If the working day raises the least number of questions, then the banking day largely remains a mystery not only for the bank’s clients and partners, but sometimes even for the employees themselves. The need to independently determine the length of the banking day leads to frequent confusion in reports and documents due to the ambiguity of this concept. From a legislative point of view, banking day does not exist at all, since it does not appear in any set of laws, which adds even more mystery to it. We will talk about what a banking day is below.

Is a banking day a calendar or working day?

Definition of the concept

Banking day (BD) is not a universal concept, since each financial organization has its own specific “banking days” depending on the specifics of its work. Banking days themselves refer to working hours during which the organization engages in settlement activities and serves clients.

From a legislative point of view, there are no requirements for the database, and therefore each bank has the right to fix the amount of this time period independently. The length of the banking day determines the dating of certain financial procedures, which is a mandatory element of reporting.

Throughout the banking day, accountants prepare reports

In the context of a banking day, such an important phenomenon as the operational and accounting cycle is considered. Information about this cycle should be contained in documents such as:

- accounting reports;

- daily report on the value of property and bank liabilities.

Legal basis

As already mentioned, Russian legislation does not contain any articles or provisions that would provide comprehensive and accurate information about the accounting day. Due to the fact that the laws of both the banking and tax spheres remain silent on this issue, banking days can be identified with the following intervals:

- working days, the duration of which is determined by the management of the financial organization;

- operating hours (their duration is shorter than the length of working days - for example, one working day may have 5-6 operating hours).

At the legislative level, the banking day is not designated in any way

In practice, an operating day can be either shorter than a working day or equal to it, depending on the operating rules of a particular institution. The difference between a trading day and a working day lies in the way it is formalized. The duration of the “Operational Day” must be fixed in an official order, which is issued by the management of each bank.

Reference. If you want to obtain information about the operational hours of a specific financial organization, you must contact its employees. Unlike working hours, information about information is difficult to find on the website or on any other media.

Ask bank employees about operating hours

conclusions

If you need to carry out a calculation, it is worth remembering that the rules are different . When transferring funds from one to another account, the amount will not be received until it is processed by a branch employee.

We recommend reading: what is the difference between an international driver’s license and a regular and national one? What is it?

Commercial and state bank: difference, characteristics. See information here. Given that there are differences in time , the calculation is carried out differently . On weekdays, banking hours are limited to 10-16 hours . The worker, in turn, 8−12 . A person has to deal with different terminology all the time. That is why it is worth knowing its meaning. This is especially true for loan agreements, where the possibility of delays is not allowed. Watch a video about how working days are calculated:

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Difficulty of definition

The reason why the issue regarding the identification of a banking day has become the topic of an entire article is very obvious - this term is very vague and there are objective grounds for this vagueness. So, there are several difficulties that prevent us from giving an unambiguous definition of the database:

- each credit institution sets its own work schedules and has its own rules for customer service;

- In the network of the same bank, different offices can operate on databases of different durations. This feature can create problems not only when communicating with other banks, but also with subsidiaries of one organization;

- The banking day in many cases does not coincide with the working day, which is specified in the organization’s documents. This discrepancy becomes especially obvious during the New Year holidays, when most of the employees’ time is spent on preparing annual reports;

Banking day is not the same as working day

- absolute freedom in determining the boundaries of the banking day periodically leads to misunderstandings when conducting interbank transactions.

How does the calculation work?

The calculation of banking days involves the summation of all working days of a credit institution - days during which the bank engages in various settlement operations. Banking days may include both weekends and holidays. The main criterion for counting days is not their overlap with various holidays, but the presence or absence of financial services.

When preparing reports, it is important to distinguish between banking and working days

Accountants involved in the preparation of various documents and reports should clearly distinguish between three concepts:

- calendar day;

- working day;

- banking day.

Thus, answering one of the common questions about whether a banking day is a working day or a calendar day, we can say unequivocally - a banking day is neither one nor the other.

Differentiation of concepts

Let's repeat it again:

- working days mean the total duration of the institution’s functioning throughout the entire day. The working day includes both the implementation of operational activities and the implementation of other procedures that do not involve interaction with clients;

- During banking days, employees of the organization are engaged in receiving or paying out funds associated with a variety of payment procedures, depending on the procedures specific to a particular bank.

Failure to distinguish between banking days and calendar days will lead to significant errors in reports

Neglecting the content of these concepts will inevitably lead to confusion in contracts and offensive mistakes. Therefore, from all these terms, which seem synonymous, it is important to choose the one whose content most correctly reflects the intent of the specialist preparing the documents.

What is the difference?

A banking day is a period “nested” within the working day . The working day is in most cases longer than that of a bank. However, the opposite also happens. For example, if an employee works a short shift, and his number of working hours is less than the banking day established in a financial organization, during which the specified employee has the right to perform cash settlement operations .

Based on the above, a banking day is determined by cash transactions. All other time while the employee is at the workplace refers only to his working day . Operations with the cash register are not performed. Unlike working and banking days, calendar days are determined only by dates in the calendar, which is reflected in the name. The main characteristics of a calendar day are the number in the current month, the month number and the year number. There are as many calendar days as there are total days in the year. The number of banking and working days is less than 365-366 per year. Using the concept of a banking day can simplify or, conversely, complicate the task when drawing up agreements with a bank or between organizations.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

It is important to take into account

the differences between this definition and the concepts of working and calendar days . And, if necessary, replace it with another, more precise wording that fits the terms of the contract.

How does the consumer protection law save you from imposing a service? Find out the answer right now.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

It's fast and free! There was a very unpleasant situation with the execution of a bank payment order, I really want to sort it out so that this doesn’t happen again. The essence of the problem: on Friday (at about 14:00) a payment order was submitted to a commercial bank demanding the immediate transfer of a certain amount of money to the personal account of the plastic card holder. Both banks (payer and recipient) are Russian, the payment request was issued without violations, the required amount of money was available in full. The money was debited from the payer’s account on the same day (according to the teller), which was later confirmed by a statement. However, neither the next day (Saturday) nor the day after (Sunday) the money was credited to the recipient’s account. The money arrived only on Monday, in the afternoon, late in the evening. As far as I know, the payment request must be executed within a business day from the moment of acceptance, and if there is little time left until the end of the business day, then within the next business day. I ask you to help me with a question: is there enough time from 14:00 until the end of the working day to fulfill the payment request, especially considering that the funds were written off on the same day and were received only on the next working day? And to what extent is Saturday considered a non-working banking day? Thank you in advance for your answers.

You have inaccurate information about the timing of non-cash payments. The payment order is executed by the bank within the period provided for by law, or in a shorter period established by the bank account agreement or determined by business customs applied in banking practice. According to Article 31 of the Law “On Banks and Banking Activities” and Part 2 of Article 849 of the Civil Code of the Russian Federation, a credit institution is obliged to transfer client funds no later than the next business day after receiving the corresponding payment document, unless otherwise established by federal law, agreement or payment document . The bank's operating day is considered to be the time it serves clients on weekdays. This time is specified in the bank account agreement. In any case, the concept of “operating day” implies a working day. As a rule, Saturday and Sunday are non-working days for commercial banks. You can find out about holidays in your particular bank from the bank itself or from the text of the agreement with the bank. At the same time, it should be borne in mind that the bank is considered to have properly executed the payment order for the transfer of funds from the moment they are credited to the account of the BANK serving the recipient, and not to the RECIPIENT’S ACCOUNT. Therefore, it is possible that your bank transferred the funds on the same day, but the recipient’s bank credited them to the recipient’s account only on a working day - Monday, which is also not a violation. Thus, based on the terms of your question, the bank did not violate the rules of non-cash payments.

Similar questions

lawyer Alexey Vladimirovich Antyukhin: Hello!

You do not have the right to pay him again. lawyer Malykh Andrey Arkadyevich: It shouldn’t, the law does not oblige you to control income. I have to return it. Civil Code of the Russian Federation. “Article 1102. Obligation to return unjust enrichment 1. If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

lawyer Nikolaev Dmitry Konstantinovich: Dear Tatyana! You can go to court with a claim for entry and non-obstruction in the use of residential premises. Sincerely, Dmitry Konstantinovich. The presence of an agreement for the provision of banking services allows a person to ask the question of the difference between a banking day and a working day. The first coefficient affects the measurement of payment terms, the second relates more to the employment contract. When concluding a contract, two parties are involved, each of which must know their rights and obligations.

Purpose of the database

After we have figured out that failure to distinguish between calendar, banking and working days can lead to unfavorable consequences, let’s talk about the purposes for which the banking day was introduced. So, a banking day has the following set of characteristics:

- the day starts with the conversion of the remaining part of incoming funds into foreign currency;

- at the end of the day, employees are preparing bank reports, which will confirm that the bank has not violated any regulations;

- throughout the day, employees are allocated a certain number of hours for customer service;

- a day includes fixed operating time, which is allocated to a branch of the Bank of Russia, whose tasks include maintaining a correspondent account for a commercial financial organization.

At the beginning of the banking day, currency conversion occurs

What is a banking day?

A banking day as the period during which financial institutions carry out payment transactions with the participation of specialists. As a rule, it is between 10 and 16 hours.

The participation of bank employees in payment transactions is the main criterion for determining a banking day. The fact is that with the development of remote service technologies and the introduction of electronic payment interfaces, clients of financial institutions increasingly prefer to carry out transactions on their own. Moreover, such technological solutions, as a rule, operate around the clock. Consequently, the term “banking day” in relation to independently made payments is not always applicable.

But there are some types of financial transactions that, on the one hand, are carried out by a bank client without contacting cashiers, and on the other hand, in fact require the intervention of specialists from a credit institution at certain stages of the transaction.

For example, using the Bank-Client system, a citizen can create an order to transfer funds from one bank account to another - at any time of the day. However, in some cases the “payment” is processed only within the banking day. Therefore, a person often needs to wait a little while until his transfer order is completed.

On practice

Despite the fact that banking days for different institutions may have their own specific details, it is possible to identify several common features. First of all, a banking day determines the time boundaries within which hours are allocated for the implementation of financial transactions based on the internal regulations of a particular bank. It is necessary to take into account that the schedule covering the receipt and payment of financial resources does not coincide in all cases.

The main difficulty in interaction between banks is the discrepancy between operating hours

In order not to make a mistake with the time, it is recommended to find out about working days in advance from bank tellers. Also, you should take into account the fact that some banks prefer to handle settlements during weekends and holidays. This approach implies an inevitable increase in the duration of financial transactions.

What is a working day?

The term “ working day ” has 2 main interpretations:

- a calendar day that is not a holiday or weekend;

- the time period within which hired employees must be at work and fulfill their duties under the employment contract.

Thus, a somewhat tautological, but quite meaningful construction of the form is acceptable: “Tomorrow is a working day, I have a long working day,” when a person wants to say that tomorrow he, firstly, needs, in principle, to be at work, and secondly , he will be there for quite a long time.

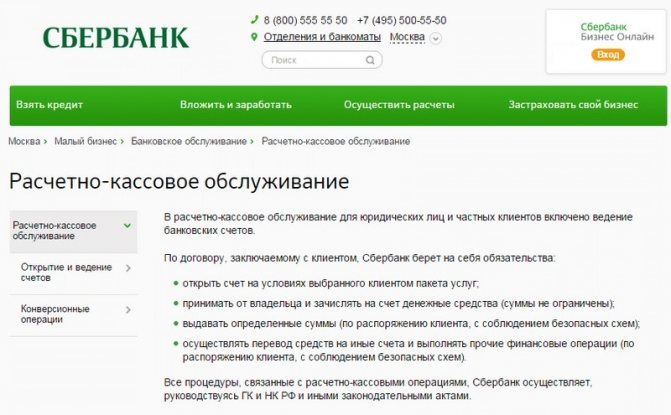

Settlement and cash services

Separately, I would like to touch on the topic of banking days in the context of cash settlement services. Databases, in relation to cash settlement services, have a variety of operational tasks, depending on the chosen credit institution. The operating hours of certain bank branches must be obtained from employees.

The type of payments made is determined by the time at which payments occur. The time it takes bank employees to process specific types of payments can increase to several days and does not depend in any way on the length of the operating day. As a rule, delays in completing these transactions can be encountered during holidays. The reason for these delays is a discrepancy between the schedules of certain financial structures.

You can read more about what RKO is and why it is needed below.

What is cash management services?

Comparison

Banking day is a period that is somehow present within the working day. An exception may be a scenario when an employee of a financial institution comes to work part-time and works, for example, from 11 a.m. to 3 p.m. In this case, his working day will be shorter than a banking day, within which he can, if necessary, perform cash transactions.

Thus, the fundamental difference between banking days and working days is that the criterion for determining the first is the specific type of activity of the employee. In this case, this is conducting cash transactions in a bank. In turn, the remaining working time of an employee of a financial institution will not be related to the banking day.

Having determined what the difference is between banking days and working days, we will reflect the criteria we have identified in the table.

The legislation of the Russian Federation (including banking and tax regulations) does not officially interpret the concept of “banking day”.

When using this phrase, experts mean the time period of a specific day of the work week during which employees of a financial institution (bank) carry out payment transactions dated by the current date. Payment transactions mean a significant volume of types of work carried out by bank employees. During the banking day, bank employees receive and serve clients, conduct credit transactions, finance capital investments and conduct cash transactions (acceptance and withdrawal of cash).

In some cases, the duration of the banking period is equated to the total working time of the organization, but more often this term describes the operating hours of a particular bank, since the activities of a financial organization involve the use of technological operations. In this regard, the concepts of “banking” and “operating” day often describe the same time period.

If you want to find out how to solve your particular problem in 2021, please contact us through the online consultant form or call :

During operating hours, bank employees accept documents for acceptance or withdrawal of funds, and also process, transfer and execute them. Often, to carry out one or another type of operation, a specialist requests confirmation from employees of higher departments, interacts with colleagues and always depends on the functioning and efficiency of the bank’s operating system. All these factors affect the actual duration and productivity of operating hours.

The approved regulations of a specific financial company establish the hours of the calendar working day, during which all transactions performed are dated on the same day. Working hours of a bank branch are not always equivalent to the time of operational customer service . It happens that the branch is still open to receive visitors, but cash settlement services are no longer provided. This suggests that the “banking day” is already over.

Read more: Is it possible to hire a pregnant woman?

Please note that reliable information about the beginning, end and duration of the operating day, as well as the bank’s work schedule, is provided only by employees or official information resources of a particular financial institution.

Contract deliveries

Banking day is also important for contractual deliveries. The fact is that when concluding all kinds of agreements on the periods of delivery of goods, the time period that is allocated for the implementation of obligations is calculated precisely in banking days. And due to the fact that this concept does not have an unambiguous formulation, the boundaries of banking days must be clearly stated in the agreement, the goals of which are:

- regulation of the rights of the parties to the agreement;

- listing the obligations of the parties to the agreement.

To avoid violation of delivery deadlines, contracts should indicate banking days in advance

If the agreement uses the concept of “banking day” without specifying its duration, mutual settlements will face a number of difficulties. Moreover, inconsistency in the operating modes of cooperating credit institutions is one of the most common reasons why conflicts arise between counterparties. Meanwhile, disagreement can be easily avoided by thinking through and discussing the delivery time frame in advance.

What operations are available at the end of the operating day?

The procedure for accepting documents after working hours is individual for each department and is described in detail in the banking service agreement.

Dividing the working day into operational and non-operational time allows you to competently implement the transition between different reporting periods for legal entities.

The bank's corporate clients can conduct transactions at any convenient time using remote services, with the exception of transactions related to the provision of paper documentation. For example, if you need to receive a bank confirmation of payment. In this case, you will have to visit the office during business hours.

Functions of banks

At the end of the article, we will give a more complete description of some of the functions of banks, which were repeatedly mentioned in the text.

Table 1. Main functions of banks

| Function | Description |

| Accumulation of funds | In addition to the formation of financial resources, banks are also focused on internal accumulation of funds, which contributes to economic growth. The accumulation of funds occurs mainly due to a dynamic deposit policy - if this is accompanied by a favorable macroeconomic “climate” in the country |

| Stimulating savings | The creation of conditions conducive to the accumulation of funds is created by fixing acceptable rates on deposits, guaranteeing the safety of depositors’ money, and a wide range of deposit services |

| Mediation in loans | This function is one of the most important for banks, which allows them to be called credit institutions. Taking out loans by clients contributes to the circulation of finances in the economy on 3 principles: -repayment; -urgency; -payment. |

| Mediation in payments | The initial task of banks, thanks to which they began to exist. In the context of a market economy, all households. subjects have bank accounts through which initial settlement occurs |

| Reproduction of credit routes of communication | The function implies the production of money using the resources of the banking system. The capabilities of this system include the expansion of loans and deposits through multiple increases in the monetary base |