Obtaining a driver's license in the modern world is considered common not only for adults, but also for individuals who have recently crossed the threshold of their 18th birthday. A pleasant moment for a rookie driver will be a tax deduction for training in a driving school. Successful passing of the theoretical exam and driving practice lead to the acquisition of the long-awaited document.

As a rule, rarely does anyone receive rights free of charge. Mostly people use the services of private driving schools and pay some sums for the educational services provided. Another article will tell you about the legislative side of the issue, how to apply for compensation, what is required for this and will reveal other important subtleties.

Legislative regulation of the issue

Officially employed Russian citizens have the right to count on some tax breaks from the state. Thus, at the legislative level, various tax deductions are provided for, fixed in Art. 219 of the Tax Code of the Russian Federation. Among them there is also compensation for training expenses.

The majority of users of reimbursement of part of their study costs are students pursuing a profession at a university or other educational institution. However, this does not mean that issuing a refund for driving lessons is prohibited. This type of expense also applies to education expenses.

IMPORTANT !!! Since the deduction is socially oriented, it is possible to apply for a refund annually if there are grounds.

For example, in 2021, Smirnov paid for his own driving lessons and received compensation for taxes. In 2021, I paid for the child and will also be able to claim a deduction.

How to get a tax deduction for your education

You can study at a university, college or take courses in any form - full-time, evening, part-time, distance learning. To return part of the expenses, the following conditions must be met:

- you are a tax resident of the Russian Federation;

- you are officially employed and pay 13% personal income tax or have other income on which you pay tax;

- The educational institution where you pay for education is licensed.

The university may be located abroad, this is not an obstacle to a tax refund.

In order to return the tax, you must submit a package of documents to the inspectorate at your place of residence, including a 3-NDFL declaration and an application for deduction.

Quick registration and help from a tax expert!

Register

Conditions for granting compensation

Not every applicant will be able to actually receive a deduction, even with the expenses incurred.

The legislator has determined the requirements for:

- the identity of the person wishing to receive compensation;

- the educational institution where the training takes place;

- the permitted list of persons for whom you can receive a deduction when paying.

They will not be able to issue a deduction:

- Not working people.

- Unofficially employed, without an employment agreement.

- Students who have no income other than a scholarship.

- Women on maternity leave.

- Pensioners living solely on pension funds.

Compensation will not be provided if:

- the educational organization does not have permission to carry out this type of activity or the license has expired and has not been renewed.

It is possible to issue a refund of part of the expenses upon payment of tuition fees for the following individuals:

- For your own self-education. In this case, the form of training does not matter when submitting documentation to the inspection.

- When paying for a son or daughter, both your own and adopted. Here it is necessary that training be carried out compulsorily according to the full-time education model and the child’s age does not exceed 24 years.

- For a sister or brother. If the student is not older than 18 years of age.

ATTENTION !!! Thus, it is possible to receive compensation if the applicant complies with a number of established requirements. However, the requirements are not considered difficult to implement and many people take advantage of the benefits.

If your teacher is an individual entrepreneur

When training as an individual entrepreneur, there are nuances. It all depends on how the individual entrepreneur carries out its activities - directly or with the involvement of teaching staff (clauses 1 and 5 of Article 32 of Law No. 273-FZ).

If an individual entrepreneur attracts other teaching staff , he must have a license. Only in this case will you be able to receive a tax deduction for training from such an entrepreneur.

If the individual entrepreneur works alone and personally teaches you or your child . In this case, he may not have a license (clause 2 of Article 91 of Law No. 273-FZ). And this will not be an obstacle to your receiving a tax deduction for education.

In order to return the tax, you must submit a package of documents to the inspectorate at your place of residence, including a 3-NDFL declaration and an application for deduction.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Some features of the deduction

Each individual benefit from the state has its own characteristic features. The commented type of compensation is characterized by:

- when courses are paid for exclusively by the employer, without the participation of the employee’s funds, the latter is not entitled to claim benefits;

- Individual entrepreneurs operating under the simplified taxation system will not receive compensation;

- when spending funds from maternity capital, there is also no deduction;

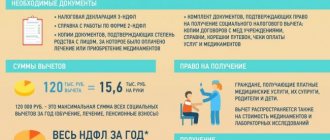

- The law sets maximum amounts from which 13% is calculated. With expenses for your own education - 120 thousand rubles, for each child - 50 thousand. That is, 15,600 for yourself, 5,500 for children;

- the amount of the payment does not increase if both parents receive a deduction for one student;

- The statute of limitations for applying is three years. That is, it is possible to receive a deduction for the last 3 years. For example, a girl studied at the institute from 2021 to 2021. She did not apply for compensation for tuition fees annually. Now you can apply for the benefit for 2018, 2021, 2021.

When and for what period can a tax be refunded?

Tax deductions can be issued only for those years when you actually paid for education.

The 3-NDFL declaration and application are submitted next year after the year of payment. If you paid for training in 2021, then the documents are submitted to the inspection in 2021. You have three years to process your tuition deduction. For example, in 2021, you are entitled to a tax refund for 2021, 2021 and 2021.

After receiving the documents, the Federal Tax Service begins a desk audit. This takes up to three months. If the inspector has no comments and all the paperwork is completed correctly, within 30 days the money will be credited to the account you indicated in the deduction application.

There is another way to receive a tuition deduction - through your employer. In this case, you don't have to wait until next year. Upon notification from the tax office, your company will suspend the transfer of 13% of your salary to the budget until the entire refund amount has been exhausted.

Place your order and we will fill out the 3-NDFL declaration for you!

Order a declaration

Design methods

Payments can be calculated and processed in two ways:

- Through the Federal Tax Service.

- Through the employer.

In both the first and second cases, you will have to contact the tax office, but the difference lies in several points.

Comparative characteristics can be viewed in the table:

| In inspection | At the employer's |

| You will need a complete list of papers, including 2-NDFL, as well as an income declaration | Notice from an authorized institution about the authorization of accruals, employee statement |

| You can submit documents after the preference arises in the next reporting period | Documentation is submitted immediately after the prerogative for registration arises |

| The verification period is 3 months and the transfer is expected within another 30 days | Throughout the month, information is updated and payment is made in the same month. |

| The entire amount will be charged | They transfer their dues in installments, monthly along with their salaries. |

The payer decides which of the registration and transfer methods to choose. From the point of view of ease of submission and verification, the method of registration through the employer wins. However, many are attracted by receiving the entire amount at once and for this reason they choose to submit documentation and petitions to an authorized institution.

The registration procedure through the Federal Tax Service will require the following actions:

- Visit the branch at the place of registration with a package of papers;

- write an application for a deduction, indicating information about the personal account to which you would like to receive the transfer;

- wait for the check to complete;

- wait for the funds to be transferred.

If you choose to apply for compensation through the accounting department at your company, you will need:

- Collect documentation and contact the authorized body to obtain permission to make payments.

- Wait for a notification from a government agency.

- Pick up a notice from the tax office.

- Record the application and send the documents to the management of the organization.

- Receive an increased salary (without deduction of personal income tax) until the period when the benefit amount is exhausted.

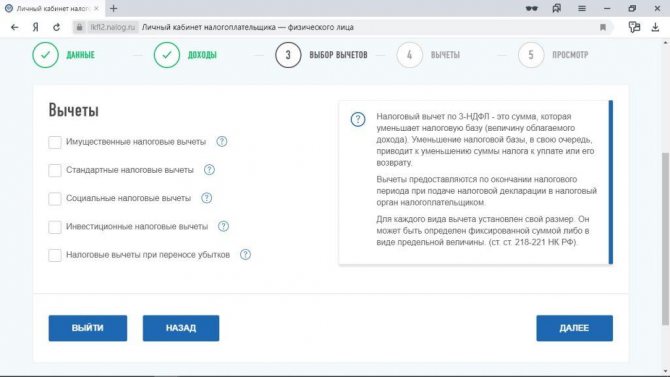

Is it possible to submit applications online?

For many people, the main disadvantage of the procedure for obtaining a tax deduction seems to be the need to travel to the tax office - of course, this will take a lot of time, and not everyone has the opportunity to devote it to this. Fortunately, today there is an option to apply online. To do this, just go to the appropriate portal, upload pre-scanned documents to your personal account and submit an application. The full set of processes is quite simple and does not require much time to be spent on it.

Is it possible to get a tax deduction by studying at Autotema?

When deciding to enroll in courses, many people think about the possibility of receiving a tax deduction when applying to a specific institution. If you enroll in our driving school in Moscow, you can count on paying part of the amount you give us for our services. We have a license, so if you comply with other conditions, you will receive the maximum benefit. Want to clarify any questions? Our employees will advise you in detail at the most convenient time - just call us!

Basic manual transmission course

- Full course of theoretical studies

- 28 hours of practice

What's included in the program:

- 2 lessons at VEC

- Exam in the traffic police

- Educational literature

- Petrol

- Registration and submission of documents to the traffic police

- Submitting a car for an exam

RUB 27,000

Submit your application

Full manual transmission course

- Full course of theoretical studies

- 56 hours of practice

What's included in the program:

- 2 lessons at VEC

- Exam in the traffic police

- Educational literature

- Petrol

- Registration and submission of documents to the traffic police

- Submitting a car for an exam

RUB 36,000

Submit your application

Basic automatic transmission course

- Full course of theoretical studies

- 28 hours of practice

What's included in the program:

- 2 lessons at VEC

- Exam in the traffic police

- Educational literature

- Petrol

- Registration and submission of documents to the traffic police

- Submitting a car for an exam

28,000 rub.

Submit your application

Full automatic transmission course

- Full course of theoretical studies

- 54 hours of practice

Required Documentation

In 2021, the list of documents to be submitted to the Federal Tax Service includes:

- applicant's identity card;

- request for provision (indicate the information of the body to which the application is submitted, information about the person wishing to apply for the benefit - full name, address, contact information, Taxpayer Identification Number, basis for provision from the law - Article 219 of the Tax Code of the Russian Federation, date and signature);

- income declaration (the profit received by the applicant for the past period is recorded);

- certificate 2-NDFL (the employee’s salary is recorded, transfers transferred for him monthly and in total for the year);

- a duplicate of the agreement on the provision of educational services;

- confirmation of the license of the educational institution;

- payment documents confirming the fact of expenses incurred. An important nuance here is that the applicant should be indicated as the paying party. They can be different checks, receipts, payment orders;

- To confirm family ties with children, you will need their birth certificate;

- when receiving benefits for a ward or adopted child, documentation is also provided proving the status of the legal representative.

There are three ways to submit documentation:

- When visiting the branch in person. However, wasting time, standing in line, as well as the need to submit only to the authority at the place of registration, but not residence, make this method not entirely attractive.

- Use postal transfer services. To do this, along with the letter, you should send an inventory of the paper support included in the valuable cargo. You should also take care of the notification.

- You can apply for a deduction through government services or the official website of the Federal Tax Service. The method is most convenient for regular Internet users, since it allows you to carry out the procedure without leaving your home. But to use it you need to have a verified account.

Upon expiration of the inspection period, the inspectorate will notify the applicant as appropriate. If the decision is positive, the money will be transferred to the specified account within 30 days from the date of completion of the verification.

Upon acceptance of the refusal to deduct, the applicant is sent a letter justifying this conclusion.

Documents for tuition deduction

Documents from the educational institution:

- An agreement between you and the educational institution. It is enough to attach a copy.

- License. Copy.

It is not necessary to attach a license if its details are specified in the contract. Copies can be certified at the educational institution or in person.

If the university is located outside of Russia, then a package of documents is required, which is issued by the university upon admission. Among other things, the package must include a document stating that the university has the right to conduct educational activities. Notarized translations are submitted to the Federal Tax Service.

Payment documents : receipts, payment orders, checks. You can restore the lost document where you paid: get a payment certificate from the university’s accounting department or confirmation of payments from your bank. If the tuition fee has changed, do not forget to attach a supporting document.

Help 2-NDFL. Issued by your company's accounting department. If you changed several jobs during the reporting year, you must provide 2-personal income tax from each employer.

Declaration 3-NDFL . The original is provided to the Federal Tax Service.

Tax refund application. It indicates the account details where the money will be transferred after the deduction is applied.

Passport. A certified copy is accepted.

If you paid for your children’s education, you will additionally receive:

- Child's birth certificate. Copy.

- A certificate from the educational institution stating that the child is a full-time student. Original.

To receive a deduction for the education of a brother or sister, you need:

- Your birth certificate. Certified copy.

- Birth certificate of brother, sister. Certified copy.

- A certificate from the educational institution stating that the brother/sister is a full-time student. Original.

Find out what documents need to be submitted in your case!

To get a consultation