Free legal consultation over the Internet 24 hoursLawyer on housing issues in St. Petersburg. Free legal consultation on labor disputes.

5/5 (1)

Is it possible to return interest on a loan from Sberbank if repaid early?

In one of its rulings, the Supreme Court of the Russian Federation clarified that, based on the norms enshrined in Article 809 of the Civil Code of the Russian Federation, interest on a loan represents a fee for the bank’s services in providing borrowed funds. Thus, the citizen is not obliged to pay for these services for the time when he did not actually use these services.

Attention! An analysis of practice shows that most Russian credit institutions use annuity, that is, equal payments. Because of this, when the borrowed funds are repaid early, the credit institution is unjustly enriched, since payment was taken for the use of the borrowed money for a time when this money was not actually used by the person who received the loan.

From the above-described ruling of the Supreme Court of the Russian Federation, it follows that the person who has attracted borrowed funds and returned these funds to the credit institution ahead of schedule, has the right to return part of the money paid as interest on the loan.

When is it possible to return interest on a loan?

Interest forms the bank's profit, which is extremely important to it. No financial institution will simply return money to borrowers. But in some cases, the borrower receives the legal right to return part of the interest:

- In case of early repayment of the loan.

- If you are eligible for a tax deduction.

- If this is provided for in the loan agreement.

We will consider all these options in detail. Only under these three circumstances can interest on the loan be returned; in all others, nothing can be done.

When can you request a refund?

It is necessary to pay attention to the time period during which the client has the right to contact the credit institution with a request to return interest in case of early repayment of borrowed funds.

These include the following items:

- application of a differentiated scheme. This option assumes that in the first part of the time period for which borrowed funds are provided, the citizen contributes a larger amount of money to repay the loan compared to the second part of this period. In this situation the percentage will be negligible;

- shortly before the expiration of the agreement under which the borrowed funds were raised, the money was returned to the credit institution almost in full. Until the loan is fully repaid, the citizen remains to make 2-3 payments. In this situation, the interest accrued on the use of funds is almost completely paid, and the remaining payments go to repay the principal amount of the debt. A refund of interest can be requested, but the amount of this refund will be small;

- borrowed funds are raised for a short period. For example, a loan was received for 4 months. In this situation, interest is distributed almost equally over the entire period of the loan. Demanding a refund of interest is virtually meaningless.

A citizen, before writing an application requesting a refund of interest, must study the loan repayment schedule.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

When can a borrower return the money overpaid for the mortgage payment?

More than half of conscientious borrowers pay off their mortgage debt before the end of the contract, while specifically specifying a long term when applying for a loan. There are two options that are the basis for recalculating the payment amount by the bank in which you can count on a refund of interest paid:

- Partial early repayment. That is, the borrower regularly or several times knowingly pays money that exceeds the required monthly mortgage payment. In these cases, the bank, in order not to miss out on its benefits and so that you do not claim a refund of overpaid interest when repaying your mortgage early, offers to either shorten the term of the contract or reduce the amount of the monthly payment. In this case, the borrower also does not lose, since the bank recalculates the amount with the deduction of what has already been paid;

- Full early repayment. This means that at the time the loan agreement is valid, the borrower pays off the entire amount of debt with a lump sum payment. The annuity payment system of all banks at this moment generates an overpayment of interest, since it was based on a longer period and it is precisely this difference that borrowers can return.

Recommended article: Mortgages for families with 2 children in 2021

It is the second case that serves as the legal basis for the situation in which you can safely contact the bank and demand compensation for the difference in the overpayment, but only for the period of time when full payment has already been made and the contract was not in force .

The legal grounds providing for the borrower's rights to interest reimbursement are regulated by the regulatory legal acts of the Russian Federation and the explanatory regulations of the Central Bank of the Russian Federation.

Carrying out a return

Let's take a closer look at the procedure for returning interest to Sberbank PJSC:

- make an application for the return of interest. Apply with a written application to the bank branch no later than 30 days before the date of planned loan repayment;

- repay the loan. This action should be carried out before the moment specified in the agreement under which the borrowed funds were raised;

- after the loan is fully repaid, the citizen must contact the bank branch with a request to issue a certificate stating that this citizen has no debt to this banking organization. Please note that this certificate is provided free of charge;

- calculate the amount of overpaid interest using a special calculator;

- draw up and submit a new application to the credit institution demanding the return of funds overpaid as interest.

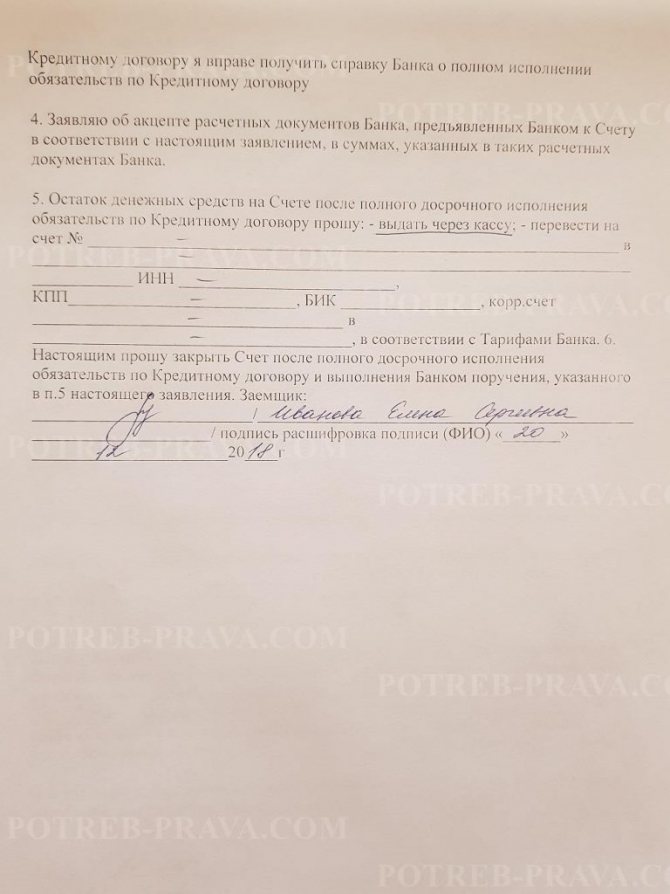

ATTENTION! Look at the completed sample application for full early repayment of the loan:

Refunds under special bank programs

This happens sometimes in the market. For example, the bank is ready to return to the borrower part of the interest paid, subject to certain conditions and mandatory repayment of the loan without omissions or even the slightest delay. In this case, there may be additional requirements, for example, the purchase of insurance or some kind of service.

A striking example is the return of part of the interest on a loan at Sovcombank. The Bank invites all borrowers to activate the “Guaranteed Rate” service. According to its terms, after payment, the bank will recalculate at the minimum rate, for example, 4.9%, and return the money to the borrower.

If you consider what the catch is, you need to carefully look at the conditions of such offers. For example, in Sovcombank this is the fee for connecting to the “Guaranteed Rate” service and the terms of recalculation:

- there were no delays on all loan products of the bank;

- In addition to the loan, the client uses a Halva installment card and has made at least 1 purchase using it every month;

- insurance was included for the entire loan term;

- the client did not make partial or full early repayment.

So, if the bank promises to return part of the interest after repaying the loan, there are definitely some conditions, and quite serious ones. Study them carefully before agreeing: in fact, not all borrowers end up receiving this refund.

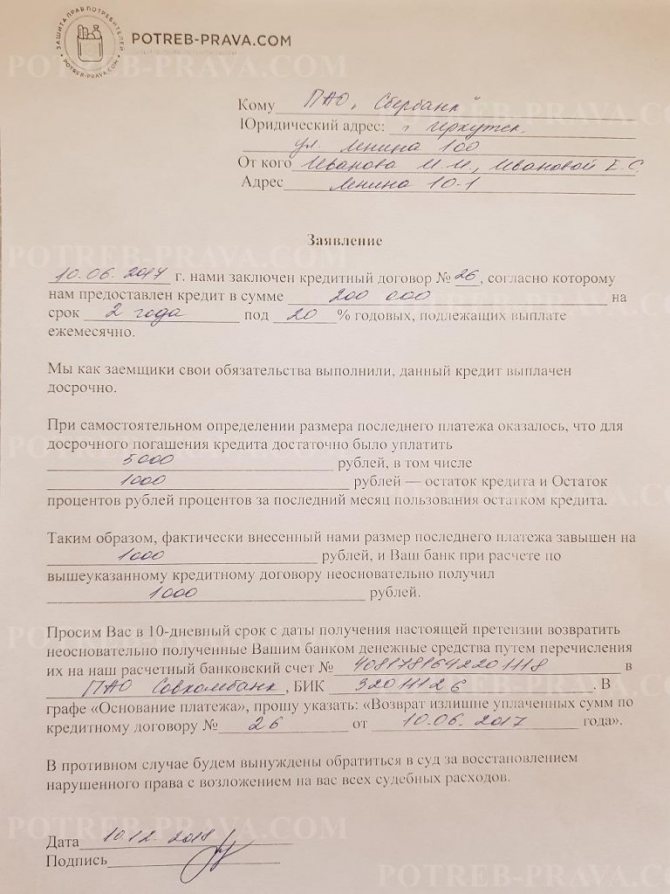

Application for refund of overpaid interest

Quite often, application forms for the return of overpaid interest are available at Sberbank branches. The citizen will need to come to the department and ask the employees to provide this form.

If you are unable to obtain the form at a Sberbank branch, you can draw up an application in free form, making sure to include the following information:

- last name, first name and patronymic, as well as details of the identity document of the citizen submitting the application;

- number of the agreement under which the borrowed funds were provided and the date of conclusion;

- description of the terms of the agreement: the amount of borrowed funds, the period for which these funds were provided, the interest rate;

- information on the return of borrowed funds in full;

- detailed calculation of the amount of overpaid interest;

- requirement to return the amount of overpaid interest;

- bank details to which the amount due to the citizen must be transferred;

- a message that if the bank refuses to return the funds, the citizen will go to court.

The application is sealed with the citizen’s handwritten signature with a transcript and indicating the date of signing.

ATTENTION! Look at the completed sample application to Sberbank for payment of overpaid interest upon early repayment:

Legal aspects of the procedure

The statement of claim is submitted on the basis of official documents confirming the relationship with the bank. A negative answer must be reasoned in writing. If the client considers it unreasonable, then he has every right to go to court.

Even if there is a clause in the contract stating that it is impossible to return interest if the loan is repaid early, the borrower can try to return it. This is provided for by the legislation of the Russian Federation, and is also reflected in the explanations on mortgage lending from the Central Bank. Therefore, if the bank reasons its refusal with an agreement, this still does not serve as a basis for termination of actions.

According to statistics, if supporting documentation is available, in most cases the court takes the side of the borrower. The government strictly regulates the receipt of housing loans by the population, so the law is on the side of the citizen. To increase the chances of a favorable outcome, it is recommended to consult a lawyer who will clarify unclear points and give an official assessment of the claims.

Required documents

In order to return funds overpaid as interest on a loan, a citizen will need to provide the following documentation:

- a copy of the agreement under which the loan was provided;

- a certificate confirming the fact of full repayment of the debt;

- citizen's identity document.

Refund of loan interest to the tax office

Most of all, borrowers are concerned with the question of whether it is possible to return 13% from a consumer loan by contacting the Federal Tax Service. Tax legislation in some cases allows borrowers to return part of the interest paid (personal income tax refund). But this is not true for every loan, especially consumer loans.

Here we are talking about the return of part of the personal income tax paid by a citizen of the Russian Federation, the right to which arises for certain expenses. These are expenses for education, medicine and the purchase of real estate. And credit has absolutely nothing to do with it. If a citizen paid for treatment with his own money, he can return 13%. If it’s credit, it can too.

If we consider whether it is possible to return 13 percent from a consumer loan, then this is impossible. By law, you can only return part of the mortgage interest. Everything, nothing else, regardless of the purpose of lending.

Let's explain the situation:

- Tax refund for treatment paid on credit. You can return 13% of the treatment amount; interest on the loan has nothing to do with it.

- Education tax refund. Similarly: no matter where a person gets the money, he can only return 13% of the training costs.

- Tax refund on mortgage loans. Here you can get 13% back on both the purchase amount and interest.

Each direction has restrictions and conditions. For example, if we are talking about education, then a personal income tax refund is relevant only for full-time education; you can return no more than 50,000 rubles.

How to calculate interest when repaying a loan early

A citizen who wants to return overpaid interest will need to calculate the amount that the bank must return.

Please note! To do this you will need to use the following formula:

- Xcredit - the amount of funds raised under the agreement (in rubles);

- Skred - the period for which the citizen was provided with funds (in months);

- Pcredit - the amount of overpayment on the loan for the term Scredit (in rubles);

- Sfact - the actual period during which the borrowed funds were repaid (in months);

- Pfact - the actual amount of money paid as interest for the period Sfact (in rubles).

Based on this, the amount of overpayment for the term Sfact is:

P = Pcredit / Scredit* Sfact

Drawing up a statement of claim

An analysis of practice shows that credit institutions quite often refuse to return overpaid loan interest to citizens. If the bank ignored a citizen’s application for a refund of overpaid interest or refused, then in order to protect legal rights and interests it will be necessary to apply to the courts.

To do this, the citizen will need to prepare a statement of claim.

Based on the norms of the current legislation of the Russian Federation, the following information must be indicated in the statement of claim:

- full name of the court to which the claim is sent;

- surname, name and patronymic of the citizen filing the claim. The address of registration and actual residence, details of the citizen’s identity document, as well as a contact telephone number are also indicated. If a statement of claim is filed on behalf of the plaintiff by a legal representative, then the same data must be indicated for this representative;

- all information about the defendant known to the plaintiff;

- description of violations of the legal rights and interests of the plaintiff with references to the norms of the current legislation of the Russian Federation;

- cost of claims;

- specific requirements that the plaintiff seeks to satisfy;

- evidence confirming the legitimacy of the claims put forward by the plaintiff;

- list of documentation attached to the statement of claim.

Attention! The statement of claim is sealed with the handwritten signature of the plaintiff or his legal representative with a transcript and indication of the date of signing.

As stated above, in accordance with the definition of the Supreme Court, a credit institution has the right to withhold interest only for the time when the citizen actually used the borrowed funds, therefore, in most cases, the courts side with the plaintiffs. However, it is important not just to go to court, but to correctly calculate the amount of overpaid interest.

Stipulated state duty

The amount of the state fee payable for filing a claim directly depends on the size of the claim.

The state duty is:

- if the value of the claim is up to 20,000 rubles - 4% of this value, but not less than 400 rubles;

- if the cost of the claim is from 20,001 to 100,000 rubles - 800 rubles and 3% of the amount exceeding 20,000 rubles;

- if the cost of the claim is from 100,001 to 200,000 rubles - 3,200 rubles and 2% of the amount exceeding 100,000 rubles;

- if the value of the claim is from 200,001 to 1,000,000 rubles - 5,200 rubles and 1% of the amount exceeding 200,000 rubles;

- if the value of the claim is over 1,000,000 rubles – 13,200 rubles and 0.5% of the amount exceeding 1,000,000 rubles, but not more than 60,000 rubles.

How to return interest on a home loan

Please note that we are talking about the return of personal income tax - the tax paid by the citizen. For example, if in a year they paid 105,000 rubles in tax of this type, he will be able to return that much.

What is returned from the mortgage:

- for purchasing a home. 13% of the amount, but not more than 260,000 rubles;

- for mortgage interest. 13% of the overpayment, but not more than 390,000 rubles.

As a result, mortgage borrowers can return 650,000 rubles, but no more than 13% of the purchase costs.

If, as a result, a citizen is entitled to a refund of 500,000 rubles, and he paid only 150,000 in taxes this year, he receives the rest of the amount gradually in subsequent periods.

To receive compensation, you must contact the Federal Tax Service, providing the appropriate package of documents. Payments occur at the end of the reporting period. In fact, there is nothing complicated; citizens cope with the return on their own without the involvement of helping companies.

How and in which court to file a claim

If the amount of the claim exceeds 50,000 rubles, then the claim should be sent to a court of general jurisdiction. A citizen has the right to independently determine whether to file a claim in court at the place of his residence or at the location of the banking organization that is the defendant.

The current legislation of the Russian Federation provides for the following methods of filing claims:

- personally;

- legal representative of the plaintiff;

- using a courier service;

- using postal services.

The citizen independently chooses the method of filing a claim in court. An analysis of practice shows that most often claims are filed through the court office. In this case, a note indicating receipt of the claim is made on the copy of the statement of claim that remains with the citizen.

Let us note that if the interests of a citizen are represented by a legal representative, then this representative must have a properly executed power of attorney confirming the authority to perform the necessary actions.

Important! If the statement of claim is sent by mail, then it is necessary to use registered mail with a list of attachments and a receipt.