petition from the defendant.

If the complaint is filed outside the deadline, it must be accompanied by an application to restore the deadline for the administrative claim. The fact that you learned about the completed action outside the deadline may lead to the restoration of the deadline, but the deadline still needs to be restored.

The deadline for filing an administrative claim is easy to calculate if a decision of a bailiff is being appealed. In this case, we start from the date of its adoption.

It is more difficult to calculate the deadlines for appealing the inactions of the bailiff. We recommend using common sense in such situations. Start from when you should have learned about the completed action (inaction). It should be noted that in some cases the inaction is ongoing (for example, the bailiff does not seize the debtor’s property). If the nature of the violations of rights is ongoing, time limits do not apply.