Modern people quite often encounter poor quality results from banking services. At the same time, banks do not always cooperate. And what to do in this case? Should we remain silent and continue to tolerate such injustice? Or file a complaint with Rospotrebnadzor against the bank? If you still prefer to solve this problem, you will find useful information in this article.

Grounds for filing a complaint

In what situations is it necessary to file a claim? If there are disagreements between the client and the banking institution that cannot be resolved peacefully.

Most often, clients file a complaint with Rospotrebnadzor against a bank if it commits the following violations:

- distorts or does not provide information about the loan at all;

- trades your debts;

- connects collection agencies that commit actions against you that have no legal basis;

- unilaterally increases the interest rate on loans;

- unlawfully withdraws money from a client’s account;

- illegally withholds a service fee from the client;

- without the knowledge of the client, it limits the right to early repayment of the loan;

- violates the law on banking and banks;

- refers you to a specific organization for insurance or appraisal.

When will Rospotrebnadzor really meet you halfway?

Most often, Rospotrebnadzor (St. Petersburg, for example, or any other city) responds to cases of refund of credit insurance. If you repay the loan ahead of schedule, you have every right to demand the return of your insurance funds, but, as a rule, banks are not willing to cooperate. Moreover, according to paragraph 1 of Article 421 of the Civil Code of the Russian Federation on freedom of contract, a citizen does not have to necessarily insure his health and life, only if we are not talking about insurance of mortgaged property. It follows that banks carry out and issue insurance only on the basis of a voluntary act, which allows them to retain money. However, you can return your funds by submitting the correct application to the bank and Rospotrebnadzor.

How is a complaint against a bank handled by Rospotrebnadzor?

Employees send a request to the banking institution to provide a copy of the agreement and the movement of the client’s money in the account.

If the bank sold or assigned the debt, then the request is sent to the collection agency, which will be obliged to send a copy of the agreement, based on which it accepted the debt.

After this, the submitted documents are reviewed, and then a decision is made:

- the actions of the bank or collection organization are recognized as legal or illegal;

- an administrative case is initiated against a banking institution or collection agency and a fine is imposed; sometimes it comes to deprivation of a license or closure of an institution.

Based on the accepted results, the institution is obliged to amend the loan agreement.

How to properly file a claim?

In order for an application submitted to Rospotrebnadzor for a bank to have the desired effect, it must be drawn up correctly. You need to fill out the information with special attention so that it is delivered exactly to the address. So, in order to file a complaint with the territorial department of Rospotrebnadzor against a bank, you must:

- First of all, talk to the representative of the bank that violated your rights. Sometimes a simple conversation will be enough to solve a problem. If you are refused to go to a meeting, then you can safely turn to officials for help.

- You need to make a formal complaint in official business language, regardless of the outcome of the conversation and the magnitude of the damage. Determine what specific actions of the bank you are dissatisfied with. You need to write a statement to the point, without being scattered.

- The complaint must indicate your requirements. Write what you want to receive in the end - moral or material compensation for damage.

What does Rospotrebnadzor do?

Before you complain anywhere, you need to find out what the organization does and what powers the state has given it. That is, find out what actions Rospotrebnadzor has the right to take in accordance with its responsibilities and capabilities. Rospotrebnadzor performs the following functions in terms of control. So, supervision:

- sanitary;

- for the protection of consumer rights;

- epidemiological;

- over the licensing activities of licensees under their control.

More specifically, the subject of the appeal can be viewed in the column of the same name when filling out an application to Rospotrebnadzor via the Internet. This government agency has an electronic application form for citizens. An application (complaint) is submitted to this organization in the form of a citizen’s appeal. This means that it falls under the law on consideration of appeals. There you can also find response times.

It is not difficult to find a sample application to Rospotrebnadzor, which can be translated into written form on paper. It (in the sense of a sample) is available on our website for free access. If you encounter any difficulties while drawing up a complaint, you can safely contact the lawyers-consultants of our website.

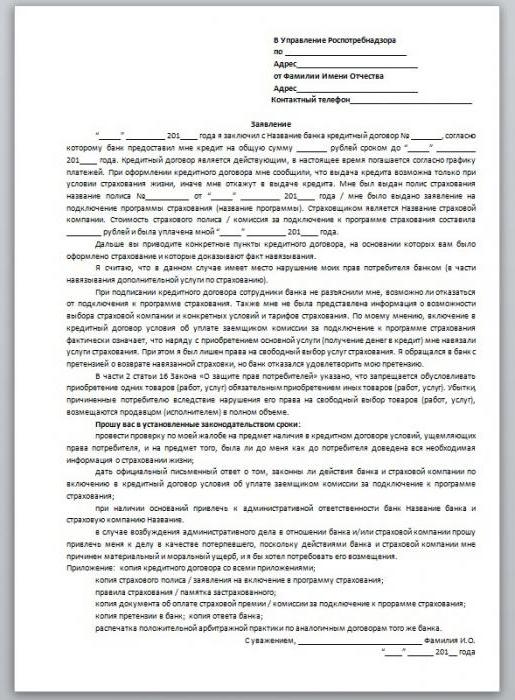

How to write an application correctly?

In order to complete your application correctly, you must also do the following:

- In the upper right corner you must indicate the full name of the territorial department of Rospotrebnadzor, its address, and then write your full name. the person making the complaint.

- Below in the middle of the sheet you must write “Application” (or “Message”, “Complaint”).

- Now you need to adequately and competently describe all the events that occurred during which the banking institution violated your rights. It is very important to indicate everything as accurately as possible. Pay attention not only to the situation and circumstances, but also to the contacts of the offending bank. But do not forget that you should not write anything unnecessary in the application. The writing style should be businesslike and events should be described in chronological order. A sample complaint against the bank to Rospotrebnadzor will be provided at the place of application.

- Then you need to indicate the regulations, the provisions of which, in your opinion, the bank violated.

After writing a complaint against the bank to Rospotrebnadzor, you must attach the following available documents:

- loan agreement;

- recorded telephone conversations;

- application for debt restructuring and negative response from the bank;

- other documents required by the organization.

Rospotrebnadzor fine

How to file a complaint against an order from Rospotrebnadzor? For judicial purposes, it is established that a person whose rights have been violated by a non-normative legal act has the right to appeal this decision to an arbitration or court of general jurisdiction within a period not exceeding three months from the moment the person became aware of the violation of his rights. Read about the time frame and procedure for appealing to the ITU in this article.

- Sending documents by registered mail via Russian Post or other delivery service;

- Personal visit to the department;

- Writing a complaint on the official website.

Submission deadline

The application can be submitted in person at your place of residence, by fax, mail, email or through the government services portal.

If you decide to file a complaint with Rospotrebnadzor against the bank in person at your place of residence, be sure to take your passport with you.

According to Federal Law No. 59, the application will not be considered if:

- Full name not indicated the person making the complaint.

- Your return postal address is not written.

- The complaint contains any obscene language, various threats to health, life, etc.

- The name of the banking institution against which you are writing a complaint, as well as its legal and actual address, is missing.

The application must be registered within three days and reviewed within thirty days. If your situation does not fall within the competence of the department, then the application will be forwarded to the appropriate authority within seven days. If you have too many issues that will be dealt with by several authorities, then it is likely that this will delay the consideration period by another week.

Application consideration period

Your complaint must be registered within 3 days. Next, the process of processing it begins, and the time it takes to respond to a claim depends on various factors, including:

- If the filed complaint falls within the competence of another department or service, Rospotrebnadzor sends it to the appropriate authority, and sends you a notification of this fact. The period for submitting a complaint and sending a notice should not exceed 7 days.

- If the complaint falls within the competence of Rospotrebnadzor and there are no problems with reading it, then it is accepted for consideration. The consideration period is 30 days from the date of registration of the complaint. After this, you will be sent a letter with the results of the review and the decisions made.

The procedure for appealing the order of Rospotrebnadzor

This information must be contained in the filed complaint; in the event of a judicial procedure, the absence of one of the specified conditions may be grounds for leaving your application without progress, and subsequently for the return of this document.

An official complaint against the order of Rospotrebnadzor is filed in an administrative or judicial manner. In the first situation, you should send a letter to the organization itself indicating the reason for not performing the specifically specified actions. The official period for appealing the order of Rospotrebnadzor after sending the document is two weeks.

Legislative regulations

What laws specifically control the client’s relationship with a banking institution? Let us list the legal documents that regulate them.

Firstly, this is the law of the Russian Federation “On the Protection of Consumer Rights”, which regulates the relationship between clients/consumers and performers, manufacturers, sellers:

- The eighth article of the above-mentioned document is about the consumer’s right to information about the contractor (manufacturer, seller) and the goods (services, works) provided.

- Article 12 of the same law, which talks about the responsibility of the performer (manufacturer, seller) for inappropriate information about the service (product, work), about the performer (manufacturer, seller).

Secondly, the federal law “On Banks and Banking Activities”, which regulates the creation, registration and activities of organizations issuing loans:

- Article 29, which bilaterally describes the interest rate on deposits (contributions), loans and commission for operations of a credit institution.

- Article 30, which regulates in detail the relationship between the Central Bank of Russia, organizations issuing loans, their clients and those who process and store information about credit histories (for example, credit history bureaus).

Thirdly, Article 821 of the Civil Code of the Russian Federation on refusal to receive or provide a loan.

Is a banking institution required to have a book of complaints and suggestions? Bank services are not household services, which means that they should not have such a document. But this does not exempt them from responsibility, and therefore they are obliged to accept claims and any complaints from clients, and then respond to them within the time limits established by law.

Complaint to Rospotrebnadzor for the Protection of Consumer Rights

In this case, only the consumer can be the initiator of filing an application (for example, a claim against the bank’s actions). Himself personally or his representative, who has a power of attorney for such actions with the certification signature of a notary. In Russia, a consumer is understood as a citizen who purchases goods or becomes the object of the provision of services for personal purposes. This means that only an individual can submit such an application and complain about the actions/inactions of the bank. Legal entities can only represent the interests of the victim (as an example, you can use a private law office). Entrepreneurs may be an exception. They also have the right to appeal the bank’s actions to Rospotrebnadzor or Roskomnadzor, provided that these services were not used for profit. Or, the product or service must have a purpose for use that was not originally intended for commercial use.

Let's take a car as an example. An individual entrepreneur bought a car and put it to work on the line in a taxi fleet. In this case, the car cannot be an object of commercial activity. Well, in our country, Mercedes (for example) for private use and certain models of this brand are not sold specifically for taxi drivers. This means that if problems arise, IP Chernov I.I. can safely go to Rospotrebnadzor. But if Chernov I.I. If you took out a car on credit as an individual entrepreneur, then the bank has the right not to comply with the requirements of the consumer protection law.

It is only worth noting that business entities (individual entrepreneurs, OJSC, LLC, etc.) have their own legal norms that protect their rights. In addition to legal entities, public organizations can also be representatives of citizens when making claims under the law we are considering.

Violation of the loan agreement

It is believed that the imposition of insurance and a complaint to Rospotrebnadzor against a bank are practically synonymous, but the main reason for the appeal is still a violation of the borrower’s rights.

In every loan agreement (99%), the banking institution violates the rights of the borrower. The client does not have the right to change the standard agreement, but by law has rights equivalent to those of the creditor. Even if you try to challenge something, it is extremely unlikely that you will be able to get your money back.

A banking institution does not have the right to unilaterally (i.e., without the knowledge of the client):

- increase the interest rate on the loan;

- change any terms of deposits;

- reduce the interest rate on deposits, etc.

All of the above violates the law and insults customers and their rights. If, unfortunately, similar situations happen to you, we recommend using your right to go to court (Article 3 of the Civil Procedure Code of the Russian Federation). This is the only way to “put in its place” the organization that provides loans. Otherwise, you will become a debtor or lose all your money.

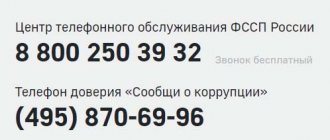

Complaint to Rospotrebnadzor against a collection agency

The clients of collection agencies are banking institutions. We are simply debtors to them. And the laws say the same thing. It is for this reason that complaining in this situation is, unfortunately, pointless.

But if the debt has not yet been sold, then the victims have every right to file a complaint with Rospotrebnadzor (St. Petersburg or any other city) against the banking institution. The amount of the actual debt is temporarily transferred under an agency agreement (Article 1005 of the Civil Code of the Russian Federation) to a collection agency, whose employees call, threaten and intimidate. Be sure to record all telephone conversations and write a complaint to the prosecutor's office and Rospotrebnadzor.

In such a situation, the banking institution will be fined a large amount, because the trial has not yet begun, and you are not officially considered a problem borrower yet. The measures taken will force you to return your loan agreement back and begin civilized collection through the courts.

Application to Rospotrebnadzor from business entities

Public organizations have the opportunity to file a complaint with Rospotrebnadzor, protecting the interests of their members. This is usually done by legally educated people. A statement is drawn up. For this purpose, a sample typical for individuals is most often used. Simply, the information about the applicant is replaced with the details of the public organization and the personal data of its leader. In such cases, representatives of the public organization act within the limits established by the statutory documents. If we talk about legal entities and other services, their rights are more limited. They have no right to contact Rospotrebnadzor. Unless, of course, such a possibility is spelled out in the regulatory legal act that regulates the activities of this organization/service.

Rospotrebnadzor has the right (one might even say more - it is simply obliged) to accept complaints from legal entities and enterprises about the actions of their employees or about their own branches.

Well, statements against licensees whose activities may lead to damage to innocent citizens. Experienced corporate lawyers often take advantage of this legislative uncertainty. A good lawyer will definitely have a sample needed for such a situation lying around in the folder containing application samples. If this is not available, then our specialists will easily help you draw up this document without remuneration for their work.